Project Overview

Lithuanian company UAB Rail Asset Management, part of the Rail Holding Group, brings over 20 years of experience in railway logistics across Central Asia. Specializing in fleet management, leasing, operations, and full-cycle servicing of rolling stock, the company now presents an investment opportunity to acquire brand-new 80-foot container flatcars. These wagons will operate in Kazakhstan, servicing international freight trains along the China–Kazakhstan–Europe route and other strategic corridors. Investors receive stable passive income from long-term lease contracts with national and international rail operators, while Rail Asset Management acts as the dedicated project management company.

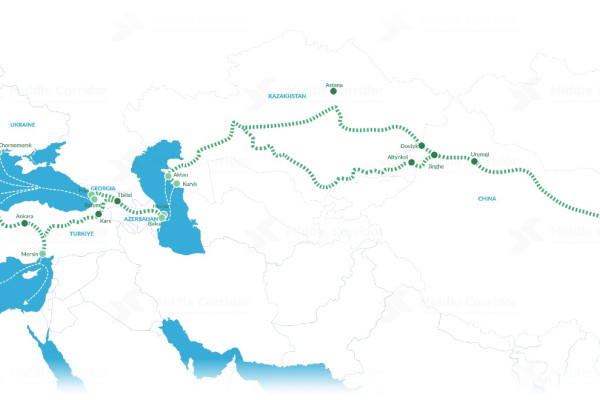

Regional Focus: Republic of Kazakhstan, Middle Corridor (Trans-Caspian Route) between China and Europe.

Market Relevance & Problem Statement

The demand for container shipping via the Middle Corridor is growing rapidly. However, the current flatcar fleet is insufficient to meet market needs. This shortage limits throughput capacity and reduces the efficiency of freight operations.

Solution & Product Description

The project entails purchasing new 80-foot flatcars from a certified Kazakh manufacturer with factory warranties. The wagons will be operated and maintained by the experienced team at Rail Asset Management.

This product addresses the rolling stock shortage, supports growing transit and export demand, and provides investors with a reliable income-generating asset.

Market Snapshot

- Container transport volumes in Kazakhstan more than doubled over the past 5 years

- In 2024, container transit grew by 62%, reaching 4.5 million tons

- Forecasted volume by 2027: 10 million tons

- Kazakhstan–China crossings rose 12%, reaching 31.8 million tons

- Market trend: flatcar shortage and increasing support from governments and international bodies (EU, China)

Clients & Counterparties

- Primary clients (lessees): major private international and domestic operators, and national railway companies

- Potential lessees: KTZ (Kazakhstan Railways), KDTS, private operators

- Manufacturer: Certified plant in Kazakhstan

- Insurance: Local insurance companies

- Financing: Local Kazakh banks and international financial institutions from Europe, UAE, and China

Current Project Status

- Wagon manufacturer and pricing confirmed

- Financial model developed

- Preliminary lease agreements negotiated

- Tax-free registration zone secured (AIFC)

- Operating and governance structure finalized

Current phase: Preparation — company registration in the AIFC, manufacturer negotiations, operator onboarding

Capitalization not yet initiated; contracts to be executed upon investor confirmation

Project Team (Key Management)

Andrius Gedris – CEO

- Founder and director of Rail Asset Management, Andrius has over 20 years of experience in business and operations.

- A shareholder in the holding company, he possesses deep commercial insight into the rail sector. His strategic, cost-efficient approach consistently enables the launch of new logistics projects with minimal overhead.

Oleksandr Bobrov – Head of Projects & Investments

- With 5+ years of experience in attracting investments in rolling stock and transport assets, Oleksandr has successfully initiated and scaled multiple road transport ventures.

- He is the initiator and coordinator of the current Rail Capital project.

Key Financial Metrics

- IRR (USD): approx. 18.6–21.1%

- ROI (10 years): +228–254%

- Average DSCR: 1.5×

- Total investment (31 wagons): $1.643 million – $1.798 million

- Investor equity (30%): $465,000 – $511,500

- Loan (70%): $1,085,000 – $1,193,500, annuity loan at 12.6%

- Deposit requirement 15%: $162,750 – $179,025

- Total additional commissioning costs: 31 wagons * $3,000 = $93,000

Investment Budget

The minimum required investment is the purchase of 31 platforms, equivalent to $720,750 – $783,525. A larger volume can be discussed separately.

The collateral for the bank includes a guarantee from the DAMU Fund and the wagons themselves, or a deposit placed at interest. Company registration is carried out in Kazakhstan.

$53,000 – $58,000 per wagon = $1.643 – $1.798 million for the full set (31 wagons). The costs include procurement, delivery, registration, insurance, and maintenance.

Exit Opportunities

-

Sale of the wagons after 10 years at the projected price of $38,000–$40,000 per unit (~$1.178 million–$1.240 million for the full set).

-

Full loan repayment by year 10.

-

An early exit of the investor from the project will be discussed individually, with a planned exit mechanism developed to avoid any losses for the parties involved.