RESEARCH HIGHLIGHTS 2014-2015

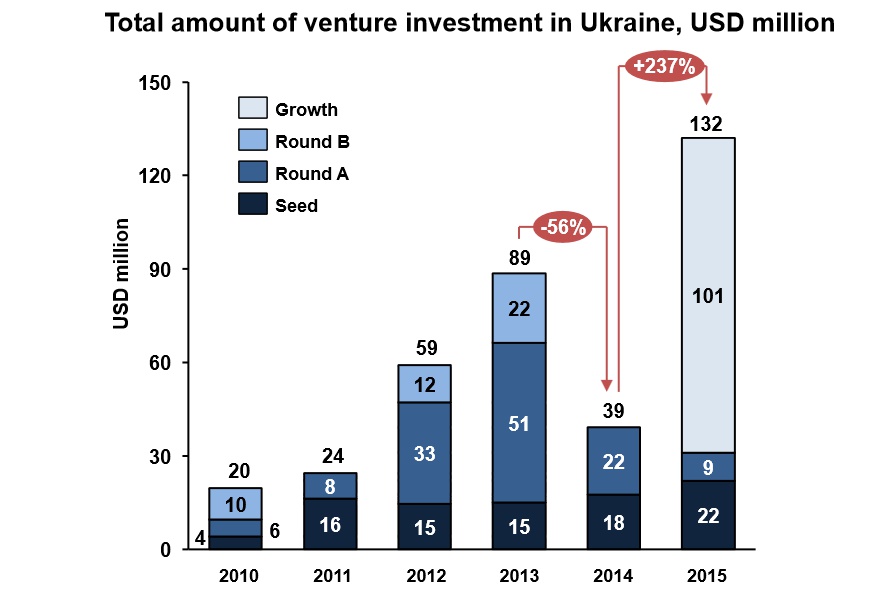

- In 2015 the Ukrainian venture market bounced back from its temporary setback of the previous year, with a record total investment volume exceeding $132 million. That number not only more than triples the $39 million of 2014, it also significantly exceeds the $89 million of 2013, then considered the best year ever for Ukrainian tech. This exciting increase in total volume demonstrates both country-specific good news – the rejuvenated confidence of local and foreign investors in the Ukrainian tech scene and its ability to grow and achieve results amid crises – as well as increased investor interest in technology investment in general.

