Global economy

The global economy contracted during Q1 2020 for the first time in 11 years. Data indicates the world is facing a deep but short recession, followed by a relatively slow recovery period. Global GDP is expected to decline by roughly 5% in 2020, far more severe than the worst of the Global Financial Crisis (GFC).

Global capital flows

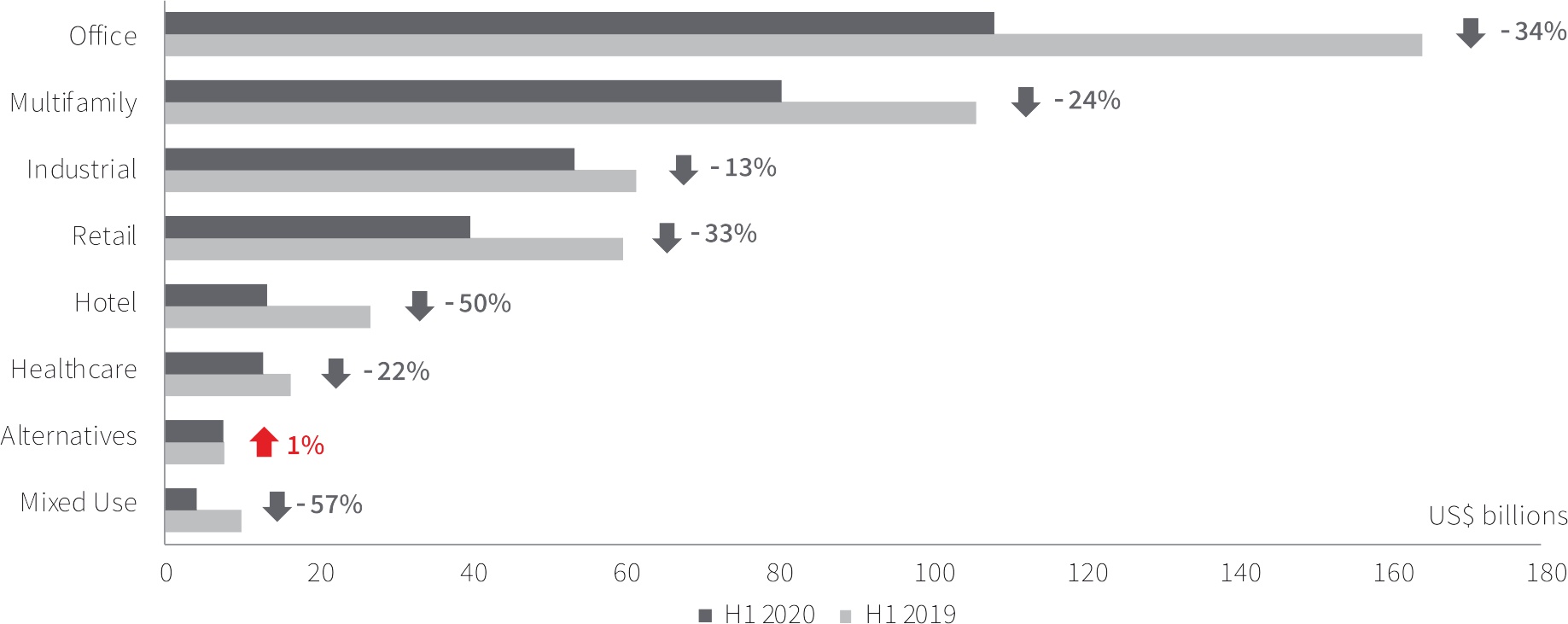

- Global commercial real estate investment in Q2 2020 dropped 55% year-on-year to US$107 billion,

equating to a 29% decline in H1 2020, as the impact of the pandemic became evident. The Americas and Asia Pacific saw activity decrease by 37% and 32% respectively during H1, while a spillover of pre-COVID deals in EMEA contributed to a more muted fall of 13%. Expectations for a recovery in investment activity in H2 2020 are varied across markets, with Asia Pacific likely to improve first as lockdowns are lifted and business activity increases. - Investor strategies are focused on defensive, operationally-critical sectors which are aligned with secular trends. This will continue to benefit industrial, multifamily, data centers and other alternative assets.

- Global real estate debt markets moved closer to stabilization in the second quarter against a backdrop

of record-low interest rates around much of the world and government intervention in credit markets. This has brought many lenders, who took a ‘wait and see’ approach at the onset of the pandemic, back into the marketplace and quoting new transactions. Nevertheless, lenders have generally retained a defensive posture and continue to place greater scrutiny on leverage, sector, asset profile and cash flows relative to the pre-COVID era. - The uncertainty surrounding the pandemic has impacted fundraising by private closed-end real estate

funds, as aggregate capital raised in H1 2020 fell by 26% year-on-year. Despite this drop-off in fundraising activity, the longer-term trend of increased allocations to real estate remains apparent as more managers are seeking to go to market with offerings. However, investors are consolidating manager relationships, with a relatively high percentage of investors expecting to invest in only

one fund over the next 12 months. - Cross-border investment has slowed significantly and is likely to remain muted as travel restrictions and logistical challenges hamper activity. Markets which are more reliant on cross-border capital are already feeling the effects of this market shift, resulting in steeper declines in transaction activity in the short-term. Private capital, which had already been expanding in its influence before COVID-19, will remain an important source of liquidity going forward. Private local investors and high-net-worth family offices from the Middle East, Hong Kong, Singapore and the U.S. have emerged as new sources of liquidity, as institutional investors have taken a step back to assess risk.

