This year, new protections put in place by the U.S. government to limit the sharing of critical technologies with foreign individuals will affect a large number of startups as well as related investments, mergers, and acquisitions. And since the law applies to all foreign individuals, whether abroad or in the U.S., companies with investors, partners, or customers who are based in the U.S. but are not U.S. citizens could feel significant impact.

As the requirements begin to take hold, VCs and tech companies, particularly startups, must be aware of compliance protocols.

t isn’t yet fully clear which technologies fall under the new protections. Last August, when the government updated a national security law that blocks U.S. companies from sharing critical technology with foreign persons, it mandated that several new, unspecified “emerging technologies” be covered under that law.

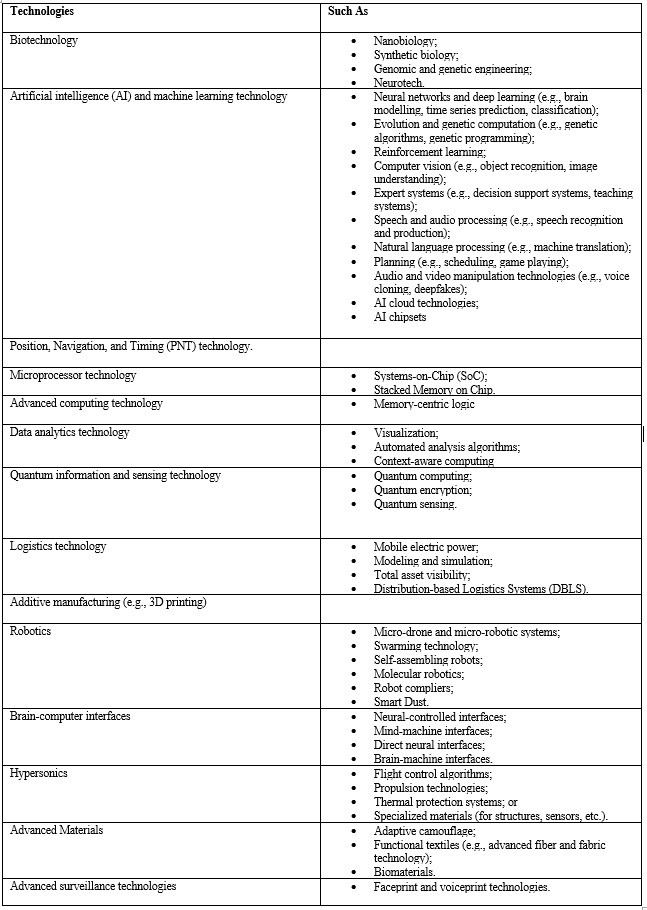

In November, though, the Commerce Department gave us a first look at which technologies could be affected. The Federal Register Notice gave the following list of those being considered for inclusion in the new definition of emerging technologies:

We can expect the Department of Commerce to finalize the list of affected emerging technologies sometime this year. At that point, U.S. companies producing those technologies will come under heightened scrutiny and will face new limitations under the export control laws.

Why the new definitions matter

If a startup has or will have any foreign ownership and is involved in the production, design, testing, manufacture, fabrication, or development of a critical technology related to one of 27 targeted industries (which range from aircraft manufacturing to the development of nanotechnology), it will have to file that information with the Committee on Foreign Investment in the United States (CFIUS) if the foreign entity has:

- control of the company or\

- access to any “Material Nonpublic Tech Information” of the U.S. business or

- membership, appointment, or observer rights on the board or

- involvement in decision-making regarding the use, development, acquisition, or release of critical technology.

This policy shift is important since it means there will be new limits on who can buy, work for, or invest in a tech company in the U.S. The CFIUS filing requirement regarding the 27 targeted industries became law in late 2018, so startups will need to keep this in consideration when evaluating financing options.

Additionally, if a startup has critical technology in its business, it must determine if it can share the technology with foreign entities outside of the U.S. and foreign persons in the U.S. With the upcoming enlargement of technologies defined as “critical,” the government will also place export controls on more technology.

What should you do?

If your startup could be affected by these changes, you’re responsible for the following:

- Self-classifying or obtaining export classifications for products and technology to determine whether your company’s technology is considered “critical.”

- Determining if there are any “deemed export” or export controls applicable to your product/technology. A deemed export is sharing controlled technology with a foreign person in the United States.

- Determining your company’s foreign ownership and if investors (directly or indirectly) will have control of the company; will have access to any critical technology or related “Material Nonpublic Tech Information”; will have a board seat or observer rights or the right to appoint board members; will have any involvement in decision making of the company (other than through ownership rights).

- Ensuring your legal advisors understand this area of the law or can get you to someone who does. It can hinder, and potentially even kill, a transaction if you don’t know ahead of time that you have controlled critical technology that could limit your ability to do business in the global economy.

Moreover, all U.S. companies must ensure they don’t do business with any Specially Designated Nationals (SDNs), other restricted persons, or with those in embargoed places. Obviously, this requirement is especially important for companies with sensitive items and technology. To ensure your company doesn’t do business with a restricted party or in any embargoed country, you’ll need a compliance program with procedures to reduce your risks.

Tech investors should understand these changes, too, to ensure their portfolio companies are aware of relevant regulatory issues.

Technology companies have filed comments on the proposed definition through the Commerce Department process. Some of these comments have expressed concern that export controls on artificial intelligence will stifle future U.S. research and development in the industry. Many companies remain hesitant to bring their technology to the attention of the agency.