Global M&A activity declines year-on-year in 2017

The volume and value of global mergers and acquisitions (M&A) declined in 2017. In all, there were 96,082 deals worth a combined USD 4,740,969 million announced over the course of the 12 months. In terms of volume, this represented an 8 per cent drop on the 104,559 deals announced in 2016, while value slipped 3 per cent from USD 4,892,779 million over the same timeframe.

The result is particularly disappointing as it represented the second consecutive annual decline in both volume and value (2015: 109,615 deals worth USD 5,871,017 million). However, the result represents an improvement on 2012 and 2013.

Despite the disappointing showing, several world regions actually attracted more value in 2017 than in 2016. Examples include Western Europe, where value climbed 6 per cent from USD 1,213,785 million to USD 1,281,917 million over the 12 months, as well as the Far East and Central Asia (USD 1,250,128 million to USD 1,275,161 million).

Global deals by volume and value

|

Year |

No of deals |

Total deal value (mil USD) |

|

2017 |

96 082 |

4 740 969 |

|

2016 |

104 559 |

4 892 779 |

|

2015 |

109 615 |

5 871 017 |

|

2014 |

102 746 |

4 811 910 |

|

2013 |

92 741 |

3 698 861 |

|

2012 |

85 325 |

3 329 556 |

US tops rankings in 2017

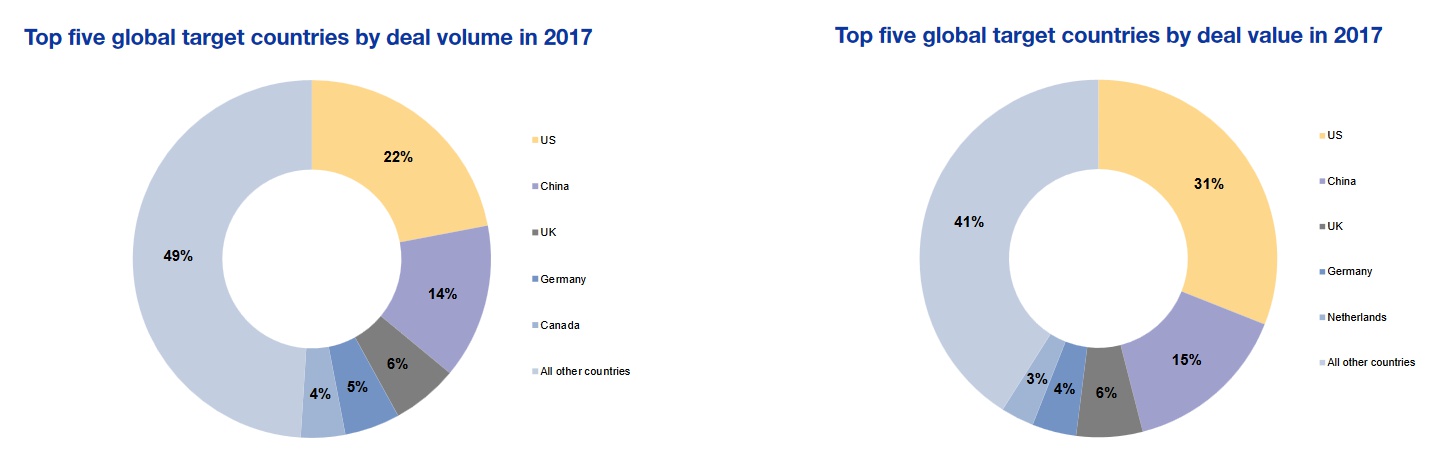

Once again, the US attracted the most investment in 2017, and also topped the country rankings by volume. Companies based in the country were targeted in 20,897 deals worth a combined USD 1,455,399 million. Its nearest rival on both fronts was China, which placed second with 13,679 deals worth USD 720,892 million. The UK was third, with 5,832 deals totalling USD 285,419 million.

The US’s position at the head of the country rankings is unsurprising given that it featured in nine of the year’s top 20 deals by value, including all of the top three. The largest of all featured an insurance player as CVS Health agreed to pick up Aetna for USD 77,000 million. This was followed by the Walt Disney Company’s USD 66,100 million takeover of Twenty-First Century Fox, which was announced in December, while third place was taken by British American Tobacco’s USD 49,400 million acquisition of Reynolds American.

