- According to your press-release that followed the Al Jazeera publication of the classified Kramatorsk Court’s sentence, ‘ICU had carried out a mandatory identification procedure and performed financial monitoring in respect of domestic government bonds buyers before entering into the agreement on broker services provision’. Having performed this procedure, whom did you think than you were servicing?

- Having completed the verification, we identified the clients and the controllers. Neither of them were on any sanction lists, and they were not connected with the government acting at that time. As a broker, we carried out the identification procedure in keeping with the law, only then did we carry out the standard broker operations.

We did not have the legal grounds, or powers of the law enforcement authorities to make further investigations in order to study the clients more thoroughly. Subsequently we handed all documents related to these companies over to the investigative authorities.

- Was it Oshchadbank’s (Ukraine’s State Savings Bank) decision to choose you?

- Again, you have to look at what actually happened. As you can read in the published document, the companies had been executing transactions on domestic government bonds purchases directly with Oshchadbank since 2012. The bank was licensed as a broker/dealer and there was no need to involve an external broker. In October 2013, the law changed thereby requiring both parties in a transaction to a third party broker/dealer.

As we understand it, Oshchadbank recommended its foreign clients several brokers. It was not surprising that they contacted us: we were the market leader for government debt instruments. We were also among the first ones ready to follow requirements of the new legislation and as a result, we had been servicing transactions related to domestic government bonds sale and purchase between Oshchadbank and non-residents for two months – November-December 2013.

- How much did your company charge for servicing such transactions?

- ICU charged a standard flat fee for an agent’s role – UAH 1 000 per transaction regardless of the transaction’s volume. We signed a standard contract for broker services provision given that at the very beginning nobody said anything about the transactions’ volume, nor about the execution period for the transactions. Transactions were executed on the grounds of one-time orders. We performed the function of an agent only, Oshchadbank and the companies negotiated the price for securities directly between them. The companies also had cash accounts as well as securities accounts opened with Oshchadbank.

- How many transactions were there in all?

- There were 36 transactions, for which we charged UAH 36 000 accordingly. There was no added value and no credit risk. This is a mechanic process. We execute dozens of these transactions daily and we have around two hundred clients for whom we act as a broker.

- Yuriy Lutsenko, Prosecutor General, stated that the Regulator’s – National Securities and Stock Market Commission’s (NSSMC’s) – inspection was followed by the additional examination of the transactions. Who is carrying out such examination and what is its role?

- That is a question for the Prosecutor General. We learned about the additional examination from his statement to the press.

Previously, following a court ruling initiated by the public prosecutor’s office, the NSSMC inspected our actions in respect of the transactions to find out whether they met the legislative requirements at that time. The inspection lasted for two months and proved that we had done everything correctly.

Either way, we are not concerned about any new potential inspection as we have acted in accordance with law.

- To what extent have requirements for the financial monitoring and client identification changed over the last four years? Would you execute similar transactions today?

- The law that tightened KYC regulations came into force in 2015. According to the law now, financial institutions shall check the source of clients’ funds. The law also stipulates the extended broker’s powers to get information about the client from additional sources.

- If we understand the situation correctly, Latvia carried out asset forfeiture earlier than Ukraine. Nonetheless, international law enforcement authorities have not contacted you on this matter, have they?

- No, they have not.

Let me also mention that in keeping with the European Anti-Money Laundering legislation that is binding for all EU regulated financial institutions, the recipient’s bank may not check the source of received funds that have been transferred by another European bank. It is the remitting bank that is responsible for the primary monitoring.

- According to the declassified court’s decision, was the Latvian PrivatBank a remitting bank? Everything was done there via it?

- According to the text of the court’s decision – yes, almost everything. If you have a look at the International Bank Account Numbers (IBAN codes), you can see three other banks are also involved; they, however, transferred minimal amounts. Those banks are the Latvian Baltic International Bank, the Estonian Versobank, and the local branch of Danske Bank.

- We are interested, if one can apply to the international court on the grounds of that published decision to get payment from Ukraine. We mean those, who have repurchased these offshores, and would classify themselves as good faith purchasers.

- It is hard for me to comment. It would be better to ask international lawyers that question. Broadly speaking, the answer will depend on the jurisdiction in which the case might be handled, the date of execution for the transactions, and other information available at the time of such transaction’s execution etc.

- However, influence of the Cypriot court and the Kramatorsk court is probably different.

- I don’t think it is right to compare them since the subject matter of the potential lawsuits is completely different.

- As an investment banker, in a similar situation would you buy such debt instruments issued by the other country if they were really cheap?

- It is a very old business area: handling distressed assets. One can purchase anything – claims against Pakistan, Argentina’s default debt…

- Can it serve as one of the possible underlying reasons for ‘Al Jazeera’s’ coming up with the classified decision?

- Theoretically speaking. It’s a notion that cannot be ignored.

- Let me ask a more extended question: Do you have a kind of a ‘stop-list’ or ‘blacklist’: a list of clients, which you will not service even if they will go through the KYC procedure, the financial monitoring, and the identification successfully? Or in the Ukrainian investment business is nobody choosy about clients?

