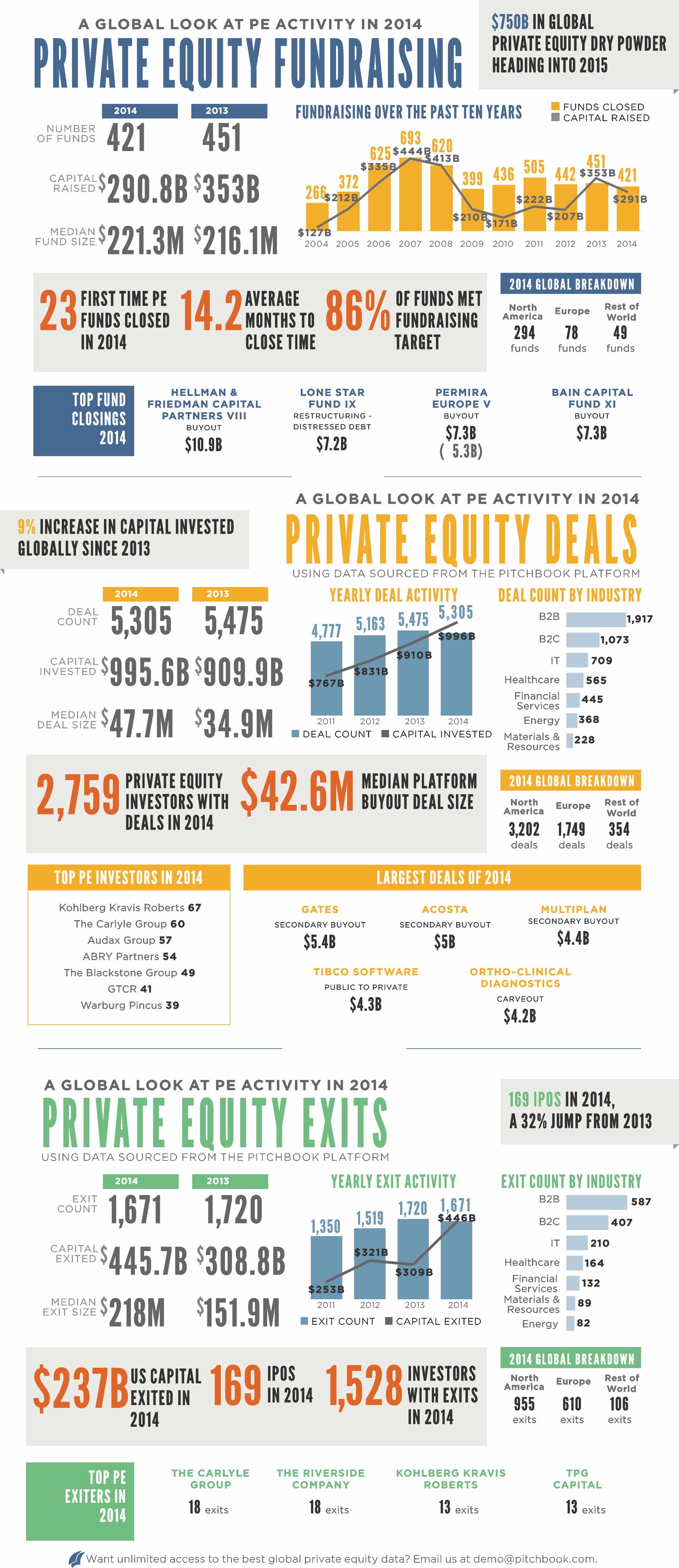

2014 proved another strong year for the global private equity market despite challenging market conditions. Deal flow remained very active with 5,305 completed private equity deals totaling $995.6 billion of capital invested, the highest amount since 2007. In response to a more difficult market, PE firms shifted their interest to minority and growth investments, add-on investments, which accounted for 60% of total buyouts for 2014 and liquidity, where capital exited reached a total of $445.7 billion, marking a record-high. Additional key highlights from the year can be found below.

Key Facts Sourced from the PitchBook Platform:

PE Deals

- Deals by Region: PE deal activity picked up in Europe with nearly 34% of global PE capital invested across its 1,749 deals. Deal flow in North America remained steady with $591.6 billion invested across 3,202 deals - 59% of total capital invested globally.

- Deals by Type: Add-ons have accounted for nearly 60% of buyouts this year, marking a decade-high percentage and the fourth straight YOY increase.

- Deals by Industry: PE interest in B2B and B2C companies remains strong accounting for roughly 35% and 21% of PE deals this year, respectively.

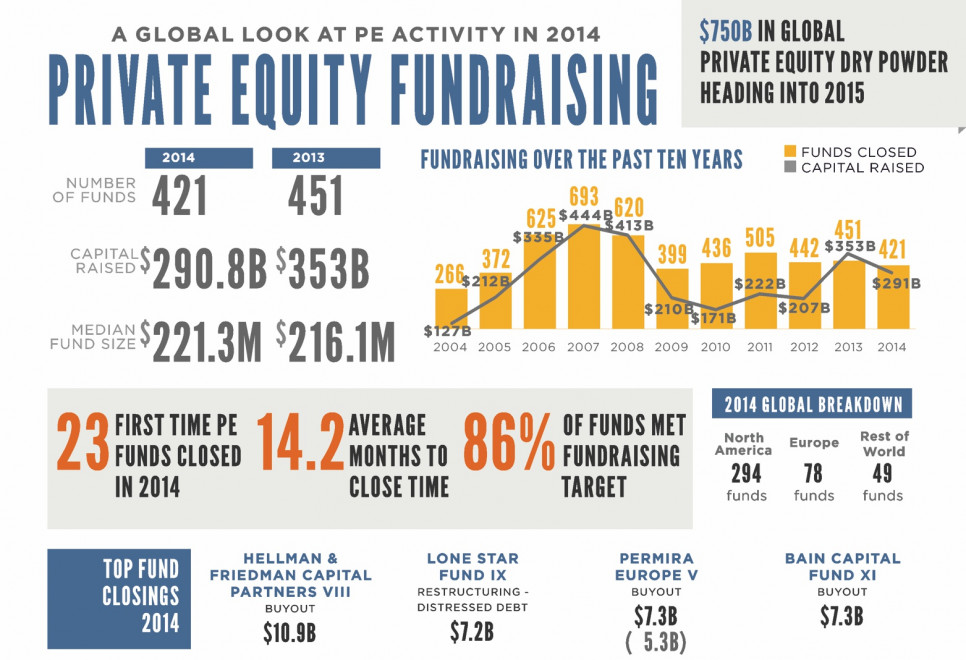

PE Fundraising

- Total Closes: Global PE fundraising registered 421 closed funds totaling $291 billion in 2014, a 18% drop from last year but the second highest total since 2008.

- Fundraising Success: Of the funds closed in 2014, 86% hit their target and 41% exceeded their fundraising goal.

- Largest Funds: The largest fund to close in the year was Hellman & Friedman Capital Partners VIII, which held a final close on $10.9 billion.

PE Exits

- Total Exits: Global exit flow remained stable in 2014 with 1,671 total exits totaling $445.7 billion, up 46% from last years $305.5 billion exited.

- Exits by Region: North America accounted for 56% of global capital exited in 2014, down from 62% last year. Europe realized 31% of total capital exited in 2014, mirroring 2013s percentage of total capital invested.

- Exits by Industry: The B2B and B2C industries accounted for a large portion of exits in 2014, roughly 35 percent and 24 percent respectively.

- Largest Exits: The largest exit of the year should come as no surprise, Alibabas $25 billion IPO was far and away the largest exit of 2014. Leading exit investors (PE and other) include Silver Lake Partners, General Atlantic and Insight Venture Partners.

Comment:

"Remarkably, PE firms invested nearly $1 trillion of capital globally, despite somewhat difficult market conditions," commented Adley Bowden, Senior Director of Analysis, PitchBook Data, Inc., "this years success was a result of PE firms ability to adapt and modify their investment strategies to meet todays realities. We expect 2015 to be even more active for private equity investors as they continue to adapt to these conditions and the tailwinds of significant dry powder, active M&A market and recovering economies help drive deals."