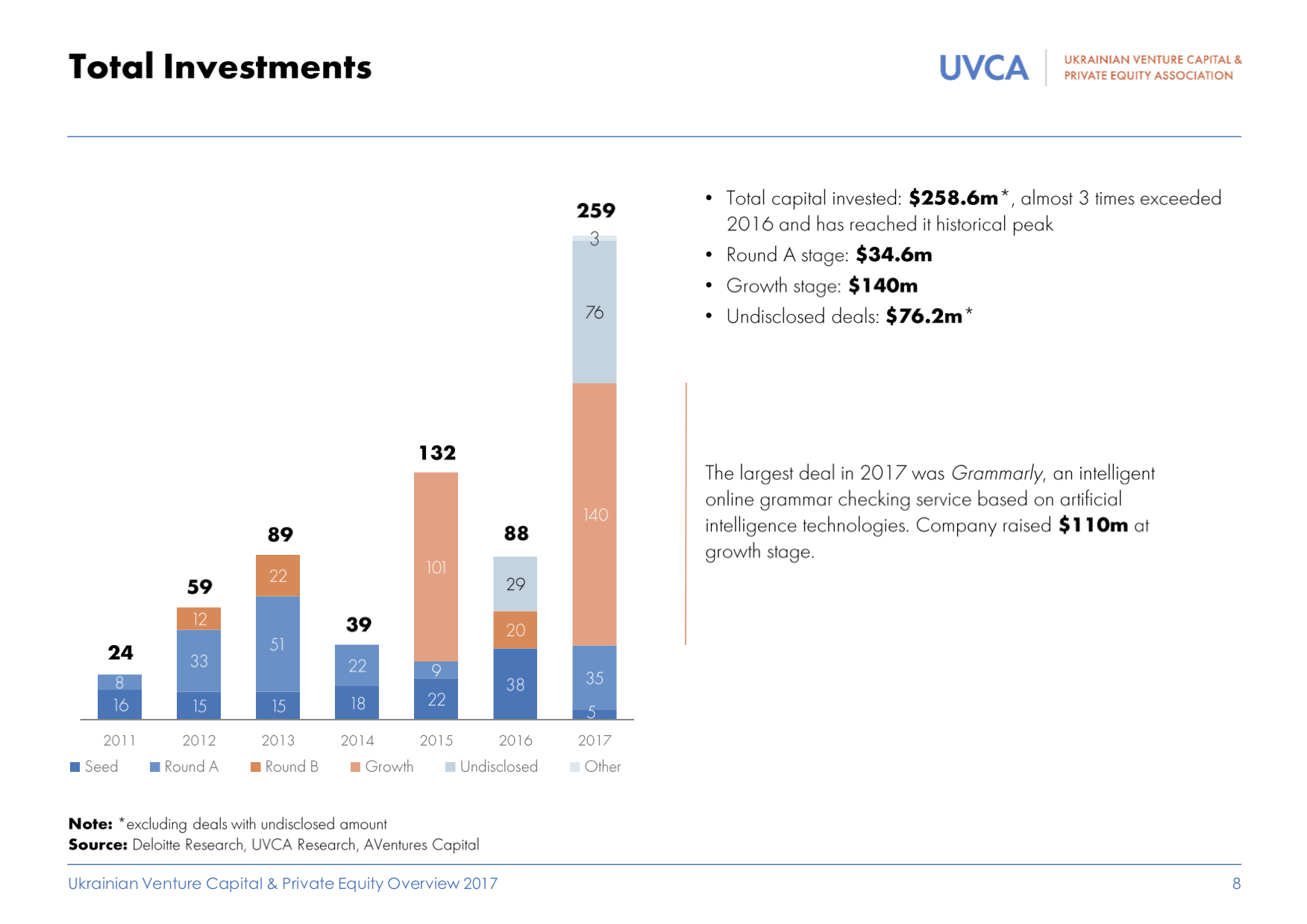

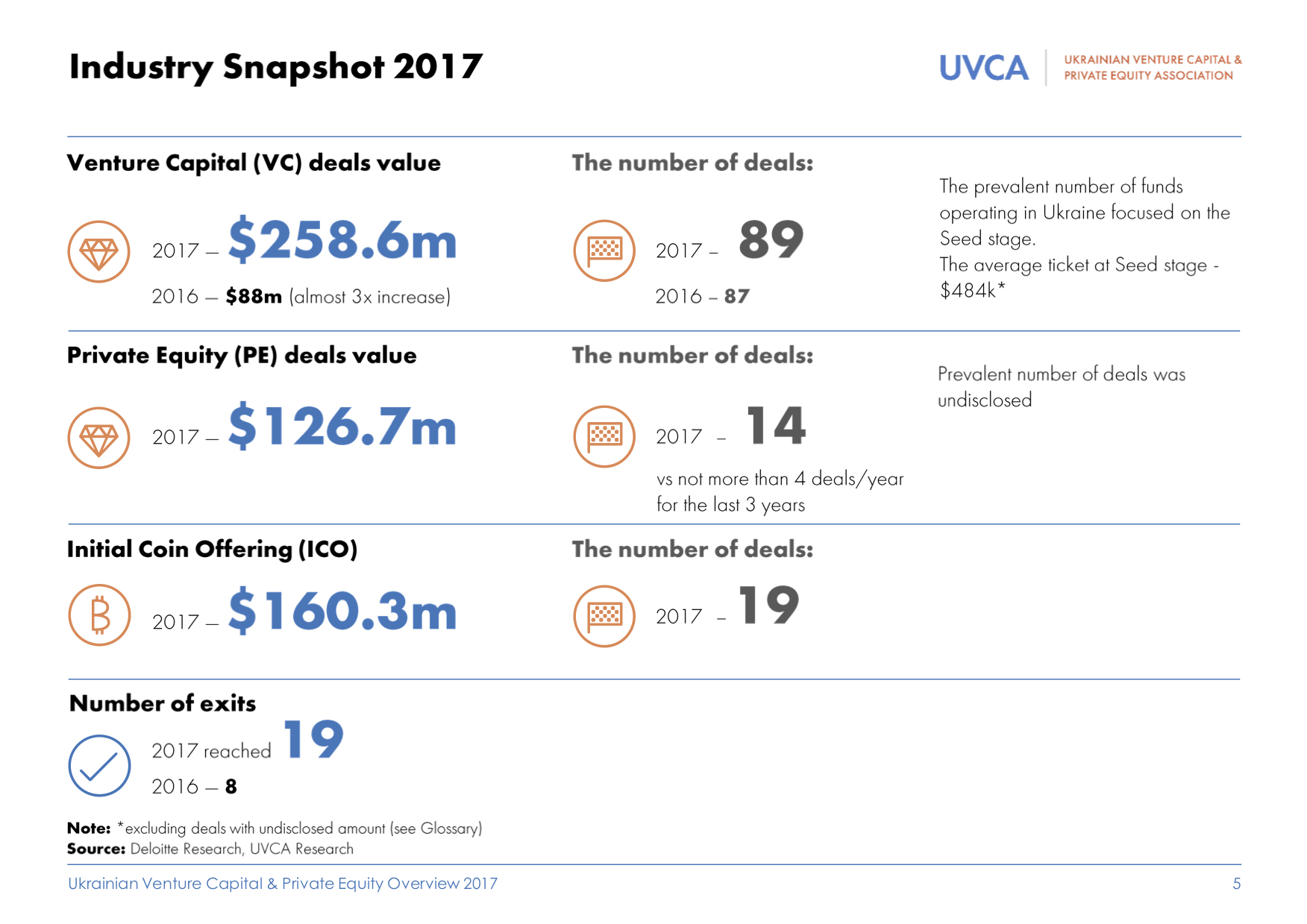

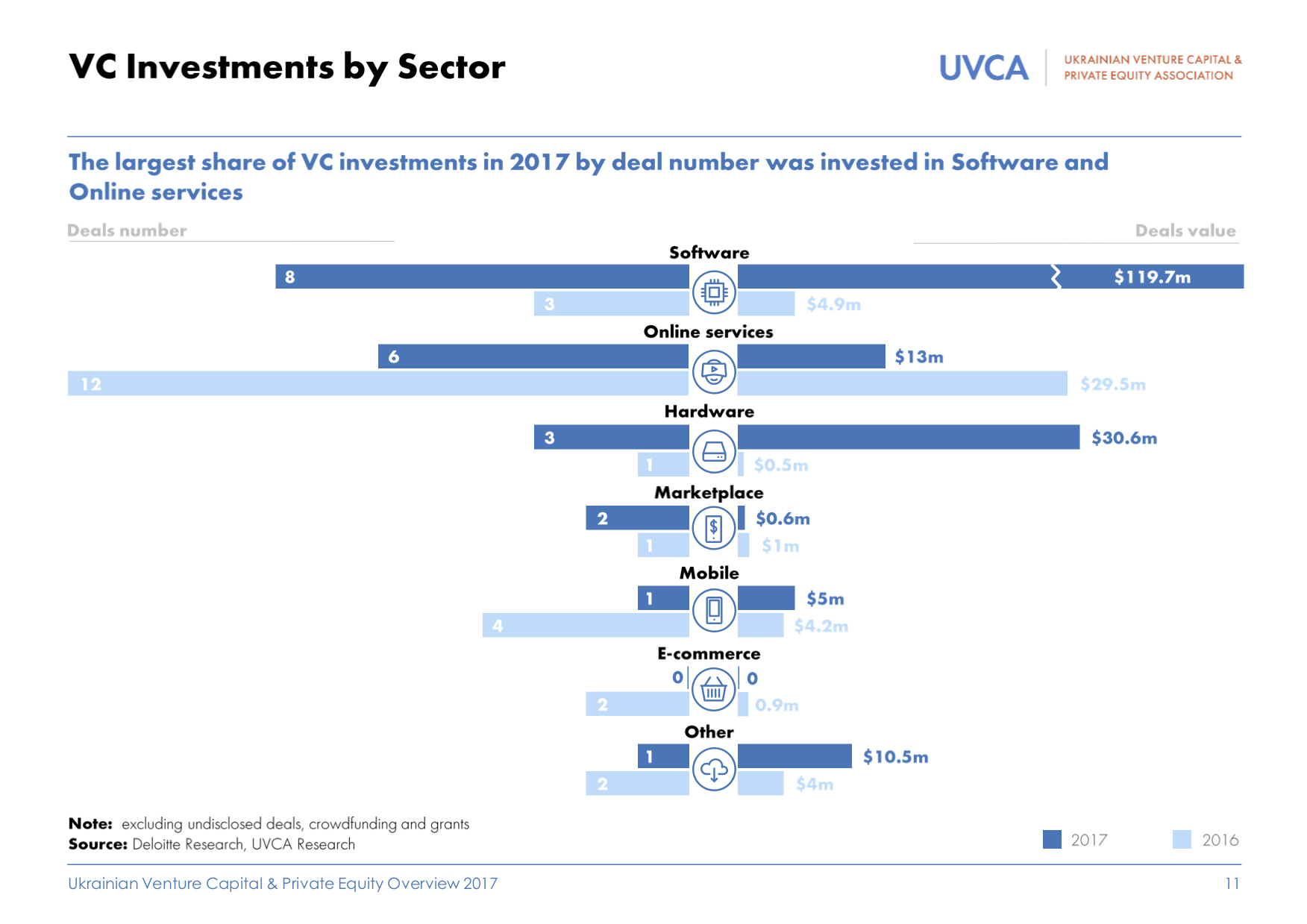

Following a dip in 2016, the data for 2017 indicates that the total amount of venture capital investment in Ukrainian IT companies has reached its peak totaling $259 million, tripling compared to the previous year. Although in line with the global trend of shifting investors’ focus from quantity to quality, the number of deals remains at about the same level with 89 deals.

For the first time, the Overview also covers two additional segments on the top of private capital trends: private equity deals and ICO.

2017 was an exceptional year for private equity investments due to a relative rise in activity, compared to the last 3 years, when the average number of deals did not exceed 4. The value of PE deals in Ukraine totals $ 126.7m, and numbers at 14, however, the deals were undisclosed.

