In its first report on Ukraine’s merger and acquisitions market, one of the big global four auditors — KPMG — sees a rebound.

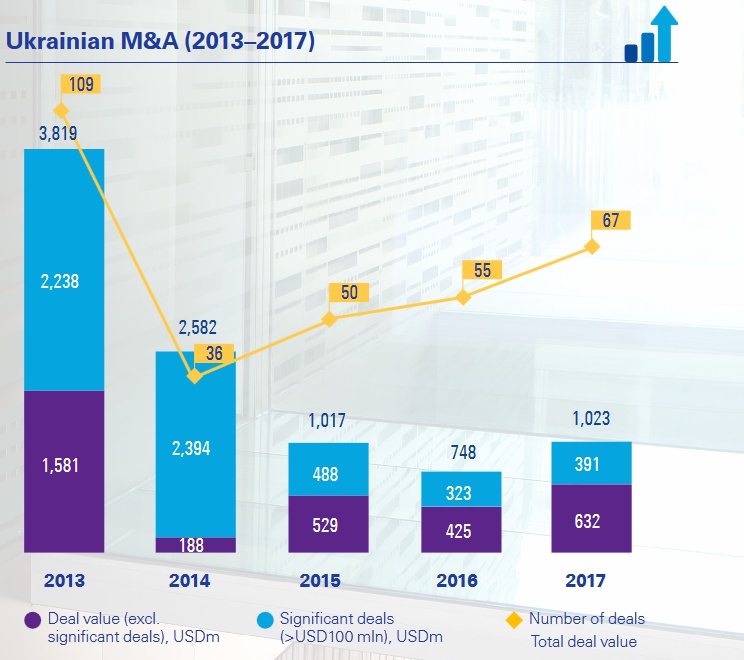

Overall, Ukraine’s 2017 M&A market showed growth in value of deals ($1 billion) and announced deals (67). The market is still, however, only about 60 percent of the size it was in 2013, before the twin shocks of revolution and war sent Ukraine’s economy into recession.

The full report "Ukrainian M&A Review 2017" can be viewed here.

Moreover, Ukraine is still lagging. The country’s deal activity is just under 1 percent of gross domestic product, which is four times lower than the global average and more than 10 times less than in mature markets such as those of the United States and United Kingdom.

But KPMG’s Peter Latos, head of the company’s deal advisory department — a team of 50 people — says that investors’ appetite in Ukraine is starting to grow.

“It’s a market that’s clearly showing signs of recovery from where it was in 2013,” told Latos. “We as a team here are exceptionally busy… so we are seeing a lot of international investors coming to us asking for our help.”

After years of decline, 2017 finally saw Ukraine’s mergers and acquisitions market return to growth.

