- Some markets see increase in deal value and volume, but CEE M&A activity down overall

- Private equity fund investment up 16%

- Investment by US based companies and funds increases by 61%

Fragmented investment landscape

Investors no longer regard Central and Eastern Europe as a coherent investment area as countries in the region present increasingly different risk profiles. While the CEE M&A market overall was down on 2014, a number of markets saw increases in 2015 in both deal value and volume, as reported in Emerging Europe M&A Report 2015/2016, published by CMS in cooperation with EMIS.

Helen Rodwell, Partner, CMS Prague : “Political changes can be seen to have a direct, and often immediate, impact on the levels of new investment and the sustainability of investments. The net result for the region may be neutral, however, as investment is simply diverted to other CEE countries, rather than withdrawn”.

Stefan Stoyanov, Global head of M&A database, EMIS: “Looking ahead to 2016, we expect a year of respite for emerging Europe M&A. Political risks remain, but many external shocks have been curbed or at least taken into account. On the private equity front, ripe portfolios and a flight to higher returns are likely to spur more deals in the region.”

While the 2015 global M&A market saw more deals with more value than any year since 2007, CEE was relatively flat with a 3% decline in announced deals (2,138 transactions), but a sharper 15% decline in total value (from EUR 63bn to EUR 53bn). Poland, Hungary, Serbia and Bosnia and Herzegovina saw an increase in deals – both value and volume – from 2014.

Increased private equity interest

A total of 288 deals were announced (a 16% increase), more than half of which constituted new PE entries. The largest transactions predominantly attracted US and UK investors.

Radivoje Petrikić, Partner, CMS Vienna: “Private equity funds are traditionally characterised by a greater risk appetite than corporate players. It should be expected that funds will to a large extent shape the situation on the M&A market in the region in the coming months”.

US investors increasingly active

In 2015 US based investors increased their M&A activity in the region by 61% in value and 9% in volume with 127 deals valued at almost EUR 4bn.

Helen Rodwell, Partner, CMS Prague: “The most active foreign investors in CEE in 2015 were from the US. This is not surprising, given the strength of the dollar against the Euro, and is a consistent trend across the European M&A market. A new wave of investment from China and a developing interest from South Korea was also apparent.”

CEE also saw more interest from German (a 22% increase in volume to 88 transactions) and UK investors (a 23% increase in value of transactions closed by UK–based buyers to EUR 2.5bn).

The most active sectors in M&A

Manufacturing was the most targeted sector with 343 deals for a total of EUR 8.9bn (14% increase), followed by Telecoms & IT and Real Estate with 298 and 263 deals for EUR 5.7bn and EUR 8.3bn, respectively.

Ukraine

Cautious optimism rests on a successful privatisation programme and continued reform efforts

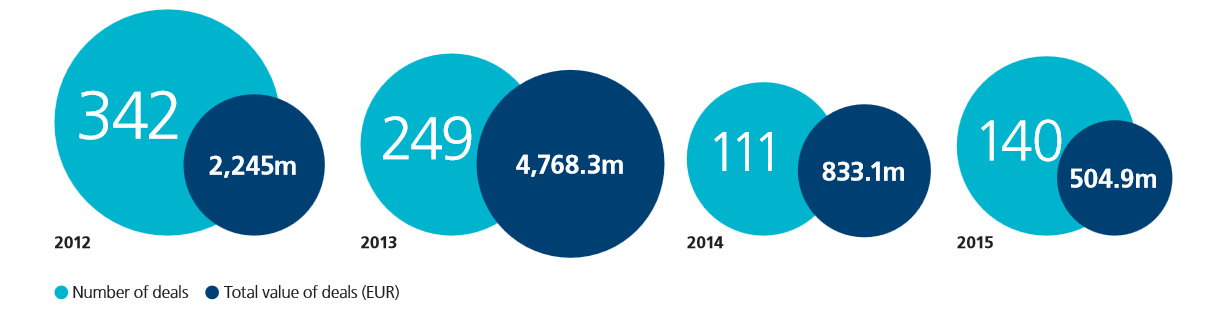

2015 did not bring radical changes to the M&A market in Ukraine, as we had predicted. Whilst 2015 saw an increase in the number of M&A deals, the overall deal value dropped significantly, continuing the trend from 2014. Telecoms & IT had the biggest share of total deal value at 57%, largely due to Snapchat’s EUR 132.7m acquisition of Looksery Inc. and Turkcell’s EUR 89.3m purchase of a 45% stake in Astelit. By deal number, the financial services sector was the most active and

accounted for 46% of total volume.

Deals by Value and Volume in Ukraine (2012-2015)

Given the continuing political unrest, we do not expect a boost in the M&A market in Ukraine in 2016. At worst, we see 2016 being much the same as 2015, with a few strategic exits and a number of high profile deals carried out by Ukraine’s elite. The most attractive sectors in 2016 will continue to be financial services, agriculture and telecoms & IT.

The optimistic expectations in relation to Ukraine’s 2015 privatisation programme were not met, as the government failed to prepare the legal framework and privatisation targets for a transparent and competitive sale process. Privatisation of large-scale assets has been postponed to 2016 and UAH 17bn is expected to be raised from their sale. If the government follows through on its commitments, the M&A landscape in 2016 may be driven by large-scale deals in the energy, infrastructure, chemicals and mining sectors.

