H2 2022 Highlights

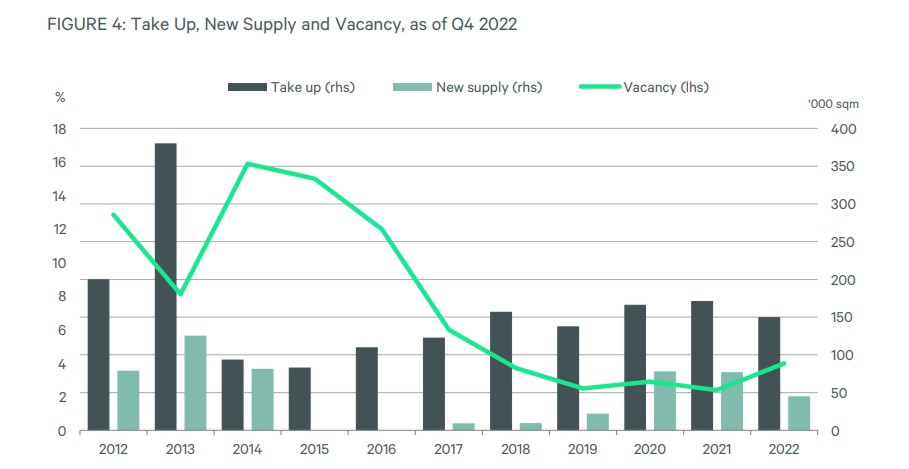

- 2022 take-up totaled 144,000 sqm, a 16% decrease over 2021

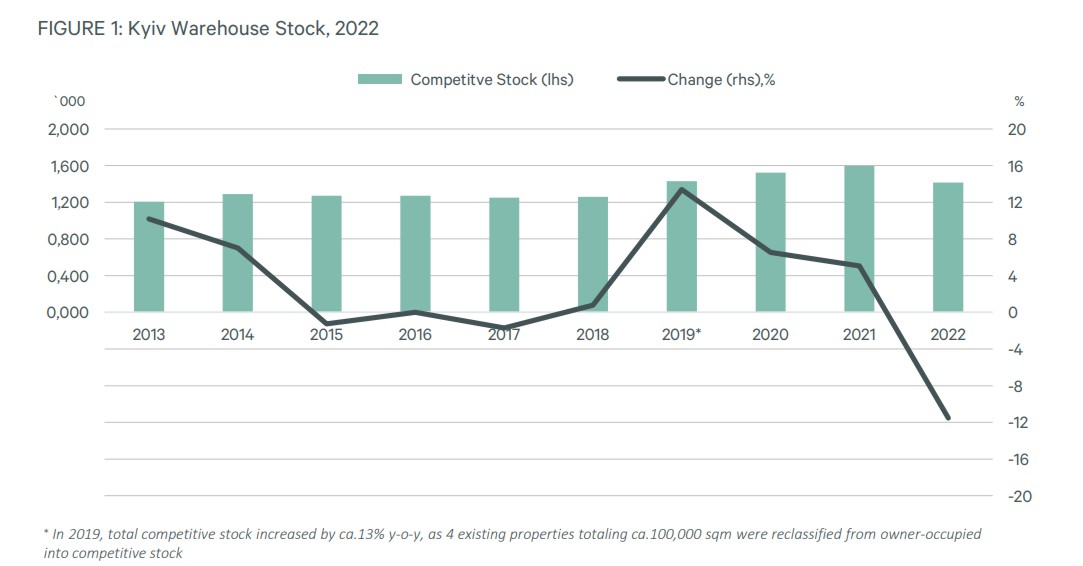

- For the first time in the market history, competitive warehouse stock declined by 12% yo-y due to military action near Kyiv in 2022

- In H2 2022 around 45,500 sqm of new completions came online

- New supply was represented by RLC Logistics Center II (24,000 sqm) and two phases of Makariv Warehouse (10,200 sqm in phase 3 and 11,300 sqm in phase 4)

