"When written in Chinese, the word crisis is composed of two characters – one represents danger, and the other represents opportunity." So said former US President John F. Kennedy, and the year 2022 encapsulated both sides of the crisis equation – not least in the energy sector.

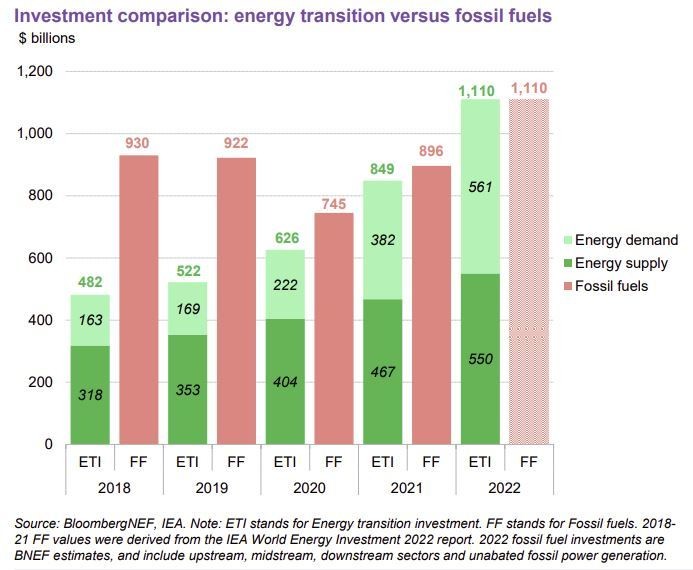

Russia’s war on Ukraine caused a spike in energy prices and talk of potential winter blackouts. But it also triggered a long overdue shift away from gas and other fossil fuels towards cleaner forms of energy – so much so that global investment in low-carbon energy technology surged to a record level of $1.1 trillion in 2022, according to a new report from research firm BloombergNEF (BNEF).

This is up 31% from 2021, and means that investment in low-carbon technologies is now level with that devoted to the supply of fossil fuels.

Investment in low-carbon energy technologies is now level with spending on fossil fuel supply

“Our findings put to bed any debate about how the energy crisis will impact clean energy deployment,” says BloombergNEF’s Head of Global Analysis, Albert Cheung. “Rather than slowing down, energy transition investment has surged to a new record as countries and businesses continue to execute on transition plans. Investment in clean energy technologies is on the brink of overtaking fossil fuel investments, and won’t look back.”

Renewables records tumble

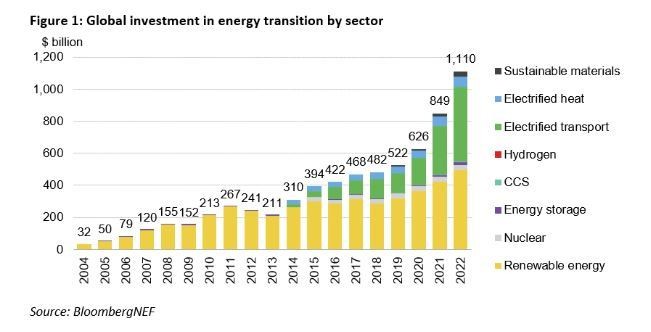

The low-carbon investment measured in the report includes renewables, carbon capture and storage, zero-emission vehicles, charging infrastructure, hydrogen production, energy storage, nuclear, recycling and heat pumps.

Spending broke records in every area except nuclear power, where investment was essentially unchanged compared with a year earlier.

Low-carbon spending has broken records in every area except nuclear

The biggest share of investment went towards renewable energy – wind, solar, biofuels and others – with a 17% rise on the year to $495 billion.

But it was almost beaten by electrified transport – electric vehicles and related infrastructure – where spending surged by 54% to $466 billion.

Solar and wind power overtook gas as Europe’s main source of electricity generation for the first time in 2022, according to think tank Ember’s latest European Electricity Review. The increase in renewables investment over the past 12 months means the gap is likely to widen.

“Growing policy support and the increasing competitiveness of clean energy technologies continue to underpin a rapid acceleration in the energy transition,” the report says. “While supply chain disruption and inflation have posed challenges, they do not appear to have put a meaningful dent in the speed of the transition.”

Hydrogen investment

However, one area that could need more policy support is hydrogen. Production of clean hydrogen is not growing fast enough to meet the International Energy Agency’s Net Zero Emissions by 2050 Scenario, the World Economic Forum’s Noam Boussidan points out. And it is the low-carbon sector that received the lowest investment in 2022, at just $1.1 billion, representing just 0.1% of the total.