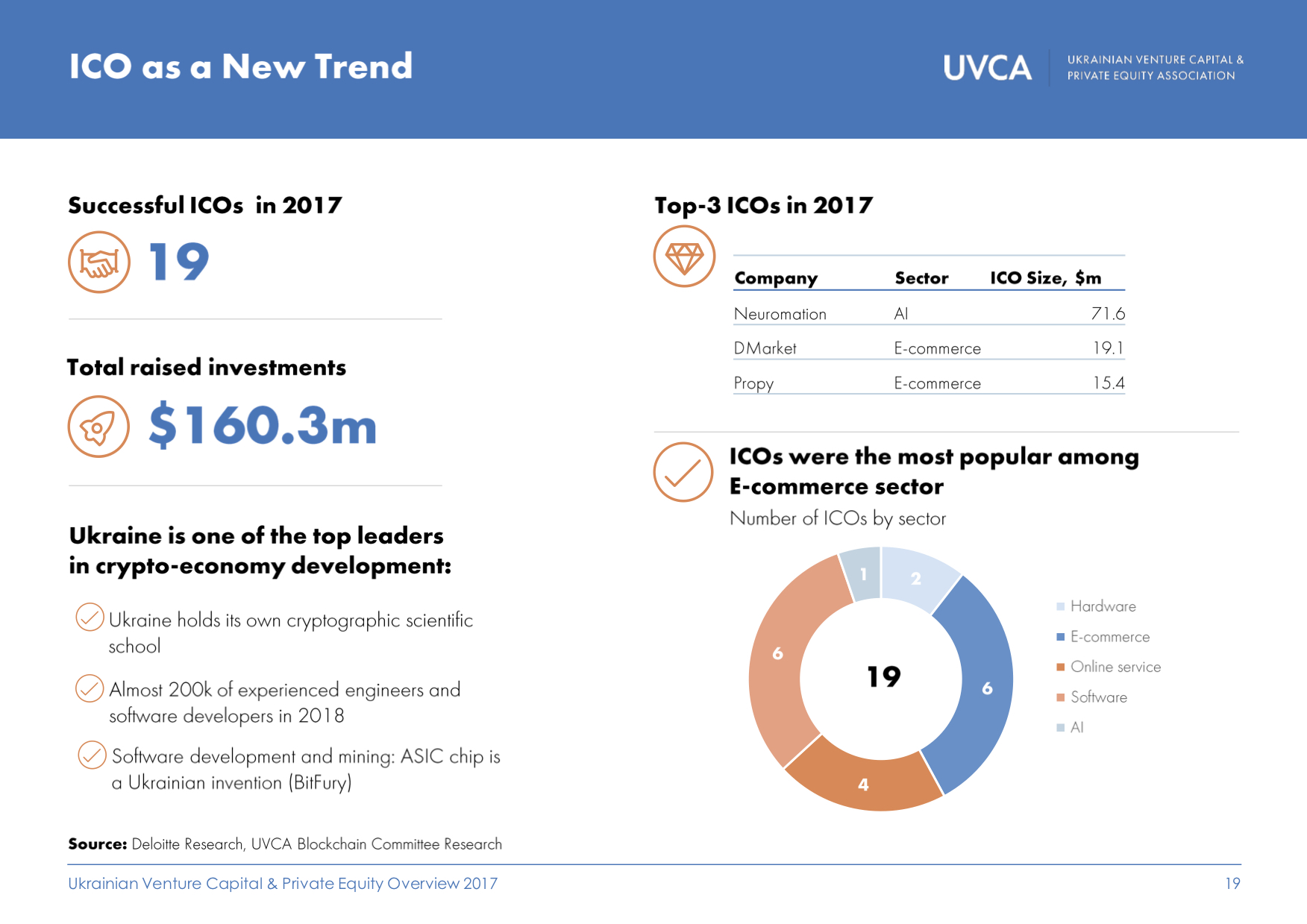

Initial Coin Offering (ICO) financing is the new trend in attracting investments by Ukrainian startups. 19 startups succeeded in attracting $160m within ICO in 2017. Moreover, VC funds focused solely on crypto-related businesses emerged, establishing stronger ties between private capital and blockchain. Neuromation ($71M), Dmarket ($19,1M) and Propy marketplace ($15,4M) were the top 3 ICOs from Ukraine in 2017.

“According to the UVCA Survey, 59% of investors met their expectations for 2017. But 76% of current investors are expecting new private equity and venture funds to emerge in Ukraine in 2018 – says Olga Afanasyeva, Executive Director of UVCA. - On behalf of Association’s members, we continue to showcase investors’ enthusiasm for Ukrainian companies. We do this both within the country, and globally - presenting at international industry events, and expanding our network for effective deal-making by our members. 2018 is already promising to be a busy year for the VC industry.”

In the annual Overview UVCA & Deloitte also made research about regional distribution of investments within Ukraine presenting Ukrainian VC Map. 56% of the deals (excluding aggregated ones) were made in Kyiv region, and take 77% of all VC investment volume.

“2017 was a remarkable year for Ukraine, with a record amount of investments from venture funds for the past 8 years and a high activity in private equity, - says Vladimir Yumashev, Partner, Tax & Legal, Deloitte. This means that Ukrainian startups, professionals, and products, which are in demand worldwide, are competitive on a global scale. An ample evidence is Grammarly, an online grammar checking service based on AI technologies. This Ukrainian startup raised $110m in 2017.

We are glad that our collaboration with UVCA starts with an Overview of Ukrainian Venture Capital and Private Equity Market. Deloitte’s mission is to make an impact that matters. We believe that this year’s Overview will enhance Ukraine’s investment attractiveness for venture funds and other international investors.”

Crowdfunding platforms and grant programs grew in popularity among Ukrainian startups. $2.1mln were raised by technology and internet sector startups over 16 crowdfunding campaigns during 2017. $429k were received by the main grant programs: Vernadsky Challenge (4 grants) and Horizon 2020 (6 grants).

Download Report Ukrainian Venture Capital and Private Equity Overview 2017

Ukrainian Venture Capital and Private Equity Association (UVCA) has been established in mid-2014 by the example of the European Venture Capital and Private Equity Association (Invest Europe), and currently unites almost 50 members - private equity and venture capital funds, accelerators, incubators, educational institutions, and non-government organisations, which make significant impact on the development of Ukrainian investment market. The association promotes investment opportunities in Ukraine for foreign investment funds, conducts market research, lobbies for improving investment and business climate.