For several years, agro-industry has been considered as the most attractive sector for investments in Ukraine. At the same time, the critics make a point that Ukraine is losing behind in terms of investment attractiveness compared to other countries. What prevents investors from bringing money into Ukraine? Which sectors are the most interesting to making investments from the perspective of the foreign capital and the local? InVenture made an interview with Andriy Yarmak, the agricultural economist and market analyst at the investment department of FAO (Italy).

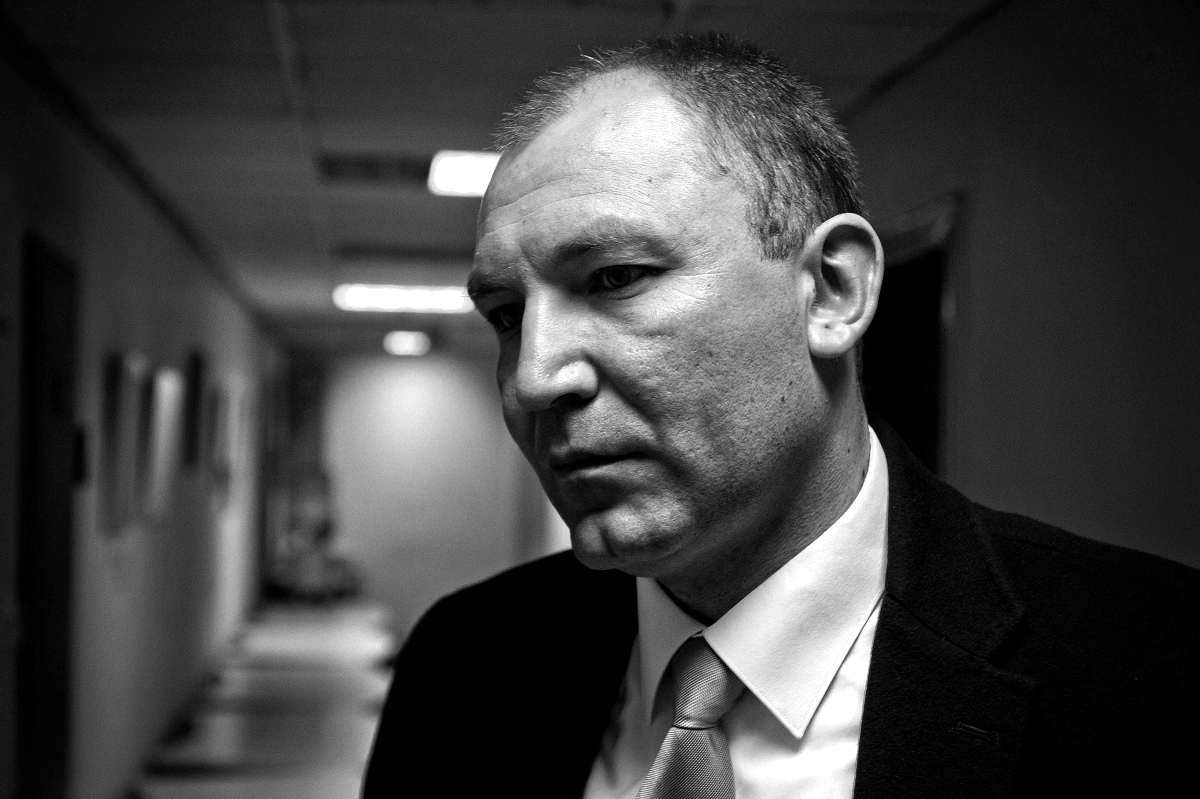

Profile:

Andriy Yarmak – the economist of the investment department at FAO, Italy

FAO (Food and Agricultural Organization of the United Nations)

Activity: The Food and Agriculture Organization of the United Nations (FAO) is the agency of the United Nations and deals with international food security and agricultural development. The organization was founded at a conference in Quebec on October 16, 1945 with the aim of achieving lasting solutions to the problems of hunger and poverty. At present, FAO has 197 member states.

