About the InVenture M&A Index (IMAI)

The InVenture M&A Index (IMAI) is an integrated indicator that reflects the current condition and dynamics of the Ukrainian M&A market, including its level of activity, structural depth, and capacity to recover under heightened risk conditions.

Unlike traditional M&A statistics that capture only completed transactions, the InVenture M&A Index (IMAI) reflects the real dynamics of investment decision-making — from initial investor interest to deal closure. This allows the Index to be used as a leading indicator of the Ukrainian M&A market.

While the Index does not aim to capture every non-public transaction, it provides the most representative picture of market trends and sentiment, taking into account the limited transparency of the Ukrainian M&A market.

The InVenture M&A Index is a proprietary analytical product of the InVenture platform and is updated on an annual basis. Going forward, the Index is expected to expand with interim indicators and thematic sub-indices by economic sector.

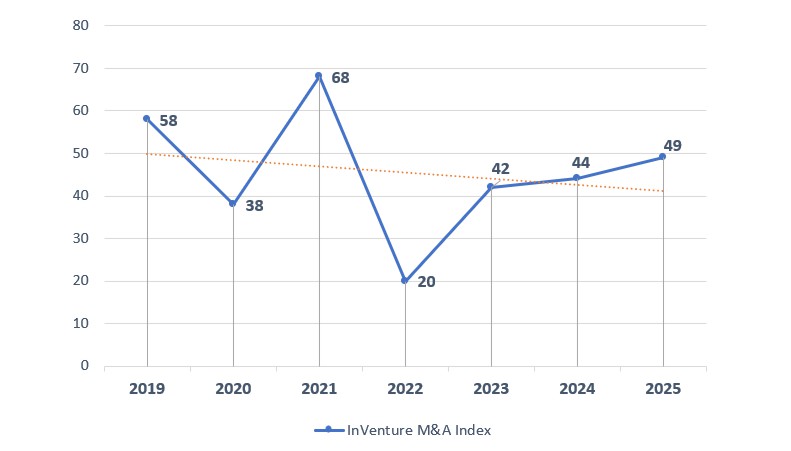

InVenture M&A Index Ukraine: 2019–2025

| # | Metric | Weight | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Deal Activity Score (DAS) | 0.25 | 10 | 10 | 15 | 7 | 12 | 14 | 15 |

| 2 | Deal Volume Score (DVS) | 0.25 | 17 | 6 | 18 | 2 | 11 | 8 | 9 |

| 3 | Market Depth Score – M&A-to-GDP (MDS) | 0.15 | 8 | 5 | 8 | 2 | 5 | 5 | 5 |

| 4 | Foreign Investor Activity (FIA) | 0.10 | 4 | 4 | 6 | 3 | 5 | 7 | 5 |

| 5 | Sector Diversification Score (SDS) | 0.10 | 8 | 5 | 9 | 3 | 4 | 4 | 6 |

| 6 | Investor Activity Index (IAI) | 0.15 | 11 | 9 | 12 | 3 | 6 | 8 | 9 |

| InVenture M&A Index (IMAI) | 1.00 | 58 | 38 | 68 | 20 | 42 | 44 | 49 |

Source: InVenture M&A Index (IMAI), InVenture M&A Database

Update status: Q4 2025

Update frequency: Annual

Interpretation of the Index Scale

IMAI value interpretation:

-

0–30 — Deep market stagnation, minimal investment activity

-

30–50 — Crisis / transition phase

-

50–70 — Stabilization and formation of investment demand

-

70–85 — Active M&A market phase

-

85–100 — Overheated market with high multiples and intense competition for assets

Methodology

The InVenture M&A Index is designed for institutional and private investors, business owners, advisors, and public-sector stakeholders as a tool for assessing M&A market cycles, deal timing, and benchmarking Ukraine against other emerging markets.

The Index is used:

-

by investors — to identify optimal market entry timing;

-

by business owners — to assess asset sale windows;

-

by advisors and brokers — to analyze overall market sentiment and expectations;

-

by media — as a quick barometer of the M&A market.

The Index is calculated annually using a historical database dating back to 2013, enabling analysis of pre-war, crisis, and recovery phases of market development. The calculation is based on publicly available M&A data, macroeconomic statistics, industry analytical reports, and proprietary operational data from the InVenture platform.

Components of the InVenture M&A Index (IMAI)

The InVenture M&A Index (IMAI) consists of six key components, each reflecting a distinct dimension of the development and quality of Ukraine’s M&A market.

1. Deal Activity Score (DAS)

Measures transactional activity by tracking the number of completed and announced M&A deals during the reporting period, adjusted for dynamics versus prior years. This component reflects the intensity of market processes and overall business activity.

2. Deal Volume Score (DVS)

Assesses the total monetary value of M&A transactions. The indicator demonstrates deal scale, capital concentration, and the market’s ability to attract substantial investment despite elevated risks.

3. Market Depth Score (MDS)

Measures market depth via the ratio of total M&A deal value to GDP (M&A-to-GDP ratio). This component reflects the degree of integration of M&A activity into the national economy and the market’s structural maturity.

4. Foreign Investor Activity Score (FIA)

Captures the level of foreign investor participation in M&A transactions, considering both deal count and deal value. It serves as an indicator of international capital confidence in the country, regulatory environment, and investment outlook.

5. Sector Diversification Score (SDS)

Evaluates the sectoral structure of the M&A market, specifically the degree of diversification across industries. Higher values indicate lower concentration risk and more balanced market development.

6. Investor Activity Index (IAI)

A proprietary InVenture indicator reflecting real-time investor engagement. It is based on platform and market operational data, including the number of initiated and closed deals, investment inquiries, signed NDAs, initial deal screening stages, and actual investor site visits.