That said, hydrogen did have the fastest growth in spending, which more than tripled compared with 2021.

More government support is on the way, with India recently launching a $2.1 billion plan to promote production of green hydrogen (hydrogen made by splitting water into hydrogen and oxygen using renewable electricity).

The US Inflation Reduction Act includes tax credits and other incentives to encourage development of the country’s clean hydrogen industry, and the EU has approved $5.2 billion of funding for hydrogen projects.

Which countries are low-carbon leaders?

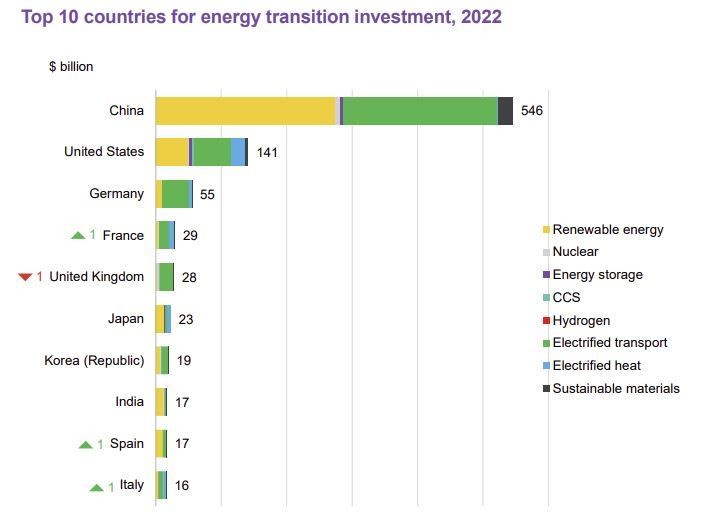

There was a clear leader in low-carbon spending in 2022, and that was China. It accounted for almost half of global investment, pumping $546 billion into energy transition technologies, the BNEF report shows.

China surged ahead of other countries on low-carbon spending in 2022

This was almost four times higher than the second-placed US with $141 billion, although if the EU was considered as a single bloc, it would have come second with investment of $180 billion. EU spending was led by Germany – in third place at $55 billion – mainly thanks to growth in the country’s electric vehicle market.

The only country in the top 10 where spending fell was the UK, with a 20% drop to $28 billion because of a fall in offshore wind deals. However, the UK is still the world leader in offshore wind power capacity, and boasts the world’s largest wind farm, after Hornsea 2 started up in August.

Not enough for net zero

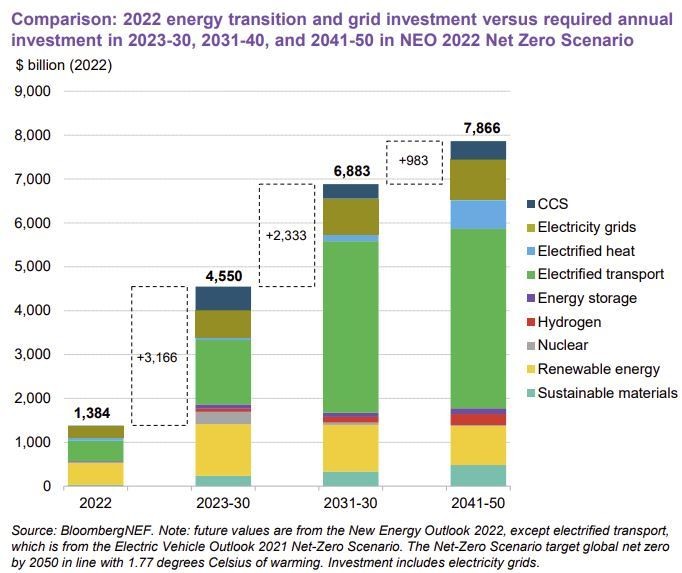

Despite spending breaking records in 2022, it is still not enough to put the world on track to reach net zero carbon dioxide emissions by 2050, BloombergNEF says. Annual investment needs to more than triple, and to average $4.55 trillion between 2023 and 2030 in order to make net zero possible.

Annual low-carbon spending is still not enough to reach net zero emissions by 2050

The biggest opportunities are in electrified transport, renewable energy and power grids, and there will need to be more cooperation between the public and private sectors to get capital flowing into these areas in the short term, the report says.

The World Economic Forum’s Global Future Council on the Future of Energy Transition is helping promote this collaboration, by bringing together leaders from government, business and civil society. Only through collective action can the world turn today’s crisis into more of an opportunity than a danger.