Executive Summary

If Ukraine can build on its considerable technical expertise to create a vibrant digital entrepreneurial ecosystem, it could become a major player in the global digital economy, bolstering its competitiveness and long-term prospects.

• Hit by the economic crisis, Ukraine’s 340,000 businesses need digital solutions to cut costs and become more productive, with small- and medium-size enterprises in the agriculture, retail, and logistics sectors leading demand.

Weaknesses and threats

• A shortage of investment capital remains a major barrier, particularly beyond the seed stage in a start-up’s development, forcing some entrepreneurs to go abroad for funding.

• A lack of business and global market knowledge means talented IT specialists don’t necessarily succeed as entrepreneurs.

• Political instability has prompted about half of Ukraine’s outsourcing companies to scale back their activities, according to some market experts, while some R&D centers have closed.

• Ukraine has few incubators and accelerators, while universities and large businesses provide insufficient support to start-ups.

• Market experts and entrepreneurs flag gaps in the legal framework regulating online businesses, over-regulation in some areas, high taxes and corruption as major issues, making Ukrainian start-ups less attractive for foreign investors.

Recommendations Sharing expertise

• Ukraine’s corporates need to give entrepreneurs better access to their key decision makers and provide start-ups with more managerial support and expertise, possibly through the involvement of non-executive directors or informal mentors.

• Universities need to provide more effective business education to help engineers develop managerial Universities in Ukraine need to partner with corporations to introduce efficient business courses for non-business faculties.

Expanding markets

• Start-ups need to think globally from the Given the relatively small size of the domestic market, Ukraine’s public and private sectors need to work together to harness the Ukrainian diaspora and establish a network of foreign partners willing to help start-ups break into overseas markets.

Encouraging investment

•Investors can mitigate risks by creating syndicates. Investors can lower risks by establishing syndicates, involving foreign venture capital (VC) funds but with local VC funds taking the lead.

• The government needs to consider judicial, intellectual property, and political Looking beyond the current geopolitical situation, investors need to be assured of a level playing field and the rule of law.

Stimulating innovation

• Academia and industry need to collaborate more. More universities need to follow Kyiv Polytechnic Institute’s example, collaborating with international tech giants and local digital companies, and setting up incubators to encourage innovations and entrepreneurship by students and alumni.

Ukraine is grappling with both the immediate impact of the ongoing geopolitical situation and fundamental structural challenges in its economy. In 2014–2015, the Ukrainian economy has halved in dollar terms. Ukraine’s aging and shrinking population, together with an over- dependence on raw materials and agriculture, are dampening the country’s long-term growth prospects.

The paper presents key findings from research conducted by A.T. Kearney and VimpelCom for Make Your Mark, the flagship corporate responsibility program of VimpelCom, which is a major player in Ukraine’s nascent digital economy. A.T. Kearney interviewed key market experts, including educational institutes, investors, accelerators, and entrepreneurs, and conducted an online survey of digital start-ups.

Several digital start-ups from Ukraine have become successful on the global stage. One of the most prominent is Readdle, which provides applications for document reading, scanning, formatting, and printing on iPhones and iPads. About 40 million people have downloaded Readdle’s apps. Another international success story is Deposit Photos, an online library from which designers can source professional photos. It has annual revenue of more than $10 million and has opened an office in New York. Moreover, Ukrainian start-ups have caught the attention of global Internet players. For example, Snapchat spent $150 million to acquire Looksery, a Ukrainian company that developed real-time face transformation filters that can be used when taking a photo with a smartphone.

