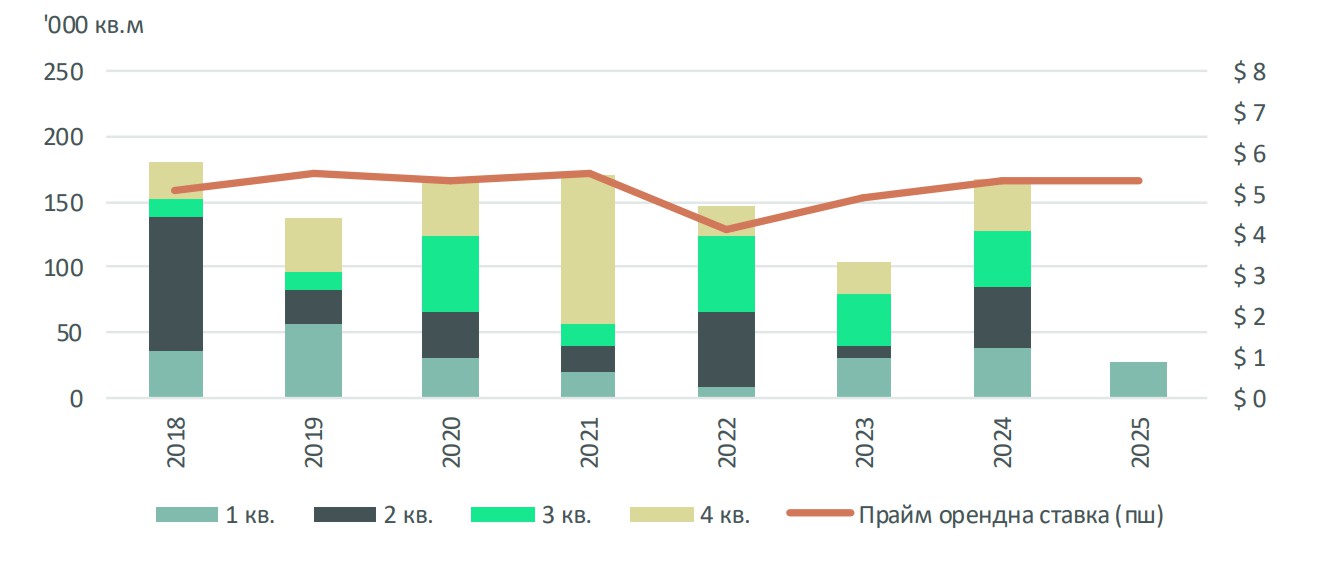

In Q1 2025, Kyiv’s warehouse real estate market demonstrated steady activity, supported by stable demand from logistics operators and retailers. Gross take-up for the quarter totaled approximately 27,500 sq m, marking a 28% year-over-year decline. Third-party logistics (3PL) providers accounted for the largest share of leasing activity (48%), followed by wholesale and retail trade operators (24%).

One of the quarter’s major additions to supply was the second phase of the “Dudarkiv” logistics complex, delivering 22,300 sq m of new space. This brought Kyiv’s total competitive warehouse stock up by 2% to 1.4 million sq m — a figure approaching pre-war levels.

Vacancy edged up slightly to 4.2% (+0.4 pp QoQ), reflecting a natural market adjustment amid new supply deliveries and continued tenant rotation, rather than a decline in demand.

Rental agreements remain denominated in the national currency, in line with prevailing macroeconomic conditions. The prime effective rental rate for high-quality warehouse space, calculated in USD, held steady at $5.3/sq m/month (excluding VAT and OPEX). Asking rents in hryvnia ranged between UAH 190–240 per sq m per month (approximately $4.5–$5.7), supported by a more balanced supply-demand dynamic.

Market Outlook (Gross Take-up | Prime Rents)

Development Activity (New Supply | Vacancy)

Warehouse Real Estate Reclaims Ground — Who Stands to Benefit in 2025?

Warehouse real estate in Ukraine continues to attract investor interest due to its resilient returns and growth potential. Despite a high entry threshold, the sector remains stable and shows signs of recovery in 2025, offering attractive opportunities for long-term investment.