- Firstly, there is a wide range of legislative ‘stop-lists’ – these include Ukrainian sanction lists, OFAC sanction lists, EU and UN Security Council sanction lists, and others. Moreover, yes, we are selective when it comes to our clients, and we choose them very carefully. If, for example, we come across politicians, the so-called ‘PEPs’, we will try to avoid them.

- So, it seems that you have come to certain conclusions for the last years, haven’t you?

- We did not service ‘PEPs’ particularly before that. But if you are talking about the country’s major ‘PEP’, we had started working with him long before he became ‘PEP No.1’ – since 2000, when I was working for ING Bank.

- People call you Poroshenko’s investment banker…

- People call me ‘Poroshenko’s investment banker’ because they stand to gain from that kind of name calling. You could also call me an investment banker of Verevskyi [Andrei Verevskyi is a Chairman of the Board of Directors and co-owner of Kernel], Kozhemiako [Vsevolod Kozhemiako is a General Director and co-owner of ‘Agrotrade’ group], Kostelman [Vladimir Kostelman is a co-owner of Fozzy Group], Petrov [Aleksandr Petrov is a Chairman of the Board and co-owner of IMC agroholding], and many other people. The reason for this is that in respect of certain sectors and areas of business in Ukraine, the proportion of the overall volume of transactions which I have executed throughout my career exceeds 50%.

- Do you provide any services to the President today?

- No. A single contract, which ICU fulfilled for the President, was a joint project with Rothschild on the sale of Roshen. The project ended for us in April 2016 after the assets had been transferred to a ‘blind trust’.

- Another series of accusations is connected with a ‘Rotterdam+’ formula and a purchase of DTEK bonds by ICU. There was pressure on the energy company and the price for its eurobonds was decreasing; later on the State Regulator’s (NUERC’s) dramatically altered its position and the ‘Rotterdam+’ formula was approved. The price for the company’s eurobonds began to increase. The Regulator’s manager, as we know, had previously worked for ICU.

- If you are working within Ukraine’s and CIS’s debt markets, you cannot avoid working with eurobonds issued by DTEK, ‘Metinvest’, and FUIB. If you take a list of all corporate [excluding government and quasi-government] eurobonds issued in Ukraine at that time, the DTEK will account for around 40%.

We began investing in DTEK eurobonds in 2011-2013 at the price that equaled its nominal value. In 2015 and 2016, we purchased some more DTEK eurobonds for two reasons that were obvious for investors: they were cheap securities and it was the start of the company’s negotiations with its creditors on the restructuring of its debt.

