- Global M&A value up 37% in 2015, as megadeals hit record highs

- New June record underlines momentum in second-highest first half on record

- Appetite to acquire at five-year high with further capacity for upward trend in current M&A cycle

This year could become the highest on record in terms of global deal value as the resurgence of M&A has further accelerated in the first half of 2015.

The first six months of 2015 are the second-highest on record at US$2.27t, just behind the all-time high first half of US$2.59t in 2007. The 37% increase in deals value globally was bolstered by the most megadeals in a six-month first half. The 31 deals of more than US$10b surpassed the previous record of 27 in the first six months of 2006.

The records continue unabated – 2015 seen the highest June on record for global deal value – and on current trajectory, the full year should challenge 2007’s record as the best ever year for global M&A.

Pip McCrostie, EY’s Global Vice Chair, Transaction Advisory Services, says:

“M&A as a route to growth is firmly back on the boardroom agenda. There are two clear drivers of activity after half a decade of deal stagnation. Disruptive forces are driving deal-making at every level. The disruption is triggered by sector convergence, technology and changing consumer preferences. In addition, divergent economic conditions are accelerating cross-border M&A.”

Is the hot deal market over-heating?

The second half of 2015 should be as strong as the first with deal-making intentions running at a five-year high. More than 50% of global executives surveyed for the Global Confidence Barometer’s 12th edition are planning to pursue acquisitions in the next 12 months.

Although the global deal market is running hot, there is evidence to counter claims of it over-heating. Although M&A value is challenging record highs, there has been no associated increase in the volume of deals during the last M&A cycle. That suggests a high level of discipline in selecting the right deals. Deal multiples are elevated, but not at 2007 levels, while bid-premiums are in line with midpoints of prior M&A cycles.

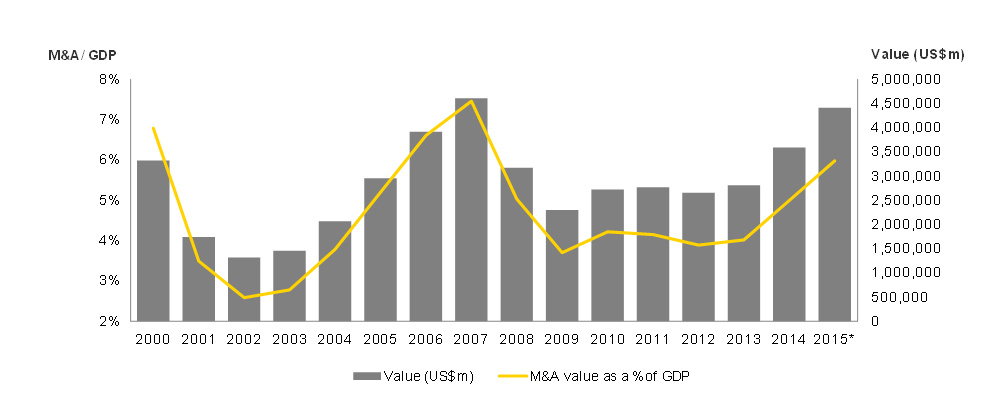

Other key measurements show headroom in the current cycle. Total M&A value as a share of global GDP is well below previous highs.

Source: Dealogic, Oxford Economics and EY analysis.

McCrostie adds: “Companies are not doing deals for deal’s sake. We are seeing a proliferation of high-value deals, but also an expansion of M&A pipelines as companies carefully consider their strategic options before making a move. Executives are expressing increasing confidence in the global economy and this, combined with steady confidence in corporate earnings and attractive interest rates, is fostering the conditions for companies to make bold M&A moves.”

Divergent economic and monetary conditions boost cross-border deal-making

The total value of cross-border deals has risen to US$716b, up 48% on the same period in 2014. The top targeted country for cross-border deals was the US (US$184b), closely followed by the UK (US$169b). Switzerland, France and Mainland China complete the top five targeted nations.

In terms of overall value by country, including domestic deals, the US leads with US$1.01t (46% of all global M&A). Second most targeted is Mainland China (US$222b), followed by the UK, Hong Kong and France. With South Korea, Australia and Japan, Switzerland and Canada also in the top 10, there is a balanced spread of M&A globally, across North America, Europe and Asia.

Life sciences deal market in rude health

Health care is the most active sector in 2015 with US$340b, up 50% on 2014, driven by demand for new and innovative drugs and therapeutics. Oil and gas has also been active, driven by volatility in benchmark crude prices, with deal value more than doubling (up 136%) to US$264b. Technology (US$247b, up 69%) and telecoms (US$211b, up 13%) remain in play, boosted by increasing sector convergence, driven by changing customer demands.

Niche growth is driving many acquirers. The search for specialization is fostering deals – from orphan drugs in life sciences to new materials and technology in industrials.

“All sectors are engaging in deal-making in this current market,” concludes McCrostie. “We have seen technology and health care lift deal values in the past few years, but we now see increased activity across all industries. Barring a major economic or geopolitical-driven, we can expect high-value deal activity to continue through 2015 and beyond.”

Vladyslav Ostapenko, Head of Corporate Finance and M&A group, EY Ukraine: «With bank lending being frozen and international capital markets closed for Ukrainian companies, M&A deals seems to be the only source of financing. Global M&A market activity provides opportunities for Ukrainian companies and their owners, who want to accelerate their business growth by attracting foreign partners. Certainly, investment activity is hit by the military conflict in the Eastern Ukraine. However, we can observe that even a fragile stability encourages some investors to look for investment targets in Ukraine. Thus, we successfully completed three selling transactions of Ukrainian assets to foreign investors from Denmark, Canada and Bulgaria over the past year. Two projects are in final stages, and the number of those in negotiation process is even bigger. This clearly indicates that with global investment activity it is possible to find buyers when a deal is properly structured and a seller is well-prepared.”