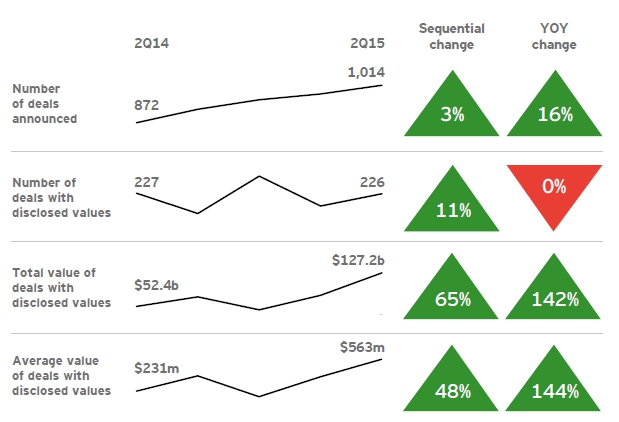

2Q15 aggregate value of disclosed-value deals hit US$127.2b, higher than any quarter since 2000 and up 65% over 1Q15

Quarterly deal volume inched above 1Q15 to set a sixth consecutive post-dotcom-bubble record of 1,014 deals

According to EY’s Global technology M&A update: April-June 2015, technology disruption continues to accelerate as corporate technology buyers seeking broader solutions pushed 2Q15 deals to a record US$127.2b, which is higher than any quarter since 2000 and up 65% over 1Q15. In addition, the report finds that technology-enabled digital transformations disrupting multiple industries are in their infancy with more big-ticket transformative transactions anticipated.

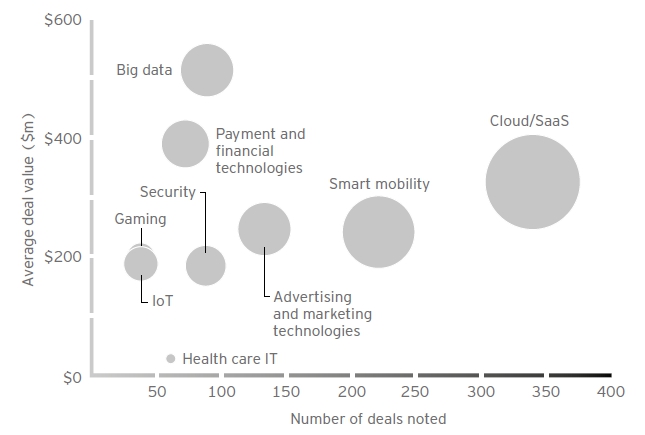

A directional view of select 2Q15 deal-driving trends

The report finds that all categories of buyers — corporate tech, non-tech and private equity (PE) — contributed to record growth in 2Q15. However, megadeals by corporate technology buyers fueled the biggest increase, as semiconductor and communications equipment companies positioned themselves for a foreseeable future of explosive growth in Internet of Things (IoT) devices, continued smart mobility expansion and the need for super-performing cloud data centers.

Average value per disclosed-value deal did soar to an all-time record, including the dotcom bubble. PE buyers posted the third-highest aggregate value in the eight years EY has produced these reports. Notably, big data analytics topped the chart in average value per deal in 2Q15 on the strength of the largest technology take-private deal so far this year.

Global technology transaction scorecard (corporate and PE), 2Q15

Jeff Liu, Global Technology Industry Leader, Transaction Advisory Services at EY, says: “We’ll see more megadeals in response to disruptive technology and cross-industry ‘blur.’ Such deals position tech buyers with end-to-end solutions to address the explosive growth in IoT devices, continued smart mobility expansion and the growing need for high-performance cloud data centers to manage the computing load required by this rapidly arriving future.”

Report highlights:

- 2Q15 aggregate value of disclosed-value deals hit US$127.2b, up 65% sequentially (over 1Q15’s post-dotcom bubble record) and 142% year-over-year (YOY).

- 15 deals topped US$1b, including three above US$10b.

- Average value per deal, which even during the dotcom bubble never quite reached US$400m, soared to a new all-time high of US$563m.

- Quarterly deal volume inched above 1Q15 to set a sixth consecutive post-dotcom-bubble record of 1,104 deals.

- Strategic technology deal drivers remained strong (especially security), but “consolidation” was the 2Q15 watchword.

- Cross-border aggregate deal value set a new quarterly record of US$43.6b, up 257% YOY and 35% sequentially.

Looking ahead: robust dealmaking expected

In 1Q15, non-tech buyers drove the growth. This time, all buyer types posted big numbers. The tech industry is transforming, fueled by cross-industry blur, IoT and digital transformations and enabled by universal cloud adoption and a growing need to add cybersecurity to a wide range of products and services. It’s clear 2015 will be another blockbuster year for tech M&A.