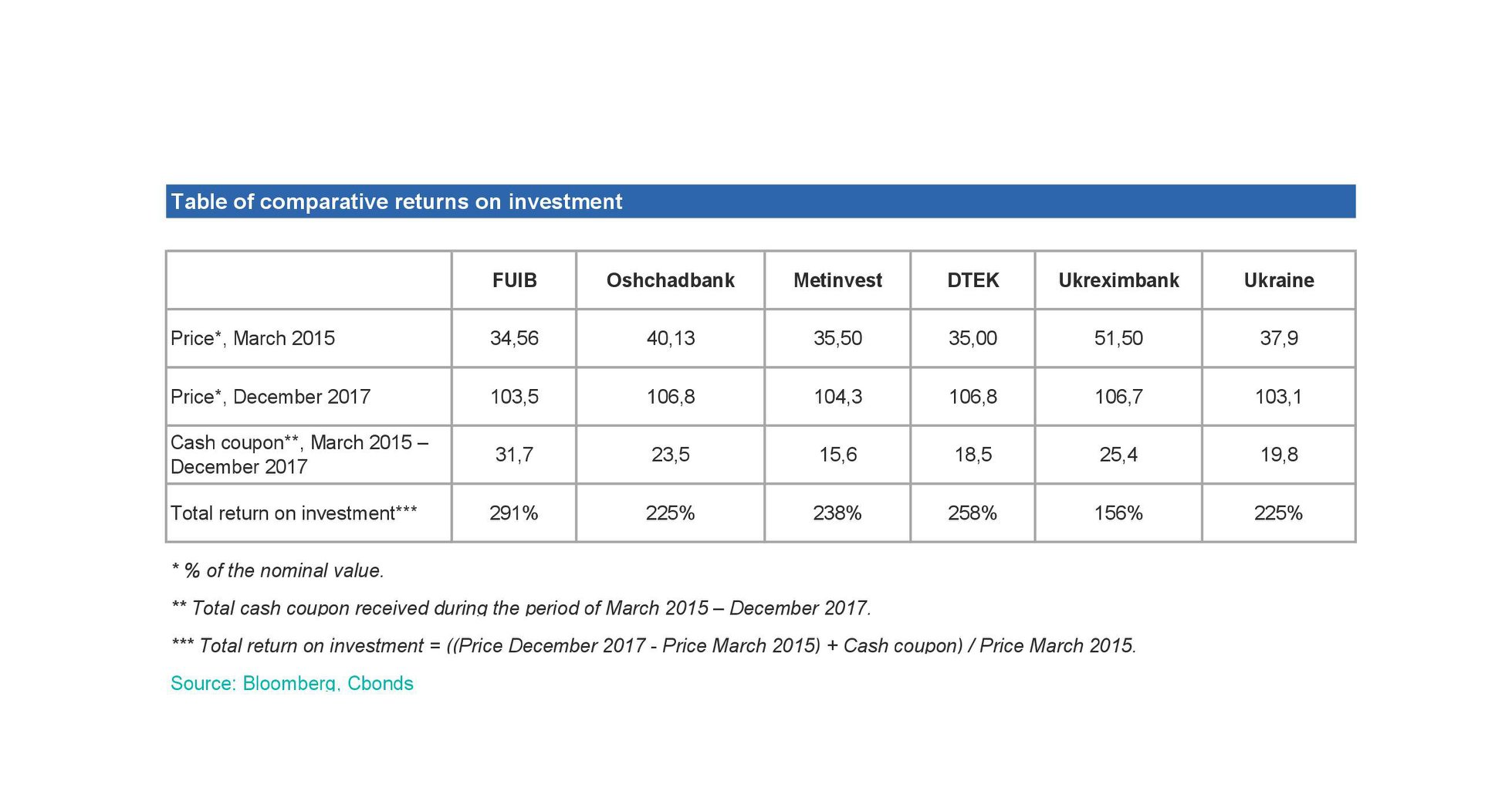

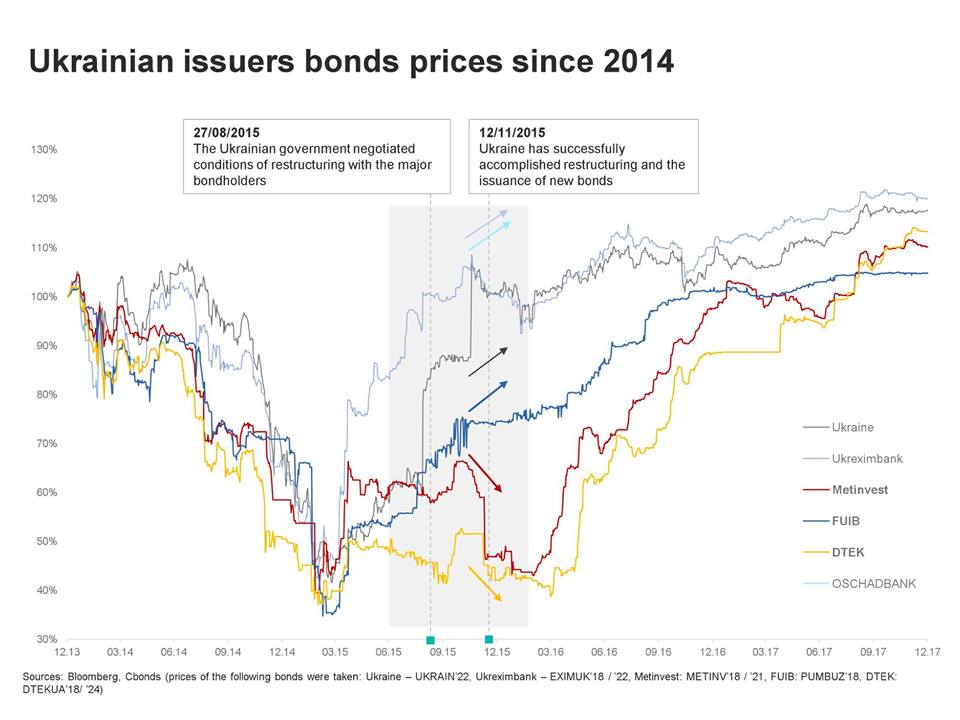

On the price, just look at the dynamics of prices for securities of the biggest Ukrainian issuers and a return on investment indicator since March 2015. We can see that the prices had been increasing for all securities. This means that the growth drivers were also identical for all of them.

- You are trying to put forward your investment logic, but I relate more tothe logic of accusations against you: there was a pressure on DTEK, and the price for its securities was decreasing…

- Ok, I understand your thinking. Can you then tell me the reason for the price increase of Ukrainian eurobonds at the end of 2015 and for the almost simultaneous decrease in price for the DTEK and ‘Metinvest’ eurobonds?. Was there a pressure on ‘Metinvest’ as well?

- I think this is the period when the default of ‘DTEK’ and ‘Metinvest’ had just begun, and the government had already accomplished the restructuring.

- That’s correct. What happens when a company goes through a restructuring? It is immediately downgraded to ‘SD’ or a selective default rating. Many investments funds have certain limitations in their memorandums and simply cannot invest in bonds with an SD rating and thus have to sell the bonds. There are, however, investment funds that can invest in almost everything, but even they must still act in the best interests of their clients. Thus, if fund managers refuse to sell SD-rated assets, they take other steps to protect funds of their clients, for example, by entering into the restructuring process with the borrowers. Many restructuring stories, including the ‘Mriya’ case, show that this route is often long-lasting and unpleasant.