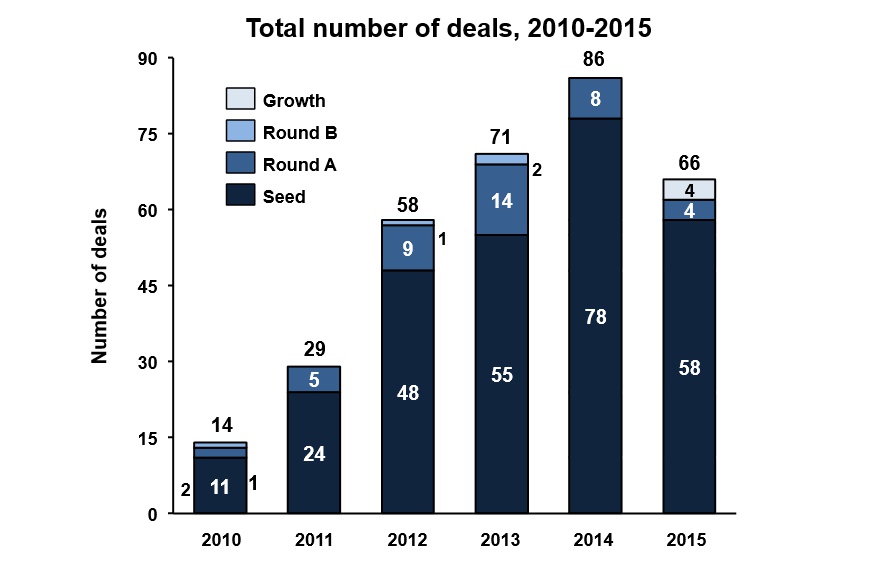

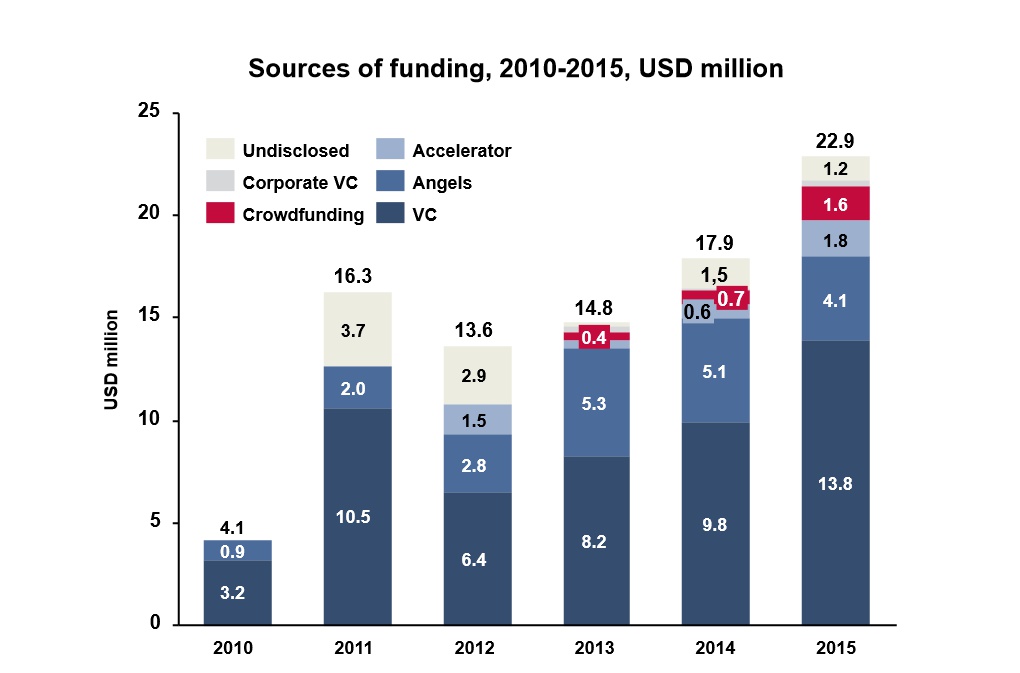

- Investment volume significantly increased across seed deals. In 2015 the majority of early capital came from professional angels and VC funds, whereas in previous years a significant portion of small-ticket investments were made by local accelerators and incubators that ceased operations in 2014. Thus while the number of seed deals decreased from 78 in 2014 to 58 in 2015, invested volume went up from $19 million to $22 million, signaling an increase in the average seed-round ticket. The average seed investment in 2015 came to $380,000, almost twice that of 2013-2014. Check outline of most remarkable deals in IT sector of Ukraine in 2015.

