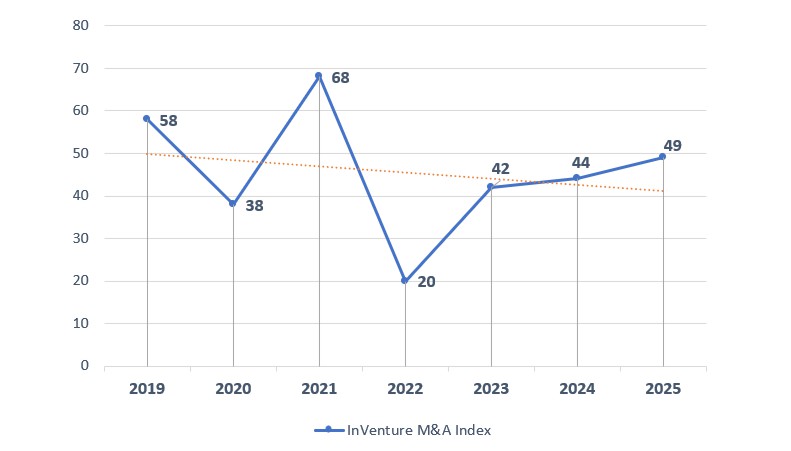

Covering 2019–2025, the InVenture M&A Index reflects the key phases of Ukraine’s M&A market evolution — from pre-war stability through crisis shocks to gradual recovery under wartime conditions. The index combines data on completed M&A deals, overall investment activity, and investor behavior, providing a holistic view of the market’s current state.

InVenture M&A Index Dynamics in Ukraine (2019–2025)

In 2019, the index stood at 58 points, indicating a relatively mature M&A market with a moderate number and value of deals. In 2020, it declined to 38 points amid the COVID-19 pandemic, a global investment pause, and delayed transactions.

2021 became the peak year in the observed period, reaching 68 points, driven by pent-up demand after the pandemic, abundant liquidity, and record investor activity. However, in 2022, the index collapsed to 20 points — the lowest level for the entire period — due to the full-scale invasion, a sharp decline in deals, and the near halt of foreign direct investment.

Starting in 2023, the market entered an adaptation phase: the index rose to 42 points, increased to 44 points in 2024, and reached 49 points in 2025. The recovery has been supported by growing transactional activity, local deals, and renewed investor interest in specific sectors — agriculture, energy, real estate, technology, defense tech, and distressed assets.

At the same time, the index remains below pre-war highs due to the limited volume of large-scale transactions and restrained foreign capital participation. The current IMAI trend indicates not a full recovery, but the formation of a new, more selective model of M&A activity focused on strategic rationale and long-term resilience.

“The dynamics of the InVenture M&A Index show that Ukraine’s M&A market has moved past the initial shock of the full-scale war and entered a phase of adaptive recovery. We see rising investment activity even under wartime conditions, but the structure of deals has become more selective. In the coming years, the key driver will be not the number of transactions, but their quality and strategic logic,” said Oleksii Oleinikov, Managing Partner at InVenture.

About the Index and Methodology

The InVenture M&A Index (IMAI) is an integral indicator that reflects the current condition and dynamics of Ukraine’s M&A market, including its activity level, structural depth, and ability to recover amid elevated risks.

Unlike conventional M&A statistics, which capture only completed deals, the InVenture M&A Index reflects the real dynamics of investment decision-making — from initial investor interest through to transaction closing. This allows the index to be used as a leading indicator of Ukraine’s M&A market conditions.

The index does not aim to fully capture all non-public transactions, but it provides the most representative picture of market trends and sentiment given the limited transparency of Ukraine’s M&A market.

The InVenture M&A Index is a proprietary analytical product developed by the InVenture platform and is updated on an annual basis. In the future, InVenture plans to expand the index by publishing interim indicators and thematic sub-indices by economic sector.

The InVenture M&A Index is intended for institutional and private investors, business owners, advisors, and public-sector stakeholders as a tool to assess M&A market cycles, deal timing, and, in the future, to benchmark Ukraine against other emerging markets.

The index is used:

-

by investors — to determine optimal market entry timing;

-

by business owners — to assess the best window for asset sales;

-

by consultants and brokers — to analyze overall market sentiment and participant expectations;

-

by media — as a quick barometer of Ukraine’s M&A market conditions.

The index is calculated annually using a historical database dating back to 2013, enabling the tracking of pre-war, crisis, and recovery phases of market development. Its calculation relies on public M&A deal data, macroeconomic statistics, industry analytical reviews, and InVenture’s proprietary operational data.

More detailed information about the InVenture M&A Index

InVenture’s M&A deals database in Ukraine

Annual reserach of Ukraine’s M&A market will be released soon