- Average vacancy reversed the H1 trend and declined to 4%, down from 6,8%

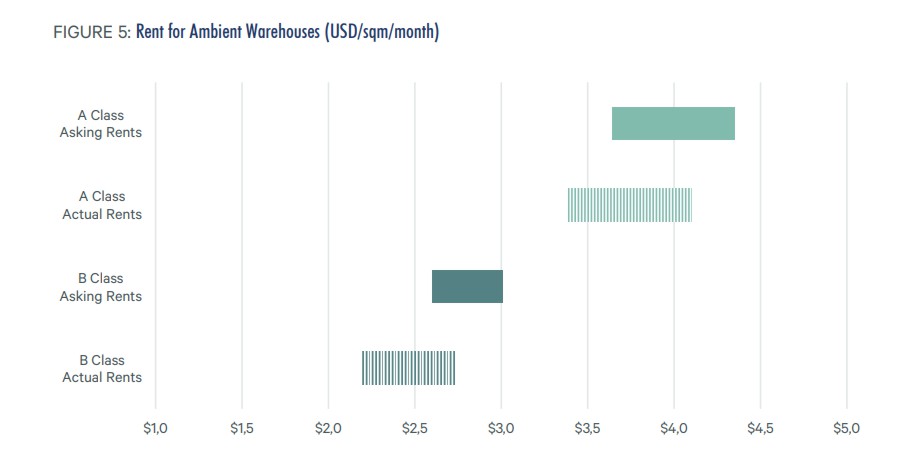

- Asking rents for ambient warehouses ranged between 133-159 UAH/sqm/month ($3.6-$4.3) for A class and 95-110 UAH/sqm/month ($2.6-$3.0) for B class, with actual rents 5%-7% lower on average

Demand

2022 was a difficult year for the warehouse market on the backdrop of full-scale military aggression in Ukraine. Logistics real estate suffered significant damage since the start of the war, with around 22% of Kyiv warehouses destroyed. Nonetheless, the warehouse market adapted to the challenges, alongside other commercial real estate sectors.

In H2 2022, demand for warehouse premises was modest and continued the trend of the first six months of the year. Leasing activity was primarily driven by relocations of existing companies from damaged warehouses, migrations from Eastern regions of Ukraine, as well as returns to Kyiv from western parts of the country. Moreover, take-up was supported by several expansion deals, mainly from 3PL & Transportation operators. As a result, annual take-up on the Kyiv market amounted to a healthy 144,000 sqm, a rather moderate 16% decrease from 2021.

Occupier activity was largely dominated by Wholesale & Retail sector, as well as 3PL&Transportation operators, with their respective shares at 51% and 35% of total take-up. The shift in take-up structure in favor of Wholesale & Retail companies was primarily driven by forced demand for new storage from the biggest local retailers whose facilities were damaged or destroyed in Kyiv and the region. Additionally, recovery of consumer demand after de-occupation of Kyiv region and relocation of over 700 industrial and manufacturing enterprises from eastern regions gave a noticeable impetus to the warehouse market.

During 2022, the highest leasing transaction volume (58%) was recorded along the Chernihiv Highway (M-01), with four large leases of more than 10,000 sqm each, representing 48% of take-up. Small transactions of up to 5,000 sqm constituted 24% of leasing volume. Looking at key leases in H2 2022, the most notable transactions were 22,000 sqm lease in Makariv Logistic III by Foxtrot, a leading local retailer, and 21,000 sqm lease in Unilogic Park III by Budpostach, the largest local retailer of professional equipment.

Supply

During H1 2022, the volume of total warehouse space in the Kyiv region decreased dramatically from 1.6 to 1.36 mio sqm. Approximately 382,000 sqm of warehousing and logistics facilities (including office space and other buildings within the complexes) were destroyed due to military action near Kyiv. Almost 340,000 sqm of net warehouse space was either wholly (213,000 sqm) or partially (169,000 sqm) destroyed, comprising 22% of total warehouse stock in the Kyiv region.

Dragon Capital, one of the biggest warehouse landlords, has already restored one of the buildings of the West Gate Logistic Complex with the area of 7,700 sqm, which was damaged in March 2022. ATB, the largest local retailer, is starting to rebuild both its warehouses. RLC, one of the largest logistics operators, has also started restoration works of its partially damaged warehouse in Brovary. As for other developers, due to lack of financing and security risks, the reconstruction of damaged warehouses will probably begin after the war.

2022 registered a modest volume of new supply represented by 45,000 sqm of warehouse space, comprised of RLC Logistics Center II (24,000 sqm) and two phases of Makariv Warehouse (10,200 sqm in phase 3 and 11,300 sqm in phase 4). Thus, the total speculative stock slightly increased by 3% (H2 to H1) to 1.41 mio sqm as of the end of 2022.