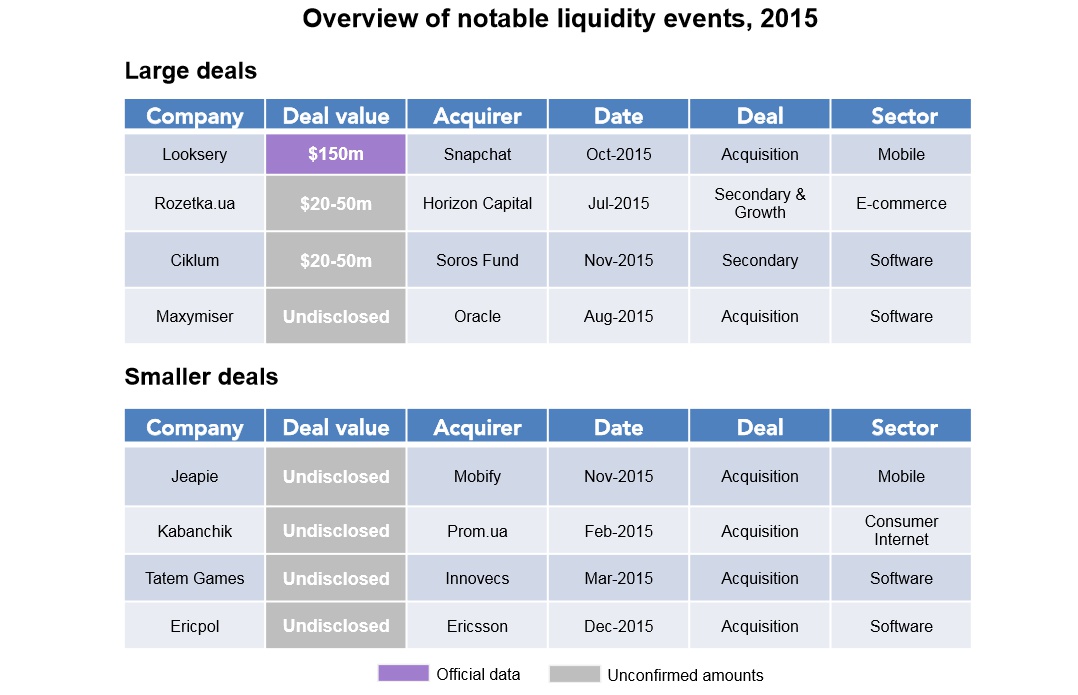

- The increase in the number of growth-stage and secondary deals demonstrates the gradual maturity of the investment climate and startup ecosystem. In 2015 we saw a number of growth deals that provided both cash-out opportunities for founders and existing investors and growth capital to develop the businesses further. The total volume of such deals came to $100 million. Although most of these deals remain undisclosed, we can mention Horizon Capital’s stake purchase in the biggest Ukrainian e-commerce player, Rozetka.ua, and a stake purchase in the software outsourcing giant Ciklum by George Soros’ Ukrainian Redevelopment Fund. The latter deal is expected to be the first in a series of similar investments in the Ukrainian technology market, as Soros has committed to investing as much as $1 billion in the years to come.

- Ukrainian investors and funds committed a record $68 million in 2015, three times more than in 2014 and 25% more than 2013. Accounting for 52% of total committed capital, Ukrainian funds were nearly even with foreign funds, exceeding the latter by only $10m. The most active local funds in 2014-2015 by number of deals included Digital Future, AVentures Capital, Detonate Ventures, and CIG.

- Foreign funds and individuals invested a record $60 million in 2015, a twofold increase over 2013 and a threefold increase from 2014. The biggest deals of the year by foreign funds included the Soros Fund investment in Ciklum; Horizon Capital in Rozetka; TMT Investments in Depositphotos; Almaz Capital, ABRT and AVentures Capital in Starwind Software; InVenture Partners, Intel Capital and Finsight Ventures in Gilbus; and Almaz and AVentures Capital in Petcube. The most active foreign funds by number of investments included Almaz Capital and Imperious Group.

- While some previously active funds remained inactive in 2015 (among them Vostok Ventures, Siguler Guff and Fison), several newly formed funds such as Digital Future and BeValue emerged as active investors. Digital Future alone made seven disclosed seed investments in 2015.

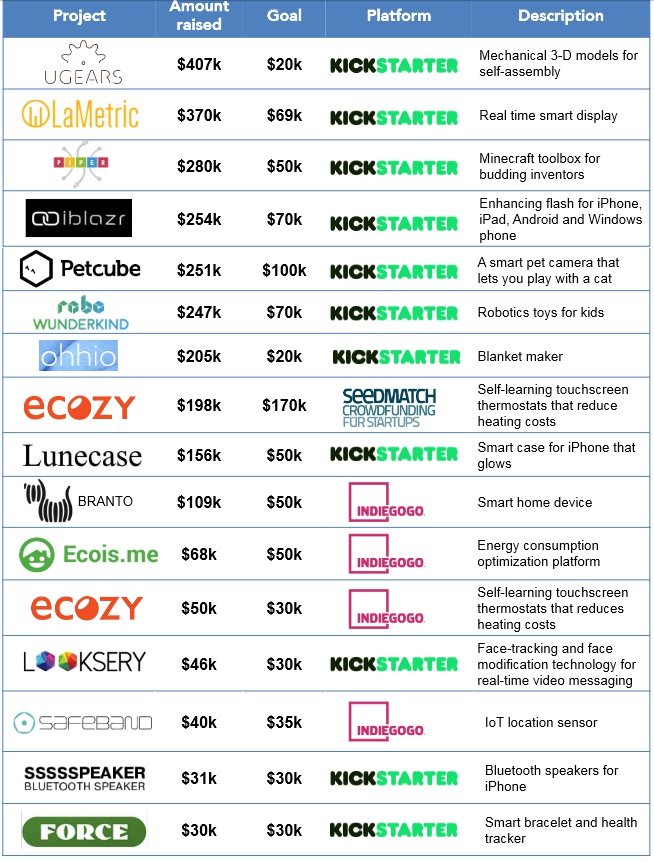

Ukrainian projects on crowdfunding platforms

Download Full Report - The Dealbook of Ukraine 2016: The Ultimate Report about the Ukrainian Startup and Venture Scene