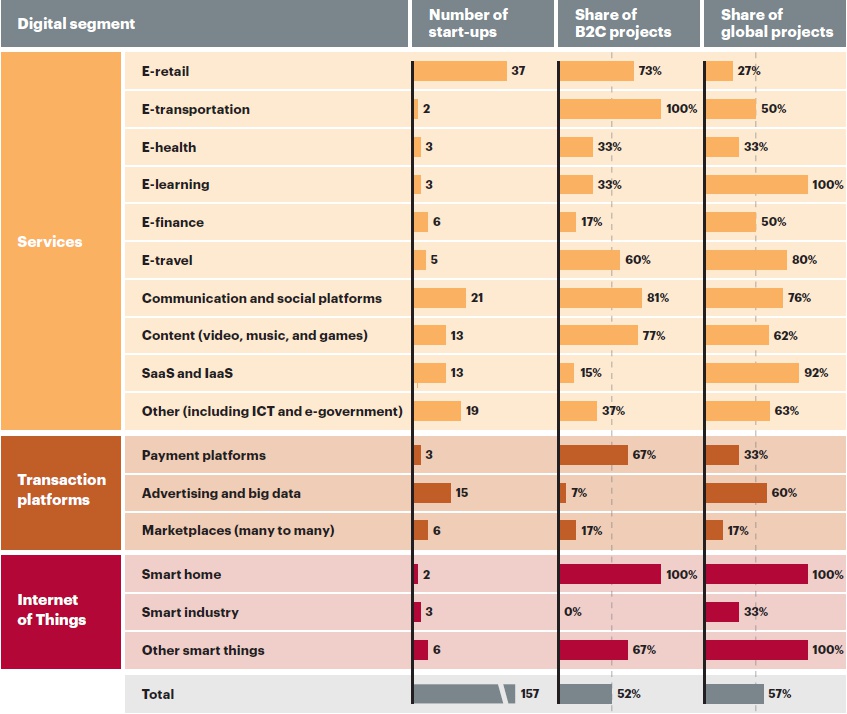

Start-ups that received funding in 2012-2014

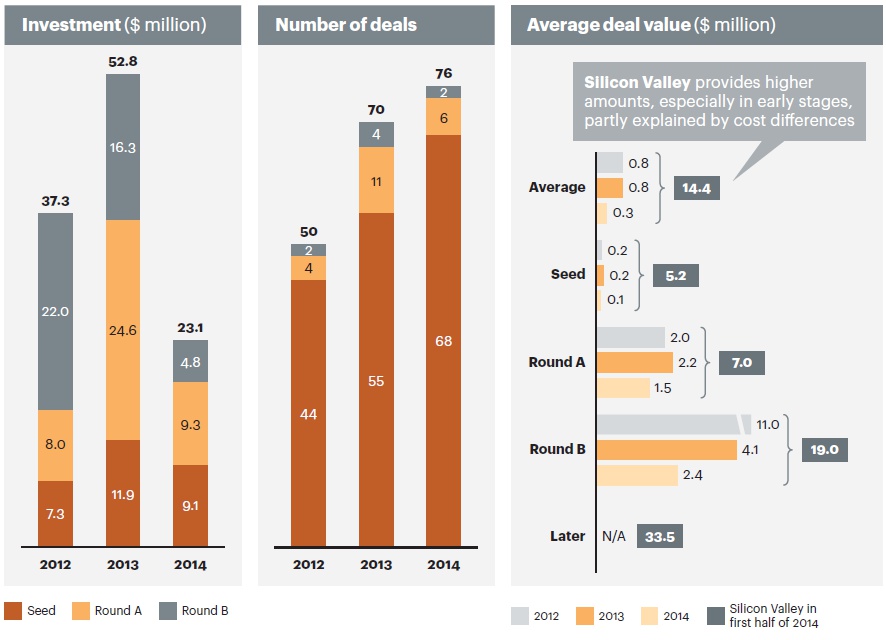

2.2 Dramatic decline in investment

The size of investments in Ukrainian entrepreneurs has shrunk

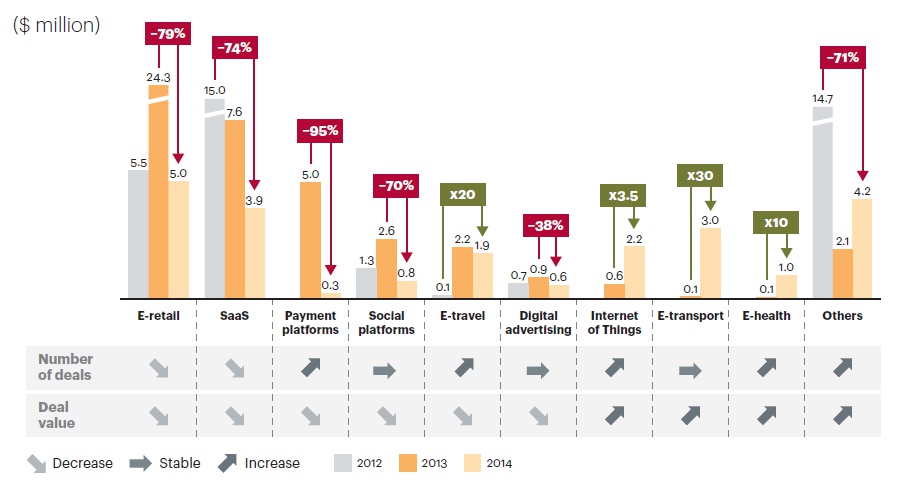

2.3 Some sectors are growing

Investments in some digital areas are growing in Ukraine

2.4 Venture capital could bounce back

In Ukraine, 2015 is likely to mark the bottom of the venture capital market. Even under a pessi- mistic scenario in which the number of deals remains flat in 2016, the overall investment by venture capitalists in Ukrainian digital start-ups is likely to rise slightly. The average deal value is likely to grow slightly in 2016-2017 (from a very low base) as earlier projects mature and seek new, larger investment rounds. However, many of these later funding rounds could take place abroad as a result of continued political instability and lack of local investors.

This growth could be driven by the launch of several accelerators and innovative centers that attract the attention of global investors looking for fresh talent. Ukraine has a strong base of software developers. At the same time, local investors could become more active as they see opportunities to make a return through later funding rounds led by global investors.

The number of Internet users in Ukraine rose to 20 million in 2014, taking the proportion of the population with Internet access to 43 percent—significantly below that in developed countries (see figure 5). Internet usage has been held back by a lack of fixed-line infrastructure and the relatively late launch of 3G mobile services. Still, growing smartphone adoption is enabling more people to get online. By 2018, there are likely to be 41 million smartphones in use in Ukraine, up from 16 million in 2014.

Ukraine does have key assets that could help digital start-ups develop. One is a major IT outsourcing industry made up of more than 500 companies generating collective annual revenue of about $2 billion each year, according to an estimate by VERNA. For digital start-ups, this sector, which employs more than 40,000 people, is both a competitor for and a source of engineering and managerial talent. Ukraine is also home to more than 100 R&D centers run by global companies and more than 100 established online commerce and digital platforms, primarily serving the local market. Again, these employers represent both a potential source of and a potential competitor for software developers and managers.