Naturally, major shake-up of investor base led to sell-off and sharp price decrease. Therefore, the main trigger of the price decline is the expected or declared failure to service the debt on the agreed terms; this is the moment when distressed situations take shape. This is a standard trading strategy for funds specialising in distressed assets: analyze the defaulted borrower and the market environment, and come up with possible restructuring scenarios and calculate potential return on investments. We have applied a similar strategy to a number of restructuring processes taking place in Ukraine and other markets .

Also, let’s discuss the actual terms of DTEK’s and ‘Metinvest’s’ restructuring. If, according to the restructuring terms, these companies were allowed not pay interest to their creditors the interest, then, perhaps such restructuring is first and foremost profitable for DTEK and ‘Metinvest’? Where is a so-called ‘treason’ here if creditors have agree to such terms at the expense of their returns on investments as well as the cash flow?

- The point is that you, having a title of ‘Poroshenko’s investment banker’ and connections with the Regulator’s officials that previously had ties to ICU, knew that the company’s financial standing would improve.

- Didn’t the rest of the market know that too?

- They were not certain to the same extent.

- If you are talking about the Regulator’s decisions, all of them were transparent. If you compare the dates when these regulatory decisions were published or taken with the DTEK eurobonds prices chart at that time, you will hardly see any correlation (demonstrates another chart).

It is a well-known fact the ‘Rotterdam+’ formula does not directly influence the electricity prices for households. Let me also remind you that Regulator’s decision to increase the electricity price for households was prompted by the IMF and the Coalition Agreement.

Furthermore, we have a wholesale model of the electricity market in Ukraine. In such model power companies are paid by the energy market after it accumulates funds from the consumers. The market operator distributes the funds among power producers proportionally to their output and tariffs. Bearing that in mind, the “treason” accusations would be true if the distribution of the pool of funds received by the energy market was skewed towards DTEK and other thermal power producers to the disadvantage of other producers. In reality however, it happened differently. For instance, the tariff for ‘Ukrhidroenergo’ grew for more percentage points than that for thermal generation, which provided for a five-fold increase of the company’s investment program.

- If there isn’t any ‘treason’, why is there so much noise around this topic then?

- I think that all the clamor around ‘Rotterdam+’ is primarily a result of the oligarchs’ quarrels caused by rather simple reasons: someone has begun to earn less, whereas others allegedly more. The major industrial electricity consumers are well known moreover, share of electricity in total production cost for them constitutes as much as 30-45%. To make the topic big and flashy someonedecided to add some political tint. Only this explains why everyone does not focus on the wholesale-retail electricity price (WRP) in general, but on ‘Rotterdam+’ and coal generation, which constitutes only 30% of WRPwith the share of output decreased from 40% in 2015 to 25% in 2017. If we are talking about the ultimate electricity cost, it is the WRP that the industry should care about. . Hovewer, instead of instigating substantive discussion, mass media opts to publicize series of accusations and opinions of ‘experts’

There is yet another fact to consider. Let me ask you this: Who has been the main proponent of the schedule of the electricity, gas, and heating prices increase for households?

- The IMF.

- Exactly. By 2015, the fees for electricity, gas, and heating for households covered the lesser part of production costs. This caused inefficiency and imbalances within the sector: households were subsidized at the expense of the industry, there was fiscal pressure on the budget, and consumers were not encouraged to adopt energy saving measures. Elimination of these imbalances was important for sustainable economic growth, and to no surprise formed part of the IMF requirements as well as in the Coalition Agreement.

Was the discussion with IMF about tariffs increase public? Was the timing of their increase transparent?

- Yes, it was transparent. For various generation types, however, such an increase could have had a different impact. It also depends on the Regulator.

- Price increase for households results bring more cash flow into the energy market, which (as we already know) is distributed amongst all energy market participants. If one knows the schedule of tariffs increases, one can calculate the approximate additional cash flow that each type of generation can potentially receive. To illustrate the point – during 2015-2017 the amount of additional cash flowed into the energy market from the increased households’ tatiffs constituted around USD 1,6 bln. The amount was distributed among all generation types proportionally to their share.

The share of the thermal generation in the WRP amounts to 35%, of which DTEK has around 70% share. Consequently, in 2015-2017 the company could have get additional cash flow of ca. USD 390 mln provided the company’s expenditures remained the same. At the moment of restructuring the company’s debt was USD 2 bln. Assuming interest rate was 10%, then the absolute cost of such debt per year totaled to USD 200 mln annually. Now let us compare the annual cost of the DTEK debt servicing with the additional funds in the amount of USD 390 mln, which the company could get in 2015-2017 as a result of tariffs increase. The debt could be serviced. it also worth mentioning that company’s EBITDA was positive at the time of restructuring. This is the investment idea in a nutshell: the company would be able to restructure its debt and service it in full despite the conflict in eastern Ukraine and ailing economy.

- How many clients have you serviced by purchasing DTEK and ‘Metinvest’ securities for them?

