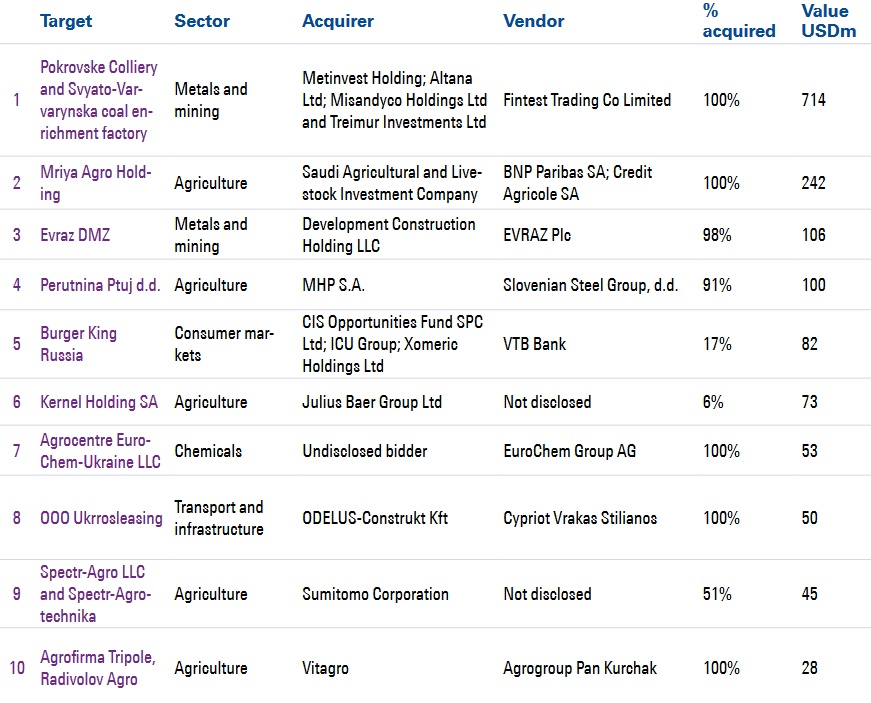

From its low point in 2016, Ukrainian M&A has now recorded two consecutive years of double-digit growth, despite the country’s political and economic challenges. During 2018, deal activity increased by 18 per cent, with 80 transactions announced. Notwithstanding this, and an impressive 78 per cent increase in the value of Ukrainian M&A to USD1.8 billion, the total value and the number of deals was still less than at its 2013 peak.

This dynamic reflects both a decline in the transparency of Ukrainian M&A over the last five years, with deal values disclosed for only 46 per cent of transactions in 2018 compared to 59 per cent in 2013 (significantly lower than typically seen in more mature markets), and a reduction in the average size of transactions valued at below USD100 million.While the average value of significant deals (>USD100 million each), jumped by 82 per cent between 2013 and 2018 to USD291 million, only four such transactions were announced during the year, compared to 14 in 2013, when almost half were inbound deals. However, the average value of deals in the underlying core of M&A activity declined by nearly one-third, to USD20 million over this period, reflecting the impact of the economic downturn (including the devaluation of the Hryvnia) on financial performance, and hence the valuation of companies.

Nonetheless, Ukrainian M&A has demonstrated remarkable resilience over the last two years as domestic and international players have increasingly shown their willingness to invest further, fueling the economic recovery.

M&A market volume in Ukraine (2013–2018)

Dynamics of M&A

Despite an increase in the number of inbound deals, M&A has become an increasingly domestic play in recent years, with 62 per cent of total deal value (USD1.1 billion) and 63 per cent of total deal volume (50 transactions) involving a Ukrainian buyer and seller in 2018. The largest domestic and overall deal in 2018, was the USD714 million acquisition of Donetsksteel by Industrial Coal Holding LLC, a company reportedly owned by Ukraine’s largest steelmaker, Metinvest, and other co-investors. This raised the average ticket size for domestic deals by 52 per cent to USD49 million.Inbound M&A activity increased by 47 per cent in 2018, with 25 deals announced, of which encouragingly, 44 per cent were made by first-time investors into Ukraine. However, although the acquisition of the restructured Mriya Agro Holding by

SALIC, the Saudi investment company, boosted total spend to USD508 million, average deal value fell by 16 per cent to USD42 million. One reason for this is the more cautious approach displayed by first-time investors, who on average, spent less than half the amount of their more seasoned counterparts on each acquisition.