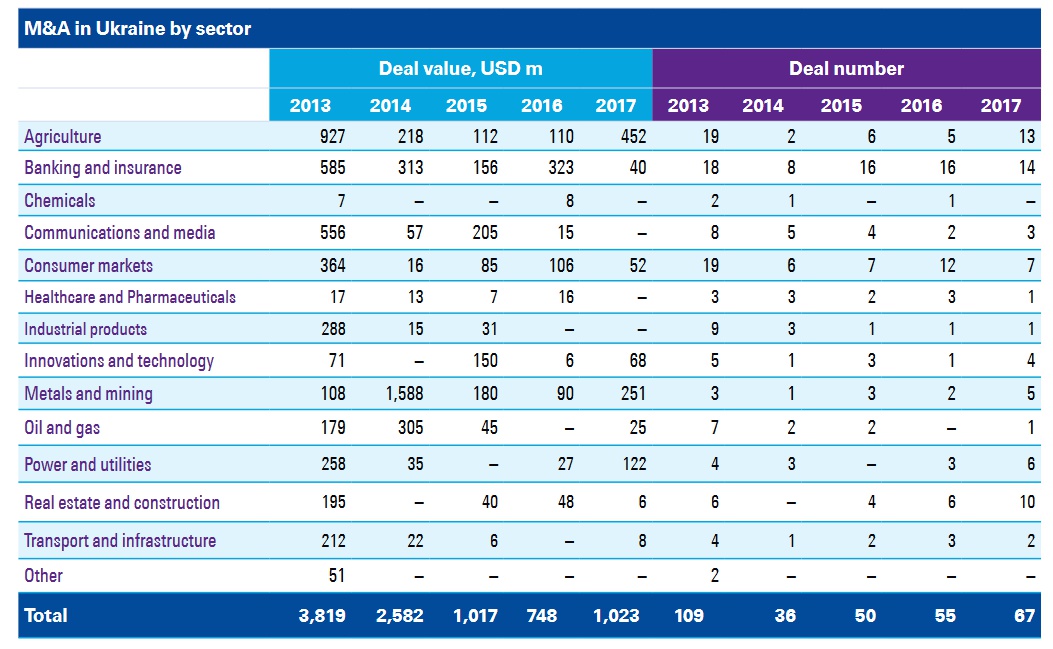

Agriculture was the most active sector in 2017, attracting $452 million of deals, or 44 percent of the total deals.

The value of 2017 Ukrainian M&A was driven to a large extent by three deals each valued in excess of USD100 million. In June 2017, Kernel, Ukraine’s largest agricultural business, used part of the proceeds from its January Eurobond raising to acquire Ukrainian Agrarian Investments from Russia’s Onexim Group for USD155 million. A group of international investors acquired a 13 per cent stake in Ferrexpo from CERCL Holdings in January for USD126 million, while in May Evraz Group

sold its Ukrainian iron ore mine and beneficiation plant (ESB) to DCH Group for USD110 million.

Agriculture

The strongest M&A sector is agriculture. “We see a lot of interest in Ukrainian agriculture from our clients from a number of different geographies,” Latos said. “This interest covers the full production value chain, from processing, handling, and distribution, to supermarkets and retail chains.”

Other strong sectors include IT and communications, minerals and mining, and oil and gas.

“The volatility between industrial sectors can swing quite significantly from year to year, but in terms of the general trends what we’re seeing is increasing levels of activity and investment coming into the country, and that’s what we think will continue.”

But much of that success depends on further reforms, which have been stalled by Ukrainian President Petro Poroshenko’s administration.

The most important reforms, such as establishing an anti-corruption court, privatizing state enterprises, strengthening the financial sector and lifting the ban on selling agricultural land, are priorities from the International Monetary Fund and Ukraine’s other financial backers.

“Clearly, the investment that’s come in from the IMF and (European Union) is a key metric, which is helping to bring stability to the economy, and clearly any investor wants to know that there is political and economic stability for them to invest,” Latos said.

Banking sector

The banking sector still needs an overhaul, despite the National Bank of Ukraine shutting down 90 banks, about half of the total supply, and transferring their assets to the Deposit Guarantee Fund.

“There’s going to be further deals in this market, predicated on the fact that the Deposit Guarantee Fund needs to liquidate all of the so called ‘toxic assets’ that it currently holds,” Latos said.

In a bid to attract foreign investors, KPMG will soon be launching a platform together with the fund to sell non-performing assets in Ukraine. “There’s a huge number of non-performing loans within the Ukrainian economy — mainly corporate,” Latos said.

Ukraine’s EuroMaidan Revolution, which drove Kremlin-backed President Viktor Yanukovych from power in 2014 and triggered Russia’s ongoing war against Ukraine, damaged the economy — and the M&A market. But it did not shake faith in the nation’s “medium to long-term fundamentals,” Latos said.

A less successful sector is infrastructure. “We don’t see investors coming in from that angle particularly at the moment,” Latos said.

Upcoming elections

With the nation’s politicians fixated on the 2019 presidential and parliamentary elections, painful reforms are expected to grind to a halt.

“The risk is always that people start to take shorter term views as they’re coming up to an election cycle,” Latos said. n