- We do not provide any services to clients in respect of these securities and we do not provide broker services in respect of eurobonds at all. We buy individual assets only for ourselves and for the funds which we manage.

- What is your share in DTEK and ‘Metinvest’ issues?

- The overall volume of DTEK issue totals USD 1,3 bln, and ‘Metinvest’ is USD 1,2 bln. Our share in these issues is insignificant. In this respect, we cannot compete with the global funds that are major holders of these securities.

- Moreover, you might also have a share in the FUIB securities issue, and this is a one-owner risk.

- We have a different opinion about it; it is the fundamental analysis that we consider in the first place.

- Does it mean that you do not consider the political risk at all – today ‘Akhmetov is well-liked, tomorrow he is not that well-liked’?

- We have experience working in many different environments. The asset’s quality and its trajectory is what we are really interested in. Financial results of most Ukrainian issuers depend on international commodity prices: for instance, when the price of metal or iron ore grows then the shareholder earns more, when they decrease the shareholder earns nothing, and when prices fall – the company can barely service its debts in a timely manner. The situation is then clear for the creditors, and they are ready to face those risks. The creditors, however, do not understand the situation when the companyy simply does not want to pay its debt. And there will be nothing worthwhile investing in in this country until this simple rule is well understood. The creditors do not care who a shareholder is: they were ready to go to court on ‘Mriya’ issues, they will be ready for the long-lasting legal proceedings in cases of DTEK, ‘Metinvest’, and FUIB.

- To summarize this ‘accusatory’ part of the interview, what is or who is the reason for yet another barrage of accusations against the company?

- We link it with the tightened political struggle as well as with the reforms that have been carried out by our former employees and managing partner. Even though these individuals are not connected to ICU anymore, some people are aggrieved by their reforms because they can no longer reap the proceeds of corruption. These ‘sufferers’ find it easier to attack ICU. We are the collateral damage caused by politics and reforms.

- Following such logic - the nearer we get to 2019, the more pressure you will feel.

- Yes, we expect this.

- Does the extra attention on the company not frighten off your clients?

- Thanks God, no. They understand this happens and know what is happening in the country.

- We were surprised to find out that ex-MP Eduard Prutnyk had sold part of his business here and purchased a diamond mining company in Africa. Do you plan to do something similar?

- No. Our business will stay in Ukraine. We are comfortable here. Besides, we can invest in any foreign assets from here. Today I can buy the Ukrainian securities, tomorrow I can buy the Croatian Agrokor bonds, the day after tomorrow – Suriname bonds etc. (By the way, we have already purchased Suriname bonds. We learned a lot when we were working on our investment thesis and it was a successful investment). And today, with all its potential, Ukraine is certainly one of the best countries to invest in.

- Today KPMG has just sent a report stating that Ukraine is a good country for starting a contract business.

We appreciate our employees and pay them competitive salaries which are no different to salaries employees in the developed countries would get for the same job – if we compare them on disposable income grounds (and this is the right way to think about it). With the same disposable income, the quality of life here and there is not significantly different.

Our key personnel are in Kyiv. Most of our employees trained in international banks and asset management companies, many have worked abroad, and many has an international education. There are also many foreign job seekers who apply to work with us, and there are quite a few foreigners already working for the company. These are people that have graduated from the popular ‘Princetons’ and ‘Stanfords’, and have worked for ‘Citibanks’ and ‘Deutsche banks’. In general, our team in Ukraine does not differ at all from the teams working for the western investment banks operating in the region.

- Did you change the group’s business structure in Ukraine?

- The business structure is the same. If we talk about the Ukrainian part, it consists of several divisions. There is the asset management business. The major part focusing on pension funds management.

We also have a securities broker/dealer as well as an ‘Avangard’ bank – despite all ‘accusations’, it is a small bank with a transparent business model and reporting mechanisms. Anyone can see how much Avangard earns and can calculate (and this is the most important thing) its returns on investments.

- You have not disclosed the group’s financial indicators before, but the press mentioned the information about the annual net profit in the amount of USD 150 mln.

- This is certainly a very flattering estimation, but it is not correct. Unfortunately, the group’s annual profit is much lower. Being a private company, we do not publish it. We, however, disclose this information to our foreign counterparties upon their request.

- How much assets are there under ICU management?

- Today we manage assets which total volume exceeds USD 500 mln.

What does this represent?

If we speak in terms of assets under our management over the past five years, annual growth has averaged around 25%. This was driven by positive investment results, new products, and successful M&A deals.

Let’s move on to the macroeconomic outlook. Do you think Ukraine could jump from GDP growth of 2% and see stronger increases while preserving macroeconomic stability?

I think 3–4% is the maximum. Unfortunately, Ukraine will remain hostage to world macroeconomic trends until it takes proactive action to boost its economic growth. Ukraine is a commodity-dependent country. In our view, most commodities will grow against the dollar this year. Some suggest this will be a result of the weakening of the dollar, but I prefer to speak about the strengthening of key commodity markets. This will drive the growth of non-dollar currencies, first and foremost in developing markets, since they rely so heavily on commodities. Developing markets will benefit greatly from this growth. This is a global macro-trend that will become the key theme of 2018 for investors.