"And considering the rapid growth of the world population, many investors want to have access to the agricultural equities in such a promising agrarian country"

InVenture: In your opinion, are foreign investors interested in the long-term development of the agricultural enterprises and the agriculture as a whole in Ukraine, or are they pursuing the possibility of a rapid return on investment?

Andriy Yarmak: There are different kinds of investors and their strategies differ too. However, every investor pursues higher profitability levels and quick payback period because these are investment goals and objectives. Of course, not everyone makes it a ‘no matter what’ priority.

If to talk about the investment attractiveness of Ukraine, it remains extremely low, as of present. But if to put aside the country risk and its peculiarities, the agriculture refers to industries where foreign investors are interested in making the investments, as almost all believe in the huge potential of Ukraine as an agrarian country.

And considering the rapid growth of the world population, many investors want to have access to the agricultural equities in such a promising agrarian country. The growth rates of the agricultural industry speak of themselves and confirm it, even for the last 15-17 years.

InVenture: Where do the investments go in particular? What are the most interesting spheres/niches for foreign investors and residents?

Andriy Yarmak: It is soil. Land plots of Ukraine are still the most interesting, even when it is the farmland lease agreements. Infrastructural projects remain of interest at this time too. It is about providing services for crop raising farmers and facilitating the trade and processing of grains, oilseeds, and the products made of them. The oilseed processing has always been of interest for foreign investors, but this sector is already quite saturated.

As investments into primary production grow, the very sector hereafter attracts more investments. Now, there is also a tendency of increasing exports of the processed products with a higher value added.

Foreign companies invest less in livestock production. Meantime, the investments into vegetables and fruits are even smaller. On the other hand, the segment of growing berries is strongly on the rise, as an example. We also expect a brisk growth of investments into animal feeding and cattle slaughter in particular, for the production of quality beef for exports.

InVenture: What are the profitability and marginality of the most promising niches?

Andriy Yarmak: Profit margins depend upon the business approach and its model. The projects in the production of cereals and oilseeds pay off more quickly than the production of milk or meat, but marginality in milk and meat production can be higher. At the same time, investments into processing of milk and meat can pay back much more quickly provided that the company controls supplies and quality of raw materials. However, it all depends on the chosen business model. In vegetables, fruits and berries, the payback period ranges from 4-5 to 12 years. But marginality is higher, and the returns per hectare are really higher chosen with higher risks.

"Profit margins are literally in the way"

InVenture: Some are saying that the profitability levels of crop production will decrease from one year to the next. What do you think about it? If so, what a level down, it may be?

Andriy Yarmak: I do not think so. I do not understand what kind of profitability they are talking about. If it is the Soviet concept of profitability, then there is no point in talking about it. If we talk about marginal revenues, in this case Ukraine still has an excellent opportunity to improve the efficiency of production in grains and oilseeds. So, profit margins are literally in the way. We need to learn and develop.

By the way, vegetables and fruits are also part of the culture of plants. And there are many plants for growing, each of which is a separate investment case. So in general, I, of course, do not agree with such a statement practically. But I can only agree that producers really face problems, especially those who grow grains and oilseeds using old technologies applicable and profitable 15 years ago. After all, now the corn yield of 12 tons per hectare is not surprising for anybody, when 15 years ago the yield of 4-5 tons was considered as fairly good.

InVenture: Do you know companies that revealed their intentions to invest in agriculture in Ukraine? Can you please name a few?

Andriy Yarmak: I think that if a company wants to reveal its intentions, it makes it publicly. Otherwise, it is no need to talk about it. As of present, almost all of the well-known international agro-companies work in Ukraine, and they continue to invest. Newly interested investors come here daily, but they are usually not very famous and they tend to take long breaks in order to explore opportunities here. For example, many Chinese companies examine the prospects for investments in our agribusiness, but they do not jump to conclusions of investing that fast. A similar example is companies from the Middle East.

"Interests significantly have grown for animal breeding and some niche markets of sugar and other value-added products"

InVenture: What profitability levels and payback periods are acceptable for an average foreign investor considering all the risks for Ukraine?