The largest deal with a non-US target involved Germany-based Linde, which Praxair agreed to acquire for USD 37,861 million in June. The buyer intends to carry out the deal via a newly-formed entity known as Linde plc. Germany actually placed fourth on the country rankings by value in 2017 (USD 175,240 million), of which 22 per cent is attributable to the Linde deal.

Machinery, equipment, furniture and recycling is top sector by volume and value in 2017

The machinery, equipment, furniture and recycling sector topped the industry rankings in terms of both volume and value in 2017. In all, the sector featured in 9,959 deals worth a combined USD 568,957 million in 2017. Value was boosted by the year’s fifth-largest deal overall: a USD 30,000 million acquisition of Rockwell Collins by United Technologies. In addition, the USD 24,000 million takeover of CR Bard by Becton Dickinson and Company had a significant impact on the result.

The chemicals, rubber and plastics industry placed second by value, having been targeted in deals worth a combined USD 388,990 million, placing it ahead of banks and the primary sector, which attracted dealmaking of USD 311,973 million and USD 297,952 million, respectively.

PE/VC value bucks trend, hitting record high

Despite the decline in global M&A volume and value in 2017, a more positive trend was recorded in terms of private equity and venture capital (PE and VC) investment. Although volume was still down year-on-year, value actually hit its highest level in ten years. In all, there were 23,103 deals worth a combined USD 752,791 million announced during 2017, compared to the USD 588,028 million invested across 23,947 deals in 2016.

The last time annual PE/VC value surpassed this level was in 2007, prior to the onset of the global financial crisis, when deals worth USD 920,865 million were announced.

Value was undoubtedly boosted by several high value deals. The largest of all featured a US target as an investment consortium led by Energy Capital Partners agreed to acquire Texan gas-fired power plant operator Calpine for USD 20,474 million, via an acquisition vehicle known as Volt Parent. This deal, which was announced in August, accounted

for 3 per cent of total PE/VC value for the year under review. It was followed by a USD 17,714 million acquisition of Japanese semiconductor maker Toshiba Memory by Pangea, which received support from Dell Technologies Capital and Bain Capital Private Equity.

Target sector by volume and value - global deals 2017

| Target sector | 2015 | 2016 | 2017 | |||

| Volume | Value, mil USD | Volume | Value, mil USD | Volume | Value, mil USD | |

| Other services | 40 515 | 1 515 036 | 37 558 | 1 433 317 | 35 300 | 1 290 726 |

| Machinery, equipment, furniture, recycling | 13 159 | 730 117 | 11 796 | 707 022 | 9 959 | 568 957 |

| Wholesale & retail trade | 7 010 | 300 933 | 6 368 | 231 482 | 6 040 | 231 288 |

| Chemicals, rubber, plastics | 6 288 | 621 827 | 5 897 | 511 520 | 5 076 | 388 990 |

| Publishing, printing | 6 257 | 150 649 | 5 788 | 138 054 | 5 055 | 140 251 |

| Metals & metal products | 5 553 | 150 822 | 5 673 | 150 341 | 4 862 | 116 171 |

| Construction | 4 373 | 328 801 | 3 732 | 193 701 | 3 506 | 251 044 |

| Primary sector | 3 356 | 327 971 | 3 280 | 274 998 | 2 683 | 297 952 |

| Food, beverages, tobacco | 2 767 | 173 035 | 2 335 | 246 318 | 2 132 | 179 914 |

| Banks | 1 936 | 359 272 | 2 279 | 212 691 | 2 023 | 311 973 |

| Transport | 2 295 | 255 149 | 2 158 | 166 538 | 1 878 | 195 997 |

| Education, health | 1 795 | 70 310 | 1 716 | 42 502 | 1 811 | 55 171 |

| Gas, water, electricity | 2 143 | 227 167 | 1 914 | 250 557 | 1 799 | 249 738 |

