Ukrainian M&A Market Overview

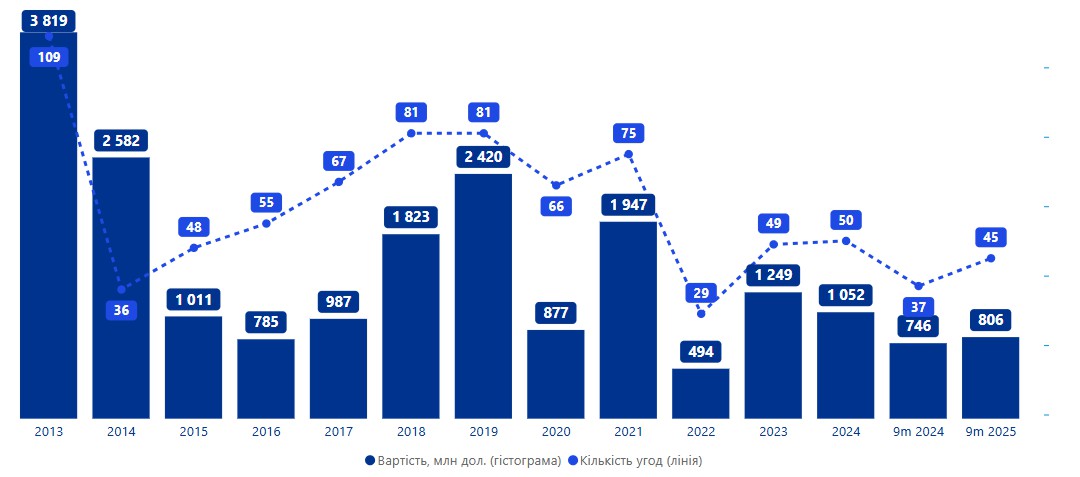

The Ukrainian mergers and acquisitions (M&A) market showed moderate growth over the first nine months of 2025, as local players continued to consolidate their positions despite ongoing wartime challenges.

During the reporting period, 45 transactions were recorded with a total disclosed value of USD 806 million, representing a 22% increase in volume and an 8% increase in value compared to the same period in 2024 (37 deals worth USD 746 million).

The relatively low market transparency, a typical feature of Ukraine’s M&A landscape, continues to affect data availability: the share of deals with disclosed value fell from 59% in 2024 to 53% in 2025. This suggests that the actual market size may be higher than the officially reported figures, partially explaining the discrepancy between the growth rates of deal count and value.

Major M&A Transactions in Ukraine (9M 2025)

Two large transactions exceeding USD 100 million accounted for 56% of the total disclosed deal value and became key drivers of market growth:

-

MHP, a Ukrainian food and agri-tech company, acquired 92% of Spain’s Grupo Uvesa, one of the leading producers of poultry and pork, in a deal valued at over EUR 270 million;

-

Kyivstar acquired the ride-hailing and delivery platform Uklon for USD 155 million.

As there were no deals over USD 100 million in Q3 2025, the list of top transactions remained unchanged compared to H1 2025.

The average deal size was also stable, standing at USD 34 million.

Largest M&A Transactions in Ukraine (9M 2025)

| Target Company | Buyer | Seller | Stake | USD million |

|---|---|---|---|---|

| Grupo Uvesa | PJSC “MHP” | Not disclosed | 91.77% | 300.0 |

| Uklon ride-hailing service | PJSC “Kyivstar” | Serhii Smus, Vitalii Dyatlenko, Dmytro & Viktoria Dubrovsky | 97% | 155.2 |

| Quinn Properties Ukraine (Leonardo BC) & Univermag Ukraina Mall | City Capital Group | IBRC (Ireland) | 100% | 70.0 |

| Tabletki.ua (LLC “MTPK”) | PJSC “Kyivstar” | Oleksandr & Nataliia Muravshchyk et al. | Undisclosed | 30.0 |

| LLC “Beiken Energetyka Ukraine” | Prato Golf Investments LTD (Ihor Mazepa) | Beiken | 100% | 25.0 |

| Total | 580.2 |

Deals Involving Ukrainian Investors

Transactions involving Ukrainian investors remain the backbone of the domestic M&A market.

In 9M 2025, their total value reached USD 442 million (vs. USD 212 million in 2024), representing about half of the total market and nearly double the previous year’s figure.

By volume, Ukrainian investors accounted for 73% of all deals (up from 51% in 2024).

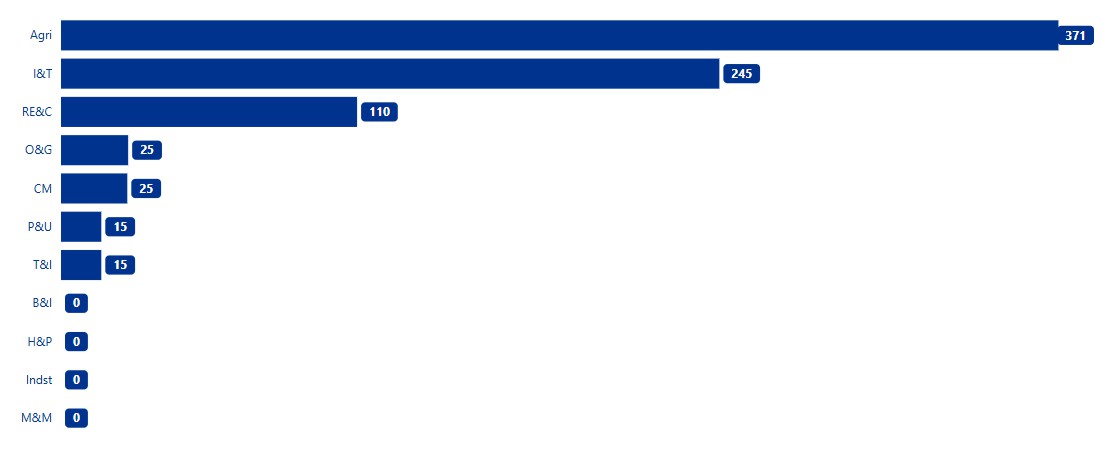

Sectoral breakdown:

-

Innovation and technology — 5 deals;

-

Real estate and construction — 12 deals;

-

Agriculture — 6 deals.