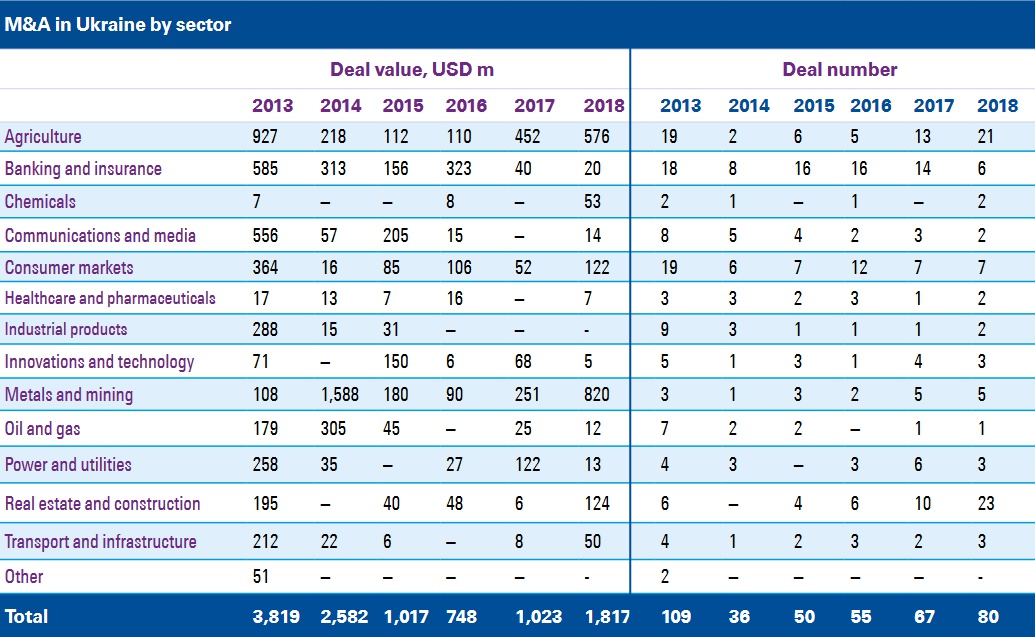

The ten largest deals of 2018 were worth a combined total of USD1.5 billion in 2018, including two transactions in the metals and mining sector for USD820 million (55 per cent), and five transactions in the agriculture sector, including three inbound deals, for USD488 million (33 per cent).

Largest M&A deals in Ukraine in 2018

Expectations for 2019

Despite concerns regarding the global economy and the uncertainty that the presidential and parliamentary elections will inevitably bring, the economic outlook for Ukraine looks more assured on the back of the USD3.9 billion of IMF funding secured under the Stand-by Agreement and forecast GDP growth of circa 3 per cent for 2019.The encouraging increase that we have seen in inbound deals, particularly from investors new to the Ukrainian market, is based on those sound economic and structural indicators, as well as the comparatively low price of assets. We expect to see inbound investment continue to grow over the years ahead, with more foreign entrants to the market.The resurgence of confidence amongst domestic deal-makers is also a positive indicator. Reinforcing this message, in January 2019, Horizon Capital, the private equity firm, saw its ‘Emerging Europe Growth Fund III’, which will invest in fast-growing, export-oriented companies that leverage Ukraine’s cost competitive platform to generate global revenues, primarily in IT, light manufacturing, food and agriculture, hit its hard cap of USD200 million, far surpassing its USD150 million target.While there maybe some softening in deal-activity ahead of the forthcoming elections, provided government policy remains consistent and fiscally responsible, we believe a strong pipeline will exist for Q4 of 2019 and beyond. On this basis, our outlook is for a modest increase in the value and volume of Ukrainian M&A for the full-year.

