Despite entering the fourth year of a full-scale war, Ukraine’s technology ecosystem in 2025 is showing signs not merely of recovery, but of structural transformation. Investment activity, a strong focus on defense technologies, the growing role of artificial intelligence, and the emergence of new unicorns are shaping a new quality of the Ukrainian tech market—one that is increasingly integrated into global value chains.

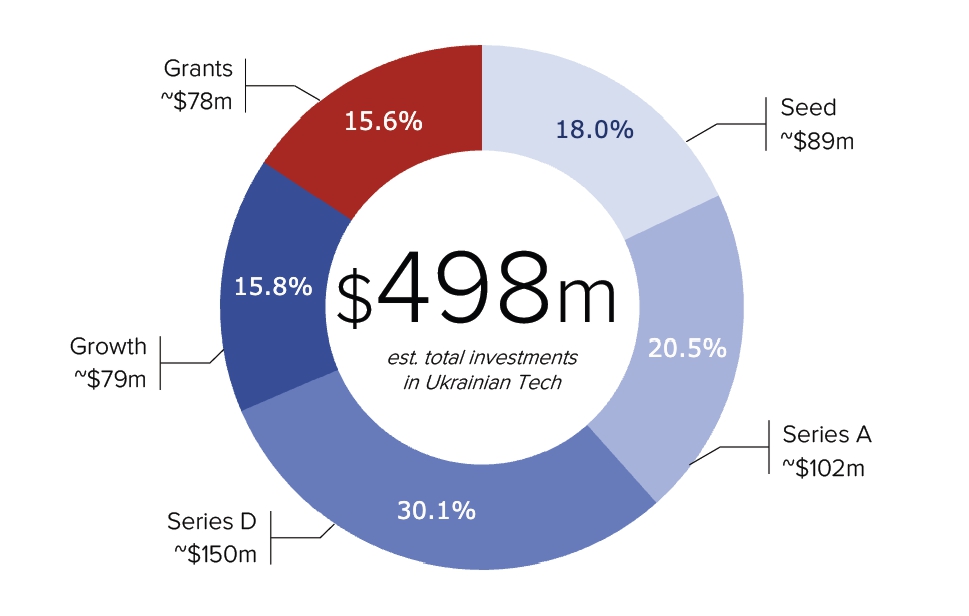

According to the DealBook of Ukraine 2025 by AVentures Capital, Ukrainian technology companies attracted $498 million in venture and grant funding in 2025, an 8% increase year-over-year compared to 2024.

This result is particularly notable given wartime risks, limited access to capital, and the broader global slowdown in the venture capital market.

Investment Landscape 2025: Stabilization After the Shock

Funding in 2025 was broadly distributed across stages, rather than being concentrated in a handful of mega-rounds as in the pre-war years. At the same time, late-stage rounds (Series D and Growth) once again accounted for nearly 50% of total investment volume, signaling a gradual return of investors to larger check sizes.

A key positive signal was the sharp rebound in Series A, with volumes nearly doubling year-over-year. This indicates that the ecosystem is not merely “living off” its existing pipeline, but is actively generating a new layer of scalable businesses capable of entering global markets in the medium term.

Another critical shift was the dominance of foreign capital over local capital at early stages. For the first time since 2021, international investors invested more than Ukrainian funds—clear evidence of renewed confidence in Ukraine’s innovation potential despite the ongoing war.

