Location: Kyiv, Ukraine

Problem the Product Solves

The Ukrainian market lacks a modern online platform for car auctions. The main players — AutoRia and RST — operate under the model of traditional classifieds without auction mechanics. Existing auction platforms are mostly government-run or focused on seized assets (CETAM, Prozorro.Sale).

Solution and Product Information

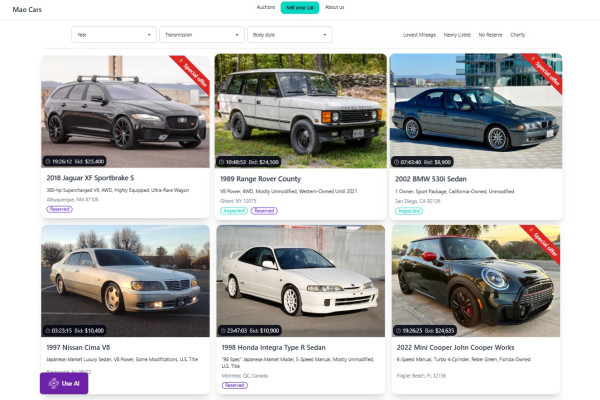

The product offers the possibility of conducting car auctions in Ukraine, modeled after Cars & Bids (USA). The platform connects sellers and buyers in one digital marketplace, ensuring a transparent bidding process, expert support, and secure payments.

Description and Service Features

- Providing a platform for car sale/purchase auctions

- Option to order professional car photography

- Consulting services for vehicle sales

- Option to purchase advertising to expand audience reach

- AI assistant for vehicle selection based on user parameters

Competitive Advantages

- The first platform in Ukraine specializing in car auctions

- No need to wait for vehicle import

- Ability to discuss technical and legal aspects within listings

- Moderation and standardized listing descriptions

- AI assistant for selecting the optimal vehicle based on user needs and budget

Market Overview

Market size: In 2024, the Ministry of Internal Affairs completed over 2.0 million registration operations, including around 120,000 new vehicles and 224,000 used imports (over 10 months), demonstrating the scale of the secondary car market (source: hsc.gov.ua).

In 2025, domestic car resale volumes significantly exceed imports of used cars. The share of imported vehicles (first registrations) ranges between 11–23%, confirming the dominance of the internal market.

Market trends:

-

The Ukrainian car market continues to grow, with both imports and first registrations increasing. Ukrainians are increasingly choosing cars that combine fuel efficiency, comfort, reliability, and safety (source).

-

Simplified mechanisms for vehicle sale and re-registration have emerged (e.g., online re-registration via the Diia app).

-

The government continues to streamline procedures for vehicle purchase and re-registration, making them faster and more convenient for users (source).

Sales and Promotion

- Marketplace and offers: individual sellers, car clubs, dealerships, and imported vehicles from Copart (USA)

- Main clients: private sellers, car dealerships, car clubs, importers

- Main buyers: private users, dealerships, car clubs, and corporate clients

- Promotion: focus on content marketing and social media — Instagram, TikTok (stories, car videos); advertising on industry websites and Telegram channels. The platform is developing partnerships with dealerships and service stations, as well as participating in themed events such as Car Fest and Old Car Land.

Main Suppliers and Partners

- Private sellers / individual owners — key content providers filling the marketplace with listings

- Vehicle verification services (VIN check, history, legal status, mileage, etc.) — provide data, API integrations, and moderation, ensuring transparency and market trust

- Institutes / analytical centers — partners in conducting research, preparing reports, and developing recommendations for industry development

- Payment systems / financial partners (e.g., Nova Pay) — enable payments for listings and promotion services, and integrate leasing or financing options

Current Project Stage (ROADMAP)

Team and Personnel:

- Oleksii Horbunov — Co-Founder, CTO, Development and Infrastructure

- Maksym Radko — Co-Founder, CEO, Strategy and Growth

Key Current and Target Project Metrics

The product is at the Proof-of-Concept stage. A demo version of the platform is available at: https://mao-cars.vercel.app/

Cash Flow Forecast (5 years):

- Initial investment: $2.5 million (Year 0)

- Profit increases from a small volume in Year 1 to approximately $3.0 million in Year 5 (0.3 → 0.7 → 1.3 → 2.0 → 3.0 million $ across Years 1–5)

- Exit (Year 5): company valuation 3× / $7.5M, 5× / $12.5M, or 7× / $17.5M

|

Indicator |

3× ($7.5M) |

5× ($12.5M) |

7× ($17.5M) |

|

Year1 (CF) |

0.3 |

0.3 |

0.3 |

|

Year2 (CF) |

0.7 |

0.7 |

0.7 |

|

Year 3 (CF) |

1.3 |

1.3 |

1.3 |

|

Year4 (CF) |

2.0 |

2.0 |

2.0 |

|

Year 5 (CF) |

3.0 |

3.0 |

3.0 |

|

Exit |

7.5 |

12.5 |

17.5 |

|

NPV (20% discount) |

≈2.8 |

≈6.2 |

≈8.2 |

|

IRR |

≈53% |

≈61% |

≈68% |

|

Payback period |

≈4 years |

≈4 years |

≈4 years |

INVESTMENT PROPOSAL

Total investment volume: $2,500,000 for 24 months, covering 12 months of development prior to launch and 12 months of active market operation.

Investment structure:

1. Equity (company share) – a strategic partner receives 25% of shares (depending on contribution and agreements):

- Seed investor → 25%

- Founder 1 → 30%

- Founder 2 → 30%

- CMO (Chief Marketing Officer) → 10%

- Gap/reserve (future pool or Series A) → 5%

2. Strategic partnership – also possible in Smart Money format (investor contributes not only capital but also contacts, marketing, and expertise).