1. Trends in AgTech sector

Despite the fact that venture capital mainly associates with investments in advanced technology spheres, nowadays noted venture capitalists observe the promising perspectives in one of the oldest industries – agriculture.

The driving force of investment in agrotechnologies is the global increasing demand on foodstuff, which is stimulated by the population upsurge (according to the expert evaluation the world`s population reach 10 bln people till 2050). Apart from the population growth, the prosperity of a lot of countries, such as India and China, has also experienced the improvement; citizens start to consume more protein products, namely meat. According to the USDA data, it is expected that meat consumption per head is going to increase from 79 pounds in 1999 to 99 pounds in 2030. All of this, gives the reason for re-comprehension of how effective the agriculture operates today and if it will be able to provide enough food, to support the global population, without causing a substantial harm to the planet.

Nowadays, investors from the Silicon Valley begin reviewing the investments in different niches of so called «AgTech»: starting with big data and proceeding up to the drones. Venture capitalists estimate agrotechnologies as a multitrillion market, which has grown into more effective and ecological decisions in agriculture on all of the levels.

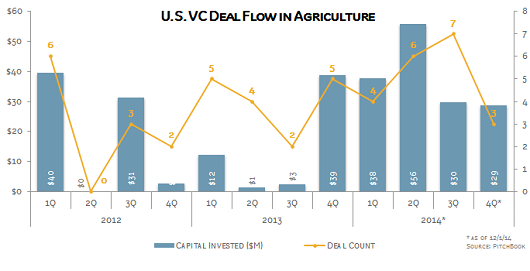

In 2013, U.S. venture capitalists invested $55 million in the "ag tech" sector, and this year, investments have spiked more than 170 percent to about $153 million.

In the sectoral section, the biggest part of venture investments in ag tech for 2014 has accrued to: logistics and security (2%), precision engineering (22%), fertilizers – (19%), phytogenetics (11%), software (11%), complete proteins – (5%), cattle breeding and dairying – (4%), Indoor agrotechnologies – (2%).

Investment operations of European Private Equity & Venture Capital industry in agrarian sector has also started to gather pace. In 2013 the amount of investments in Europe agrisector reached the record mark for the last 7 years, totaling 757,2 mln euro or 2% from the total volume of investments of Private Equity & Venture Capital funds.

European investments of Private Equity & Venture Capital in agrarian sector for 2007-2014

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

|

|

Investments of PE & VC funds in agrisector, thous. euro |

163 802 |

206 686 |

195 113 |

136 641 |

119 165 |

757 220 |

456 707 |

|

% from the total volume |

0,7 |

0,8 |

0,8 |

0,3 |

0,3 |

2,0 |

1,1 |

|

Number of the invested projects / companies |

44 |

40 |

43 |

37 |

42 |

44 |

50 |

*According to the EVCA / PEREP Analytics

A convincing reason for venture investors to focus on the certain niche, is the existence of successful deals of their technological companies` launching, by means of selling it to the strategic investors, IPO, or participation of other venture players in the new round of investment.

One of the most significant deals, which sparked the interest of venture investors in agricultural sphere, was the acquisition of The Climate Corp, climatic data collection and processing company, by the leading global technology solutions supplier in the agrosphere Monsanto, for $1.1 bln. The company represents a security service for farmers, which on basis of special instruments and data analytics estimates risks connected to the weather conditions. It worth noticing that The Climate Corp is a successful withdrawal from the project of Google Ventures and Khosla Ventures funds, which invested $42 mln in WeatherBill startup in 2011.

But Google Ventures hadn`t stopped, and in 2015 in cooperation with two more venture funds DBL Investors и Kleiner Perkins Caufield & Byers invested $15 mln on the B round in the Farmers Business Network startup. This service gives farmers an opportunity to make more reasonable and well-considered decisions against corn growing, using the data about the weather and grounds, which were collected with the help of sensing agriculture device. On basis of the data, the company gives recommendations to farmers of how to use the needed resources: seeds, fertilizers and chemicals. It is important to note the Google Ventures became the lead investor in Farmers Business Network, earlier in 2014 on the A round Kleiner Perkins Caufield & Byers invested $5,6 mln and DBL Investors invested $3,3 mln in the project.

