Business Structure and Economics

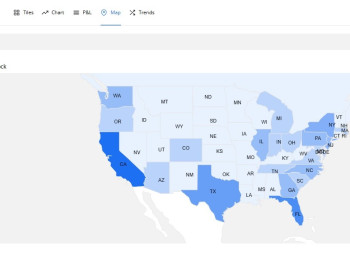

The company operates under a direct-to-consumer (DTC) model in the U.S. market, selling functional herbal teas under its own Leckar brand via Amazon USA.A U.S.-registered company owns the brand and the Amazon account. Manufacturing is outsourced to Europe on a contract basis with a local producer.

Average retail price: $17 per unit

Production cost: $1.60 per unit

High margins provide significant room for scaling through marketing.

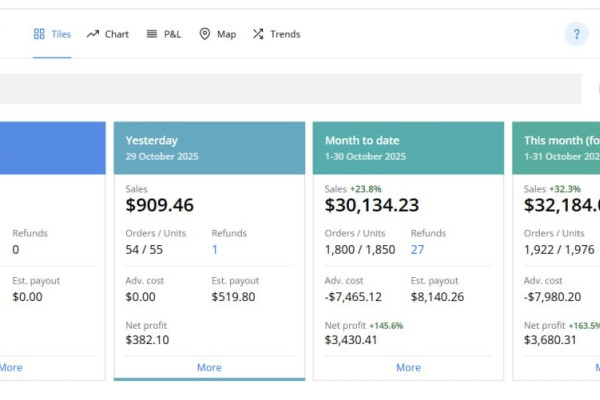

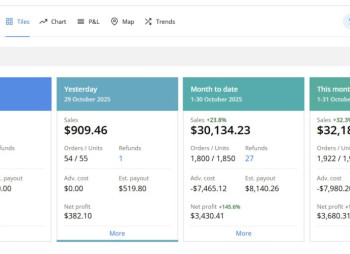

The business was launched in February 2025. Within 11 months, it reached $200k in revenue with 10% profitability.

- Q4 2025 sales: $85k

- Monthly growth: +$6–7k (~20%)

- Annual growth potential: 3–5x

Product Portfolio

The company is developing a portfolio of 6 active SKUs and 2 products in the 2026 pipeline, combining stable cash flow with strong scalability potential.

- Mature SKUs (core revenue)

- 3 products on the market for 6–11 months

- Ratings: 4.2–4.8 / 5

- Monthly sales in 2025: $34k revenue, 2,040 units

-

Growth-stage SKUs

- 3 products on the market for ~3 months

- Ratings: 4.1–4.6 / 5

- Monthly sales in 2025: $14k revenue, 900 units

-

Pipeline 2026

- Season Cough — launch in February 2026

- Go Tummy Go — launch in February 2026

Financial Forecast (2026–2029)

|

Indicator |

2026F |

2027F |

2028F |

2029F |

|

Units sold, pcs |

51 500 |

70 500 |

90 000 |

110 000 |

|

Revenue, USD ‘000 |

880 |

1 200 |

1 500 |

1 750 |

|

Cost of goods sold (COGS), USD ‘000 |

141 |

192 |

240 |

280 |

|

Amazon fees, USD ‘000 |

370 |

504 |

630 |

735 |

|

Amazon advertising, USD ‘000 |

334 |

360 |

375 |

437 |

|

Advertising, % of revenue |

38% |

30% |

25% |

25% |

|

Net profit, USD ‘000 |

35 |

144 |

П255 |

298 |

|

Net margin |

4% |

12% |

17% |

17% |

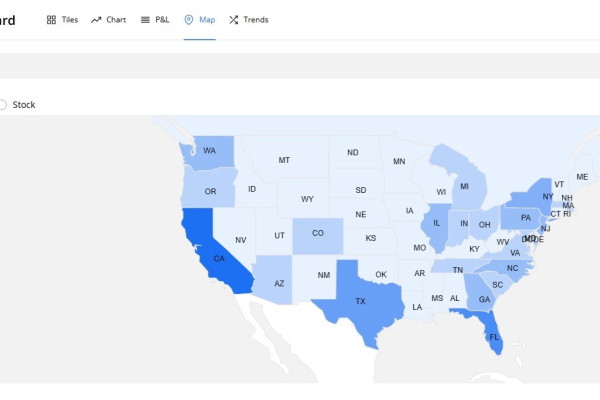

How organic sales scale from $30k to $100k per month