Andriy Yarmak: There is not a single answer, as it all depends on a segment. Well, and again, the ambiguity of profitability which foreign companies tend not to mention.

InVenture: Why do investors choose Ukraine as the location for their investments?

Andriy Yarmak: The main reason, in my opinion, is our fertile soil and vast areas of land where it is possible to organize a really effective commercial production. The second reason is a fairly educated and incredibly cheap labor force. And there are unfortunately no other reasons, so far.

"In grains production there is a shift to enlarging areas for corn instead of wheat. It is very interesting that wheat loose its influence and market share in the global markets too"

InVenture: What are the main tendencies of the Ukrainian agrarian market in 2017? What are the changes in comparison with the previous year?

Andriy Yarmak: Interests significantly have grown for animal breeding and some niche markets of sugar and other value-added products. The latter trend emerged last year, but it is very powerful. Many large enterprises start investing in organic farming, growing of berries, and fruits ... There is an increase of milk production and we notice a shift in the efficiency improvement in the processing of different types of meat. In grains production there is a shift to enlarging areas for corn instead of wheat. It is very interesting that wheat loose its influence and market share in the global markets too.

InVenture: Which markets are the most promising for Ukrainian exports of agricultural products, including those not yet discovered?

Andriy Yarmak: Every product has its own story to tell. For example, for organic products, we are actively exploring opportunities to enter the markets of South-East Asia. In the meantime, the main exports of the kind go to the EU. Generally speaking, for Ukraine the most promising markets are in the Middle East and the markets of the EU countries. There is a huge competition in the EU, but we, for example, started to sell even dairy products, although many believed it was impossible.

Moreover, I can conspiratorially reveal that in the fruits business we can successfully export even apples to the EU! And it is despite the fact that the EU suffers from overproduction of apples. The thing is that our producers get no more than 40-60% of the production capacity of their gardens, and they do not invest in the quality and staff.

Technically speaking, we are interested in all of the world markets. They can be both Sub-Saharan Africa and Asia, but to a lesser extent the Americas.

"Investments into processing are beneficial in case if owning raw materials"

InVenture: Is Ukrainian market consolidated and to what an extent?

Andriy Yarmak: Overall, I would say that it has an average degree of consolidation. In agribusiness we have a healthy situation when about a third of the farmland is at the disposal of small farmers, the medium-sized enterprises own same third along with the large producers holding similar stake of the whole land plots. In processing, the situation is different from a sector to sector. The sunflower oil production has nearly complete consolidation. The milk production has a partial consolidation, when there is a tendency to the development of cooperatives of small factories in the regions.

InVenture: Should we expect big M&A deals in the coming years?

Andriy Yarmak: I think that many will actively put M&A deals in Ukraine into the prospects. It is so due to the fact that general situation is improving in the country together with its investment attractiveness, despite a slow pace of change.

InVenture: Earlier in an interview about the dairy market in Ukraine, you said that the investments in the most expensive processing enterprise will be ten times smaller per 1 liter of the processed milk compared to the investments into a farm in order to produce that one liter of milk. Are such trends common only for the milk market or, in general, it is becoming profitable to invest into processing?

Andriy Yarmak: This is typical for almost all the sectors. And very often, there may be proportions of 1 to 20. However, the investments into processing are beneficial if the investor has raw materials in place. So this is a double-edged sword, one cannot just simply invest in processing if not laying hold of something to process otherwise the money will get absorbed as in sand.

It should be noted that the investments into processing targeted at B2C is significantly higher compared to B2B (that is, a production of a commodity of sorts). B2C will require significant investments in the creation and promotion of a brand. The sales process also requires additional spending. For instance, a large dairy plant can be built for USD 20mln. And for the first couple of years, around USD 10mln must be channeled to develop a brand to making sales, as the market is very competitive.

InVenture: What is the payback period for investments into the processing of agricultural crops and which crops are the most promising?

Andriy Yarmak: Being said, there will be different estimations for each type of processing depending on the business model. Also the question is, whether it is a greenfield or a brownfield project. In general, there is no plain answer and it cannot be, as each case has its own peculiarities.

