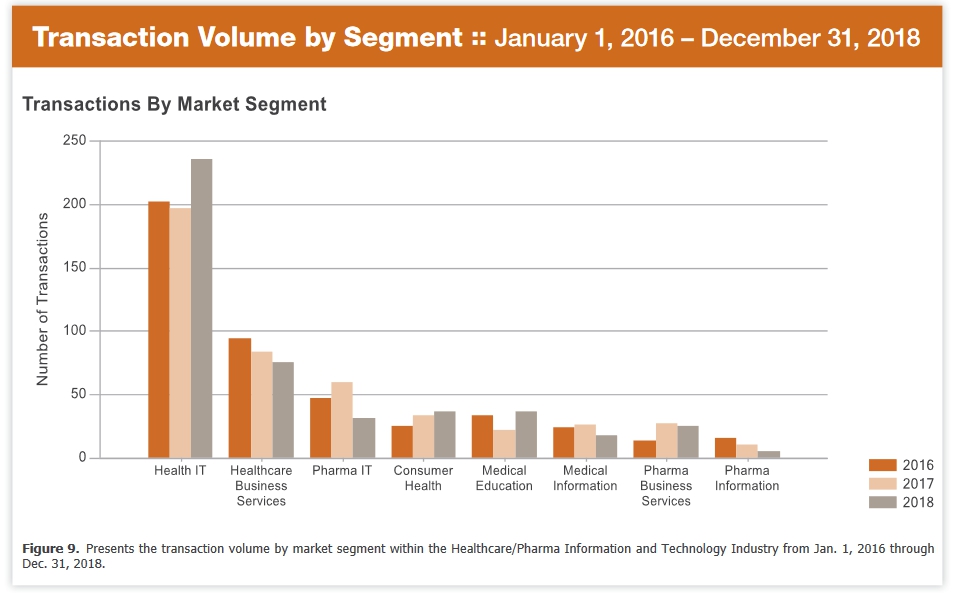

The Healthcare IT segment accounted for about one-half of the healthcare and pharmaceutical IT industry’s aggregate volume of mergers and acquisitions (M&As) last year, according to a new report by Berkery Noyes Investment Bankers.

Strategic acquirers, i.e., those in the same industry, accounted for 75 percent of Healthcare IT volume.

The healthcare IT segment saw a 19 percent year-over-year gain in M&A volume, reaching 237 transactions in 2018.

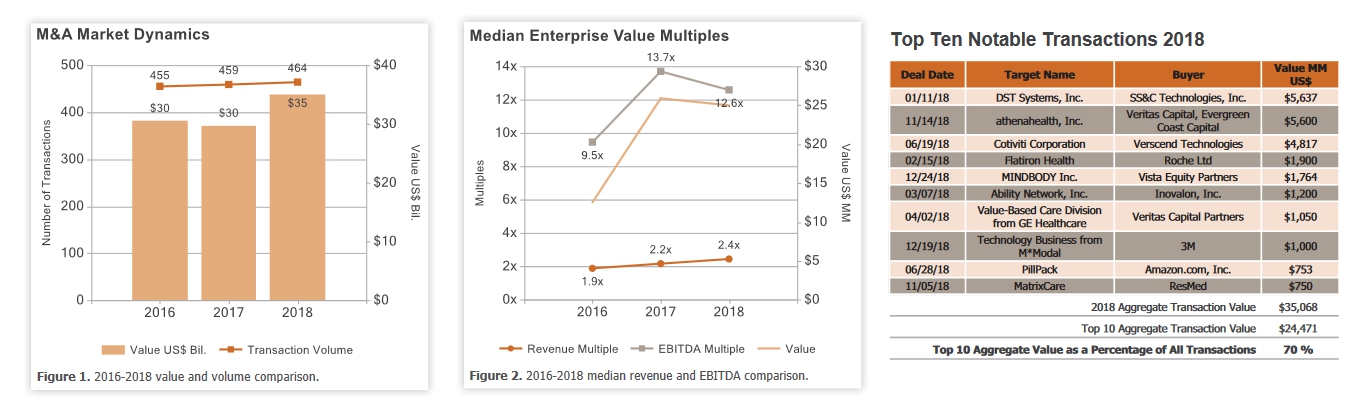

In 2018, M&A transaction volume for the healthcare and pharmaceutical IT industry in 2018 jumped slightly to 464 deals, compared with 459 deals in 2017 and 455 deals in 2016.

M&A transaction value in 2018 increased by 18 percent, reaching $35.07 billion, up from $29.68 in 2017.

Last year, Veritas Capital and Evergreen Coast Capital’s $5.7 billion acquisition of athenahealth, a provider of network-enabled services for hospital and ambulatory customers, was the largest private equity backed deal.

Veritas and Evergreen said they plan to combine athenahealth with Virence Health, which includes the GE Healthcare Value-Based Care assets Veritas acquired for $1 billion earlier in the year.

Other major healthcare and pharma IT M&A transactions last year include SS&C Technologies’ purchase of DST Systems for $5.6 billion, Verscend Technologies’ acquisition of Cotiviti Corp. for $4.8 billion, Roche’s purchase of Flatiron Health for $1.9 billion, Vista Equity Partners’ purchase of MINDBODY for $1.8 billion, Inovalon’s acquisition of Ability Network for $1.2 billion, 3M’s purchase of M*Modal’s technology business for $1 billion.

While healthcare IT was the largest segment in terms of M&A volume, the medical education segment was the faster growing, with a 68 percent year-over-year jump in M&A transaction in 2018.

The report found that there were 132 financial M&A transactions with an aggregate value of $17.18 billion, representing 28 percent of the total volume and 49 percent of the total value, respectively. Financial transactions are those financed by private equity, venture capital, and other investment firms.

To compile the report, Berkery Noyes tracked 1,378 healthcare and pharmaceutical IT M&A transactions between 2016 and 2018, of which 297 disclosed financial terms, and calculated the aggregate value to be $85.31 billion. It estimated the value of the remaining 1,081 undisclosed transaction to be $9.56 billion based on known transaction values, for a total value of $94.87 billion over the three-year period.

Healthcare IT firms are not the only healthcare firms diving into M&A waters. Healthcare providers are also making waves in the M&A seas.

Providers are being pushed toward M&A transactions by value-based reimbursement, shrinking hospital margins, and record-high healthcare spending.

For 2019, major hospitals and health systems are making plans to form new partnerships in the face of financial challenges, while others are still working through the issues involving deals from last year.

According to the latest figures from PwC, the health services industry saw 1,182 M&A deals in 2018, a 14.4 percent increase over 2017. At the same time, M&A deal value for the industry dropped 31.4 percent year-over-year in 2018 to $121.5 billion. This was still 1.4 and 1.7 times higher than 2015 and 2016, respectively.

Factors that are driving M&A deal activity in the health services sector include regulation, policy, and tax reform; inpatient volume pressure and high costs; cross-industry deals and vertical integration; evolving technologies and disruptive models; and pursuit of capabilities that facilitate consumer/patient targeting.

“Although 2019 has started with some economic and regulatory uncertainty, a number of signs suggest that interest in deals will continue this year,” said PwC US Health Services Deals Leader Thad Kresho.

“Corporate and private equity buyers both have access to significant levels of capital, and with double-digit volume growth is some subsectors, it’s clear that deals are seen as an important strategy in an increasingly cost- and consumer-conscious ecosystem,” Kresho observed.