Demand for offices

Kyiv office market remained constrained in 2022 for obvious reasons of military aggression in the country, resulting in a decline of economic indicators and dramatic slowing down of commercial activity. Nevertheless, the Ukrainian real estate market defied the worst collapse expectations and has gradually adjusted to new realities.

In H2 2022, leasing activity remained subdued and driven mostly by renewals, renegotiations, and the contraction of existing office space. As of December 2022, full-year leasing activity reached 40,000 sqm, which isonly 22% of that in 2021 (ca.185,000 sqm). The most notable transaction was the relocation of an international public organization (ca.3,000 sqm) to Eurasia BC in Q3 2022. During the third quarter, the office market saw some positive signs of recovery in business activity. However, after continuous attacks on the countrys power system starting in October 2022, the market returned to the wait-and-see position.

-

Leasing Activity - 40,000 sqm (-78% y-o-y)

-

New Office Supply - 97,000 sqm (-37% y-o-y)

-

Total Office Stock - 2,21 mio sqm (+5% y-o-y)

-

Average Office Vacancy - 26% (+11.9 pp y-o-y)

-

Prime Office Rent - $21 sqm/month (-16% YTD)

During the year, tenants were reacting to the war with two main approaches. Large international companies primarily kept their office footprint, adopting the the wait-and-see approach, and paid full or partial rent. Smaller international and local companies, where possible, shrank office space or moved to smaller and more budget-friendly locations, mostly on short-term leases. However, with only 34% share of the total leasing activity, migration into new buildings was quite limited, relocation costs standing in the way of such decisions (particularly where premises are offered in shell&corecondition).

Office real estate for sale in Ukraine

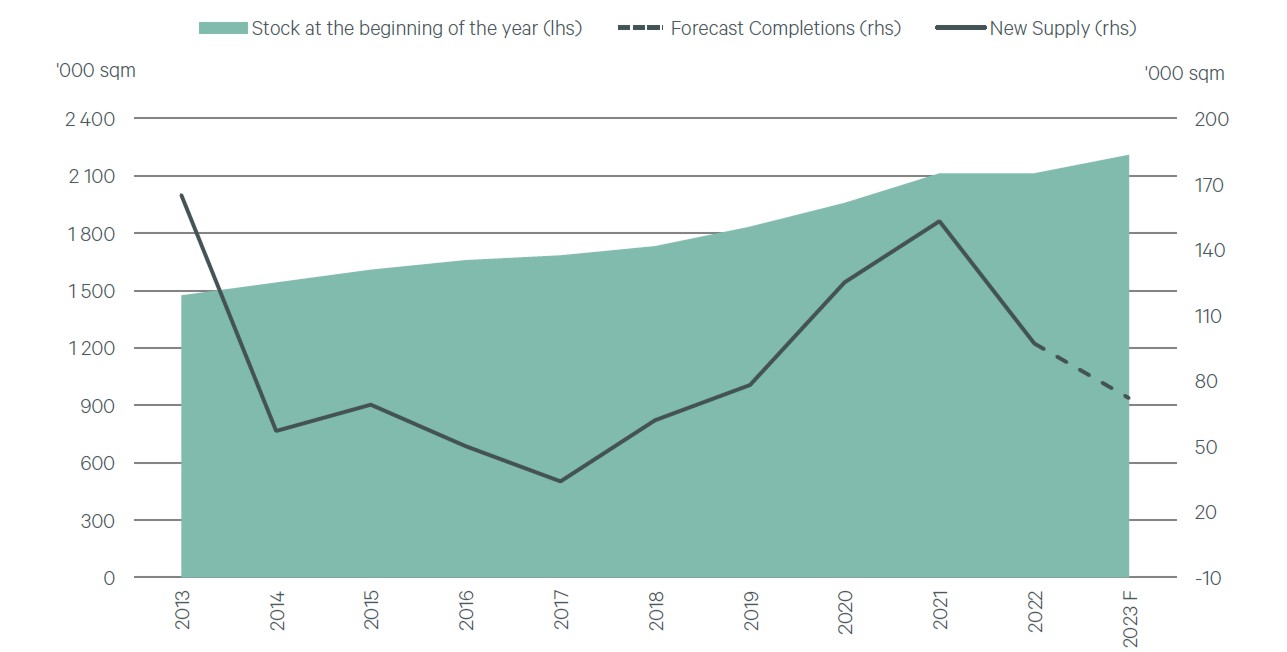

Office Stock Development, Supply, and Vacancy, as of Q4 2022

By-the-industry distribution of leasing activity indicates that the IT sector, which was actively gaining momentum over the past years, noticeably reduced the demand for office space in 2022, alongside all other sectors. The share of IT companies in the leasing activity structure was only 22%, with renewal transactions predominant. Notably, exports of IT products and services, a major foreign currency earner, have held steady, in many cases seeing an increase over 2021. According to the latest IT Ukraine Association report, 9 out of 10 Ukrainian IT companies currently operate at 80% (or more) of pre-war capacity. Full-featured remote work allows many IT tenants to keep office space as "reserve stock" rather than seek relocation. Employee out-migration inside the country and abroad reduced the current need for office space in this sector in particular and in the market overall. Furthermore, many Ukrainian companies have found ways to partially relocate and/or expand their business in other countries.