Do you expect the hryvnia to get stronger against the dollar?

Against the current rate, yes (the official rate was UAH 28.775 per USD 1 when the interview was done - IF). This will be accompanied by growing prices for metal and iron ore. We forecast that oil prices will continue to grow, resulting in an average of USD 65-70 per barrel for the year.

What is the role of the IMF in your projections? Do you assume continued IMF funding and support from other international financial organizations?

As far as I can see, this is the key issue for the country’s survival. Let’s not forget that the IMF is not rescuing anyone. It’s just buying time for Ukraine to start rescuing itself. The IMF simply provides Ukraine with some stability and predictability in the short term.

Do you believe that Ukraine will get the IMF loan tranche in the first six months of 2018?

I hope so. At least this is the scenario we hope for, and which we take into account in our investment decisions.

Based on this vision of the macro-economic landscape, what are the key investment themes you see for Ukraine in 2018?

Assuming that we receive the IMF loan, we can expect lower returns on corporate bonds? by Ukrainian issuers against the backdrop of two trends: the dollar curve and changes in the price of money.

Down to what? The government places bonds at 16.5% annually.

I’m talking about Eurobonds. The yield on Metinvest Eurobonds is around 9% and it is nearly 9.5% for DTEK, so they are close. The return on Kernel Eurobonds is 5.6% and MHP is at 3.7%.

I think they will now be quite close by equity valuation.

It’s better to think beyond equity valuation. Kernel is a super business that’s making money and has a great business model. But its land is rented. In my view, Metinvest’s credit rating should be comparable to that of Kernel because, from a business-model perspective, one trades in grain and the other one trades in metal. All of this is exported and is tied to commodities which are now growing. The prime cost of the products will hopefully not go up too much. There is a small difference in leverage between the two companies—two for Metinvest compared with 1.5 for Kernel—but that’s not very important. For creditors, a 3 to 5 difference in leverage matters. The 1 to 3 difference is not too big as it is affordable at both levels.

The difference in yield between these stocks is four percentage points. The yield spread between Kernel and Metinvest, or Kernel and DTEK will shrink. Even a two-percentage point yield decline for five-year stocks is not a bad rally compared with the current price.

This is for Ukrainian stocks. In terms of global markets, as I said, it’s the currencies of the developing markets plus commodities-driven companies, from Glencore to Rio Tinto, Vale, and so on.

Given your forecast for a strengthening hryvnia, do you believe that the purchase of hryvnia-denominated government bonds by foreign banks last autumn was the right decision?

Yes, I do. Moreover, the demand for long-term hryvnia-denominated bonds is still fairly high today. Yes, it will be volatile, and its owners will feel somewhat uncomfortable in terms of mark-to-market for some time. But these banks buy in order to hold the bonds; they have a mid-term vision that takes into account the IMF program and other positive trends.

There will be no new restructuring of Ukraine’s external public debt?

I don’t think so. It’s not serious. Of course, a comparison of Ukraine’s foreign-exchange reserves to the upcoming payments and potential payments Ukraine might have to make under the disputes with Russia over the USD 3bn Eurobonds and USD 2bn gas supply looks frightening. Everyone is now talking about tactical solutions when a strategy is what we need.

Still, you don’t take into account any political factors?

Why we should take it into account? As far as I understand, this investment idea works unless things explode macro-economically. Debt and debt securities are a very old business. It doesn’t produce any space technologies, but it could fund it. Perhaps I could create these space technologies, but I do what I know. I’ve been working with the distressed debt market for a very long time; I’ve done many deals there. Look at Velyka Kyshenia [supermarket chain], Nadra bank, CreditPromBank, PUMB and many others.

What about DonetskSteel? It has exploded—quite literally—as a result of war, not politics.

It has exploded partially.

So, is there still a chance to have some debts paid in such a case?

Yes, we look at this proactively.

Can investors accept war-related risks?

This is a matter of price and negotiation. Of course, when a debtor says, “we won’t pay our debts because we don’t want to,” this is wrong position. However, when the debtor says “that’s because of the macro-economic situation. Our business was in hryvnia while our liabilities were in dollars, and we were too optimistic, but we still want to restore our business,” so, you can talk to them.

We can contribute to their equity and help them restructure their business. But at the end of the day, we need just a return on our capital that has been invested, not someone’s business. Sadly, in some cases, there is no alternative but to seize the asset. But that’s the worst-case scenario.

Why does the American economy recover from crises much faster than the European or Japanese economies? Because their reboot process is automated. If you dont pay your debt, you go bankrupt. Everything is sold and you go on. That’s how it works, straightforward. When you start dragging out the process with courts, unpaid debts, and debt restructuring at 1% for a hundred years . . . What is all that about?

For instance, a state-owned bank restructures debt at 1%. But its liabilities cost 17%! Formally, it has not written off anything for the Prosecutor’s Office. But it loses 16% annually on that asset!

