A venture investment in a fintech platform that launches turnkey mobile neobanks in partnership with local banks. The platform offers credit, payments, savings, and other services via a single app; it utilizes proprietary AI-driven scoring models and attracts spin-off projects from partner banks.

Regional focus: Asia, MENA, Latin America

Market Challenge

Traditional banks in many countries are unable to issue new digital licenses quickly, while more than half of the population in these regions remains underserved by modern financial services.

Solution & Product Information

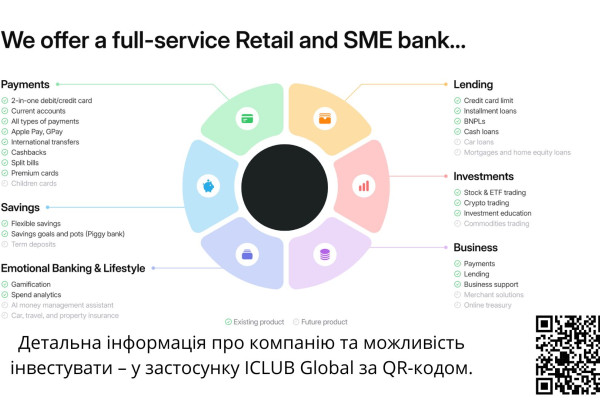

“Bank-in-a-box” SaaS platform:

- Full-stack infrastructure for mobile bank deployment

- AI scoring for thin-file clients

- UX rating of 4.9/5

- White-label and BaaS models for rapid go-to-market

- Credit, payments, savings, insurance, and investment services integrated in a single app

Market Overview

By 2028, fintech sector revenues across emerging markets are projected to grow from approximately $150 billion to around $400 billion (CAGR ≈ 15%). Growth is driven by high smartphone penetration and the shortage of digital banking licenses.

Intangible Assets

Proprietary technology platform, AI scoring models, patent portfolio, partnerships with international payment systems, and option shares in affiliated neobanks.

Current Development Stage & Achievements

- 3–5 neobanks launched (first one reached profitability in under 1.5 years)

- 1–2 million active users

- $200–250 million in signed credit limits

- ARR of $30–35 million with 2× year-over-year GP growth

- Accepted into a global network of top-tier fintech projects

Team

- CEO — serial fintech entrepreneur, co-creator of one of the region’s largest neobanks (10M+ users)

- Co-CEO — 15 years in M&A (Big 4, fintech)

- CTO — creator of a leading online banking platform, holder of 30+ patents

- 200+ professionals (ex-BigTech, Tier-1 banks)

Key Current and Target Metrics

- Annual revenue: $30–35 million

- 2× YoY growth in gross profit

- 50%+ RoE in mature markets

- Expected portfolio profitability: < 2 years from new market entry

Investor Offer

Venture-type investment, with returns generated exclusively through the company’s capitalization growth and the subsequent sale of ICLUB’s equity stake. No dividend payouts.

- Investment format: Secondaries — investors are invited to join the secondary tranche on the same terms as internal investors.

- Minimum ticket: $10,000; venture model (returns through capital appreciation)

- Deadline: June 3, 2025

Exit Opportunities

Sale of neobanks to local banks/financial groups or platform IPO within 3–5 years; projected revenue multiple of 8–12x.

Further project details are available upon registration in the app via the link or QR code.