Despite all the challenges, the investment appetite for Ukraine remains strong, and it is anticipated that the government’s continued efforts to improve the investment climate, including reforms in the agriculture, energy and banking sectors and anti-corruption measures implemented in 2015 will have a positive impact on the M&A market, starting as early as 2016.

Top 10 Deals in Ukraine 2015

|

Target Company |

Sector |

Deal Type |

Buyer |

Country of Buyer |

Deal Value (EUR m) |

|

Looksery Inc |

Telecoms & IT |

Acquisition (100%) |

Snapchat Inc |

United States |

132.71 |

|

Astelit |

Telecoms & IT |

Minority Stake Purchase (45%) |

Turkcell AS |

Turkey |

89.32 |

|

Inter TV PJSC |

Media & Entertainment |

Minority Stake Purchase (29%) |

Dmitry Firtash -private investor; Serhiy Levochkin - private investor |

Ukraine |

88.52 |

|

Arena Entertainment |

Real Estate |

Acquisition (100%) |

n.a. |

Cyprus |

36.71 |

|

Rozetka Ltd |

Wholesale & Retail Trade |

Minority Stake Purchase (n.a. %) |

Horizon Capital |

Ukraine |

36.41 |

|

KUB-Gas |

Mining (incl. oil & gas) |

Acquisition (70%) |

Cub Energy Inc. |

Canada |

27.52 |

|

Certain assets of Creative Group |

Food & Beverage |

Acquisition (100%) |

Arthur Granz -private investor; Rysbek Toktomushev - private investor |

Ukraine |

27.31 |

|

Motor Sich |

Manufacturing |

Minority Stake Purchase (9.3%) |

n.a. |

n.a. |

25.43 |

|

Univermag Ukraine |

Real Estate |

Minority Stake Purchase (n.a. %) |

Irish Bank Resolution Corporation |

Ireland |

10.03 |

|

Zernoprodukt MHP PJSC |

Agriculture, Forestry, Fishing and Hunting |

Minority Stake Purchase (10%) |

Myronivsky Hliboproduct |

Ukraine |

8.13 |

- Market Estimate

- Official data

- EMIS DealWatch Estimate

Information on the report:

The fifth edition of “Emerging Europe M&A Report 2015/2016” published by CMS in cooperation with EMIS presents the M&A trends for 2016 and an analysis of M&A deals valued over US$ 1mln announced in 2015 across 22 jurisdictions in Central and Eastern Europe, focusing on 15 of them in detail (Albania, Bosnia and Herzegovina, Bulgaria, Croatia, the Czech Republic, Hungary, Montenegro, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Turkey and Ukraine, while data on Emerging Europe include also Belarus, Estonia, Kosovo, Latvia, Lithuania, Macedonia, and Moldova). The report will be available from 19th January at www.cmslegal.com

Information about CMS:

Founded in 1999, CMS is a full-service top 10 international law firm, the largest in Europe, based on the number of lawyers (Am Law 2013 Global 100). With 59 offices in 33 countries across the world, employing over 3,000 lawyers, CMS has longstanding expertise both at advising in its local jurisdictions and across borders. CMS acts for a large number of Fortune 500 companies and the FT European 500 and for the majority of the DAX 30.

CMS provides a wide range of expertise across 18 expert practice and sector areas including Banking and Finance, Commercial, Competition, Corporate, Dispute Resolution, Employment, Energy, Intellectual Property, Lifesciences, Real Estate, TMT and Tax. For more information, please visit www.cmslegal.com.

CMS offices and associated offices: Aberdeen, Algiers, Amsterdam, Antwerp, Barcelona, Beijing, Belgrade, Berlin, Bratislava, Bristol, Brussels, Bucharest, Budapest, Casablanca, Cologne, Dubai, Dusseldorf, Edinburgh, Frankfurt, Geneva, Glasgow, Hamburg, Istanbul, Kyiv, Leipzig, Lisbon, Ljubljana, London, Luxembourg, Lyon, Madrid, Mexico City, Milan, Moscow, Munich, Muscat, Paris, Prague, Rio de Janeiro, Rome, Sarajevo, Seville, Shanghai, Sofia, Strasbourg, Stuttgart, Tirana, Utrecht, Vienna, Warsaw, Zagreb and Zurich.

Information about EMIS:

EMIS operates in and reports on countries where high reward goes hand-in-hand with high risk. We bring you time-sensitive, hard-to-get, relevant news, research and analytical data, peer comparisons and more for over 120 emerging markets. Our information platform provides a unique blend of analysis, data and news on companies, industries and countries. We license content from the cream of the worlds macroeconomic experts, the most renowned industry research firms and the most authoritative news providers. We combine this with our own company and M&A research to offer a multi-faceted view of each emerging market. Formed over 20 years ago, we employ nearly 300 people in 13 countries around the world, providing intelligence to nearly 2,000 clients. We are part of Euromoney Institutional Investor plc. For more information, please visit www.emis.com