M&A value holds month-on-month while volume halves

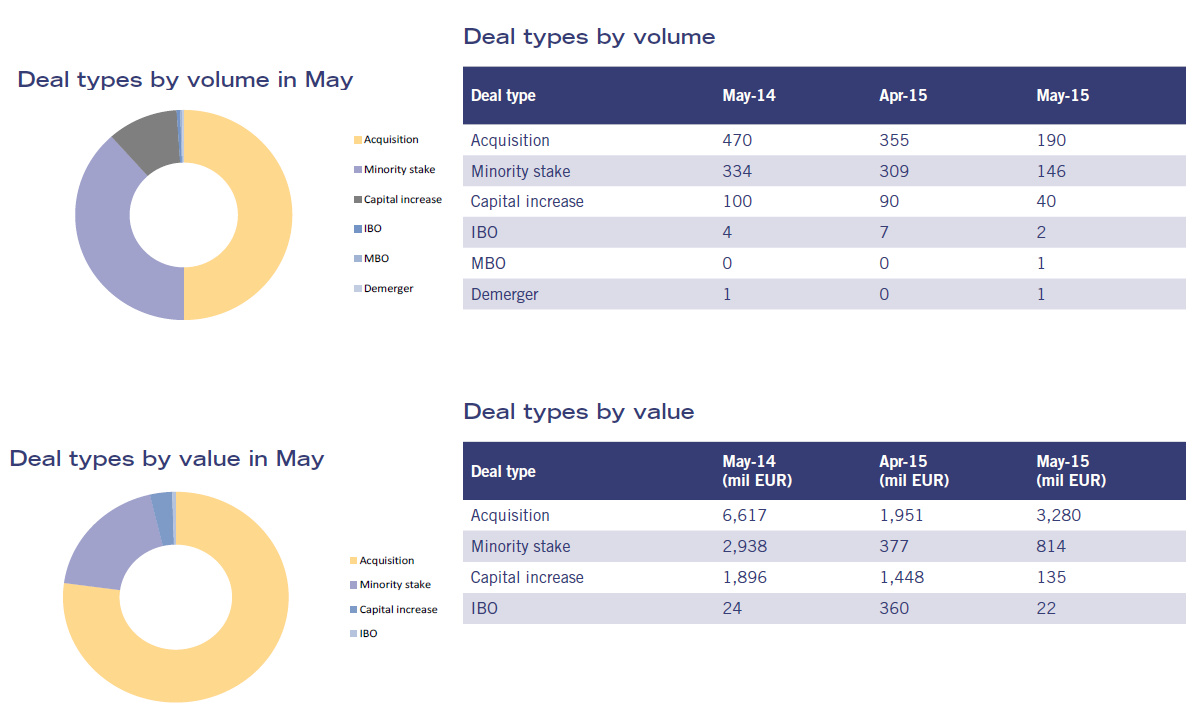

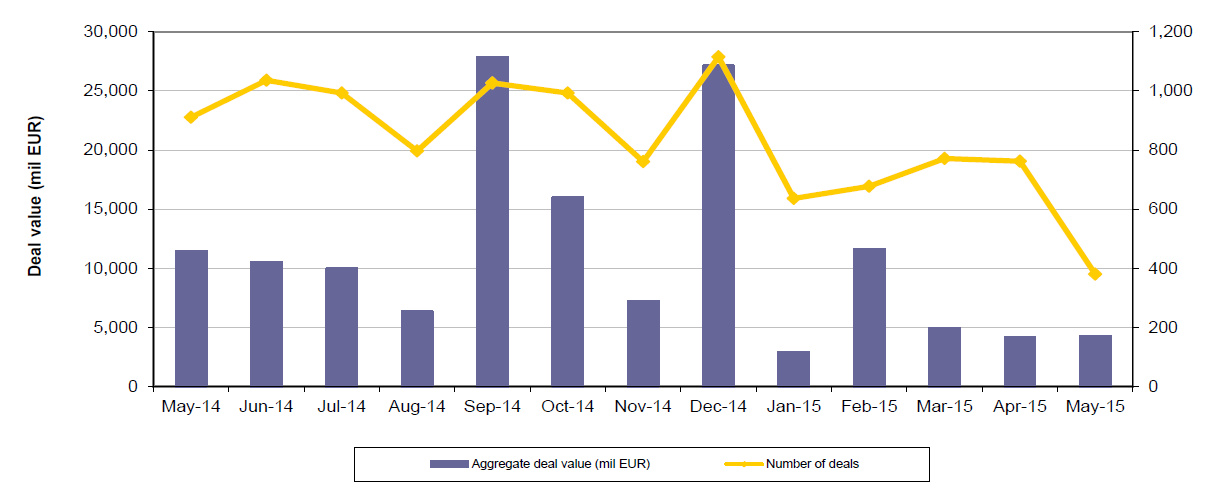

There was slight growth in the value of mergers and acquisitions (M&A) targeting companies based in Central and Eastern Europe (CEE) in May, in spite of a significant decrease in transaction volume.

