These funds have played a significant role in maintaining the country’s financial stability during the war.

“Thanks to the funds raised from domestic government bonds, we were able to finance more than 200 days of our security and defense, which is equivalent to 15% of Ukraine’s GDP in 2023. Investments in government bonds have become the second largest source of financing for the State Budget after international aid,” said Minister of Finance of Ukraine Sergii Marchenko.

In total, domestic government bonds are currently in turnover for more than UAH 1.6 trillion, of which the share of commercial banks is 42.2%, the National Bank – 41.5%, legal entities – 10%, individuals – 3.8%, non-residents – 2.4%, and territorial communities – 0.1%.

At the same time, individuals and legal entities have significantly increased their interest in purchasing domestic government bonds. The volume of investments by individuals has increased by about 600 times since 2016, and by more than 2.4 times since February 24, 2022. Legal entities have increased their investments in domestic government bonds 7-fold since 2016 and 2-fold since the start of the full-scale invasion.

Between January 2022 and March 2024, UAH 31.5 billion of coupon income was paid to Ukrainian individuals and legal entities (excluding banks), and UAH 19 billion to foreign ones, which amounts to UAH 50.5 billion in total.

Along with yield, another important characteristic is the high liquidity of domestic government bonds in the secondary market, as investors can sell bonds at any time at the current market price.

This is confirmed by the statistics of the average daily volume of transactions at par value, which is currently about UAH 2.4 billion in equivalent, which is 26% higher compared to the average daily figure in 2021. Such data indicates that there are a sufficient number of market participants to ensure efficient trading.

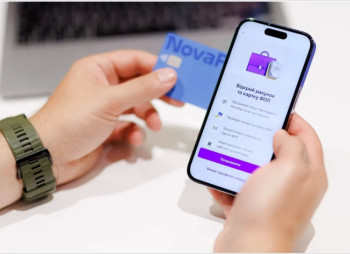

Convenient digital solutions for purchasing bonds, market yields that exceed inflation expectations, and a 100% guarantee of repayment from the state make government bonds the most attractive investment instrument on the market.