At the end of 2014 one more agro-startup FarmLogs raised $10 mln on the round B, from the venture funds that had already invested a sum, such as Drive Capital, Huron River Ventures, Hyde Park Venture Partners, and new ones - SV Angels и Sam Altman – the president of Y Combinator. This start-up exists since 2012, when it passed the acceleration support in Y Combinator incubator. Nowadays almost 15% of all farmers` households, used for plant cultivation, are subscribed for FarmLogs cloud software. The platform allows farmers to get access by using the smartphones to the information about their farms and monitor the conditions of agricultural lands, and make decisions of which lands need to be ploughed, planted, watered or where they should secure the crop. The service also monitors the hourly weather conditions, prices on the raw materials and provides diagrams on the mechanical services for agricultural machinery. Currently, in the cloud solutions of FarmLogs there is a crop volume worth of $12 bln.

From the recent deals can be distinguished Estonian VitalFields start up, which has attracted $1,2 mln on the round A, from such investors, as как SmartCap, Estonian Development Fund and one of the Sillicon Valley`s venture fund. VitalFields represents revolution solutions for farms managing, by using simple and affordable online-services. The software program includes following functionality: annual budgeting, fields management, accurate weather forecast, prognosis of plant diseases, warehouse management, financial data reporting and resource planning.

One more startup Granular, which provides the software for farms management and auxiliary analytic instruments, in 2014 raised a new round of investments in an amount of $18,7 mln from the following funds: Andreessen Horowitz, Google Ventures, Khosla Ventures, Tao Capital Partners, Emory Investment Management, Fall Line Capital and H. Barton Asset Management.

Top 5 investment transactions in the major segments of AgTech 2014

|

Company / Startup |

Funding Date |

Capital Raised |

Stage |

Investors |

|

Bioenergy |

||||

|

LanzaTech |

12.08.2014 |

$112M |

Series D |

KIWI, QiMing Venture Partners, Siemens Venture Capital, CICC, Malaysian Life Sciences Capital Fund, Khosla Ventures |

|

Cool Planet Energy Systems |

03.31.14 |

$100M |

Series D |

UBS, Goldman Sachs |

|

Fulcrum Bioenergy |

08.11.2014 |

$30M |

Series D |

Cathay Pacific Airways Ltd. |

|

Ceres |

03.10.2014 |

$23M |

Post IPO Equity |

Birchview Capital, Orgacile Investment Management |

|

NexSteppe |

09.23.14 |

$22M |

Series С |

Total Energy Ventures, ELFH Holding, Braemar Energy Ventures, DuPont Ventures |

|

Biomaterials & Biochemicals

|

||||

|

Verdezyne |

03.28.14 |

$48M |

Series С |

BP Alternative Energy, USM Venturing, OVP Venture Partners, Monitor Ventures |

|

Rivertop Renewables |

04.09.2014 |

$26M |

Series В |

First Green Partners |

|

Metabolix |

09.04.2014 |

$25M |

Post IPO Equity |

Undisclosed |

|

Plandai |

02.10.2014 |

$15M |

Equity |

Lincoln Park Capital Fund |

|

Metabalon |

01.06.2014 |

$15M |

Series E |

Camden Partners, Harris & Harris Group, Fletcher Spaght Ventures, The Aurora Funds, Syngenta Ventures |

|

Crop & Soil Technology |

||||

|

BioNano |

11.20.14 |

$68M |

Series С |

Domain Associates, Novartis Venture Fund, Gund Investment Corporation, Legend Capital, Battelle Ventures |