Deals worth a collective EUR 4,250 million were announced over the four weeks, compared to EUR 4,136 million in April, representing a 3 per cent increase month-on-month. However, the result was down almost two-thirds on the EUR 11,474

million recorded at the same time last year.

Volume halved between April and May from 762 to 380 transactions, the second consecutive decrease and the lowest figure recorded in the 12 months under review.

When taken in isolation, a similar trend emerged in Russia, with value advancing for the second month in a row to EUR 2,441 million (March: EUR 1,431 million; April: EUR 1,705 million) against a 60 per cent drop in volume from 156 transactions in April to 62, again marking a 12-month low.

CEE deals by volume and value

| Announced date | No of deals | Total deal value (mil EUR) |

| May-15 | 380 | 4,250 |

| Apr-15 | 762 | 4,136 |

| Mar-15 | 771 | 4,958 |

| Feb-15 | 677 | 11,620 |

| Jan-15 | 636 | 2,935 |

| Dec-14 | 1,115 | 27,121 |

| Nov-14 | 761 | 7,216 |

| Oct-14 | 993 | 15,982 |

| Sep-14 | 1,027 | 27,855 |

| Aug-14 | 797 | 6,329 |

| Jul-14 | 993 | 9,970 |

| Jun-14 | 1,036 | 10,481 |

| May-14 | 911 | 11,474 |

Russian rail company targeted in May’s top deal by value

Russian targets dominated the month’s top 20 deals by value, featuring in 11 transactions.

The top deal was a capital increase in which Russian rail transportation company Rossiiskie Zheleznye Dorogi issued EUR 1,143 million-worth of shares to its sole stockholder, the Russian government. This transaction accounted for almost half of the month’s total deal value for Russia (EUR 2,441 million) and more than a quarter for the CEE region as a whole (EUR 4,250 million). Slovak Telekom was targeted in the second-largest transaction in May.

Deutsche Telekom offered to acquire the remaining 49 per cent it does not already hold in the telecommunications company from the Slovak government for EUR 900 million.

There was a significant degree of investment from outside the region, with acquirors based in the US, Singapore, the UK, Taiwan and Thailand featuring in the top 20 deals in May.

Regional structure of M&A deals

|

Target country |

Top countries by volume |

Target country |

Top countries by value |

||||

|

May-14 |

Apr-15 |

May-15 |

May-14 |

Apr-15 |

May-15 |

||

|

Poland |

108 |

159 |

81 |

Russia |

5 603 |

1 705 |

2 441 |

|

Romania |

64 |

43 |

81 |

Slovakia |

222 |

0 |

900 |

|

Russia |

221 |

156 |

62 |

Poland |

627 |

621 |

593 |

|

Bulgaria |

296 |

141 |

53 |

Romania |

167 |

12 |

110 |

|

Ukraine |

46 |

149 |

24 |

Latvia |

6 |

36 |

106 |

|

Latvia |

26 |

14 |

12 |

Czech Republic |

40 |

21 |

33 |

|

Estonia |

22 |

11 |

12 |

Ukraine |

4 141 |

614 |

12 |

|

Belarus |

21 |

11 |

11 |

Belarus |

26 |

3 |

12 |

|

Bosnia and Herzegovina |

15 |

5 |

9 |

Bosnia and Herzegovina |

60 |

5 |

12 |

|

Slovenia |

5 |

8 |

8 |

Bulgaria |

134 |

254 |

11 |

|

Serbia |

15 |

13 |

6 |

Slovenia |

25 |

365 |

7 |

|

Moldova |

20 |

8 |

5 |

Lithuania |

294 |

104 |

6 |

|

Czech Republic |

13 |

6 |

4 |

Estonia |

17 |

1 |

4 |

|

Lithuania |

9 |

10 |

4 |

Croatia |

98 |

36 |

2 |

|

Croatia |

8 |

17 |

3 |

Serbia |

6 |

30 |

2 |

|

Hungary |

13 |

8 |

2 |

Moldova |

2 |

4 |

0 |

|

Montenegro |

0 |

0 |

1 |

Macedonia |

1 |

0 |

0 |

|

Slovakia |

7 |

2 |

1 |

Montenegro |

0 |

0 |

0 |

|

Albania |

0 |

0 |

1 |

Albania |

0 |

0 |

0 |

|

Macedonia |

4 |

0 |

0 |

Hungary |

7 |

556 |

0 |

|

Kosovo |

0 |

0 |

0 |

Kosovo |

0 |

0 |

0 |

M&A value in transport sector leaps

The Rossiiskie Zheleznye Dorogi capital increase transaction gave a major boost to deal value in the region’s transport sector, with a more than ten-fold increase from EUR 115 million in April to EUR 1,229 million, the highest result since November 2014.