Global transaction volumes by sector, H1 2019 & H1 2020

A divergence in pricing from pre-COVID levels has become more apparent in Q2 and is largely dependent on local occupier fundamentals and asset-level risk.

Although a bid-ask spread remains in the market, a broader recovery in the capital markets will accelerate price discovery and enable investors to better underwrite opportunities and understand the impact of the pandemic across different sectors and risk profiles.

Corporate occupiers

- Re-entry strategies picked up pace across the globe in the second quarter in accordance with national, state or local governance, with a partial return in Europe and the U.S., while a full return was experienced in some Asia Pacific countries. For occupiers the future will continue to be unclear throughout 2020. Scenarios are still being dictated by economic and health data, pushing occupiers toward a short to medium-term vision rather than a long-term vision.

Office sector

- Office markets witnessed extensive disruption during the second quarter of 2020, with global leasing volumes down 59% on a year earlier. Activity fell sharply across all regions: -65% in the Americas, -61% in Asia Pacific and -49% in Europe. Widespread work-from-home programs obscured future space requirements, and lockdowns effectively ceased tour activity in many markets. Occupier decision-making processes have also lengthened as uncertainty and disruption remain key concerns. Vacancy rates moved up across all regions in Q2, with the global vacancy rate now recorded at 11.2% (+50 bps).

- Heading into the second half of 2020, all eyes will be on the ability of markets to withstand or contain a potential second wave of COVID-19 as well as on tenants’ response to re-entry that began gradually in Q2. With the majority of demand in a state of pause, some degree of rebound in leasing activity is anticipated in Q3 and particularly Q4.

- Demand from the flex sector has come to a virtual standstill after several years of creating substantial demand. Operators are responding with higher operational efficiency (skeleton support staff, job cuts), rent deferrals/discounts, and utilization of government support. However, over the longer term, businesses will have a greater need for flexible space to accommodate portfolio expansion and contraction and to provide varied workplaces for their employees.

- Most occupiers are focused on reopening their offices and getting used to the ‘new normal’, including some level of de-densification that meets social distancing requirements. Even so, office space still has a pivotal role to play in facilitating essential face-to-face activities that are not easily replicated online. Additionally, there is now an abundance of survey evidence that shows employees are keen to return to the office for at least part of their working week. Offices will remain a fundamental part of corporate culture.

Retail sector

- Footfall and retail sales have begun to recover from recent lows following government easing of lockdowns in many countries but remain below 2019 levels. Operating conditions continue to be challenging, with the impact of the pandemic becoming more apparent during the second quarter.

- The short-term outlook remains highly uncertain, with ongoing social distancing measures and new outbreaks limiting the recovery for many operators. Most retailers continue to be cautious and are focused on returning to profitability and reassessing strategies to best meet the shift in buyers’ shopping habits given the uncertainty about future prospects.

Logistics sector

- The resumption of industrial production following the gradual lifting of lockdown restrictions helped to ease the supply chain disruption and logistical challenges seen in H1. Occupier demand across all three regions saw a general softening in Q2, reflecting restrictions on property viewings and a wait-and-see approach from some occupiers. Sectors such as medical supplies, grocery and online sales proved resilient and have boosted demand.

- While new additions had slowed as pipelines faced disruptions, the sector’s solid fundamentals and future demand projections have seen developers quickly re-start construction projects. Global vacancy saw an uptick to 8.2% but supply remains tight in many markets. Momentum in the rental market has eased with stalling rents in all three regions.

Hotels & hospitality sector

- The hospitality sector has been hit hard by the pandemic with the ongoing pullback in both leisure and business travel continuing to flow through to the sector. Hotel markets across the globe have started to reopen, but revenue per available room is significantly down on last year.

- Heightened uncertainty has impacted investor appetite for hotels, with asset valuations becoming more challenging. Acquisitions are largely on hold, with the exception of several transactions well underway at the onset of the pandemic or which involved the conversion of the hotel to an alternate use. As yet, distressed activity across the regions has been very limited but a pickup is anticipated in the latter half of the year.

Living sector

- Despite multifamily in the U.S. recording a dramatic decline in investment volumes during Q2, it continues to be the most liquid commercial real estate sector in the country – underlining its desirability in these uncertain times. Investor demand in Europe also remains high. There are some concerns regarding modest downward pressure on rents, reflecting the potential impact of the ending of various government support schemes and increased unemployment. These effects are likely to be uneven depending on each market’s economic recovery profile.

- Stronger sales performance was evident in the Asia Pacific residential market in the second quarter as pentup demand was relieved in several markets. In Mainland China, home sales rebounded in Beijing and Shanghai as falling interest rates and temporarily discounted prices encouraged cautious buyers. Price growth was generally muted across the region in Q2.