Having recently left San Francisco for the Italian alps, I have been reflecting a lot on the opportunities and problems for companies outside of startup hubs which, by the way, are the vast majority of the world’s companies.

In this post I’ll try to put down on virtual paper my current observations and the reasons I think there is a clear opportunity for alternatives to standard VC approaches at the moment and in the future.

The trends

1: VC isn’t everyone.

Running a micro venture fund, I can more and more understand how VCs need huge outcomes to make any attempt at a decent return for their LPs.

The VC model makes it absolutely non-profitable to invest in any business which doesn’t have a very real chance of being a $100M+ business in a relatively short timeframe.

Oftentimes I’ve found myself saying:

wow, this is going to be an awesome business, but I seriously doubt it could scale past $5–10M in revenues.

If you think about it, that’s a crazy thing to say: an “easy” $5–10M business is amazing!

But the risk / reward balance is completely different from how we (and most VCs) set up our fund, where most businesses are expected to fail (because they risk big trying to become #1) and so the successful one needs to return the fund multiple times (eg return 50-100x).

This means that any business who structurally only has the possibility to become a $1M-$10M business, or is playing in markets who don’t enjoy massive margins and stellar growth, needs to find an alternative to finance itself.

And guess what, that’s 99% of all businesses in the world which are getting overlooked by VCs.

2: Growing trend of businesses aiming for healthy sustainability

Some savvy businesses now openly reject the VC-first, growth-at-all-costs mindset and intentionally go out to create a small, sustainable business that doesn’t drive them crazy.

This growing number of entrepreneurs is thinking very strategically about their funding options, and is not compromising on control of the company and dilution.

This is not only happening in not-sexy-anymore markets like retail, ecommerce, and services; but also more and more in traditional VC hotbeds like SaaS.

Building a 500+ person business or being the market leader in a category is not in the wildest dreams of most people. Most entrepreneurs start out wanting to bring something to the market and then use employees and growth as a tool to deliver a better product or service, while also making more money.

Most entrepreneurs are perfectly happy running a profitable business, which gives them a high quality of life and fulfills them.

3: Alternatives suck

So, we have VCs that rightly focus only on what will drive their very specific returns, but at the same time we would expect the market to take care of the remaining 99%.

Somehow that’s not the case. Financing a non-high growth business is a mess and business owners spend way too much time between bank loans, government programs, friends and family, reward crowdfunding, equity crowdfunding, etc

None of these options are easy to access, and most importantly none of these options are optimal for these businesses.

This means that these businesses also often go and try to raise money from traditional VCs and accelerators, wasting everyone’s time and creating a lot of discontent in the process: VCs are overloaded with mediocre “venture” deals, and entrepreneurs need to face multiple rejections (try hearing all over again “your business isn’t good/fast/big enough” multiple times per day) and end up spending a ton of time on activities which don’t contribute to the business.

Alternative Funding Sources For Startups

As you can see from Frank Denbow’s post, it doesn’t look great for someone who wants to fund their business without venture capital. Especially if outside of the US.

There isn’t much for most small internet businesses that need an investment and which are somewhat risky (no bank loans), will only be able to return it in the medium term (no pure debt), and don’t have the possibility to become a $100M+ business (no venture capital).

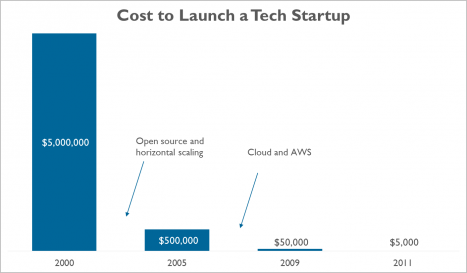

4(a): Plummeting cost of starting an internet-enabled business

Nothing new here: cloud, open source, great content, etc.

What is rarely mentioned is the, quite obvious, impact this has: many, many more internet companies are being created every single month.

4(b): It’s getting harder and more expensive (plus physically and mentally taxing) to become a gorilla business

Uber has famously raised $12.5B in funding, and doesn’t look like it’s done, in order to become the dominant player in its market. Many other venture businesses are following suit and are having to raise bigger and bigger rounds in order to keep the growth trajectory needed.

Increased number of companies means increased competition, which in turn leads to higher customer acquisition costs for virtually anyone, requiring more and more cash in order to grow big.

It’s not easy wanting to become a big startup when you start with 3 competitors with $20M in funding each. Take for example all the food ordering startups, or even the much more unproven market of “we’ll park your car for you in SF”.

