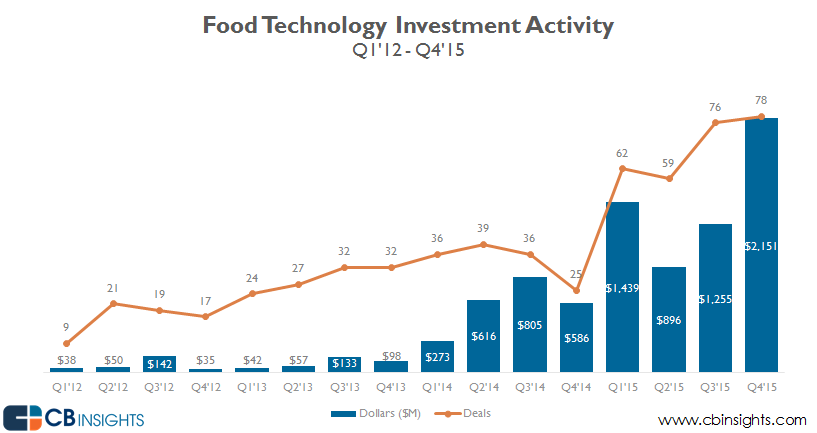

2015 created a perfect storm for food tech startup funding, as the global shift to on-demand consumption paired with increased investor interest in the massive addressable markets associated with food, drove global funding figures to four straight $1B+ quarters in 2015.

The food tech category covers tech-enabled companies specifically involved with the preparation, assembly, and/or delivery of food products to consumers including prepared meal delivery companies (like Munchery and Sprig), online ordering platforms (Delivery Hero, Ele.me), meal kit delivery companies (Blue Apron, Plated), among others. It does not include restaurant tech or companies marketing traditional food products.

Overall, food tech startups raised $5.7B across 275 deals in 2015, up 152% on a funding basis and 102% on deals basis year-over-year. Large deals, including online food ordering site Ele.me’s $1.25B corporate minority round, Womai’s $220M Series C and Grofers’ $120M Series C led Q4’15 to reach an all-time high for food tech funding at $2.15B, up 267% versus the same quarter a year prior.

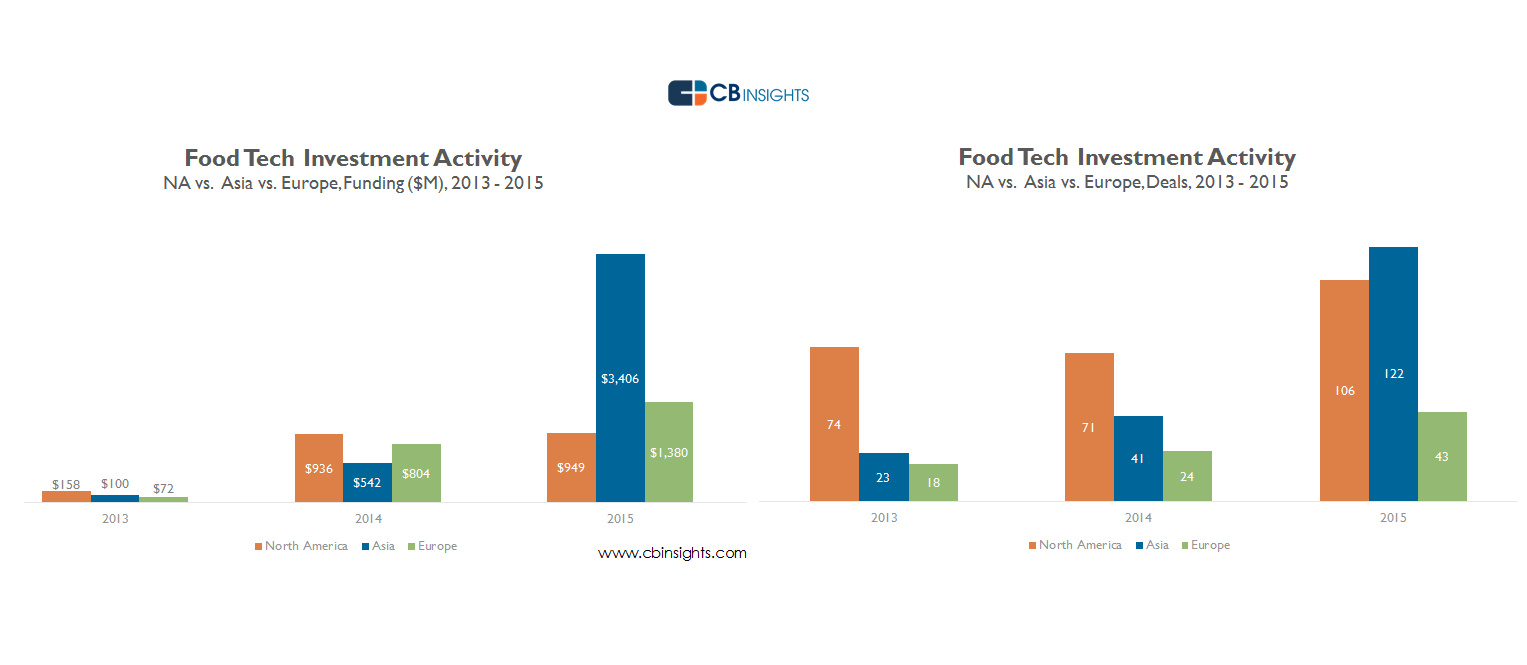

Funding by continent

When breaking down funding figures by continent, Asia dominated in 2015, raising more than both Europe and North America combined thanks to 5 mega-rounds of $100M+, including 3 to Ele.me which ended up raising a cumulative $2.23B in 2015, as well as the previously mentioned Womai and Grofers Series C rounds.

Europe also saw over $1B in funding, led by the Rocket Internet-backed trio of Delivery Hero (raised a cumulative $673M across 2 rounds), Foodpanda ($210M across 2 rounds), and HelloFresh ($211M across 2 rounds).

Alternatively, after funding increased over 5x for North American food tech startups from 2013 to 2014, 2015 saw fairly minimal funding growth year-over-year, increasing to $949M in 2015, led by 2 $100M+ rounds to Blue Apron and Impossible Foods.

Deal activity by continent

Despite the drastic differences in funding figures, deal activity between North America and Asia was much closer. Asian food tech deal activity saw explosive deal growth to accompany its funding boom, increasing nearly 198% year-over-year. North American deal activity also was up, increasing 49% over the 2014 total, as early-stage investment activity picked up in 2015.

Most active VC investors in Food Tech (since 2013)

|

Rank |

Investor |

|

1 |

500 Startups |

|

2 |

Accel Partners |

|

3 |

Index Ventures |

|

3 |

Slow Ventures |

|

5 |

Phenomen Ventures |

|

5 |

Sequoia Capital China |

|

5 |

Great Oaks Venture Capital |

|

5 |

Andreessen Horowitz |

|

5 |

Khosla Ventures |

|

5 |

Bessemer Venture Partners |

|

5 |

SAIF Partners |

|

5 |

BoxGroup |

|

5 |

Sequoia Capital India |

|

5 |

East Ventures |

|

5 |

SV Angel |

|

5 |

First Round Capital |

|

5 |

IDG Capital Partners |