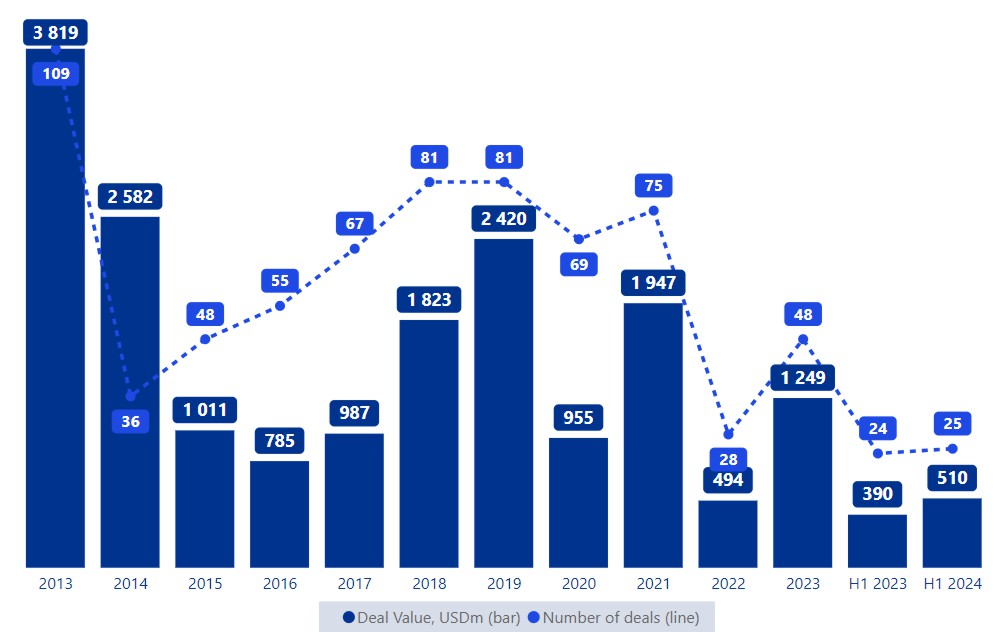

Despite ongoing challenges due to the war, the M&A market saw a 4.2% increase in deal numbers and a significant 31% surge in total deal value compared to the same period in 2023.

"In the first six months of 2024, the Ukrainian mergers and acquisitions market closed 25 deals totalling USD510 million, demonstrating a steady restoration of investor interest and adaptation to changes in the economic landscape. This growth has been supported by the National Bank of Ukraine successfully managing macroeconomic risks, supporting a stable exchange rate, and controlling inflation; all of which increasingly supports both domestic and international investment," notes Svitlana Shcherbatyuk, Head of Transaction Services, Deal Advisory, KPMG in Ukraine.

Ukrainian M&A Market Trends 1H 2024

Ukraines economic growth also indicates recovery, with the Ministry of Economy of Ukraine reporting a GDP increase of approximately 3.7% in May 2024 compared to the previous year. The International Monetary Fund (IMF) forecasts that Ukrainian GDP growth will range from 2.5% to 3.5% by the end of this year, despite ongoing war-related events. Continued growth is expected to be driven by both the increasing stability of the established Ukrainian maritime corridor and a high level of domestic demand for construction services supported by national infrastructure reconstruction funding.

"Several initiatives, including the creation of the Export Credit Agency (ECA) and a USD350 million insurance programme from AON and the U.S. International Development Finance Corporation, aim to accelerate Ukraines economic recovery by reducing war risks and enhancing investor confidence. Locally, programmes like the Ministry of Economy of Ukraines platform Made in Ukraine will attract investment by improving communication between the Ukrainian government and entrepreneurs; supporting local producers and strengthening the economy," explains Volodymyr Maksymenko, Associate Director, Deal Advisory, Transaction Services, KPMG in Ukraine.

While H1 2024 has seen a relatively lower level of transparency in reporting transactions compared to 2023 (48% deal value disclosure compared to 58% in H1 2023), the resilience of the Ukrainian mergers and acquisitions market is evident and recent positive trends have been underscored by notable key transactions. These include deals such as the USD200 million financing round for IT company Creatio and NJJ Capital’s USD120 million acquisition of telecommunications company Datagroup-Volia. These investments have entailed an increase in average deal value: up from USD28 million in the first half of 2023 to USD43 million in the same period in 2024, offering evidence of increasing investor reassurance in the Ukrainian market.

