COMPANY OVERVIEW

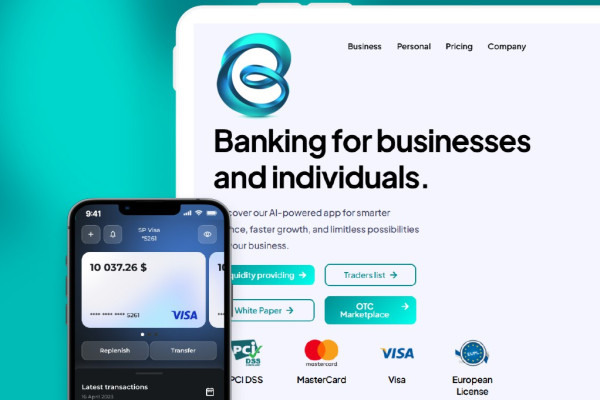

The financial marketplace is a next-generation universal European platform that combines innovations in financial technology and digital assets. The platform operates in the following areas:

- A global financial marketplace featuring rankings and listings of liquidity providers, top-level traders, and licensed P2P crypto sellers

- Integration of fiat and digital assets

- Card processing and acquiring

- Cryptocurrency exchange and custody

- Opening bank accounts in Europe and the UK for individuals and businesses

Core technologies used:

- Artificial Intelligence

- Blockchain

- Integrated banking solutions

MARKET

Global financial market volume (2023) = $2.5 trillion

Forecasted growth 10–12%

Key market segments:

- Swift/Sepa payments for individuals and businesses

- Card payment processing for businesses

- Cryptocurrency exchange

- Cryptocurrency custody

- Selection of liquidity providers

- Selection of asset managers

- Selection of licensed exchange services

Current market challenges:

- Lack of seamless integration between traditional banking systems and digital assets

- Difficulty of quick investing for individuals without experience

How the project addresses these issues:

- AI-powered payment optimization

- A unified platform for managing fiat and digital assets with seamless interaction between bank accounts and blockchain

- Access to professional asset managers in the user’s region

- Ability to purchase securities or stocks in the user’s region

- Access to verified and licensed crypto providers in the user’s region

European market volumes

-

Digital Banking – $10.9 trillion, with forecasted growth of over 3% annually until 2032

-

Buy Now Pay Later (BNPL) – $190.2 billion, projected to grow to $354.3 billion by 2029

-

Insurance – $1.6 trillion by 2025

-

Investment Platforms & E-Brokerages – $13.5 billion, projected to grow to $32 billion by 2033 (CAGR 9%)

CONSUMERS

- iGaming – high transaction volumes and need for rapid payment processing

- Forex – instant payments, high security, and international support

- Crypto industry – integration with digital currencies and secure exchange

- E-commerce / Services – convenient payments for everyday purchases, support for SMEs, flexible payment solutions

- Technology & Innovation – support for startups and tech companies through fast payments

- Travel / HoReCa – multi-currency operations and simplified refunds

- Education & Culture – subscriptions and one-time payments for courses and events

- Charity – simple and transparent donation solutions

- Corporate clients – comprehensive payment solutions integrated with financial reporting

- Freelancers / Sole proprietors – low fees and convenient access to international payments

TEAM EXPERIENCE

- 10 years in the banking sector — deep understanding of banking processes, financial services, and regulation

- 7 years in payment systems — experience in integrating and optimizing payment solutions provides an advantage in building fast, secure, and user-friendly processes

- 7 years in currency and crypto exchange — extensive knowledge of fiat and crypto markets facilitates innovative solutions for multi-currency operations

- 5 years of technical development of the proprietary platform

COMPETITION

- Stripe (USA) – $357B/year

- Adyen (Netherlands) – $252B/year

- Klarna (Sweden) – $279B/year

- Trust Payments (UK) – $56B/year

- Wise (UK) – $120B/year

- Revolut (UK) – $157B/year

- DECTA (UK) – $7B/year

- TRANSACT (USA) – $13B/year

- Unlimit (Cyprus) – $800M/year

PRODUCT & ADVANTAGES

- Ready-to-use platform with a basic service package (BaaS solution)

- Licenses (BaaS solution) – MSB Canada, VASP crypto license, EMI agent partnership (Lithuania), Co-brand EMI partnership, EMI dealer partnership (Great Britain)

- Formed professional team

- Existing client base

- An extensive network of consumer and partner contacts in relevant niches, enabling an increase in current turnover and deal volume

INVESTMENT OPTIONS:

1) Investment to increase working capital

The company is ready to scale and onboard new clients. To expand operations, investment in working capital is required:

Investment amount: €6.38 million

Investment options:

- Direct funding: 50% of profit from each transaction

- Debt funding: 6% annual interest on the invested amount

- Average transaction margin: 1.1%

Current financial indicators: €5 million turnover/month

Projected financial indicators: €30 million turnover/month

2) Investment in obtaining own licenses and expanding platform functionality

The company is currently operating on a platform and under licenses, using BaaS solutions. The project aims to acquire its own licenses to increase operational margins.

Investment amount: €12.947 million

Budget allocation:

- Working capital (49%) – €6.38 million

- Company registration and licensing (20%) – €2.59 million

- Office and personnel (25%) – €3.24 million

- Operating expenses (6%) – €0.78 million

Investment period: 36 months

Investment options:

- Equity participation: 45% in the new company that will hold all licenses direct funding of working capital: 50% of profit from each transaction

Road Map for licensing (36 months):

- Company registration in Lithuania — considered the best jurisdiction for obtaining an EMI license due to regulatory transparency, European reputation, and established cooperation with Visa/MasterCard

- Opening an account in a national bank or financial institution within the EU

- Obtaining an EMI license to operate across the European market

- Obtaining Visa/MasterCard Principal Membership

- Opening a Low Risk registration with Visa/MasterCard

- Obtaining High Risk registration

Simultaneously with obtaining their own licenses, the investor begins receiving 50% of the profit from current deals starting from the first month (thanks to BaaS licenses), due to their investment in working capital.

Average transaction margin: 1.1%

Projected financial indicators:

- Expected average monthly turnover: €32 million

- Expected average monthly gross profit: €352,000

- Projected gross turnover over 36 months: €1.152 billion

- Projected gross profit over 36 months: €12.67 million

- Average profitability: 1.1%