VCs are also all trying to put the most cash possible into the few deals who will return the most money, meaning funding for non-category winners could be scarce.

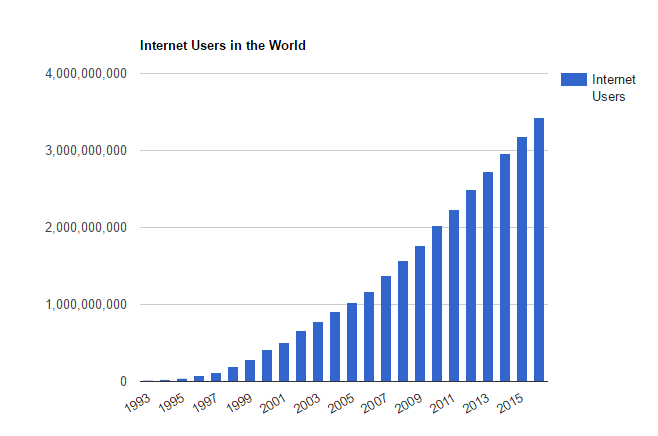

4(c): Bigger and bigger online markets

Again nothing new here, I could insert any other up-and-to-the-right graph in here to explain just how many potential buyers of products and services exist today online.

4(d): Increasing number of very successful niche businesses

The above points, mean that I believe we will continue to see more and more successful small internet businesses — which is an awesome thing.

These businesses will continue to enjoy the key traits of vc-funded internet businesses (high-margins, easy to distribute, scalable, easy to pivot and adapt to the market, etc.) but won’t have to compete to the extreme in order to become the dominant player in a specific market.

In fact, VCs’ biggest problem today isn’t finding which business will work and which won’t, but finding which business will scale and become massive.

5: Not everyone can be located in a startup hub

Creating a high-growth startup outside of the traditional startup hubs adds another (big) layer of difficulty to achieving unicorn status.

Local VCs can surely fill the gap, but oftentimes it’s not particularly profitable to set up a VC fund in non-hot ecosystems which leads to scarcity of venture capital. Italy is a prime example of this.

The opportunity

Given all of the above, I think there is a clear opportunity for creating alternative financing programs that target this emerging crop of successful, profitable, quality businesses which I like to call SIB (small internet businesses).

I think the bulk of businesses that would be interesting candidates will fit in the three very broad categories of ecommerce, saas and services; and will exclude anything that is social, consumer and big tech; but I won’t be surprised to find unexpected business types in the mix.

I’m still figuring out what the perfect instrument would look like. It will most likely have to be a mix of equity, convertibles, pure debt, royalties, preferred dividends, and other exotic structures.

Who’s doing something about it

There are dozens of new venture funds launched each month, but surprisingly there aren’t many people tackling this new opportunity.

The one that drew the most attention recently is Bryce Roberts’s Indie.vceffort which started out as an experiment but has since raised a “big” dedicated fund to continue on the vision. They recently got a feature on the WSJ as well.

Indie.vc works in a very, very, very entrepreneurial friendly way: as soon as a company decides to pay a dividend, Indie.vc receives 80% of it until they get 2x their investment, after which point they will get 20% until a 5x return.

If a company decides to raise follow on funding or sell the company before they have returned the 5x, the investment will convert to a negotiated equity amount.

This model is very innovative and seems to have stirred up the interest of many entrepreneurs.

It remains to be seen how this translates to returns. 5x is not that much of a return, meaning that the margin of error in selecting the companies is very small and they can’t afford many to fail, otherwise they wouldn’t even be able to return the capital, let alone an interesting IRR (given that the return is also probably going to take a while).

That being said, Bryce has been thinking about this more than anyone else and already have a full batch of data to evaluated what would work best.

Others include Lighter Capital, which loans between $50,000 and $2M and gets repaid through a percentage of the company’s revenue. This approach is much less entrepreneurial-friendly and aligned to the company, as it takes away very valuable money from the company’s balance sheet, especially if still unprofitable.

On the plus side, the business won’t give away any equity should it get acquired or raise more money, and the maximum repayment will be around 1.5–2.5x the investment.

RevUp by Betaspring has the same model, but act as an accelerator program at a much earlier stage.

As I enter the next dimension of my life outside of a startup hub, I’m extremely interested in understanding how this growing number of businesses can be financed to enable more innovation, economic growth, job creation and ultimately value creation in places that can’t rely on billion dollars venture funds.