In the years since the global financial crisis of 2009, late-stage venture capital has undergone a raft of dynamic structural changes due to investment shifts and legislative measures. Crossover investors, active in multiple segments of the private markets and nontraditional vehicles such as PE firms, hedge funds, and sovereign wealth funds, have significantly increased their participation in late-stage VC.

“The average venture growth deal size nearly reached the size of a mega-deal ($100 million+),” said Kyle Stanford, Lead Venture Capital Research Analyst at PitchBook and author of the Q4 2022 PitchBook Analyst Note: Introducing Venture Growth. “Even considering median deal value, the venture growth figure in 2021 was nearly three times the late-stage figure, a significant jump that highlights the market’s dependency on non-VC capital.”

According to the report, late-stage VC deals garnered $237.2 billion in the US and $70 billion in Europe last year—110% and 130% higher, respectively, compared to 2020, accounting for two-thirds of capital invested in each region.

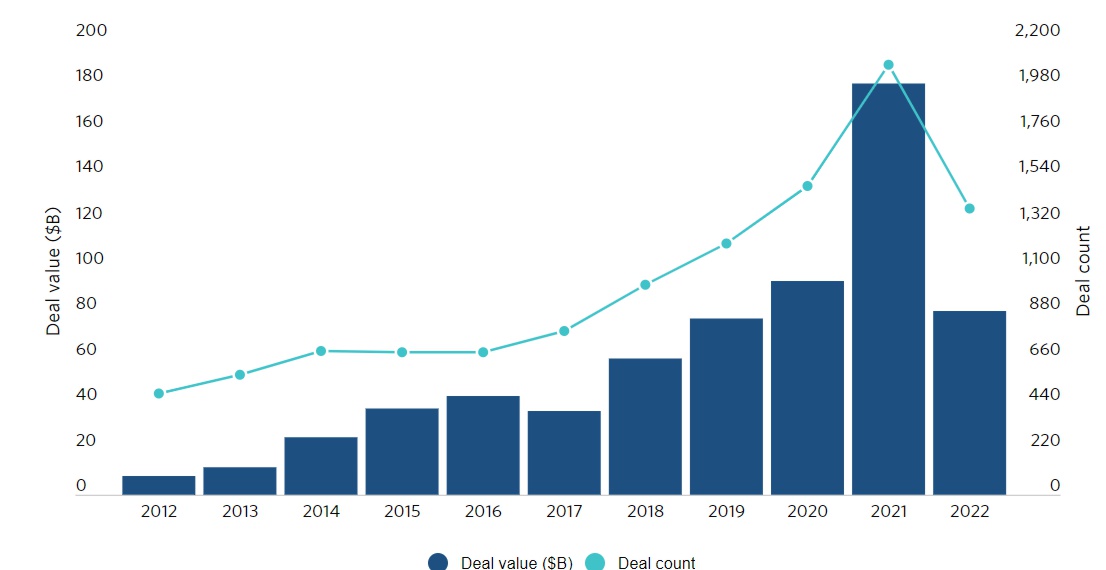

Global venture growth deal activity

Top 10 VC growth deals by size

Below, we take a look at the top ten venture growth stage deals by size.

1. Didi Global

Deal size: $10.8B

Deal date: August 1, 2019

Headquartered in Beijing, Didi Global develops a mobile ride-hailing application designed to match customers with local drivers in China. In 2019, the company raised $10.8 billion of venture funding from Toyota Motor, Booking Holdings, Syren Capital Advisors, Fisher Capital Investments, and other investors.

2. Didi Global

Deal size: $7.3B

Deal date: June 15, 2016

Post-valuation: $28B

Three years prior, in 2016, Didi Global raised $7.3 billion of venture funding through a combination of debt and equity, putting its pre-money valuation at $23.5 billion with participation from Apple, Alibaba Group, and 17 other participants.

3. Uber

Deal size: $5.6B

Deal date: May 24, 2016

Post-valuation: $66.6B

Founded in 2009, Uber operates an online platform that offers peer-to-peer ridesharing and food delivery services. The company raised $5.6 billion of Series G venture funding from multiple investors in 2016 at a $61 billion pre-money valuation. The first $2 billion was financed by Tiger Global Management, T. Rowe Price, Caspian VC Partners, L1 Technology, Morgan Stanley, SoftBank Investment Advisers, and Bank of America.

4. VillageMD

Deal size: $5.2B

Deal date: April 1, 2022

Post-valuation: $15.7B

VillageMD is a provider of healthcare management services intended for primary care physicians to maximize success in a changing healthcare environment. The companys platform gives tools, technology, operations, and staffing support needed to drive the highest quality clinical results across a population. VillageMD raised $5.2 billion of venture funding from Walgreens Boots Alliance this year, putting the companys pre-money valuation at $10.6 billion.

5. ByteDance

Deal size: $5B

Deal date: February 28, 2021

Post-valuation: $355B

ByteDance is a developer of mobile applications designed for online entertainment and social networking. The company focuses on applying artificial intelligence technology to mobile internet applications, enabling users to produce and share relevant content with their followers and online audience.

Last year, the company raised $5 billion of venture funding from 2B Global Capital, Coatue Management and 10 other participants putting the companys pre-money valuation at $355 billion.

6. WeWork

Deal size: $5B

Deal date: January 8, 2019

Post-valuation: $47B

WeWork is a provider of shared office workspace community spaces designed to facilitate collaboration and engagement between entrepreneurs and startups.

The company raised $5 billion of financing from SoftBank on January 8, 2019, putting its post-money valuations at $47 billion. Other undisclosed investors also participated in the round. The financing includes a $1 billion convertible debt portion and a $3 billion warrant agreement.

7. Grab

Deal size: $4.8B

Deal date: October 9, 2019

Post-valuation: $14.9B

Founded in 2012, Grab provides ride-sharing services, food and grocery delivery, and financial services (payments, consumer loans, and enterprise offerings) through its mobile platform. The company partners with merchants and riders, in eight Southeast-Asian countries, connecting them with consumers while charging commissions to both sides. Grab raised $4.8 billion of Series H venture funding in a deal led by Toyota Motor in 2019, putting the companys pre-money valuation at $10.1 billion.

8. Ele.me

Deal size: $4B

Deal date: November 7, 2018

Post-valuation: $30B

Ele.mes platform simplifies meal ordering and delivery in China. Its website and mobile application enable users to search for nearby restaurants and have food delivered to their homes. The company raised $4 billion of venture funding from Alibaba Group, Ant Group and Primavera Capital Group in 2018, putting the companys valuation at $30 billion.

9. Flipkart

Deal size: $4B

Deal dates: August 10, 2017

Post-valuation: $30B

Flipkart is an e-commerce shopping portal operator intended to offer a wide range of consumer products. The companys portal provides products across a range of categories, enabling customers to buy products of their choice. In 2017, the company raised an estimated $4 billion of Acquisition Financing venture funding in a deal led by Tencent Holdings, putting the companys pre-money valuation at $9.3 billion.

10. Flipkart

Deal size: $3.6B

Deal date: July 12, 2021

Post-valuation: $37.6B

In a 2021 venture funding deal led by Walmart, SoftBank Investment Advisers, Government of Singapore Investment Corporation (GIC) and Canada Pension Plan Investment, Flipkart raised $3.6B in venture funding, putting the companys pre-money valuation at $34 billion.