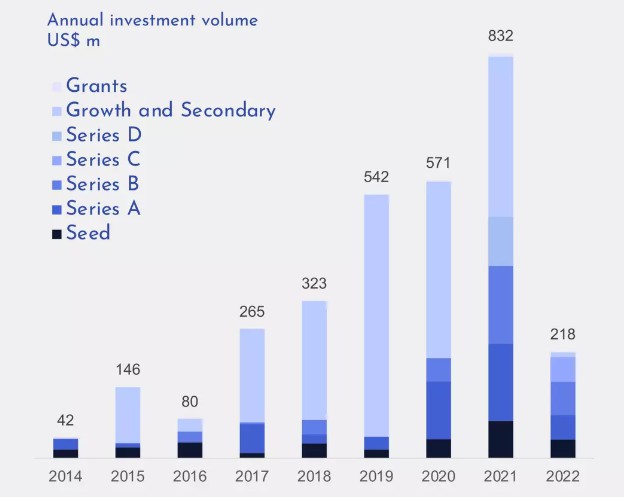

In 2022, the volume of venture capital investment fell by 74% compared to 2021. This decrease is partly explained by the general global economic downturn: for 2021-2022, the volume of venture investments in the EU and the USA decreased by 20-30%.

The largest decrease in the volume of Ukrainian investments occurred in deals at the Growth and Secondary stages, which usually make up the majority of the volume of deals.

The majority of Ukrainian technology companies focused on the global or American market continued to grow in revenue, even despite a 74% decrease in new investments. So, overall, 2022 wasn't too bad in terms of growth.

Four Ukrainian companies attracted 62% of the total volume of investments for 2022.

Airslate

In July 2022, the company raised $51.5 million from G Squared and UiPath Ventures. Airslate's valuation reached $1.25 billion, making the company one of the unicorns.

Preply

The company raised $50 million in a Series C round led by Owl Ventures. The total amount of investment in Preply reached 100 million US dollars

Fintech Farm

In 2022 and early 2023, Fintech Farm raised $22 million from Nordstar, Chrome Capital and others. Fintech Farm also closed a $7.4M seed round last year, bringing its total to nearly $30M.

Spin.ai

In August 2022, Spin.ai closed a $16 million Series A round from Blueprint Equity, Blu Ventures, and Santa Barbara Venture Partners.

Global companies continue to show interest in Ukrainian businesses, write the authors of the study, the largest exits involving Ukrainian companies in 2022.

Full research - Dealbook-2022