Investments in the production of high-quality non-autoclaved aerated concrete blocks D550 M35 F25 using a technology that has significant advantages:

- The cost of the finished product is at least 20% below market value

- The unique technology

- No autoclave

- Production on the territory of Kiev to minimize transport costs

The main features of the line in comparison with autoclave ones:

- The use of an intensive high-speed mixer with a rotating container, which provides a highly homogeneous mixture of components at a low water consumption (W / T ~ 0.3) and intensive activation of the mixture and its components, which eliminates the need for autoclaving blocks by 60-80%

- Mixing the mixture with cold water (18-25 ° С)

- Application of vibro-impact molding of aerated concrete massifs

- Exposure of molded masses in forms that exclude water evaporation

- Cutting arrays with circular saws after the main shrinkage of aerated concrete

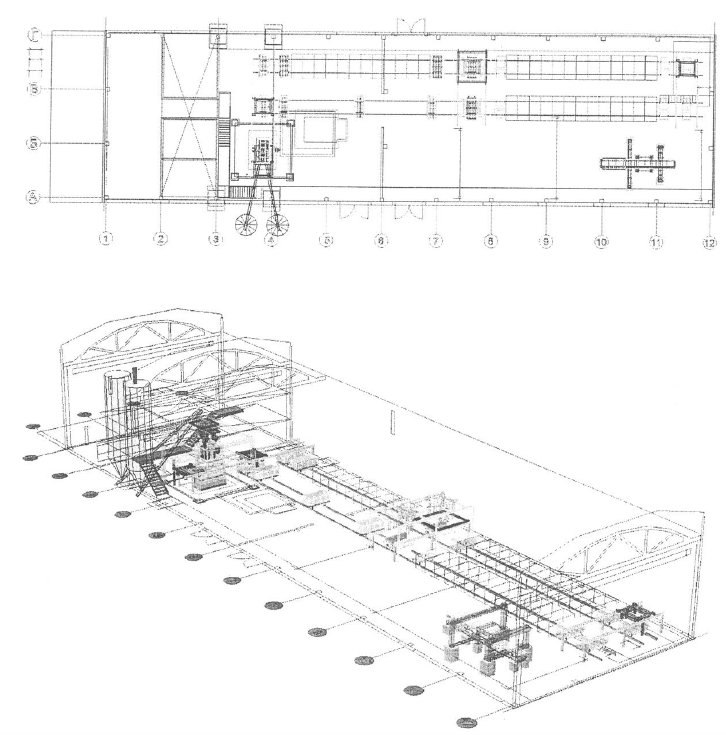

Layout plan and 3D configuration of aerated concrete block line 100 m3 / day in a workshop 54 m / 18 m:

These line features provide:

- Self-heating of enclosed arrays up to 70-95 ° С without steaming

- High shipping and brand strength

- Low shrinkage

- High frost resistance

- Low water absorption and humidity

- Low consumption of cement (25-35%)

- High dimensional accuracy: + 1-2mm

- Achieving the properties of autoclaved aerated concrete without autoclaved

The line can be used for the production of other building materials.

The line of aerated concrete blocks includes a highly functional concrete mixing unit with precise dosing and a universal intensive mixer.

The main feature of the mixer is the ability to produce any high-quality homogeneous mixtures — dry, semi-dry, plastic, viscous, liquid and others.

Aerated concrete production can also produce other building materials and products:

- Dry building mixes (external and internal plasters, masonry mixes, tile adhesive and others) - a packing unit is additionally required;

- Paving stones (FEM — figured paving elements) —vibropress, a set of pallets and specification of the configuration and layout of the line are required;

- Concrete products, including high-strength ones, - with their molding on the vibration-impact molding unit, which is included in the set of aerated concrete line.

Application:

- LCD and townhouses

- Cottages and non-commercial premises

- Commercial premises and shopping centers

- Distribution and tenders

The project looking for investments in the amount of 800,000 US dollars, which will be used to cover capital costs during the first two years from the date of the project launch on the following conditions: the first 2 years after the start of production - 5.% per annum of the balance of the loan body. Subsequent years - 10%.

INVESTMENT ACTIVITIES |

|||

EXPENSES |

2020 | 2021 | |

| 1 | Ash silo | 500 000 | 300 000 |

| 2 | Cement silo | ||

| 3 | Screw feeders for ash and cement | ||

| 4 | Weighing dosing hoppers for ash and cement with discharge valves | ||

| 5 | Weighing hopper for additives | ||

| 6 | Suspension activator | ||

| 7 | Intensive mixer with rotating bowl Ф1400 | ||

| 8 | Shaper of massifs of shock-vibration action | ||

| 9 | Load-bearing metal structure of the unit for dosing, mixing and molding | ||

| 10 | A set of forms | ||

| 11 | A set of pallets 2500x1020 mm (for 36 blocks) | ||

| 12 | Carts set | ||

| 13 | Rail tracks - direct and reverse | ||

| 14 | Array overloader | ||

| 15 | Unit for preliminary cutting of arrays into subarrays of 3 blocks | ||

| 16 | Finishing unit for cutting sub-arrays into finished blocks 600x300x200 mm | ||

| 17 | Power section and automation units | ||

| TOTAL expenses, $, including VAT | 500 000 | 300 000 | |

| INCOME | 2020 | 2021 | 2022 | 2024 | 2025 | Total |

| Sale of aerated concrete, $, with VAT | 0 | 1 930 851 | 1 930 851 | 1 930 851 | 1 930 851 | 7 723 404 |

| EXPENSES | 2020 | 2021 | 2022 | 2024 | 2025 | Total |

| Consumption for the production of aerated concrete, $, with VAT | 0 | 1 287 965 | 1 287 965 | 1 287 965 | 1 287 965 | 5 151 862 |

| Administrative expenses, $, including VAT | 136 170 | 136 170 | 136 170 | 136 170 | 544 681 | |

| Total Expenses | 0 | 1 424 136 | 1 424 136 | 1 424 136 | 1 424 136 | 5 696 543 |

| TAXES | ||||||

| VAT payable | -83 333 | 34 453 | 84 453 | 84 453 | 84 453 | 204 477 |

| SALDO operating activities | 0 | 555 596 | 422 263 | 422 263 | 422 263 | 1 822 385 |

| Cumulative | 0 | 555 596 | 977 859 | 1 400 122 | 1 822 385 | |

| The balance of invest and opera. Activities | -500 000 | 255 596 | 422 263 | 422 263 | 422 263 | 1 022 385 |

| Cumulative | -500 000 | -244 404 | 177 859 | 600 122 | 1 022 385 |