Together, these segments represented 85% of total deal value and 70% of all transactions.

Sector Structure of M&A in Ukraine (9M 2025)

Innovation & Technology

The sector was strongly influenced by Kyivstar’s USD 155 million acquisition of Uklon, the largest domestic deal of the period, complemented by two more Kyivstar acquisitions worth USD 41 million in total.

After two years of decline, Ukraine’s IT exports began to recover in 2025, reaching USD 4.3 billion over the first eight months — up 1.1% year-on-year.

The IT Arena 2025 conference attracted a record number of participants, while the startup competition fund reached USD 15 million, signaling sustained investor interest in Ukraine’s tech ecosystem.

Agriculture

Despite wartime and adverse weather conditions, the agricultural sector remains resilient.

The grain harvest is projected at 51–56 million tons, comparable to 2024 levels.

Support from the EU (through expanded import quotas) and the World Bank’s ARISE project (UAH 1 billion) helped stabilize the sector.

Investor interest was confirmed by Vi.An Holding Limited (controlled by OKKO Group owner Vitaliy Antonov), which acquired Borshchivska Agrarna Kompaniia and Kairos Holding in Lviv region.

Privatization

Privatization activity picked up in Q3 2025, with three deals totaling USD 29 million, including two state-owned enterprises.

The largest — VinnytsiaPobutKhym (confiscated from sanctioned ownership) — was acquired by Afina Group (owners of EVA and Varus chains) for USD 15 million.

Ukrbud Construction Company was sold for USD 19.5 million to Techno-Online LLC, owned by the Astion brothers.

Upcoming major privatizations include the Odesa Port Plant and Motor-Detal Konotop.

Energy

As in 2024, only one deal was recorded in the energy and utilities sector.

Nevertheless, energy remains strategic: Dragon Capital and Amber Infrastructure (UK) launched a EUR 350 million infrastructure fund, with its first project — a 20 MW gas-engine power plant and 40 MW energy storage system — valued at USD 30 million.

Foreign Acquisitions by Ukrainian Companies

Ukrainian firms continued to expand internationally, maintaining the trend from H1 2025.

Deals involving the acquisition of foreign assets by Ukrainian investors totaled USD 329 million, or 40% of total M&A value, across five transactions (about 10% of total count).

This contrasts with 10 deals worth USD 85 million in 2024, showing fewer but larger transactions, driven primarily by MHP’s EUR 270 million acquisition of Uvesa in Spain.

Notable examples:

-

Sigma Software Group acquired A Society Group (USA) — USD 10 million;

-

Ciklum acquired GoSolve Group (Poland) — USD 5 million;

-

TechMagic acquired Hitteps (Poland) — value undisclosed.

According to KPMG, several more cross-border deals are in progress, highlighting continued investor appetite.

Foreign Investor Activity in Ukraine

Foreign investor activity in Ukraine fell sharply in 2025.

In 9M 2025, foreign acquisitions of Ukrainian assets amounted to 7 deals worth USD 35 million, compared to USD 448 million across 2024.

Last year’s surge was driven by Creatio’s USD 200 million funding round and NJJ Capital’s USD 120 million acquisition of Datagroup-Volia.

Most 2025 deals occurred in technology and transport/infrastructure sectors.

The most notable transaction was Medlog SA’s acquisition of 50% of intermodal operator N’UNIT and 25% of the Mostyska terminal for USD 15 million, marking renewed foreign interest in Ukrainian logistics assets.

In defense tech, two landmark deals were announced — the largest in the sector’s history:

-

Swarmer raised USD 15 million (Series A, led by Broadband Capital Investments);

-

Trypillian (UK-Ukrainian deep-strike systems developer) secured USD 5 million from a UK investor.

The growing popularity of Defense Tech Valley (organized by Brave1) and ongoing discussions about dual-use export regulations are enhancing the sector’s appeal.

However, in most industries, foreign investors remain cautious, awaiting improved security conditions, expanded international support programs, and war-risk insurance mechanisms that could reignite capital inflows.

Macroeconomic Environment

Despite the war, Ukraine has maintained macroeconomic stability in 2025, largely due to substantial international financial support.

In the first nine months, external aid totaled USD 30.6 billion, with an additional USD 8.7 billion committed by year-end — enough to fully cover Ukraine’s external financing needs for 2025.

This underscores both the firm commitment of international partners and the government’s adherence to fiscal and macroeconomic discipline.

Inflation declined from 14.3% in June to 11.9% in September 2025, with the National Bank of Ukraine (NBU) projecting 9.7% by year-end and a return to 5% by 2027.

Economic growth is expected to remain modest: the NBU forecasts real GDP growth of 2.1% in 2025 (down from 3.1% earlier), and no more than 3% annually in 2026–2027.

These estimates align with the EBRD’s forecast of 2.5% growth in 2025.

Despite subdued projections, business sentiment is improving: the NBU’s Business Outlook Index rose to 50.4 points in September 2025 (vs. 48.7 a year earlier).

Corporate optimism is supported by strong consumer demand, state-funded infrastructure recovery, declining inflation, and exchange-rate stability.