60 active Private Equity & VC investors present in Ukraine in different forms, from deal participation to location of their teams and or funding sources. Besides active investor universe (we counted only the firms and angel investors who made at least one investment during 2015), there are up to an estimated 20 market players who invested prior to 2015 but remained idle last year. Out of 60 investors, there were 24 VC Funds, 5 PE Funds, 2 Family Offices, 8 corporate investors and 9 angels that participated in the 2015 deals. On top of that, we have noted up to 20 angel investors, who had not disclosed their names.

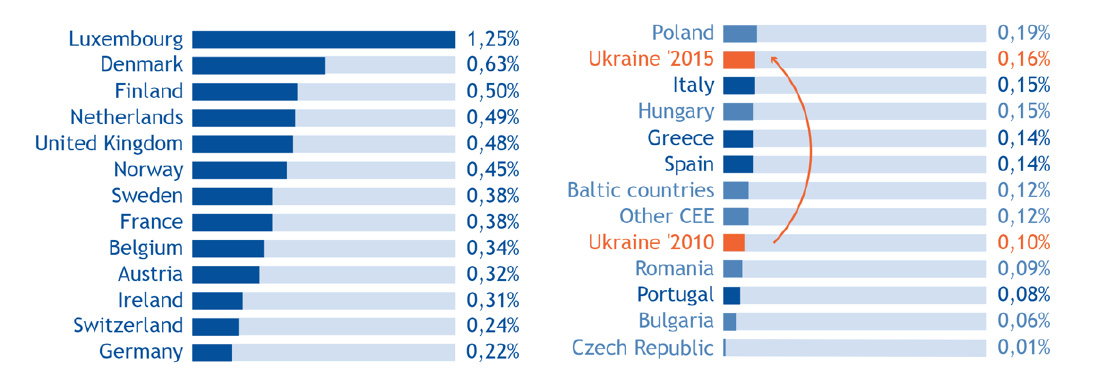

$132 overall value of the PE/VC deals in 2015, a remarkable 3x growth over 2014. Relative to GDP, PE investments into Ukrainian companies increased from 0.10% in 2010 to 0.16%, which is close to the upper level for CEE countries, with only Poland having a higher ratio (0.19%).

Private Equity & Venture Capital Investments, % GDP

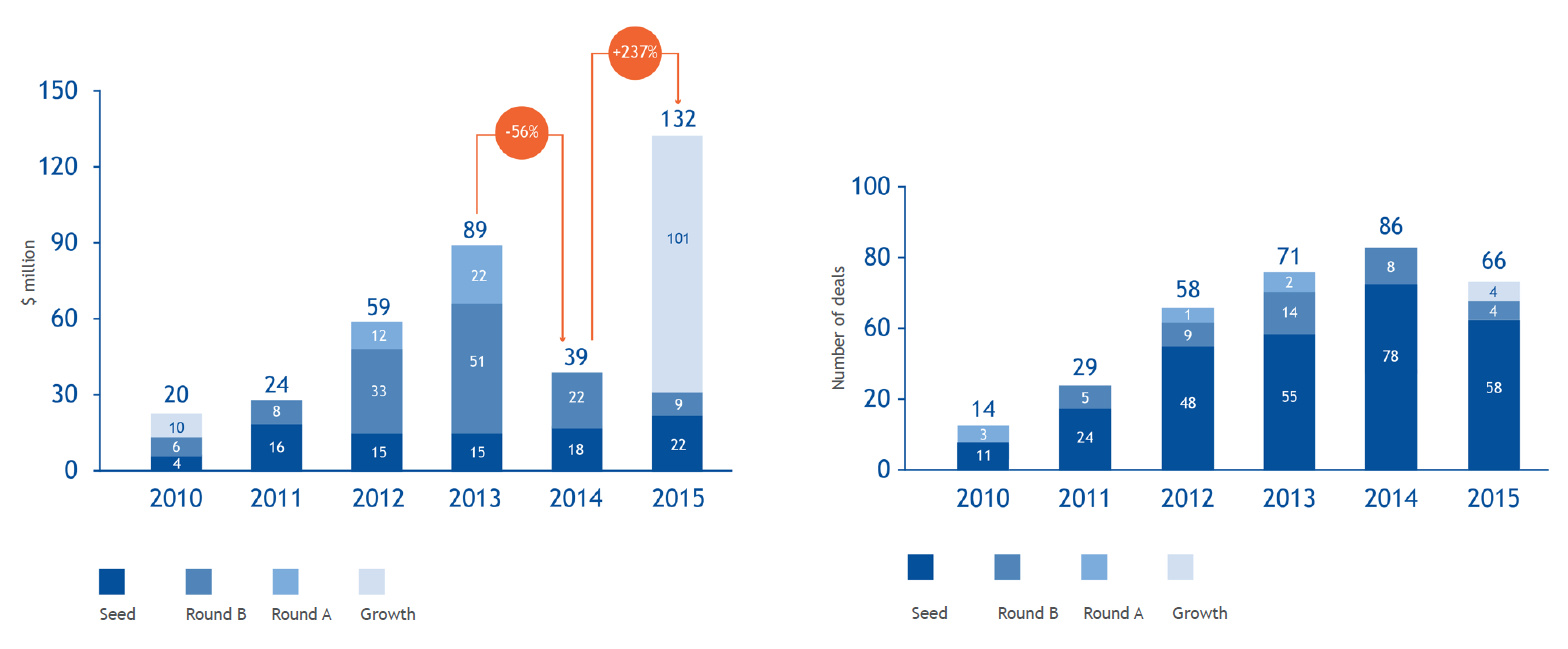

66 deals in 2015, the volume being attributable mainly to the venture deals (62) with a focus on seed stage (58 deals). Growth capital deals, however, made the last years investment in value ($101 mln).

Volume and Number of Private Equity & Venture Capital deals by stages

52% of capital provided by local investors (defined by either of HQ location or the source of funds) in 2015. With their share consistently close to 1/2, local money goes nose to nose with foreign funds during the last 5 years.

$400K average deal size at seed stage. Seed deals continue to account for virtually all the venture volume, yet the size of an average seed deal doubled compared to 2014, indicating investors preference for a late seed opportunities.

Full report: Ukrainian Venture Capital and Private Equity Overview 2015 by UVCA