M&A value also rose in chemicals, rubber and plastics and gas, water and electricity, while substantial decreases were recorded for the construction and food, beverages and tobacco industries.

Given the drop in overall transaction volume for the region it is perhaps unsurprising that volume was down across all industries, with the exception of wood, cork and paper and post and telecommunications, for which increases were recorded, while public administration and defence remained unchanged month-on-month at zero.

Top 20 deals by value

|

# |

Deal value (mil EUR) |

Deal type |

Target |

Target country |

Acquiror |

Acquiror country |

Deal status |

|

1 |

1 143 |

Acquisition increased from to 100% |

Rossiiskie Zheleznye Dorogi 0A0 |

RU |

Pravitelstvo Rossii |

RU |

Announced |

|

2 |

900 |

Acquisition increased from bl% to 100% |

Slovak lelekom AS |

SK |

Deutsche Telekom AG |

DE |

Announced |

|

3 |

241 |

Minority stake 11% |

Inter RAO EES OAO |

RU |

Announced |

||

|

4 |

184 |

Acquisition increased from 61% to 88% |

Farmstandart OAO |

RU |

Augment Investments Ltd |

CY |

Announced |

|

5 |

178 |

Acquisition increased to 100% |

VEB-Lizing OAO |

RU |

Gosudarstvennaya Korporatsiya Bank Razvitiya i Vneshneekonomicheskoi Deyatelnosti (Vneshekonombank) |

RU |

Announced |

|

6 |

170 |

Acquisition increased from 64% to 100% |

Mostotrest PAO |

RU |

TFK-Finans OAO |

RU |

Announced |

|

7 |

147 |

Acquisition 100% |

SiaieichrusOOO |

RU |

Qiwi pic |

CY |

Pending |

|

8 |

115 |

Minority stake |

EasyPack Sp zoo |

PL |

Templeton Asset Management Ltd; lnteger.pl SA |

SG; PL; PL |

Announced |

|

9 |

104 |

Acquisition 100% |

Latgran SI A |

LV |

Graanul Invest AS |

EE |

Announced |

|

10 |

101 |

Acquisition increased to 100% |

Dzhei end Ti Bank AO |

RU |

J&T Finance Group SE |

CZ |

Completed |

|

11 |

92 |

Minority stake 29% |

Bank Sankt-Peterburg PAO |

RU |

Upravlyayushchaya Kompaniya Vernye Druzya OOO |

RU |

Completed |

|

12 |

85 |

Acquisition increased from 22% to 100% |

North Star Shipping SRL |

RO |

Archer Daniels Midland Company |

US |

Announced |

|

13 |

63 |

Minority stake 49% |

Colian Holding SA |

PL |

Allumainvest Sp zoo |

PL |

Completed |

|

14 |

60 |

Acquisition |

Walki Group Oys Pietarsaari plant in Finland; Walki Group Oys Wroclaw plant in Poland |

Fl; PL |

Mondi pic |

GB |

Announced |

|

15 |

47 |

Acquisition increased from 54% to 61% |

Farmstandart OAO |

RU |

Augment Investments Ltd |

CY |

Announced |

|

16 |

46 |

Minority stake 15% |

Polenergia SA |

PL |

Completed |

||

|

17 |

43 |

Minority stake 0% |

Bank Zachodni WBK SA |

PL |

Institutional Investors |

Completed |

|

|

18 |

33 |

Acquisition 100% |

Wistron InfoComm (Czech) SRO |

CZ |

Wistron Corporation |

TW |

Completed |

|

19 |

32 |

Minority stake increased from 1% to 33% |

AIbion-2002 OOO |

RU |

Diksi Yug ZAO |

RU |

Completed |

|

20 |

30 |

Capital increase acquired 66% to hold 100% |

Charoen Pokphand Foods (Overseas) LLC |

RU |

Charoen Pokphand Foods PCL |

TH |

Completed |

Sharp drop in PE activity

While M&A value for the CEE region rose in May, there was a significant decrease in private equity and venture capital (PE and VC) investment over the four weeks.

A total of EUR 156 million was invested across 16 transactions in the month under review, compared to 25 deals worth a collective EUR 678 million in April, which in monetary terms represented a 77 per cent decline and of 36 per cent by volume.

This was replicated in Russia, where PE and VC activity weakened over the four weeks from 9 deals worth an aggregate EUR 281 million in April to 8 worth a combined EUR 10 million.

Modest transaction values accounted for the overall decline in May, with the region’s highest PE and VC deal a EUR 115 million funding round by Polish parcel locker rental firm EasyPack.

M&A deals strtucture