Outbound Deals and Inbound Foreign Investment

Ukrainian companies have been successful in overcoming challenges domestically while also expanding their horizons internationally, with outbound deals comprising a third of the H1 2024 Ukrainian M&A transactions (eight deals). Notable cross-border transactions include acquisitions of companies in North America by Ukrainian IT companies Ciklum and Intellias, while DTEK has been making considerable investments in renewable energy in Eastern Europe, all of which indicates a strategic diversification of assets. Other Ukrainian investors from various economic sectors have continued the trend of expanding activities to neighbouring Central European countries, particularly in agriculture, consumer markets, healthcare and pharmaceuticals, and transport and infrastructure.

Despite a decrease in the share of inbound deals in the H1 2024, foreign investors have still remained relatively active, with seven deals announced (compared to nine in H1 2023) for a total value of USD410 million. The lions share of inbound deals were in the innovation and technology sector, continuing 2023 trends.

IT, Agriculture, and RE&C as Key Sectors for Investment

The IT sector continues to be a driving force in the Ukrainian M&A market. Smaller geographic footprint, distributed workforces, and a greater level of working mobility allow employees from this industry to adapt more easily and feel a relatively lesser professional impact from the ongoing war.

"In the first half of 2024, activity in the IT sector in mergers and acquisitions grew by 80% to USD305 million compared to USD168 million for the same period last year. This surge is explained by the industrys adaptability and a series of strategic investments, such as Sapphire Ventures leading a USD200 million investment round in Creatio. These events highlight the sectors growing appeal to global investors, especially from North America and Europe. The resilience and dynamism of Ukrainian technology sector will continue to facilitate the restoration of investor confidence and significant capital investments in promising start-ups," comments Maksym Tarasenko, Associate Director, Transaction Services, KPMG in Ukraine.

Ukraine opening up the market for agricultural land to legal entities on 1 January 2024 triggered a spike in activity in the sector: 25,700 transactions with land plots covering 58,800 hectares were concluded in just the first quarter. This was 7% higher than the previous record set in the fourth quarter of 2023 and underscores the key role of agriculture in Ukraine’s mergers and acquisitions sphere.

Ukraine’s real estate and construction sector is also experiencing significant growth in investor interest and M&A activity (about 16% of the total volume of deals in Ukraine in H1 2024), driven by the enormous need for post-war reconstruction and development. Notable transactions included Dragon Capitals sale of the Amtel warehouse complex in the Kyiv region to ‘Novyi Styl’ door manufacturer Histion for a price approximately USD30–40 million.

Outlook and Analysis: Forecast for Ukrainian M&A

Despite the complex challenges associated with Russias ongoing invasion, the Ukrainian economy remains resilient which is largely due to a combination of external financial support and governmental reforms. The IMF recently completed its fourth review of the Extended Financing Facility, resulting in an additional allocation of the equivalent of USD2.2 billion of support for Ukraines budget. This financial aid will be crucial for maintaining macroeconomic stability and promoting fiscal and debt sustainability.

Wide-ranging structural reforms are also being effectively implemented, particularly in the areas of public finance, the financial sector, and anti-corruption measures. The Ukrainian governments increased focus on privatisation has boosted investment, as evidenced by the significant amounts of funds raised and the high level of interest in state asset auctions. More funds were raised through privatisation in the first five months of 2024 than in the entire year of 2018, for instance, and the average number of participants in online auctions for state assets recently reached a historic high of 5.15 on average.

As Ukraine continues to overcome the difficulties of war and reconstruction, ongoing recovery in the M&A sector remains a strong positive indicator of the country’s resilience and increasing prospects for the local market.

For more information and a detailed analysis of mergers and acquisitions market trends in Ukraine in the first half of 2024, visit KPMG in Ukraine’s dedicated landing page via the link: M&A Radar H1 2024: Ukraine | Market analysis - KPMG Ukraine