So, the Prosecutor’s Office should be sent to the US?! It’s a joke. You have been working with distressed assets, studying them and buying credit portfolios. One was Erste Bank.

We have bought many portfolios.

But these have been private transactions so far. Are you working with the state as represented by the Deposit Guarantee Fund?

We have applied to bid at asset sale auctions organized by American platforms at the Fund’s instruction.

What was the process like?

We signed all the documents, paid the fees, and spent months studying it all. As a result, we concluded that we were not interested because the minimum price was too steep. They are selling some land plots for construction, small stores and so on. Someone who gets involved in portfolios like this should understand that they will have to restore the value of the property, meet the people, and negotiate. If the properties had been priced much cheaper, we might have said yes. As they weren’t, it wasn’t worth the effort. We wrote back saying “thank you” and gave detailed feedback about why we were not interested after doing all the initial work. After that, we got a phone call and were told that we were the only company to say in detail why we opted not to place a bid. Still, we continue to watch this space, and will wait for a straightforward process.

Whose private portfolios have you bought? Can you name any big deals?

We have bought different portfolios. One was the Ukrainian portfolio of corporate loans from Erste Bank. Our partners in syndicated loans include the biggest international institutions, such as the EBRD and the World Bank.

You must own a certain amount of debt in order to be taken seriously by the borrower or your co-lenders in this business. Whenever you come to a big industrial group and tell them “give me back three pennies” they don’t react. If you come and say “give me back 300 pennies,” that’s a different matter. These transactions are rarely closed individually; they normally go into a pool.

We have a Ukraine Recovery Fund set up to buy distressed assets. It contains our own money, and a pool of capital from hedge funds. Why do they come to us? Because we are probably the only company in Ukraine dealing in this space. You can trade in it from London or New York. But, at the end of the day, you need someone to go to places, talk to people, and have expertise in the local situation. We do the same thing when we buy distressed assets in other countries. We speak to the local people with expertise.

How do you structure the Ukraine Recovery fund?

It’s a chicken and egg situation. Unlike a typical hedge fund, this one has the structure of a direct investment fund in which the money is not funded, but is instead provided under an obligation to transfer to a specific deal within five days. We already have agreements with a number of investors. The deals are being processed now and there are ongoing, prospective negotiations.

What other businesses are you interested in? Renewable energy, for instance?

Yes, we are looking into renewable energy.

But you have been in that state for three years probably.

I have been looking into the direct investment business since 2001 or 2002. I have even done one co-investment with ING. ING invested its own money. That investment failed, but it was a good experience. Throughout my career as an investment banker, I have not seen a single investment on the mid-sized business level in which I would invest my own money. Clearly, Kernel and similar companies are in a different situation, but nobody there ever plans to do such deals.

In terms of direct investment now, in terms of the risk/income ratio, very few deals actually count. When you come to a good company and say “we could buy a large block of shares from you at 5 times EBITDA since you are not a public company, and public companies trade at 6-7 times EBITDA”, the company thinks, why would I sell at 5 when everything is down and nobody is investing into this country? Shareholders were making USD 20mn annually before, now they make USD 10mn. They are generally happy with this. The company is right to think that it doesn’t have to do the deal now.

That’s what direct investment funds, including Horizon Capital, have faced. You have to pay more in order to buy a good business. But you can’t allow yourself to pay more in this business since the entry price is the most effective hedge. So, you don’t do anything or you pay extra.

What is different about working in distressed debt in Ukraine and other countries is that the terms and the deals are driven by banks and investors that are cleaning their balance sheets. Hopefully, the Deposit Guarantee Fund will soon start selling off its assets in large amounts. This is not to say that the deals are not already taking place. The debtors have no choice. They have to negotiate with the buyers of their debt. But let me say this, we rarely ask for it back immediately. We are prepared to support companies and inject working and share capital. If, say, they lack USD 5mn to finance the working capital, we provide that USD 5mn as a loan or in another form, but we also ask something for it.

Do you do these deals as well?

That’s what work with distressed assets is all about.

You are actively expanding the non-state pension fund (NPF) business. What is the reason for this?

Yes, the amount of NPF assets under our management grew 163% to UAH 406.5mn in 2017. The reasoning behind the expansion is pretty standard in asset management businesses—fixed expenses are distributed over more assets. That is what it is all about in the consolidation business: you buy additional cash flow and cut operating expenses. In this way, whatever has been bought begins to yield more under your management. We believe that this business will grow organically. If pension reform speeds up, we hope to participate in it too.

You mean to participate in asset management for the second pillar pension funds?

Yes, these are normal, reasonable expectations.

What is your forecast for the domestic market of corporate bonds?

We expect it to become more active.

The first banks have already gone into it . . .

It always happens like that. I don’t monitor this market, but it would be reasonable to assume that this would happen, as it does around the world, and as it has so many times in Ukraine. Banks are the first borrowers, followed by local corporations.