Market experts and start-ups stress the importance of government support. In particular, they say that market access regulations could be more flexible and that tax and investor protection laws could create a more favorable environment for the development of entrepreneurial ecosystems.

The Ukrainian government, in its decree “On the Strategy for Sustainable Development ‘Ukraine-2020,’” announced several priorities for country development, addressing critical issues such as the deregulation and development of entrepreneurship, as well as reforms of the tax system, corporate law, and the financial sector.

To step up digitization in Ukraine, several governmental programs have been launched recently: an e-commerce law was adopted in 2015 that addressed several gaps in online transaction regulations; an “Open Data Initiative” resulted in February 2016 in the opening of the “1991” incubator, which is the first non-commercial development program for digital start-ups based on open government data; and e-government and “smart city” initiatives in the largest cities have attracted talented digital start-ups.

4 Support for Entrepreneurs

4.1 Lack of accelerators and incubators

The support network available to entrepreneurs in Ukraine is very limited. The country has insufficient accelerators and incubators, a lack of local mentors and experienced entrepre- neurs, and few potential sources of investment. Market experts say several accelerators (sponsored by private investors) have had to close after adopting unsustainable business models based on short time horizons and aggressive financial terms.

Although some city administrations are launching new accelerator projects, they tend to lack a single long-term strategy and significant private investment. Moreover, several similar projects have been launched in parallel, potentially spreading the available investment too thin while complicating and delaying rollouts.