Improving investment climate

Macroeconomics

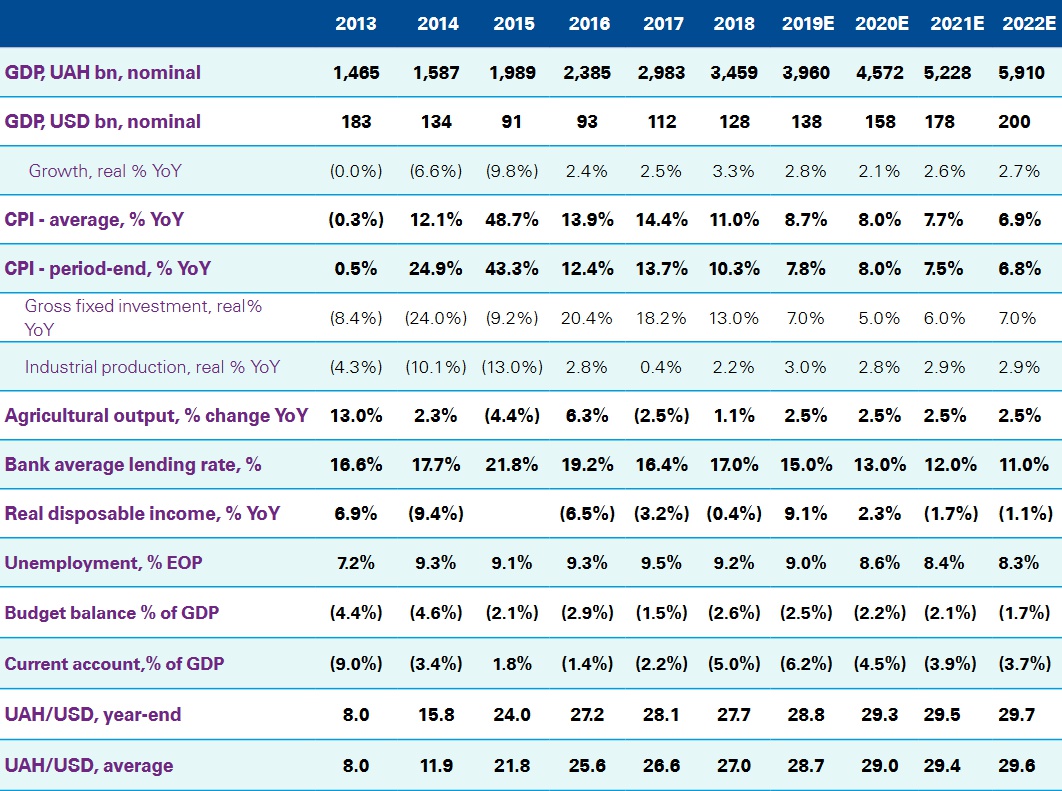

A key driver of Ukrainian M&A over the last two years has been the continuing economic recovery much of which is attributable to the stability brought by the loan packages agreed with the International Monetary Fund (IMF) and European Union (EU). Despite the often sluggish progress of reforms imposed as conditions of the IMF and EU loans, confidence in the economy has increased among both domestic and international business leaders, and Ukrainian consumers. The Ukrainian economy delivered a third consecutive year of growth in 2018, with full-year GDP of 3.3 per cent, according to the National Bank of Ukraine (NBU). This figure represents the country’s strongest economic growth since 2011, and is in line with the 3.2 per cent forecast by the IMF at the start of the year.The economy was buoyed by rising household consumption, driven by a tightening labour market and real wage growth, coupled with a record harvest of grain and oilseeds, and strong export of agricultural products as the Hryvnia remained stable at an average of 27 to the US dollar. Inflation finished the year at 10 per cent, which although continuing the recent downward trend, was above the NBU target, resulting in the Bank holding the key policy rate unchanged at 18 per cent.