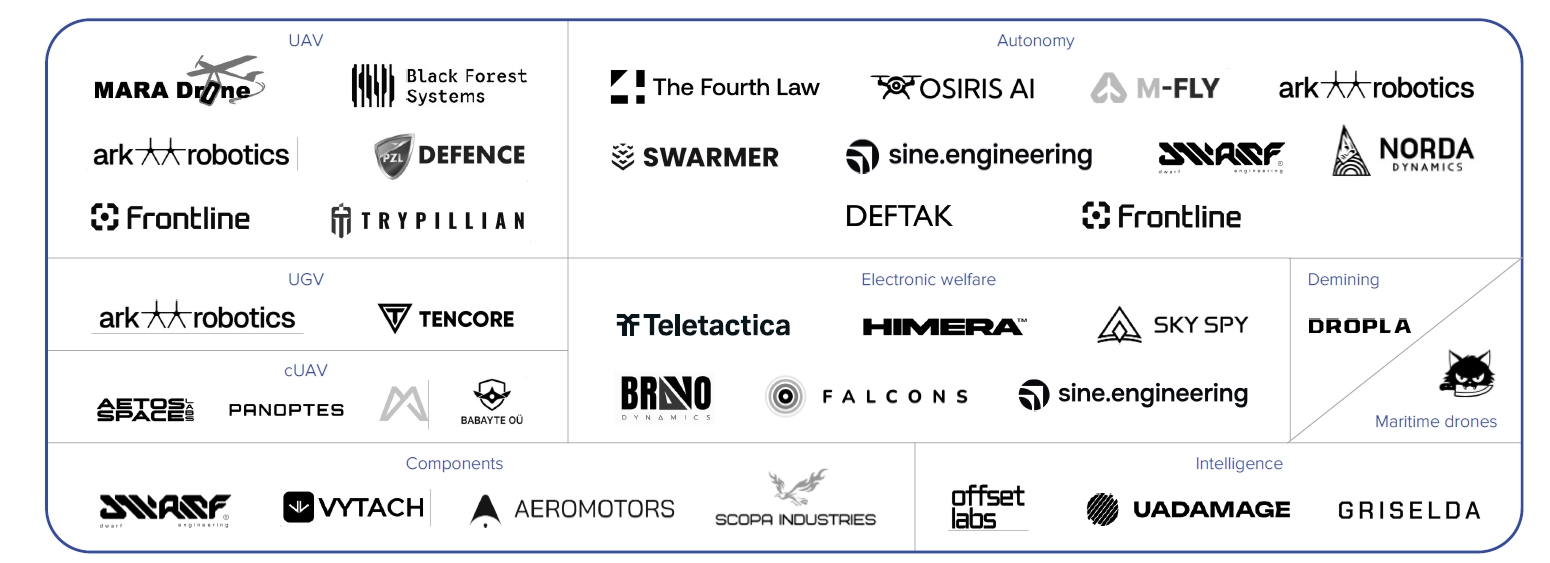

Defense Tech: The Largest and Fastest-Growing Sector

The undisputed growth driver of Ukraine’s tech market in 2025 was Defense Tech. According to AVentures estimates, investments in military and dual-use technologies reached $129 million, representing nearly a 19× increase over three years and +119% year-over-year growth.

Defense Tech startups in Ukraine

Ukrainian defense tech is unique for several reasons:

-

real-world combat validation of products;

-

rapid feedback loops between the battlefield and developers;

-

a strong focus on autonomous systems, electronic warfare, drones, navigation, and secure communications;

-

early integration with NATO and U.S. defense ecosystems, despite formal export restrictions.

The average deal size in the sector increased fivefold to $2.1 million in 2025, while the total number of deals declined slightly. This is a classic sign of sector maturity: the market is shifting from mass experimentation to scaling the most effective solutions.

Importantly, some Ukrainian defense startups have already reached operational profitability, operating exclusively on domestic contracts—an exceptional case for the global venture market.

AI as a Horizontal Technology: Not Hype, but Infrastructure

In 2025, artificial intelligence ceased to be a standalone segment and became a foundational infrastructure layer for most technology businesses. According to DealBook data, AI-focused startups attracted approximately $302 million, nearly three times more than companies without a significant AI component.

The most pronounced impact of AI is seen in defense tech, where autonomy algorithms, computer vision, and data analytics directly influence battlefield outcomes. In the civilian sector, AI is transforming edtech, fintech, martech, cybersecurity, and enterprise solutions.

Despite this momentum, a single dominant Ukrainian-born AI leader has yet to emerge—leaving room for a new wave of companies in 2026–2028.