One of the success stories is a project launched by the National Technical University of Ukraine “Kyiv Polytechnic Institute” (KPI). The university has established a successful school for start-ups, which provides two months of free business education focused on technology transfers and innovative entrepreneurship. KPI also runs a “pre-incubator” to help aspiring entrepreneurs validate business ideas, together with the Sikorsky Challenge contest in which the winners receive seed funding. Moreover, the university has created three venture capital funds and is engaged as a partner in seven venture capital funds.

Although most co-working places are too expensive for entrepreneurs, the government of Sweden is sponsoring low-cost facilities in Kyiv, called iHub, and there are plans to open similar facilities in other cities. Moreover, the number of networking events aimed at start-ups is growing each year, driven by local VC funds, private investors, and co-working places. Although participation by international parties is rare, these events provide opportunities for public relations and making contacts in the local market.

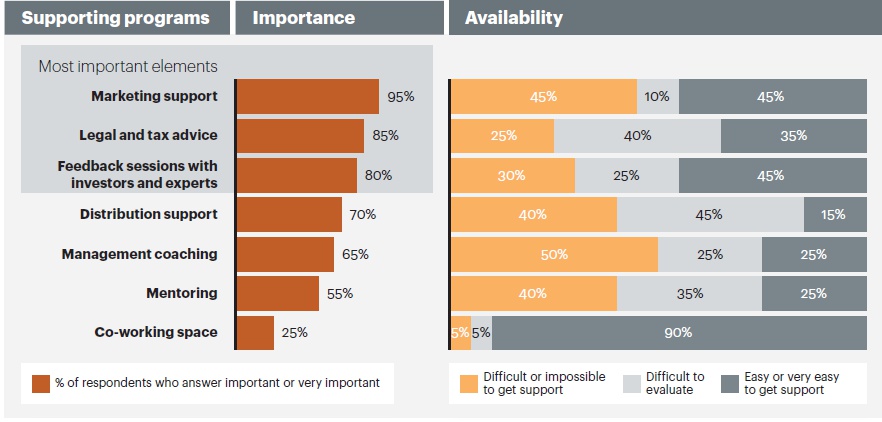

Ukrainian start-ups say they really value marketing support, legal and tax advice, and feedback sessions with investors and experts.