Key sector activity

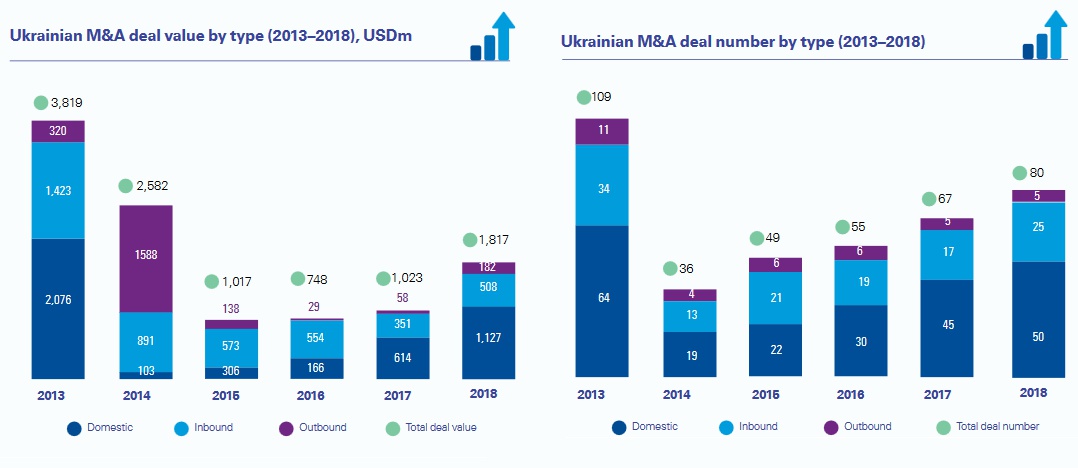

In terms of deal value, Ukrainian M&A was dominated by two sectors during 2018; metals and mining, and agriculture, which together accounted for almost three-quarters of total spend. Two-thirds of total deal volume was spread across four sectors; real estate and construction, agriculture, banking and insurance and consumer markets.

Metals and Mining

M&A in the metals and mining sector has been gathering pace each year since the political upheaval of 2014, and accounted for 45 per cent of total Ukrainian M&A spend in 2018. Deal-making in the sector has been driven by a recovery in global steel prices (up 9.7 per cent in 2018), increased demand in mature markets, and fallout from the conflict in the east of Ukraine. Producers located close to the Anti-Terrorist Operation (ATO) Zone in Eastern Ukraine, have been severely impacted by disruption to raw material and power supplies, and cuts to transport links. Some producers, mainly Russian, have sought to divest their operations in Ukraine. Despite expropriation of a substantial portion of its assets in the Donbass region, Ukraine’s largest steelmaker, Metinvest, has enjoyed strong financial results¹ on the back of the global steel market dynamics, enabling the group to refinance, and it is now reportedly on the hunt for steel rolling assets in Europe. Metinvest was involved in the largest transaction of the year, as a 24.99 per cent shareholder of Industrial Coal Holding LLC (ICH). In April 2018, ICH acquired Donetsksteel, the owner of various assets including the Pokrovske Colliery and Svyato-Varvarynska coal enrichment plant located in the Ukrainian controlled part of the Donbass, from oligarch Viktor Nusenkis’s Fintest Trading Co. Ltd. for an estimated USD714 million.Four other deals were announced in the metals and mining sector during 2018, including Development Construction Holding’s (DCH) acquisition of Evraz DMZ, a steel mill located in Dnipro for USD106 million. This was DCH’s second transaction with Evraz, following the acquisition of the Sukha Balka iron ore mine and beneficiation plant in November 2017 for USD110 million.