"One of the first projects of FAO together with the EBRD helped to establish a dialogue between the state and businesses. As a result, the shameful approach of grain export quotas was abolished in Ukraine"

InVenture: What projects does FAO carry and support in Ukraine? And what are the outcomes?

Andriy Yarmak: I cannot name all of the projects, as I, for one, carry 4-5 projects as of now, not considering those that ended so far. And there is a regional office with a lot of initiatives and we have cooperation with other international organizations. If we talk about the achievements, we should start with the grain industry where one of the first projects of FAO together with the EBRD helped to establish a dialogue between the state and businesses. As a result, the shameful approach of grain export quotas was abolished in Ukraine.

The culture for dialogues was also infiltrated in the dairy and meat sectors. Over those years, thanks to FAO projects, Ukraine has begun to export not only products but also expertise. Notably, our dairy consultants, for example, work in seven countries of the world for now.

Now, thanks to work in progress, the large investments have already started to be coming into the production of beef. The prices for live weight of cattle increased by 50%, literally after 2-3 weeks from the presentation of opportunities and the export potential in the industry a year ago! These are huge additional funds for local farmers.

We actively help to open new markets by supporting and organizing dozens of trading missions. Each mission brings a sharp increase in sales for exports. We invite the best world experts in various fields into Ukraine. We help with trainings abroad and we develop cooperation between the producers, etc.

Our program Million from a hectare made a huge spur for the development of niche crops production. As a matter of fact, the investments into growing berries, the production of dairy products from goat milk and many other sectors have sharply increased in a year and a half thanks to this very program in many ways.

InVenture: What investment programs does FAO participate in, and what are the plans for the nearest future?

Andriy Yarmak: FAO cooperates with the EBRD and other international financial institutions via technical assistance programs facilitating the improvement of the quality of investments.

InVenture: What influence did the political crisis and the war in the east of the country have upon the decision making in investing for businesses?

Andriy Yarmak: The huge negative impact it was. Many foreign companies do not take Ukraine into consideration because of this very reason. And its not a political crisis, but the war. A war for many investors is a red line.

InVenture: How to avoid unnecessary risks by investing in Ukraine, what is your recipe for local and foreign investors?

Andriy Yarmak: To do everything in accordance with the law, transparently and legally, I believe. This is the only way. Well, and to study the situation profoundly before making a decision.

InVenture: What prevents investors from sending capital into Ukraine? What can stimulate domestic and foreign investors to invest here?

Andriy Yarmak: It may sound boring, and it is the reform of the legal system at the first place, and later ─ all the other reforms. So far, Ukraine is not carrying structural reforms, but it is a sort of a cosmetic repair. The system remains old one and flawed in much respect.

InVenture: What investment strategy may work best for the agriculture? Is it establishing new enterprises or modernization of the existing ones?

Andriy Yarmak: Everything depends upon a sector in particular. Every option may work here. But given the bureaucracy in Ukraine, it is better to always buy an established enterprise that owns all of the relevant permissions and utilities available.

InVenture: Will the lifting of moratorium for the sale of land activate foreign investors?

Andriy Yarmak: Everything will depend upon the terms for such a sale of land. I do not think that foreign investors will be allowed to buy it directly or indirectly. Hence, there will hardly be any significant activities in this respect, I assume.

InVenture: If the moratorium is lifted this year stipulating that foreign investors are getting the rights to purchase land, what amount of investments can be made in this case in 2018, 2019, and 2020? What is the price per hectare of Ukrainian land under such a scenario?

This scenario is not being considered at all. Once, in a very attractive and much more organized and transparent Poland, the foreigners bought less than 4% of the lands in the first 5 years after opening the land market there, if I am not mistaken.

Ekaterina Moskaleva and Bogdan Zakharkiv, InVenture "WE INVEST IN UKRAINE" project

InVenture Investment Group – your trusted partner on Ukrainian market. We are open for cooperation and will be beneficial in dealing with mergers and acquisitions (M&A) in various industries, development and implementation of investment strategy, support of entry into Ukrainian market for international investors.