Importance and availability of different elements to support entrepreneurs

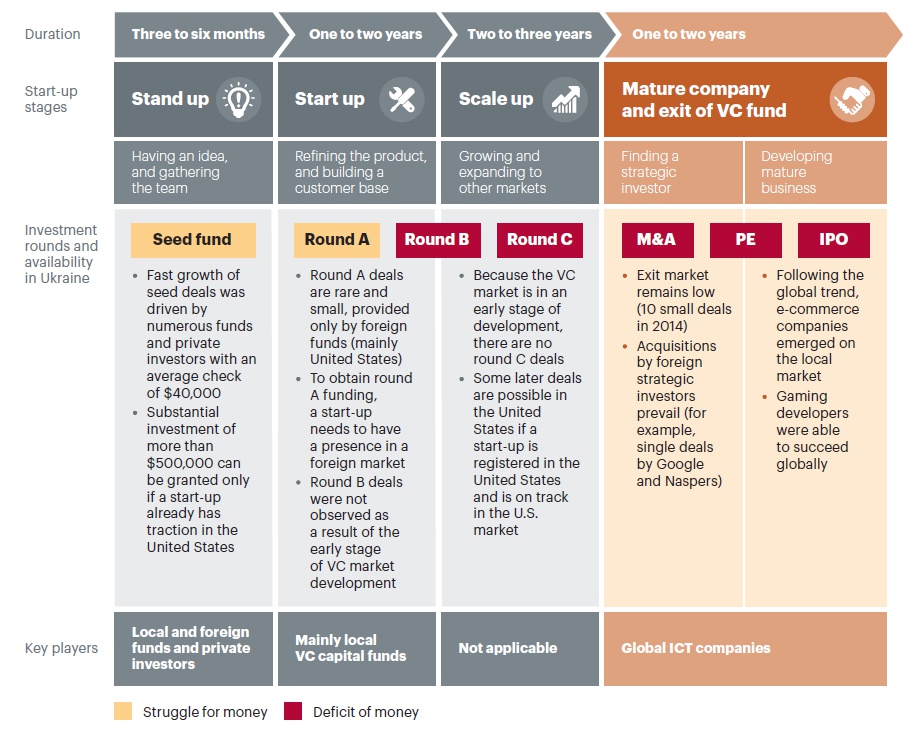

Although seed and round A funding is still available in Ukraine (see section 2.2), the geopolitical and economic situation has made it harder than ever for digital start-ups to secure round B and round C funding. This makes it tough for entrepreneurs to take their business across the chasm between start up and scale up.

Mature start-ups have a hard time finding investors (Life cycle of a Ukrainian start-up project)

The immaturity of the Ukrainian VC market means there have been no series C deals. Some start-ups have instead sought later-stage funding in the United States. In 2014, there were just 10 small exits, typically through acquisitions by foreign strategic investors, such as Google, Opera Software, and Naspers.

However, there is little effective collaboration between Ukrainian universities and industry. Higher education in Ukraine is still focused mostly on theory rather than practical application. Ukraine scores 3.5 on a seven-point index measuring university-industry collaboration on R&D—far behind the United States with 5.8 and Israel with 5.5. Low prestige and pay for academic work is also hampering innovation by Ukraine’s universities.

In our online survey of entrepreneurs, most respondents say the majority of universities don’t provide efficient business and language courses. Still, most entrepreneurs do acknowledge that Ukraine’s education system is producing competent engineers and IT specialists.

4.4 Corporations too opaque and inaccessible

Market experts and entrepreneurs say enterprises in Ukraine aren’t doing enough to support the development of a digital ecosystem. Although one-quarter of the start-ups in the online survey say they have a partnership with a corporation, more than half the respondents say enterprises have not developed sufficient transparency and haven’t made it simple enough to collaborate.

Still, most start-ups believe corporations could add significant value to their businesses as distributors, customers, and investors. Start-ups suggest potential partnership roles such as organizing workshops with industry professionals, particularly engineers, to share knowledge in specific technical areas. For corporates, there are several potential benefits to engaging with start-ups, including intangible benefits such as building a better business environment, positive public relations, and improved reputation along with practical benefits such as creating a more entrepreneurial culture, support in tackling specific business problems, and aid in expanding into new markets and services.

With a strong IT industry and a good supply of engineers, the basic conditions are in place to develop a vibrant digital start-up ecosystem. Better alignment of efforts, however, will be required to build on this foundation. Among the many factors at work, digital entrepreneurs identify the inefficient regulatory framework and limited access to investors and funding as their biggest barriers. To help the economy grow and boost the domestic market, Ukraine needs to take steps to address both these barriers. To that end, this section recommends some key actions for stakeholders in the digital ecosystem.

5.1 Sharing expertise

Mitigate risks by creating syndicates led by local VCs. Investors can lower risks by estab- lishing syndicates with local VC funds leading the deal. Such syndicates should look to bring in foreign VC funds with the financial firepower to increase the liquidity in the Ukrainian market. Foreign VCs have been open to such partnerships in the past, and the global search for engineering talent should ensure they once again become active in Ukraine. VC funds also need to promote transparency and collaboration to enable non-specialized private investors to participate in syndicates. These measures would alleviate the bottleneck in later-stage funding.

Undertake judicial, intellectual property, and political reforms. Looking beyond the current geopolitical challenges, investors need to be assured of a level playing field and the rule of law, with more opportunities for competition and fewer opportunities for corruption. If Ukraine can create a robust, trusted, and objective legal framework, the economy will gain new momentum and return to long-term growth.

5.4 Stimulating innovation

Encourage greater collaboration between academia and industry. More universities need to follow the example of KPI and collaborate with international tech giants and local digital companies, set up incubators, and encourage entrepreneurship by students and alumni.