Thus, whilst occupiers with large office units didn`t use their current space at full capacity and/or looked for ways to optimize rent expenses, subleasing or renegotiating for existing space were preferred to relocations to a smaller office. However, the share of completed sublease deals remained low due to overall limited leasing activity in the market.

Supply for offices

Annual new supply measured about half of what was initially scheduled at the end of 2021 (ca. 215,000 sqm). The main reason for the decline in new deliveries can be entirely attributed to the war. In 2022 new completions peaked in the fourth quarter when ca. 97,000 sqm entered the market, bringing the total office stock to ca. 2.21 miosqm (+5% y-o-y). Within that volume, the share of A-grade space grew to 37%, as almost the full amount of the year’s new stock came in top-quality buildings (Gradient BC, Unit.CityB6 and Unit.CityB15). Notably, approximately 57% of the new supply is concentrated in one A-class building – Gradient BC at 4 Korolenkivska St.

Rental activity by industry, 2022

- Pharmaceuticals and medicine - 38%

- IT and telecommunications - 22%

- Public sector - 17%

- FMCG - 8%

- Others - 6%

- Wholesale and retail trade - 5%

- Logistics operators - 3%

The full-scale war has left the market with an abundance of semi-finished properties where construction was put on hold. New deliveries will markedly decrease, with the announced pipeline for 2023 currently amounting to ca.71,000 sqm. Moreover, some office projects initially planned for delivery in 2023 have been entirely suspended until at least 2024. With no new development starts recorded in 2022 and none likely to be recorded in 2023, office stock in the next 2-3 years will grow only if halted developments become re-launched.

Annual and New Supply in Kyiv, as of Q4 2022

Vacancy and Rents

As of December 2022, the average market vacancy grew to 26% (+11.9 pp y-o-y). Space reductions and entry of significant new supply in the fourth quarter combined to produce such an increase in vacancy. It should be noted that almost 71,000 sqm (RetrovilleBC, LUWR BC, 101 Tower BC) of competitive stock are not included in the vacancy calculation, as these properties were damaged by missile attacks and thus are not offered to the market.

Analyzing vacancy by classes, vacancy rate in Class A grew by 13.5% YTD to 22.3% and in Class B by 11.6% YTD to 29.2%. A-quality buildings were more resilient and enjoyed lower vacancy than those of quality B, which is also true for new buildings. Average vacancy in CBD submarkets stood at 23.2%, in CBD-fringe at 28.3%, and the highest level was observed in non-central areas at 31.2% on average.

To protect occupancy and income streams, landlords elected to provide considerable rent reductions to existing and special rental terms to new tenants.Prime rent declined by 16% on average from $25 to $21 per sqm/month YTD. Asking rents for A Class varied from $18 to $26 (-18% at the lower bound and -7% at the upper bound YTD), B Class asking rents were quoted in the $7 -$17 (-22% at the lower bound and -15% at the upper bound YTD) range. However, the asking rents are not indicative in this case, as actual or effective rents were 20%-50% below the headline numbers. As a result, there a significant gap was formed between the asking and actual transaction levels.

Investment

In view of the economic shock and country risks skyrocketing due to military aggression, investment sentiment has nearly disappeared to a near complete unwillingness to commit capital to the market. The positive news is, however, that despite a number of aggressive buyers offering ca. 50% discount to pre-war prices, no seller was willing to liquidate at that price point. As a result, only 10transactions took place overall in the country, with the investment volume totaling a meagre ca. $31mioin 2022. With the exception of one industrial transaction, all investment went towards the office market. Except Kyiv, one end-user transaction was completed in the Zakarpattia Region, as an office building (2,100 sqm) was purchased by an international automotive company, which became the only transaction with foreign capital.

Investment volume into Kyiv’s commercial real estate declined by 77% y-o-y, remaining at the level of the pandemic 2020.

Outlook

Given the uncertainty over duration and intensity of war, the market situation remains with a rather uniform strategy from most players -continue to work under challenging conditions with a wait-and-see approach regarding long-term decisions. Despite the constant risk of shelling, destruction of some properties, and the outflow of workers, most Ukrainian firms continue operations by constantly adapting to the challenges at hand. Whereas some companies have adjusted to temporary power outages and others have been busy securing back-up power generation, all businesses and have implanted effective mechanisms of working remotely, especially those from service industries.

Looking ahead, occupiers will remain cautious until there is more predictability in terms of safety and macroeconomic environment. Demand for office space is expected to remain suppressed during the wartime and new development virtually non-existent. Rare investment transactions can be expected but primarily in the owner-occupier segment or in cases of seller distress.

Minor increase in average market vacancy will follow in case the currently announced completion pipeline of ca. 72,000 sqm materialized over 2023. Office rents are likely to remain relatively unchanged across the board over the course of the next 6 months. We expect to see the continuation of creative flexibility on the part of landlords to keep the buildings occupied.

Office real estate in Kyiv. Kyiv office real estate market. Analytics offices Kyiv. Office real estate 2022 and office real estate 2023. Office lease and office lease Kyiv, office lease rates. Office rent Kyiv, which office to rent. Buy an office in Kyiv. Rent an office inexpensively in Kyiv. Offices for rent in Kyiv.