|

Chromatin |

01.09.2014 |

$36M |

Series E |

BP Alternative Energy, GE Capital, Illinois Ventures |

|

Marrone Bio Innovations |

05.16.14 |

$35M |

Post IPO Equity |

Undisclosed |

|

Arcadia Biosciences |

05.08.2014 |

$33M |

Series D |

Saints Capital, CMEA Capital Mandala Capital, BASF Venture Capital |

|

Newleaf Symbiotics |

09.15.14 |

$17M |

Series В |

Open Prairie, Pangaea Ventures, RockPort Capital, Palo Alto Investors |

|

Decision Support Technology |

||||

|

FarmLink |

08.19.14 |

$40M |

Series В |

Thorndale Farm, OPENAIR Equity Partners |

|

Conservis |

09.08.2014 |

$10M |

Series A |

Heartland Farms, Cultivian Sandbox Ventures, Middleland Capital |

|

FarmLogs |

12.17.14 |

$10M |

Series В |

SV Angel, Huron River Ventures, Hyde Park Venture Partners, Drive Capital |

|

aWhere |

09.08.2014 |

$7M |

Series A |

Elixir Capital Management |

|

Farmers Edge |

11.10.2014 |

Undisclosed |

Series В |

Kleiner Perkins Caufield & Byers |

|

Drones & Robotics |

||||

|

Airware |

06.23.14 |

$25M |

Series В |

Undisclosed |

|

XAircraft |

09.01.2014 |

$20M |

Series A |

Chengwei Capital |

|

SkyCatch |

05.23.14 |

$13M |

Series A |

Google Ventures, ft Venture Capital |

|

Kespry |

10.24.14 |

$12M |

Series A |

Lightspeed Venture Partners |

|

Blue River Technology |

03.19.14 |

$10M |

Series A |

Khosla Ventures, Innovation Endeavors, Data Collective |

|

Farm 2 Consumer |

||||

|

Door to Door Organics |

11.10.2014 |

$26M |

Series В |

Greenmont Capital Partners, Arlon Group |

|

Good Eggs |

09.08.2014 |

$21M |

Series В |

Index Ventures |

|

Vital Farms |

09.25.14 |

$2.3M |

Series A |

Undisclosed |

|

Cortilia |

11.05.2014 |

$1.9M |

Series A |

P101 |

|

Hello Nature |

09.29.14 |

$1.4M |

Series A |

Mirae Asset Venture Investment, Softbank Ventures Korea |

|

Food E-Commerce |

||||

|

Instacart |

12.30.14 |

$220M |

Stage С |

Seguoia Capital, Khosla Ventures, Kleiner Perkins Caufield & Byers, Canaan Partners, Andreessen Horowitz |

|

Blue Apron |

04.25.14 |

$50M |

Stage С |

Stripes Group |

|

Instacart |

06.16.14 |

$44M |

Stage В |

Seguoia Capital, Khosla Ventures, Canaan Partners, Andreessen Horowitz, American Express Ventures |

|

Yummy77 |

05.19.14 |

$20M |

Stage A |

Amazon, AmazonFresh |

|

Fruitday |

03.25.14 |

$10M |

Stage С |

SIG China, ClearVue Partners |

|

Food Safety & Traceability |

||||

|

Aseptia |

03.04.2014 |

$28M |

Series С |

Lookout Capital, SJF Capital, Prudential Capital Partners |

|

|

||||

|

Invisible Sentinel |

01.14.14 |

$7M |

Series С |

Unknown |

|

6Sensor Labs |

09.11.2014 |

$4M |

Seed |

Upfront Ventures, Lemnos Labs, Soft Tech VC, Xandex Investments, SK Ventures |

|

|

||||

|

VC, Xandex Investments, SK Ventures |

||||

|

Mekitec |

03.05.2014 |

$2.8M |

Series A |

Inventure Oy, Finnish Industry Investment |

|

Prestodiag |

06.14.14 |

$2.2M |

Series A |

Amorcage Technologigue Investissement, Go Beyond, Kreizig Invest, CapDecisif Management |

|

Indoor Agriculture |

||||

|

SunDrop Farms |

12.04.2014 |

$100M |

Private Equity |

KKR |

|

AeroFarms |

11.10.2014 |

$36M |

Series A |

Undisclosed |

|

GrowLife |

06.21.14 |

$12M |

Post IPO Equity |

Undisclosed |

|

Gotham Greens |

11.24.14 |

$8M |

Series В |

Undisclosed |

|

BrightFarms |

01.29.14 |

$4.9M |

Series В |

NGEN Partners, Emil Capital Partners |

|

Sustainable proteins |

||||

|

Hampton Creek |

12.18.14 |

$90M |

Series С |

Tao Capital Partners, Collaborative Fund, Horizons Ventures, Founders Fund, Far East Organization, |

|

WP Global Partners, Khosla Ventures, Uni-President Enterprises Corporation,Velos Partners |