| Insurance companies | 1 553 | 177 888 | 1 387 | 78 151 | 1 264 | 172 370 |

| Hotels & restaurants | 1 521 | 56 595 | 1 448 | 69 630 | 1 210 | 55 100 |

| Post and telecommunications | 1 479 | 338 187 | 1 196 | 114 755 | 1 132 | 146 553 |

| Textiles, wearing apparel, leather | 1 162 | 33 941 | 970 | 26 012 | 886 | 43 884 |

| Wood, cork, paper | 736 | 41 298 | 612 | 19 832 | 529 | 25 366 |

| Public administration and defence | 68 | 7 145 | 91 | 1 064 | 66 | 1 548 |

Top 20 global deals by value

| Deal value (mil USD) | Deal type | Target | Target country | Acquiror | Acquiror country | Announced date | |

| 1 | 77 | Acquisition 100% | Aetna Inc. | US | CVS Health Corporation | US | 03.12.2017 |

| 2 | 66,1 | Acquisition 100% | Twenty-First Century Fox Inc. | US | The Walt Disney Company | US | 14.12.2017 |

| 3 | 49,4 | Acquisition increased 42% to 100% | Reynolds American Inc. | US | British American Tobacco pic | GB | 17.01.2017 |

| 4 | 37,861 | Acquisition 100% | Unde AG | DE | Praxair Inc., via Linde pic | IE | 01.06.2017 |

| 5 | 30 | Acquisition 100% | Rockwell Collins Inc. | US | United Technologies Corporation | US | 04.09.2017 |

| 6 | 30 | Acquisition 100% acting in concert | Actelion Ltd | CH | Janssen Holding GmbH | CH | 26.01.2017 |

| 7 | 24,7 | Acquisition increased 5% to 100% | Westfield Corporation | AU | Unibail-Rodamco SE | FR | 12.12.2017 |

| 8 | 24 | Acquisition 100% | CR Bard Inc. | US | Becton Dickinson and Company | US | 23.04.2017 |

| 9 | 23,144 | Minority stake 36% | Reliance Industries Ltd | IN | Devarshi Commercials LLP; Karuna Commercials LLP; Tattvam Enterprises LLP; Srichakra Commercials LLP; Svar Enterprises LLP; Vasuprada Enterprises LLP; Shreeji Comtrade LLP; Shrikrishna Tradecom LLP | IN; IN; IN; IN; IN; IN; IN; IN | 02.03.2017 |

| 10 | 21,864 | Acquisition 100% | Abertis Infraestructuras SA | ES | Hochtief AG | DE | 18.10.2017 |

| 11 | 20,474 | IBO 100% | Calpine Corporation | US | Energy Capital Partners LLC, Access Industries Inc., Canada Pension Plan Investment Board, via Volt Parent LP | US | 18.08.2017 |

| 12 | 19,084 | Capital Increase 94% | Orange Egypt for Telecommunications SAE | EG | 06.12.2017 | ||

| 13 | 18,8 | Acquisition 60% | Energy Future Floldings Corporation | US | Sempra Energy | US | 21.08.2017 |

| 14 | 17,9 | Acquisition 100% | Mead Johnson Nutrition Company | US | Reckitt Benckiser Group pic | GB | 10.02.2017 |

| 15 | 17,854 | Acquisition 100% | Abertis Infraestructuras SA | ES | Atlantia SpA | IT | 15.05.2017 |

| 16 | 17,714 | Acquisition 100% | Toshiba Memory Corporation | JP | Pangea, KK | JP | 28.09.2017 |

| 17 | 17,2 | Acquisition increased 41 % to 100% | ONEOK Partners LP | US | Oneok Inc. | US | 01.02.2017 |

| 18 | 15,3 | Acquisition 100% | Mobileye NV | NL | Cyclops Holdings LLC | US | 13.03.2017 |

| 19 | 14,983 | Acquisition 62% | Luxottica Group SpA | IT | Essilor International SA | FR | 16.01.2017 |

| 20 | 14,699 | Acquisition 100% | Logicor Europe Ltd | GB | China Investment Co., Ltd | CN | 02.06.2017 |