Agriculture

Significant investment in the agriculture sector in recent years, and specifically in technology and resources, has seen grain and oilseed yields almost almost double since 2001, with 92 million tonnes harvested from the same acreage in 2018. This, combined with a 4 per cent increase in agricultural exports to USD19 billion during 2018, has helped to keep the sector in the focus of deal-makers in recent years. Agriculture was the second most active sector during 2018, with 21 deals announced, and total M&A spend of USD576 million, including the largest inbound and outbound deals of the year.A successful debt restructuring enabled a consortium of international creditors to offload Mriya Agro Holding to the Saudi Agricultural and Livestock Investment Company (SALIC) for USD242 million – the largest inbound deal of 2018. The transaction, which reflects the food security strategy of the Kingdom of Saudi Arabia, provides SALIC with a further 165,000 hectares of arable land on top of the 45,000 hectares it already farms in Lviv, following its 2013 acquisition of Continental Farmers Group. The largest outbound deal of 2018 saw MHP, Ukraine’s, and one of Europe’s, largest poultry producers, acquire a 91 per cent stake in Perutnina Ptuj, a Slovenian vertically integrated poultry producer with operations across southeast Europe, for USD100 million. The transaction, which should enable MHP to realise certain synergies, is consistent with its desire for international expansion, and reflects the improving financial strength and growing confidence of Ukraine’s larger companies.

- InVenture Investment Group has interviewed the main market actors - investment-banking and legal services providers on the main M&A market development trends in the agricultural sector of Ukraine in 2018

- InVenture have rated largest M&A transactions in the agricultural sector of Ukraine in 2018

Real Estate and Construction

With yields improving and occupancy rates climbing, commercial real estate was a focus for Ukrainian M&A, making real estate and construction the most active sector in 2018, with a total of 23 deals announced – almost one-third of total deal volume for the year. Transactions were largely confined to retail and office space, as a shortage of mortgage financing and the construction boom of 2015 to 2018, has left housing developers with unsold stock and significantly weakened margins.

Real estate and construction M&A rocketed to USD124 million in 2018, the highest level recorded since 2013, of which USD51 million was attributable to Ukraine-based investment fund, Dragon Capital, which was responsible for almost a half of deal volume in the sector. During 2018, Dragon Capital increased its portfolio of prime office space to 160,000m², and acquired the Aladdin Retail Complex from Meyer Bergman, the British investment fund, for USD23 million. Elsewhere, Vadim Grigoryev acquired the 17,100m² Renaissance Business Centre for USD25 million, the largest deal in the sector, while Kovalska Group, the Ukrainian building materials and construction group, marked its first foray into commercial real estate with the USD11 million acquisition of a 7,500m² development in the Toronto Kiev Business Center from Alfa Bank.

Banking and Insurance

The NBU’s efforts to clean up the banking sector through tighter regulation, greater transparency and increased capitalization requirements saw further consolidation, with the 6 transactions in 2018, 57 per cent lower than in 2017. Deal-making in the banking and insurance sector was the least transparent of Ukrainian M&A during 2018, with deal values not disclosed for 5 (83 per cent) of the announced transactions. French insurer, AXA SA and BNP Paribas owned Ukrsib Asset Management, sold their AXA Ukraine operation to Fairfax Financial Holdings Limited for USD20 million. This was the only transaction in the sector with a disclosed deal value. This is the third investment by Fairfax in Ukraine in the last four years, following the acquisition of insurance company QBE in 2015 and acquisition of a 10% stake in Astarta Holding in 2017.