||||

|

Impossible Foods |

10.14.14 |

$75M |

Series A |

Horizons Ventures, Khosla Ventures, Google Ventures, Bill Gates |

|

Hampton Creek |

02.17.14 |

$23M |

Series В |

Horizons Ventures, Khosla Ventures, Collaborative Fund, AME Cloud Ventures, Eagle Cliff Partners |

|

Modern Meadow |

06.26.14 |

$10M |

Series A |

Horizons Ventures, ARTIS Ventures |

|

Beyond Meat |

07.29.14 |

Undisclosed |

Series D |

Kleiner Perkins Caufield & Byers, Obvious Ventures, Morgan Creek Capital, ClosedLoop Capital, DNS Capital,S2G Ventures |

|

Waste Mitigation |

||||

|

VitAg |

07.14.14 |

$110M |

Private Equity |

Shrieve Chemical, Tennenbaum Capital Partners, TPG Alternative and Renewable Technologies, Citigroup Global Markets |

|

Harvest Power |

10.27.14 |

$20M |

Series D |

Generation Investment Management, True North Venture Partners, Industry Ventures |

|

Enterra Feed |

03.27.14 |

$10M |

Series A |

Avrio Capital, Wheatsheaf Investments |

|

Ynsect |

12.17.14 |

$6.8M |

Series В |

Demeter Partners, EMERTEC |

|

WISErg |

06.24.14 |

$5M |

Series В |

Angel Investors LP |

3. Which opportunities has Ukraine for participation in venture race after agritechnologies?

The sufficient contribution of two national industries – IT and agrisector in the formation of export potential of the country, forces to pay attention to the relevance of necessity to implement IT technologies in agrarian corporations and farms with the purpose of Ukrainian AIC`s increase of effectiveness.

Ukrainian agrarians and IT-companies have a unique chance to create a brand of Ukraine, as a supplier of not only high quality agriproduct with a high efficiency of production, but also of groundbreaking IT-solutions and products for the global agrarian sector.

In spite of a great number of contributing factors of Ukrainian startups development in AgTech sphere, there are also a lot of serious hindrances.

Firstly, in Ukraine, due to the low level of entrepreneurship development, there is a small number of highly qualified entrepreneurs in agriculture sphere, who are ready to develop new technological products.

Secondly, because of the poor development of infrastructure of Ukrainian venture market, and particularly limited number of venture funds, incubators, and professional business angels, there is no need to expect the financial and mentor support from venture players.

Thirdly, for entrepreneurs to have the interest for agritechnologies development and for venture players to risk their investments, there should be prerequisites for withdrawing from the project. A good deal hangs on the maturing of Ukrainian agroholdings, in a part of readiness for merges and acquisitions of technological companies; currently, unfortunately, the priority of majority of Ukrainian latifundists is extension of the land bank.

The main task in the development of Ukrainian AgTech includes the necessity of cooperation of programmers, representatives of IT industry and agrosector with attraction of the talented youth, which has an entrepreneurial spirit.

The first step in this direction can be the carrying of Agro IT-Booster hackathon – the three-day hackathon for production of technological solutions in the agrarian sphere. The event will take place in Ternopol, September 18-20th. This is a unique event for IT-specialists and agribusiness representatives. The participants of the marathon will create new IT-products and solve the urgent problems in different fields of agricultural industry - plant cultivation, cattle breeding, raw materials and waste processing.

Developers will be able to try their hands in underexplored, but very essential niche for Ukraine – IT-solutions for agrarian business. Mobile apps, Big Data, behavioural researches, even gamification – all you could have ever imagined in the framework of your mechanical skills. Agro IT-Booster hackathon – it is a chance not only to create a valuable product, but also to instantly find a clients or investors for it, in the face of agrosector representatives. Apart from that, the winner-team will get 20 000 UAH for the implementation of their idea and product development.

Representatives of Ukrainian agribusiness will obtain the real instruments for solvation of daily problems, connected with data storage and retrieval, logistics, information analysis and processing. Business will be able to become a generator of innovational change in agrarian industry, with the help of effective and inexpensive point solutions instead of massive complex program product.

Organizers of hackathon: InVenture Investment Group, startup incubator “Continium”, Digital Future venture fund, InVenture Investment Group and eMagicOne are planning to gather 200 IT-specialists from all over Ukraine, who are ready to share their experience and learn from others, on the Agro IT-Booster hackathon.