The economies of Ukraine, Belarus and Moldova have been affected by the regional economic and security trends and by country-specific factors. The three economies are expected to contract in 2015 according to the latest Regional Economic Outlook by the EBRD.

The recession in Ukraine has deepened. Ukraine’s GDP fell by 17.2 per cent and 14.6 per cent year-on-year in the first and second quarters of 2015 respectively. There is a cautious hope that the economy has reached the bottom in the middle of 2015 and that the output level will stabilise in the second half of the year amid domestic and regional risks which remain material. The IMF programme remains broadly on track. The EBRD downgraded Ukraine’s GDP growth forecast to -11.5 per cent in 2015 and to +2 per cent in 2016.

Belarus’s growth turned negative in 2015 for the first time in almost 20 consecutive years of positive growth. In the first nine months of 2015, Belarus’s economy shrank by an estimated 3.7 per cent year-on-year, affected significantly by the recession in Russia. The EBRD downgraded Belarus’s GDP growth forecast to -3.5 per cent in 2015 and -1 per cent in 2016.

Moldova’s economy expanded by 4.6 per cent in 2014 and by 3.6 per cent year-on-year in the first half of 2015. Significant vulnerabilities in the financial sector, lower remittances, tight monetary policy, higher inflation, weak performance of agriculture, regional economic downturn, challenges in the budget execution due to the lower external financial assistance, volatile domestic politics and the substantial governance problems will be main risk factors for the rest of 2015. The EBRD retained Moldova’s GDP growth forecast at -2 per cent in 2015 and downgraded it to zero per cent in 2016.

In general, the outlook for economies where the EBRD invests remains split, with countries further to the east weighed down by the Russian recession and weak oil and other commodity prices.

Regions further to the west are benefitting from a eurozone upturn and the impact of accommodating European Central Bank monetary policies.

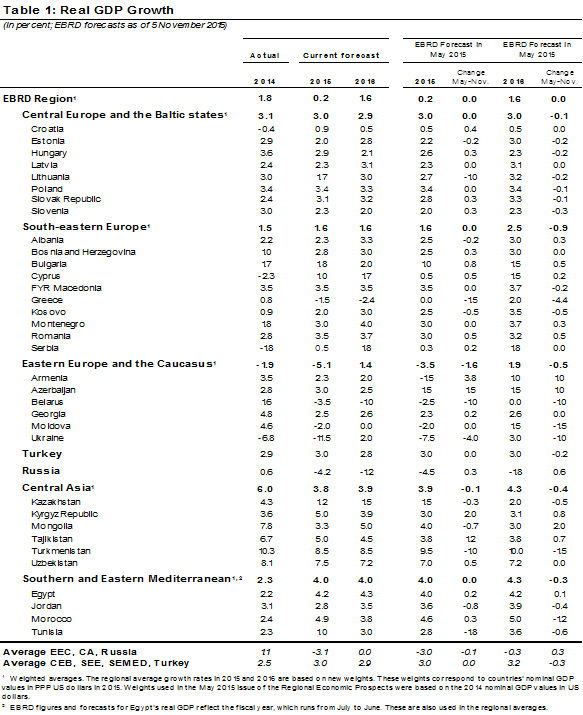

According to the EBRD’s latest Regional Economic Prospects report, growth in the region as a whole is expected to slow to just 0.2 per cent this year, from 1.8 per cent in 2014. Moderate growth of 1.6 per cent is expected in 2016. These forecasts are unchanged from May, but they mask regional differences [1].

Hans Peter Lankes, the EBRD’s acting chief economist, said, “We may be looking now for something of an upturn in 2016 after five consecutive years of slowdown. But there are significant risks on the downside.”

The report cites as risks a sharper than expected slowdown in China, a stronger-than-expected increase in US interest rates, political instability and geopolitical tensions and an uneven implementation of the bailout programme in Greece.

The report notes that the refugee crisis that intensified sharply in 2015 is affecting the economies of a number of countries.

Among “frontline” countries, Turkey is estimated to be hosting more than two million refugees, while in Jordan they account for almost one-fifth of the population. This massive influx has in some cases strained public services, government finances and labour markets.

Transit countries in south eastern Europe which have provided medical and social care, food, water, and accommodation for refugees are facing logistical and fiscal challenges.

Broken down by region, the EBRD report sees a relatively strong outlook in central Europe and the Baltics, supported by Eurozone quantitative easing (QE) and lower commodity prices which are providing scope for easier monetary conditions in the region.

“The expected average growth rate of around 3 per cent in 2015 and 2016 provides for continued, albeit slow, convergence of income levels with those of advanced economies,” the report says.

Economies in south eastern Europe are also benefitting from QE in Europe, the weaker euro and lower oil prices. Growth is expected generally to pick up in 2015 and be maintained in 2016. Greece’s economy, however, is expected to contract both this year and next.

The 2015 economic outlook in eastern Europe and the Caucasus [2] has worsened, affected by spill-overs from the recession in Russia and due to deeper recession in Ukraine and Belarus.

Growth in Turkey is forecast to remain broadly unchanged at 3 per cent in 2015 and 2.8 per cent in 2016, below the country’s long-term potential. Weak domestic demand may be partly offset by an improvement in exports in 2016, as recovery in the Eurozone supports exports while weaker domestic demand and lower commodity prices reduce import bills.

The report stresses that Turkey is particularly vulnerable to the threat of capital outflows affecting emerging markets in light of expected increases in U.S. interest rates.

In Russia, output is expected to contract by 4.2 per cent in 2015 and 1.2 per cent in 2016, as consumption and investments decline in the face of significantly lower oil prices, which compound structural problems and the effect of economic sanctions.

The recession is expected to ease in 2016 as the economy adjusts to lower oil prices.

Growth in Central Asia is expected to decelerate significantly in 2015-16 compared with 2014 on account of lower commodity prices and the region’s strong economic ties with Russia.

In the southern and eastern Mediterranean region, forecasts have been revised up for Egypt because of strong investments. In Tunisia the growth outlook has weakened due to deteriorating domestic conditions while regional security problems are weighing on Jordan. A strong agricultural performance is expected to lift growth in Morocco to 4.9 per cent in 2015. Growth is seen slowing to 3.8 per cent in 2016.

[1] The regional average growth rates in 2015 and 2016 are based on new weights. These weights correspond to countries’ projected nominal GDP values in US dollars in 2015, measured at purchasing power parity. Weights used in the May 2015 issue of the Regional Economic Prospects were based on the 2014 nominal GDP values.

[2] EEC comprises Armenia, Azerbaijan, Belarus, Georgia, Moldova and Ukraine