Consumer Markets

Although M&A activity in the consumer markets sector was on par with the previous year, with a total of 7 announced transactions, the value of deal-making increased more than two-fold to USD122 million. The largest deal saw Ukrainian investment company ICU, increase its stake in Burger King Russia to 35 per cent by exercising its preemptive right to acquire an additional 17 per cent of the business from Russian bank VTB for USD82 million. Elsewhere, Sarantis, the Greek cosmetics to household products group, increased its presence in the CEE market through the acquisition of Ergopack, a Ukraine-based producer and distributor of household products, from Horizon Capital, a Ukraine-based private equity fund, for USD18 million.However, perhaps the most interesting transaction in the consumer markets sector was the merger of two of Ukraine’s largest e-commerce players, EVO, owner of the prom.ua, bigl.ua, crafta.ua, shafa.ua and zakupki.prom.ua platforms, with Rozetka, the online and bricks-and-mortar supermarket. The deal, which resulted in Rozetka acquiring a participatory interest in EVO, will create synergies by combining the platforms and rationalising the supplier base, to leave the merged group unchallenged in the local marketplace.

Domestic

In 2018, domestic deal-making once again dominated Ukrainian M&A, accounting for 62 per cent of deal value (USD1.1 billion) and 63 per cent of deal volume (50 transactions). The average value of domestic deals has increased year-on-year since 2014, and amounted to USD49 million in 2018. However, the proportion of announced transactions with disclosed deal values in 2018, remained lower than in 2013-2015, at 46 per cent.Over 90 per cent of domestic M&A spend was concentrated in three sectors during 2018. Metals and mining attracted USD820 million, driven largely to the acquisition of the assets of Donetsksteel, followed by agriculture at USD109 million and real estate and construction at USD99 million. A little under two-thirds of domestic M&A activity was focused on the real estate and construction sector (16 transactions), agriculture (14) and metals and mining (4).

Outbound

Ukrainian companies announced five outbound M&A deals during 2018, maintaining the average number recorded in the preceding four years. This demonstrates the continued confidence of Ukrainian business in expanding geographically, and testing business models in new geographies. However, with all five deals confined to Europe (4) and Russia (1), it highlights the desire to stay on familiar, if foreign, territory.The five outbound deals were spread across the agriculture, consumer markets, innovations and technology and real estate and construction (2 transactions) sectors, in Russia, France, Slovenia, and Poland (2 transactions). Deal values were only disclosed for two transactions; MHP’s acquisition of a 91 per cent stake in Perutnina Ptuj, the Slovenian vertically integrated poultry producer, and ICU’s acquisition of an additional 17 per cent stake in Burger King Russia.

Inbound

While we correctly predicted in last year’s M&A review that 2018 would see an increased number of inbound deals, they continued to account for around one-third of total Ukrainian deal-making. A total of 25 transactions were announced in 2018, marking a 47 per cent increase over the previous year. However, the average value of inbound deals fell by 16 per cent to USD42 million, meaning that the total value of inbound M&A increased by 45 per cent to USD508 million.The Middle East (USD242 million) and Europe (USD179 million) accounted for a combined 83 per cent of inbound deal value in 2018, of which 76 per cent (USD322 million) was invested into the agriculture sector, driven by SALIC’s acquisition of Mriya Agro Holding and the acquisition of a 6.22 per cent minority stake in Kernel, the Warsaw listed major Ukrainian agri-holding, by the Swiss private banking group, Julius Baer for USD73 million. The latter demonstrates the increasing level of confidence among foreign investors in the governance of Ukrainian enterprises.Deal values were disclosed for less than 50 per cent of inbound M&A during 2018, this is lower than rates in 2013-2015. The low-level of transparency was somewhat surprising given that 76 per cent of inbound activity (19 transactions) originated from Europe, where the level of disclosure is typically greater. Excluding Europe, the picture was much better, with deal values disclosed for 83 per cent of inbound deal volume from the rest of the world. Nearly half of inbound deal volume was in agriculture (6 deals), real estate (5 deals), banking and insurance (3 deals) and consumer markets (3 deals).Nearly half of all inbound investors were new to the market. The most actractive sectors for these new investors were real estate and construction, which saw three deals and transport and infrastructure, which attracted two deals.

2019 Ukrainian M&A Outlook

Macroeconomics

What is the outlook for Ukrainian M&A in 2019, after two consecutive years of double-digit growth?

