Project Overview

This is a venture investment in a biotechnology platform that leverages AI to transform the development of protein therapies. The company is building a new generation of antigens and tools for optimizing protein production. It has already signed a contract with a global pharmaceutical company and secured a term sheet from one of the world’s largest lab equipment manufacturers.

Geographic Focus

USA, Egypt, Germany, Saudi Arabia.

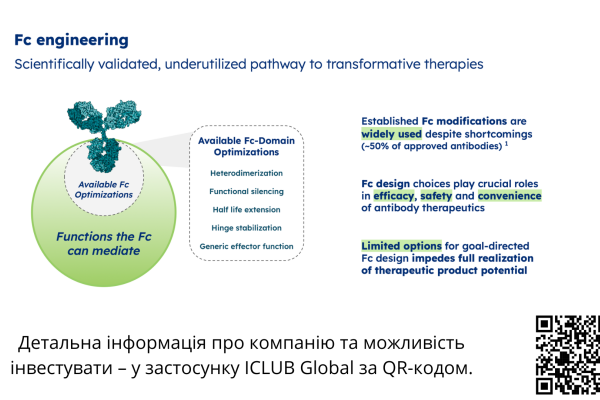

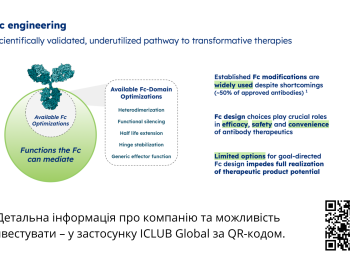

Problem Statement

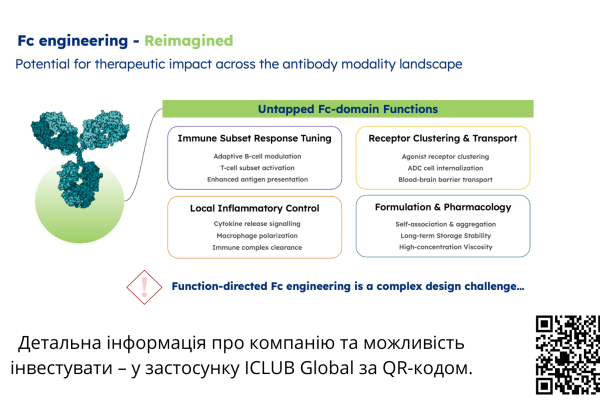

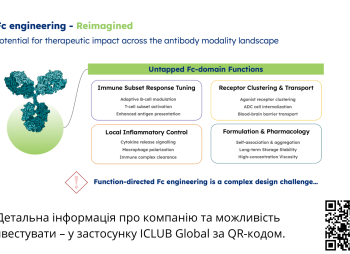

Modern antibody development is based on outdated domains, limiting therapeutic efficacy, durability, and drug delivery.

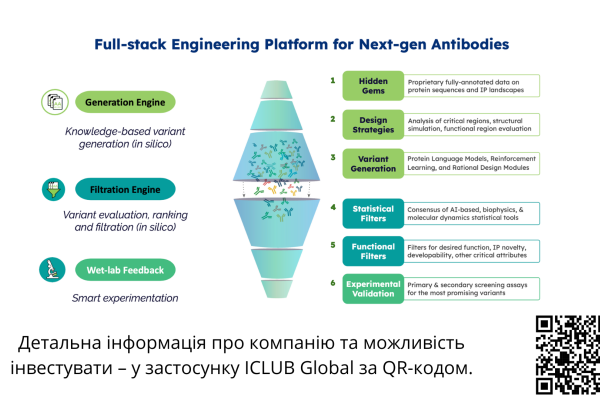

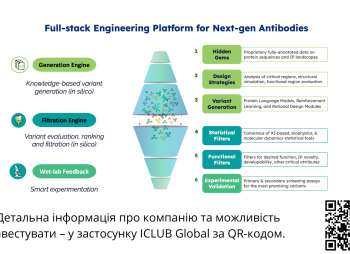

Solution & Product Information

The company’s platform enables generation of next-generation protein components with precise control over pharmacokinetics, immune response, and molecular stability. It combines LLM-based modeling, physical simulations, developability filtering, and lab validation. The company has also developed a protein expression optimization tool that increases yield by up to 9x.

Market Overview

The global protein therapeutics market is expected to exceed $445 billion by 2030. There is increasing demand for innovative antigen engineering—particularly for subcutaneous delivery, immune agonists, and immunoglobulin replacements.

Go-to-Market Strategy

The company has secured a $6 million licensing agreement with a top-20 global pharma company, and a term sheet for $1.5 million in annual licensing fees from a major lab-tech company. Revenue model: SaaS, royalties, and milestone-based deals.

Key Suppliers & Partners

Lab infrastructure in 4 countries. ML model deployment via cloud computing. In-house experimental capabilities.

Current Development Stage

- Signed agreements with a pharma company and a lab software vendor

- 3 proprietary products: inflammation, immune agonists, subcutaneous delivery

- 6–9x improvement in protein expression

- Profitability expected in 2026

Assets

- Proprietary lab infrastructure, LLMs, patented protein constructs

- Patent applications filed in 12 jurisdictions: US, EU, Japan, China

Team

- CEO — Bioengineer and founder; ex-Kantar TNS.

- CPO — Computational biologist with cross-disciplinary research background in protein engineering.

- Head of R&D — PhD immunologist; leads preclinical programs and translational strategy.

- Core team — ex-Google Research, Stanford, EU biotechs, MENA pharma, and more.

Key Financials & Targets

- $18 million deal signed ($6 million already received)

- Two licensing deals for FC domains in final negotiation

- $13 million grant from Google to build proprietary LLM

Use of Funds

- Expanding product portfolio

- Scaling platform to SaaS

- Lab research and IP protection

Capital Raised to Date

Total raised: $5.5 million. ICLUB allocation: $500,000 (minimum ticket: $5,000)

Exit Opportunities

- Acquisition by pharmaceutical companies (assets or platform)

- IPO based on a platform-clinical model (e.g. AbCellera, Schrödinger)

Offer to Investors

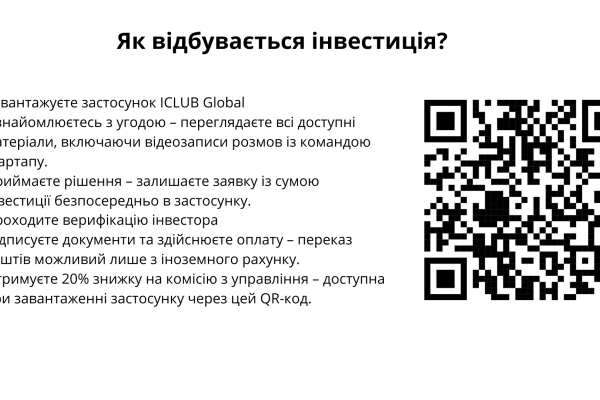

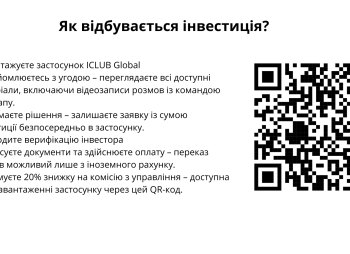

This is a venture-stage investment co-led by the ICLUB angel syndicate and TA Ventures.

It is structured as equity financing, with returns expected through company valuation growth and future share sale — no dividends.

Minimum investment ticket: $5,000

Details of the deal and project data are available in the ICLUB Global mobile app.