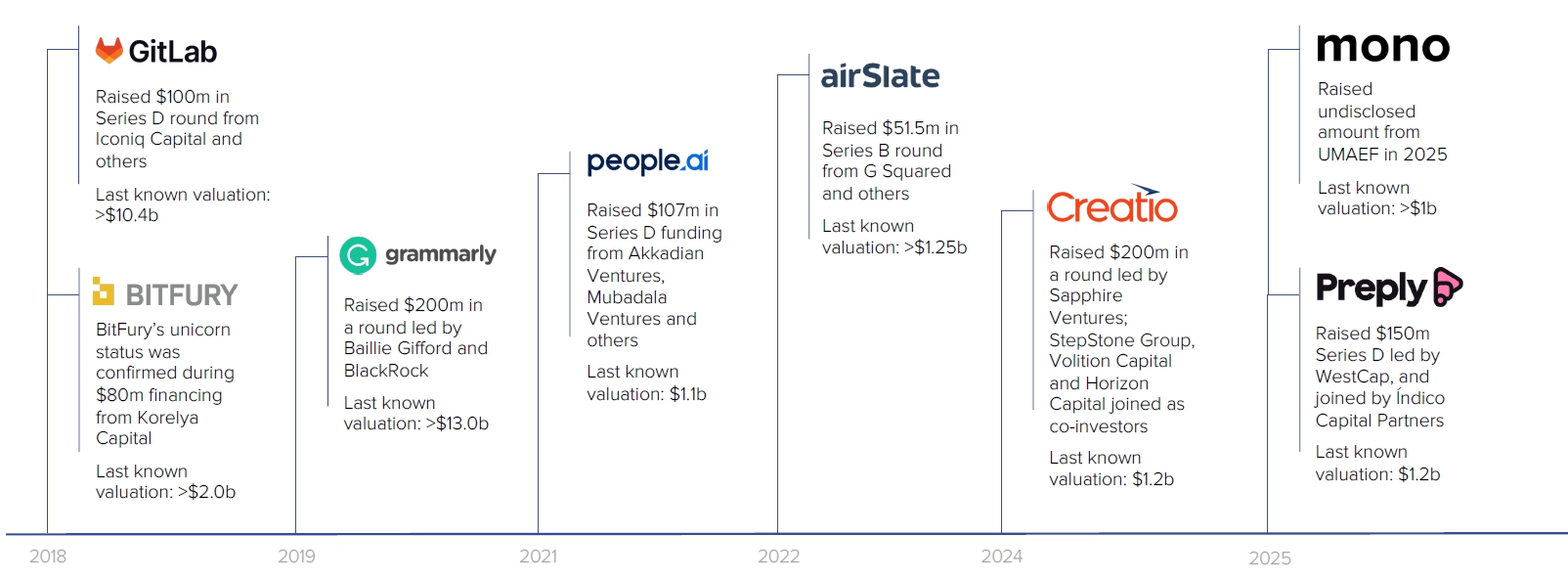

New Unicorns and Signals of Market Maturity

The year 2025 became historic as Ukraine produced two new unicorns.

The first was Fintech IT Group (monobank), which raised capital at a valuation exceeding $1 billion, becoming Ukraine’s first fintech unicorn. The second was Preply, a global edtech platform that, following a $150 million Series D round, was valued at $1.2 billion and reached EBITDA-positive status.

Unicorns co-founded by Ukrainians

These cases demonstrate a fundamental point: Ukrainian companies can not only grow but also scale globally during wartime, provided they have the right business model and market positioning.

M&A and Public Markets: Early Signals of Trust

Despite continued caution among strategic buyers, 2025 delivered several landmark M&A transactions, including Kyivstar’s acquisition of Uklon for over $155 million—one of the largest deals in Ukraine since the start of the war.

Particularly noteworthy was Kyivstar’s IPO on NASDAQ, which served as a global vote of confidence in Ukraine. The company raised $178 million at a $2.3 billion valuation and announced investment plans of up to $1 billion in Ukraine by 2027, positioning M&A as a core growth tool.

Grants as the Foundation of the Ecosystem

Grant funding remains a critical stabilizer for the market. In 2024–2025, Ukrainian startups received approximately $78 million in grants, with funding volumes increasing 56% year-over-year.

Key contributors include:

-

Brave1 as the core of the defense ecosystem;

-

Seeds of Bravery and EU programs;

-

Google for Startups Ukraine Support Fund;

-

Ukrainian Startup Fund with support from UMAEF.

Grants enable project launches in areas where venture capital is not yet ready to take on risk.

Conclusion: Ukraine’s New Role in the Global Tech Value Chain

In 2025, Ukraine’s technology market is no longer a “survival market.” It is becoming a market that creates unique expertise—in defense tech, AI, autonomous systems, cybersecurity, and complex engineering solutions.

Ukraine is gradually transitioning:

-

from an outsourcing-driven model to a product and R&D hub;

-

from grant-based survival to structural growth;

-

from a local market to deep integration into global technology and defense ecosystems.

In this context, 2025 can be seen as a true inflection point, defining the trajectory of Ukraine’s tech market for the coming decade.