Key Lease Transactions in 2022

|

Occupier |

Industry |

Property |

Class |

Directon |

Area, sqm |

Deal Type |

|

Foxtrot |

Wholesale & Retail Trade |

Makariv Logistic lll&IV |

A |

Zhytomyr M-06 |

22 000 |

Relocation |

|

Berger Cargo |

3PL& Transportation |

RLC Peremoha |

A |

Chernihiv M-01 |

21 000 |

Expansion |

|

Budpostach |

Wholesale & Retail Trade |

Unilogic Park III |

A |

Chernihiv M-01 |

15 000 |

Relocation |

|

Fozzy Group |

Wholesale & Retail Trade |

RLC Logistic |

A |

Chernihiv M-01 |

14 000 |

Relocation |

|

ATB |

Wholesale & Retail Trade |

Top Trans |

A |

Chernihiv M-01 |

13 000 |

Relocation |

Approximately 110,000 sq m of new warehouse space is expected to be delivered in 2023. Notable, only 35,000 sqm of new deliveries will be added to the speculative stock. The remaining ca. 68% of new supply will be represented by two owner-occupied projects in Novus Warehouse (40,000 sqm) by the local retailer Novus and Nova Poshta Terminal (35,000 sqm) by the leading Ukrainian logistics and mailing company. Shortage of new speculative supply is likely to persist in the medium-term, as uncertainty over duration of the war, shortage of building materials, and labor migration, an unfortunate hallmark of 2022, affect long-term developer decisions.

Vacancy & Rents

As of the end of 2022, the average vacancy rate has declined to 4% (-2.8 pp over H1 2022). This decrease can be attributed primarily to forced demand from retailers and logistics operators in light of reduction in the overall warehouse stock. Despite the challenging market conditions, the low vacancy level underscores the scarcity of quality space that the market has experienced consistently in recent years.

In short to medium term, the biggest challenge for the post-war market will be deficiency of modern competitive stock to meet upcoming and deferred demand.

With the national currency plummeting more than 30%, tenants pressured landlords to achieve temporary compromise exchange rates or rental agreements denominated in the national currency. In H2 2022 the majority of leasing transactions were contracted in the national currency. Thus, UAH-denominated rental rates remained broadly unchanged at the level of H1 2021, and rents denominated in USD declined by around 25%. Asking rents for ambient warehouses ranged between 133-159 UAH/sqm/month ($3.6-$4.3) for A class and 95-110 UAH/sqm/ month ($2.6-$3.0) for B class. Actual rents were 5%-7% lower on average. Cold warehouses were more resilient to market fluctuations owing to their scarcity, where asking rents stood at 300-360 UAH/sqm/month ($8,2-$9,8), and actual rents hovered in the 270-320 UAH/sqm/month ($7.4-$8.8) range.

During the war period, many landlords offered their tenants short-term discounts and flexible lease conditions. Some of the most common forms of rent relief included rent deferrals, temporary discounts of up to 50%, and long-term rent reductions. However, as the market adapted and tenants returned to the Kyiv region, the flexibility on the part of landlords decreased and depended on the tenants business segment and overall market demand.

New Supply and Pipeline for 2022-2023

|

Property |

Developer |

GBA, sqm |

Direction |

Status |

|

2022 RLC Logistics Center II |

RLC |

24 000 |

Chernihiv M-01 |

Delivered |

|

Makariv Warehouse IV |

Alfa Development Group |

11 300 |

Zhytomyr M-06 |

Delivered |

|

Makariv Warehouse III |

Alfa Development Group |

10 200 |

Zhytomyr M-06 |

Delivered |

|

2023 F Novus Warehouse |

Novus |

40 000 |

Inner-city/Kyiv |

u/c |

|

Nova Poshta Terminal |

Nova Poshta |

35 000 |

Kharkiv M-03 |

u/c |

|

M-06 Logistics 1 |

Amstar Europe |

32 000 |

Zhytomyr M-06 |

u/c |

Outlook

We expect occupier demand for warehouse space to remain broadly unchanged in 2023 due to uncertainty over the duration of hostilities.

At the same time, take-up is expected to be driven mostly by relocation decisions, with very few expansions and declining number of contractions. In the mid-term perspective, the warehouse market will likely see continued low vacancies, with rental rates staying broadly the same. The trend of fixing the denominated rental rates in the national currency is expected to persist until the war ends.

High security risks, an outflow of workers, power outages, and the volatility of the prices of construction materials delayed many projects from coming to fruition. Considering the gamut of risks, developers across the board postponed not only the delivery of projects at early development phases but in many cases even the near-completed schemes.

The trend is likely to continue until the end of the war. In view of low speculative deliveries, demand for warehouse space could gradually shift from leasing towards owneroccupation.

The war has caused significant damage to the countrys infrastructure, and the pressure on supply chains remains historically high. Liberalization of transport relations with the EU, opening of European markets for Ukrainian goods, and other EU initiatives contributed to easing strain on the

sector in 2022. In the post-war future, expected access to new markets and rebuilding of infrastructure will increase demand from new international players and significantly improve Ukraines logistics and supply chain sectors. Overall, the warehouse market in Kyiv is considered a

promising sector for investors and developers, as it offers strong potential for growth and attractive returns once post-war recovery begins.