With as yet, no clear front runners for the presidential or parliamentary (Verhovna Rada) elections scheduled for March and October respectively, there is likely to be some political turbulence during 2019, despite broadly similar economic priorities behind the differing populist rhetoric of the key political groups.

There is, in fact, little room for manouvre as the current government has committed the nation to a range of tight fiscal and structural reforms, including a new round of privatisations, in return for the 14 month USD3.9 billion IMF Stand-by Arrangement (SBA) which replaced the 2015 agreement, and which was approved by the executive board of the IMF in December 2018. Negotiation of the SBA followed approval in July by Ukraine’s parliament, of revised plans for the country’s anti-corruption court, fulfilling a condition of the previous round of the IMF loan package. The agreement, along with a EUR500 million EU loan and a USD700-800 million World Bank loan, both of which were dependent on the conclusion of the IMF deal, will provide an anchor for economic policies during 2019. Inflation, which finished 2018 at 10 per cent, was driven upwards by a significant, IMF mandated, increase in consumer energy prices, and is forecast to decline to around 8 per cent in 2019, with interest rates expected to decline to 16 per cent as the NBU gradually loosens monetary policy.

In December 2018, Moody’s Investors Service (Moody’s) once again upgraded Ukraine’s sovereign debt rating, which has improved from Caa3 to Caa1 over the last three years, although the outlook was downgraded from positive to stable. The agreement of an IMF SBA was the key driver of the most recent upgrade in the debt rating, along with with the expectation that incremental progress will be made on reducing corruption, given recently adopted reforms, and that Ukraine’s economic resilience to the ongoing conflict with Russia has increased further.The stable outlook reflects both the country’s continued dependence on the IMF for funding and to drive the reform agenda.

Ukraine’s standing in the global economy has also seen steady improvement in recent years, when measured across a range of indices, and the country is now ranked 71st in the World Bank’s Doing Business Index, 83rd in the World Economic Forum’s Global Competitiveness Index 4.0, and registered a score of 3.07 out of 5 in the European Business Association’s 2018 Investment Attractiveness index. The recently announced Corruption Perception Index, published by Transparency International, ranks Ukraine at 120 out of 180 countries surveyed, an improvement of ten places over 2017.

After a strong start to 2018, investors’ confidence in the global economic outlook fell back, following the slow-down of global industrial production and reciprocal protectionist measures imposed by the USA and China. This increasing pessimism cannot fail to affect Ukrainian investors. In the first few weeks of 2019 we have already seen weaker retail results for Q4 2018 in the US and Europe, and job losses across the global automotive industry as demand slows, tighter emissions regulations take hold, and the momentum for electric vehicles builds.

As long as government policy remains consistent and fiscally responsible, we are confident that deal-making will continue to grow.

The US Federal Reserve’s decision to shift its target range for the federal funds rate 2.25 - 2.50 per cent in late December 2018, and some investors’ exit to the fixed-income market, will also cool stock markets in general and those in emerging markets particularly. It is therefore not surprising that the consensus forecast is for the Ukrainian economy to slow slightly in 2019, with GDP growth of 3 per cent. This reflects the resilience of domestic demand underpinned by consumer consumption and the ever-tightening labour market, which will be tempered to some degree by election-related uncertainty and the likelihood of lower external demand as the global economy slows.

Overall, we remain cautiously optimistic for Ukrainian M&A in 2019. Whilst there may be potential for some softening in activity as investors adopt a more cautious approach until the likely outcome of the elections is known, we are confident that there will be pent up demand and an established pipeline by Q4 2019 and into 2020, potentially fuelled by the long-awaited privatisation of state owned enterprises. With Ukrainian M&A equivalent to just 1.4 per cent of GDP, it is significantly under-invested compared to the global average of 4.3 per cent.

Key drivers for 2019

We do not anticipate any significant developments in the overall structure of Ukrainian M&A in 2019, and largely expect it to be business as usual, with the majority of deal-making confined to a small number of sectors.