The problem with corporations is that big companies prefer to borrow in the international markets or take short-term loans denominated in hryvnia. It’s all about cost of funds. That’s why the first wave of corporate bond issues was not entirely successful. However, you also have retail businesses that have to be funded in local currency just because they only have goods to use as collateral. In most cases, bonds are the best way to draw the funding.

How much cheaper do government bonds have to get before investors see any sense in buying corporate securities?

This is about the cost of money. The NBU’s refinancing rate is 16%. It can still grow this year given the inflation expectations. When the rate grows and the banks have the NBU’s bonds or certificates of deposit as risk-free instruments, everything else will be evaluated against that potential return. The borrowers should ask themselves whether their business generates sufficient cash flow to service the debt.

How much can government bond rates go down by the end of the year?

I wouldn’t exclude a scenario where bond rates go up. Even if the first quarter is not always indicative, we’re talking about inflation, and that always pushes bond rates up. However, inflation expectations go down if the hryvnia strengthens. Therefore, I would assume that the rates will be more or less stable throughout the year, and government bond yields will be stable as well.

Do you believe that the commodities market will develop in Ukraine?

I do. We are prepared to invest in it and support the initiatives of the National Securities and Stock Exchange Commission. It is now important that the opinion of the regulator and the market participants are heard in parliament. Passing law No7055 will be the starting point.

Do you invest in bitcoin?

We don’t invest in bitcoin or cryptocurrencies. They are something very non-typical for institutional investors. We would not be able to justify it to ourselves or our investors, for example, when your IT person comes and says that your USD 1mn invested in bitcoins has been stolen? The infrastructure does not exist to meet the demands of international institutional investors who need facilities for saving, security, speed of settlement and the like.

With this in mind, the smarter people have made cryptocurrency-tracking Exchange Traded Funds, ETFs. Today, over USD 1bn of ETFs exists for one or two cryptocurrencies, like Bitcoin and Ethereum. That’s what we trade in. Also, we used to trade in futures at CME.

Do you understand the behaviour of prices for cryptocurrencies?

No. We trade with a trend in this particular case. Many books have been published on what drives the process of investing. One is crowd psychology. We take this into account when we trade.

I’ll tell you why we entered this area. It was an example of event-driven trading for the launch of CME futures. When deciding on a purchase at our various investment committee meetings every week, we discuss amounts, cause and effect, why we do this, and when we will be exiting it—based on the events that are supposed to take place or based on the price levels.

When you trade with a general trend, it’s important to set the stop-loss and take-profit points. Let’s assume that the price plunges 40% (it’s very volatile, but not as much at the ETF level). You have to realize that you will lose an amount X on this position. You have to close it no matter what. It’s more complex with the growing trend. We’ve had different opinions here on what profit to set. I suggested 50% of the entry level, while my colleagues offered 100%.

One-hundred percent is not really a lot for cryptocurrencies.

Greed leads to poverty.

Has crypto fever reached your clients? Are you getting requests to buy Bitcoins or to recommend the best cryptocurrencies to invest in?

One of our investors has withdrawn part of his capital from the fund to re-invest in Bitcoin. I see a trend where the demand for cryptocurrencies will keep growing. The question is which of the cryptocurrencies will grow and be adopted universally. It can be a self-fulfilling prophecy; whenever one of these assets becomes critically massive, it will happen.

In my view, Bitcoin has technological flaws. Ethereum is, essentially, better structured and more interesting. We bought the ETF for this reason. It is used to settle in most ICOs. But I don’t think either Ethereum or Bitcoin will be the currency at the end of the day.

Is a new Ukrainian IPO possible?

It is if someone wants to buy agriculture. But Kernel, MHP, and IMC have already issued shares. Otherwise, whatever is offered for an IPO should be very cheap. But then why sell it?

Could one of the issues that has already been traded undermine Ukraine’s market? Like Mriya’s default and the fraud that hit agricultural companies before?

If you think that everyone has already forgotten about Mriya and provides trade finance to Ukrainian companies easily, you are wrong. This is not the case. It really is a problem.

The last question on the structure of ICU’s share capital: do you have plans to change it or are you all comfortable working with it?

What do you mean?

Would you like to involve more partners, or maybe some have had enough of this pressure?

Anything can happen at any time. But we have to have conviction in what we can do with capital if we want to draw more. For now, we have sufficient working and investment income to implement our ideas. If a hedge fund or an asset manager comes and says that they want to buy 25% of our share capital at a double price, we will certainly think about it. When we first started, 25% of the company was owned by a global hedge fund. Could one of our minority shareholders say that they have had enough? I suppose so.

Volodymyr Demchyshyn never did, even after he became Minister of Energy and the Coal Industry.

He wanted to quit his share, but we didn’t want him to: and that’s because our resources are not endless. When Valeria Hontareva [NBU Chair – IF] was leaving, it was a very painful process because our capital was shrinking. We are in the financial business. This means that we have complex contracts signed with financial institutions. They include certain credit-event triggers. A one-time capital drawdown is one of those triggers. That’s first reason.

Secondly, we did not create our business for it to collapse at the behest of one individual. We have commitments to our employees and clients, and ultimately to our families.