What happened?

Ukraine’s Ministry of Finance has published draft legislation to implement anti-base erosion and profit shifting (BEPS) measures in Ukraine. The actual scope of the draft, however, goes well beyond the OECD’s anti-BEPS initiatives and intends to plug some historic loopholes of domestic tax legislation.

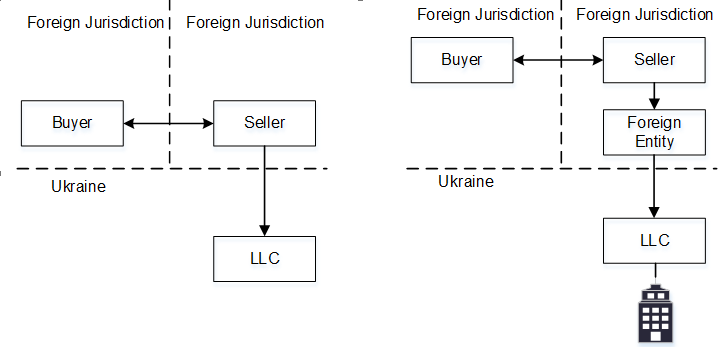

Among such plugs, the draft proposes to tax capital gains realized in transactions between foreign residents (including individuals and companies). Ukrainian tax implications will arise in the following cases:

- when a foreign buyer purchases from a foreign seller the shares of a Ukrainian target; or

- when a foreign buyer purchases from a foreign seller shares in a foreign target holding (directly or indirectly) the stake in a Ukrainian company, provided that (1) the shares of such foreign target derive at least half of their value from the stake it holds in the Ukrainian company and (b) the stake in the Ukrainian company derives at least half of its value from real estate located in Ukraine (so-called real estate-rich companies).

While in theory capital gains in such transactions should be taxable in Ukraine, in practice Ukrainian tax is not collectible due to the lack of enforcement mechanism. The new draft law aims to address this issue.

What will foreign residents have to do?

In any of the above transactions, the foreign buyer will be responsible for collecting the Ukrainian withholding tax (“WHT”) effectively acting as a tax agent. As such, the buyer will have to:

- register with a Ukrainian tax office before making any payments for shares. The registration procedure is currently unclear and should be further clarified in secondary legislation;

- open an account with a Ukrainian bank;

- obtain from the seller all the relevant documentation in order to calculate the amount of capital gain derived by the seller – that is, the difference between the price the buyer pays in the current share purchase transaction and the costs incurred by the seller at the historic acquisition of the shares;

- withhold and pay to the Ukrainian budget the 15% tax from the gain derived by the seller or, if the buyer did not obtain the documentation confirming the amount of gain, from the full purchase price of the shares.

What if they fail to do so?

If the seller’s capital gains remain untaxed in violation of the above procedure, the foreign buyer may be penalized with a fine of 25% of the unpaid tax. More importantly, the draft suggests that tax authorities would be able to freeze the assets of a taxpayer who will in future acquire the shares from a foreign resident if that foreign resident failed to collect Ukrainian withholding tax in a historic purchase of the same shares. Details of such measures (i.e. freezes) are yet available, but it is clear that lawmakers are determined to make shares with a WHT non-compliant history “toxic’’ in order to discourage tax avoidance behavior.

Any exceptions?

The draft suggests two exceptions from the general rule:

- shares are traded on a qualified stock exchange (these currently include only foreign exchanges)

- there is tax relief applicable under a double taxation treaty. Ukraine has double tax treaties with more than 70 countries, and many of them address differently taxation of capital gains. For example, treaties with Cyprus, the Netherlands and Switzerland all suggest different regimes for taxation of capital gains from alienation of shares. Whether double tax treaty relief is available to the parties should be decided on a case-by-case basis. In order to rely on treaty benefits, there should be a documentary trail and various requirements must be fulfilled.

What should foreign companies consider right now?

The draft suggests the new regime will apply starting 2019, but there is no assurance that it will be adopted by parliament in its current form. Nevertheless, investors considering the purchase of Ukrainian assets and, equally, those planning to sell their Ukrainian business (wholly or partially) should take a thorough look at the proposed rules and evaluate the possible implications.

Firstly, the parties need to answer numerous questions:

- whether the transaction they are planning falls within the conceptions described in the draft;

- which resources, time, and money they would need to allocate to comply with these new rules;

- in cases involving real estate-rich companies, how should they calculate the value of shares at each stage and portion of real estate in the share value, to understand whether their case is impacted by proposed rules, and whether there is any room for planning;

- what documentation the seller should provide to the buyer to ensure taxation of gain, and not full purchase price; and

- whether relief under double tax treaty is available.