- Agriculture: we expect M&A to be driven by foreign investors, as domestic players concentrate on driving efficiencies from existing assets. Indeed, in January 2019, Saudi Arabia’s SALIC announced the acquisition of the remaining 66% stake in United Farmers Holding Company (UFHC), which operates 44,000 hectares of crop production in west Ukraine, from two Saudi private sector co-investors, following their joint investment in 2013.

- Real Estate & Construction: activity will remain strong in the commercial real estate segment given robust supply as banks and the Deposit Guarantee Fund (GDF) continue to offload properties, potential for high-returns and comparatively low levels of risk. The backlog of unsold residential properties following the 2015 to 2018 construction boom and absence of a functioning mortgage market, could lead to forced sales of construction companies, unless they are able to successfully navigate debt restructuring.

- Power & Utilities: with the privatisation of Centrenergo and other state owned enterprises likely to be on-hold until after the elections, M&A in the sector is likely to be limited to renewables, with 2019 likely to be the last chance for investors to secure the advantageous Green Tariff for newly commissioned capacity. Although a number of pre-construction projects secured foreign investment in 2018, the majority were below the USD5 million threshold for our database. Syvashenergoprom, due to construct a wind plant with a power capacity between 250 and 330 MW, was acquired by Norwegian renewable energy company NBT AS. This was the only deal large enough to make our database. We may see larger deals during 2019 and thereafter as owners look to refinance completed power plants.

- Banking and Finance: with seemingly no resolution to the ongoing conflict with Russia, it is likely that pressure will continue to mount on Vneshekonombank and Sberbank to divest their Ukrainian activities. Further consolidation is likely in the banking segment as stricter capital requirements take hold. We expect the remaining international players to exit the insurance market because of low demand for life insurance in Ukraine and price competition in the risk insurance market among key players.

- Consumer Markets: incomes are growing and households able to increase their discretionary spending. Much of this is linked to rising foreign remittances, but with promises of higher wages and pensions, by presidential candidates, the trend should continue in the coming months. IKEA, Auchan and Decathlon have all announced plans for expansion in Ukraine.

Investors will continue to carefully monitor progress of reforms and economic development, when assessing M&A opportunities in Ukraine

Like many, we remain hopeful that the long-awaited privatisation process will soon gather momentum. Although the government, in January, committed once again to sell 23 state owned enterprises, including Indar Pharmaceuticals and the Krasnolymanska Mine, it is doubtful that such larger privatizations will happen before the elections. However, spurred on by the terms of the IMF SBA, we may see the government privatise some 500 small assets (UAH250 million in terms of assets) via the ProZorro platform.

We expect the debt-sales market to continue to develop in 2019, driven by attractive discounts to book value for non-performing loans (NPL), averaging 75 per cent in Ukraine, significantly higher than most CEE markets, and an increasing volume of NPLs sold by the DGF through the ProZorro platform, which provides a level playing field for investors. This could in turn lead to M&A activity amongst related debt-collection and management services companies and even the structures of NPL investors.

A new law on concessions and public-private partnerships (PPP) is slated for the first half of 2019, which if passed, could lead to ports, airports, rail infrastructure and ferries being placed in the hands of private investors. The Ministry of Infrastructure has also flagged its intention to give the green light to the construction of toll roads during 2019. Following on from Ukrainian Railways long-term USD1 billion agreement with GE for 30 new locomotives, modernization of the existing fleet and a long-term service agreement, it is a positive sign for infrastructure investors.

Overall expectation

In summary, whilst political and economic headwinds are building both globally and domestically, we believe that the macroeconomic fundamentals in Ukraine will remain sufficiently resilient, such that investor confidence in the medium to long-term prospects for the country will be largely unchanged. As a result, although uncertainty caused by the election process may see restrained activity during the first half of the year, we remain cautiously optimistic that 2019 will see a fourth consecutive year of growth in Ukrainian M&A.

Download full report Ukrainian M&A Review 2018

Source: KPMG