- Latest Cushman & Wakefield analysis of 123 European office, retail and logistics markets indicates later stages of property cycle.

- Semi-Core economies of Ireland, Spain and Portugal offering opportunities.

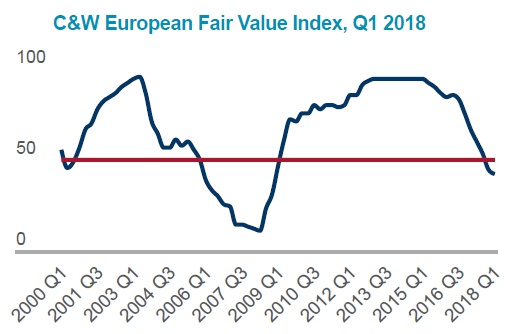

Twelve markets were downgraded and the same number upgraded as Cushman & Wakefield’s quarterly European Fair Value Index – which analyses 123 European office, retail and logistics markets – reflected an overall trend of fewer attractive prime investment opportunities in Q1 2018.

Using a proprietary metric, each market is benchmarked against ‘fair value’ – an adequate compensation over a five-year hold period for an investor’s risk when purchasing prime assets. In Q1 2018, just 19% of the index was classified as ‘underpriced’. Logistics remains the most attractive sector, with 46% of the markets classified as ‘underpriced’, and only two as ‘fully priced’.

Five most under/fully priced markets in Europe

|

Most Underpriced Markets |

Most Fully Priced Markets |

|

1. Moscow retail |

119. London (City) offices |

|

2. Moscow offices |

120. Paris (CBD) offices |

|

3. Dublin logistics |

121. Vienna offices |

|

4. Budapest retail |

122. Istanbul retail |

|

5. Lisbon logistics |

123. Istanbul offices |

Source: Cushman & Wakefield

Moscow remains top of the underpriced European markets table, ranked first and second for its retail and office sectors respectively. Dublin (logistics) was third with Budapest (retail) and Lisbon (logistics) completing the top five.

Core office markets including London, Vienna and Istanbul are all classified as fully priced having reached their lowest historical yield, with limited yield compression forecast and, in many cases, modest rental growth expectations.

The research shows that Central and Eastern Europe continues to show a good balance of ‘fairly’ and ‘underpriced’ markets while in contrast Germany, alongside the Benelux and Nordics countries have only a few markets ‘underpriced’.

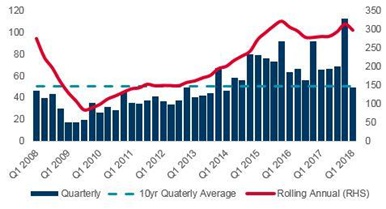

European Investment Activity, EUR bn

Source: RCA

Riccardo Pizzuti, Senior Analyst, EMEA Forecasting, Cushman & Wakefield, said: “Our findings reflect the fact that we are in the later stages of the property cycle with many markets being labelled as fully priced. That is not to say value or opportunities are not available, it depends on investors’ strategies, but in general there are fewer opportunities to identify mispriced assets.

“After record quarterly investment volumes of€112bn in the fourth quarter of last year, prime product across Europe is becoming increasingly scarce as the economic cycle matures. This resulted in the first three months of this year being the slowest quarter since 2014 with €49bn invested.

“Dublin and Lisbon’s logistics markets are both in the top five underpriced markets in the Index. The Portuguese economy, in particular, is enjoying solid momentum, with a balanced mix of consumption, investment and exports. Export volumes were at their highest for a decade last year and that positive trend has continued into 2018. We expect further yield compression over the forecast period, supported by healthy investment volumes, and stronger occupier demand.

“Overall, we expect yields to trend downward for selected markets in 2018, as weight of capital helps sustain competition for quality assets. However, from late 2018 onwards, higher government bond yields will mean that on a relative basis property will look less appealing.”

"The narrowing of investment opportunities in core European markets creates a potential for growing interest in peripheral markets in Europe. We already see the investment interest in our neighbouring countries (Romania, Hungary, Slovakia, as well as Bulgaria, Croatia, Serbia), hence Ukraine also has a chance to attract potential investors to its market. It is worth noting that Ukrainian real estate market is underestimated as there is a possibility of rental growth in all segments (offices, logistics, retail), and cap rates offer attractive returns for investors. Capitalization rates for prime office premises account for 12%, for retail - 12.5%, and 12.5%-13% for logistics", said Volodymyr Mysak, Head of Land and Capital Markets at Cushman & Wakefield Ukraine.

Investment offers in logistics real estate from InVenture Investment Group: