As in any other area, the issue of mediation becomes relevant when it is necessary to purchase or sell assets. In the context of the growing number of M&A transactions in the agricultural sector of Ukraine, the number of intermediaries who are trying to help the owners of agribusiness to solve investment issues has also increased. As a rule, each of them has either a positive experience of working with intermediaries or they avoid them however possible.

Is it worth paying tens and hundreds of thousands of dollars to intermediaries and what for?

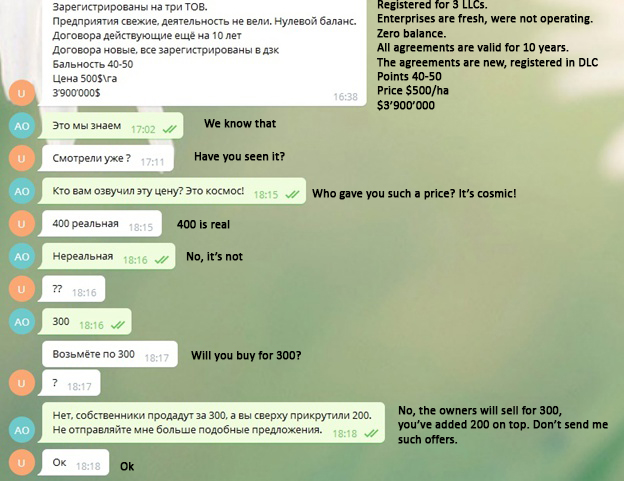

Highly effective brokerage work can lead to a successful transaction with favorable conditions. At the same time, there is a wide range non-professional players on the market, usually they are private individuals - "problem solvers", whose actions result in disorientation and damage to the development of the market. They tend to spread unverified, untrue information on the market in the hope of scooping a large profit from the sale of assets.

There even was a case, when the agro-brokers from Odessa tried to find a direct investor bypassing the representatives of the buyer. It should be noted that their resourcefulness did not fail them and they succeeded. At the same time, offering an overpriced asset with a surcharge of $100,000 to the price of the object at an asset value of about $1 million, the intermediaries managed to demand an additional 5% commission from the investor. In addition, entrepreneurs demanded an advance of $20,000 to organize a joint meeting with the owner.

The following correspondence with intermediaries perfectly illustrates the appetites of the Ukrainian intermediaries (in dialogue the price for 1 ha of the leased agricultural land is discussed).

Professional brokers use a wide range of services aimed at the successful implementation of M&A transactions. The advantage of working with professional intermediaries is undeniable, most of them are listed below.

What advantages does the owner/manager of agribusiness get when working with professional brokers?

- Efficiency in terms of results, time and cost savings. In fact, the broker becomes an independent structural unit of the company with the necessary set of competencies and motivation. For owners there is no need to deal with the issues of purchase/sale itself or keep a team of highly qualified specialists in the search and selection of agricultural assets or their "packaging" and sale. It is easy to see why dozens of years of building relationships with investors, hundreds of thousands of kilometers "agrotrips" to farms on the roads of Ukraine, daily communication with the chains of intermediaries in different regions of the country, personal relationships with private farmers of the Ukraine cost a lot. In addition, the client receives the full range of services in one place — there is no need to search for and coordinate different specialists. For example, the Ukrainian office of EY employs about 500 people — investment bankers, lawyers, tax specialists, consultants and auditors. Such investment companies as Dragon Capital, Concorde Capital, Finpoint, InVenture also provide the necessary range of services to support M&A transactions working in tandem with trusted contractors – well-known legal and audit companies.

- Confidentiality and psychological comfort. It is often uncomfortable for agribusiness owners to speak on their own behalf when selling or buying assets and to disclose their intentions to neighbors, partners or competitors. Acting through a professional intermediary it is not necessary at first to disclose your name to the seller or buyer of agribusiness, thus it is possible to act in disguise, which in turn makes it possible to influence the price of the asset and not to harm the reputation. Intermediaries have effective solutions in their arsenal to address security risks and at the same time facilitate the disclosure of important business information.

- Mediation and compromise. Broker involvement is directly connected with the search for and the development of constructive solutions that are mutually acceptable to all parties with the aim of reaching consensus and closing the deal. It is about the settlement of differences and disputes on the terms of the transaction, the development and implementation of conciliation procedures. The particular value of mediation is also to resolve differences between the parties in an informal setting (outside the meeting of the parties).

- The rhythm of the M&A deal. It is much more difficult to complete the transaction than it is joyful to announce it. Time management is an essential factor in a successful M&A transaction. If this process is stretched for months, the participants in the transaction get tired, and there is a chance that one or both partners will leave the negotiation process. Investment brokers, having the experience of both successful and failed transactions can competently build a time frame for all iterations of the transaction.

- Access to all tools in the field of corporate finance. Who else if not experienced intermediaries possess all the available tools for the transaction, ranging from diverse consulting support, implementation of auctions, the use of specialized tools such as escrow accounts, up to the involvement of trusted contractors for due diligence and structuring the transaction abroad.

- Preparation of the company for sale. As well as "car dealers" who prepare a car for sale to increase its price, and investment intermediaries know how to increase cost of the agricultural company by carrying out its pre-sale preparation. As a rule, the discount on the transaction upon detection of certain problems can significantly exceed the cost of due diligence and the creation of a transparent corporate structure.

- Psychological support and reducing the level of tension in the negotiations. The parties believe that the presence of mediators during the negotiations reduces the level of tension, as well as increases the confidence and strength of the representing party. The survey of owners of Ukrainian agricultural companies and agricultural holdings states that about 70% of respondents who used the services of professional intermediaries, achieved the desired result, and even if the transaction did not take place 85% of respondents remained satisfied in cooperation with brokers.

- The estimated fair value of the assets. Mediators can identify a fair price for agricultural assets based on evaluation of existing demand and supply in the agricultural market, and also based on their own cases/closed deals. Owners, as a rule, are guided by their own subjective assessments, supported by rumors about the sale of assets on the market.

- Competition for agricultural assets. Professional intermediaries have established relationships with most local and foreign investors who are considering the possibility of acquiring assets in the agricultural sector of Ukraine. Intermediaries who represent the sellers of the business understand the criteria that different categories of investors use when searching for agricultural assets, that is why they can easily tell you who is able to offer the maximum price for the object, and will make a pinpoint offer in the right form. Another strategy may be to create a competition for the asset, when many potential investors will consider the possibility of buying and make their offer at a price, and the owner will be able to choose the best offer.

- Access to exclusive offers. All offers that are on the open market in public access for a long period of time most likely either hide certain problems, are not attractive for investment or are overvalued. Buyers, as a rule, tend to choose exclusive offers. Those wishing to buy "something special" can be satisfied only by professional brokers, who are entrusted with the exclusive sale of objects by the owners themselves.

How to choose who to work with?

In our experience the fastest period of transaction closing was 10 days, although usually the entire transaction process takes longer: it takes from three to six months to find an asset or an investor to close a deal, and sometimes it takes up to a year. That is why it is important to make the right choice of a professional broker who will represent your interests during all stages of the transaction.

First of all, it is necessary to analyze the presence of successful transactions. This information, as a rule, can be found on the corporate website or requested in person.

Next, you should pay attention to the accumulated base of proposals in the agricultural sector or mandates from investors to purchase agricultural assets.

The recommendations from the participants of the agricultural market or the customers themselves are also important.

May all your transactions be successful!