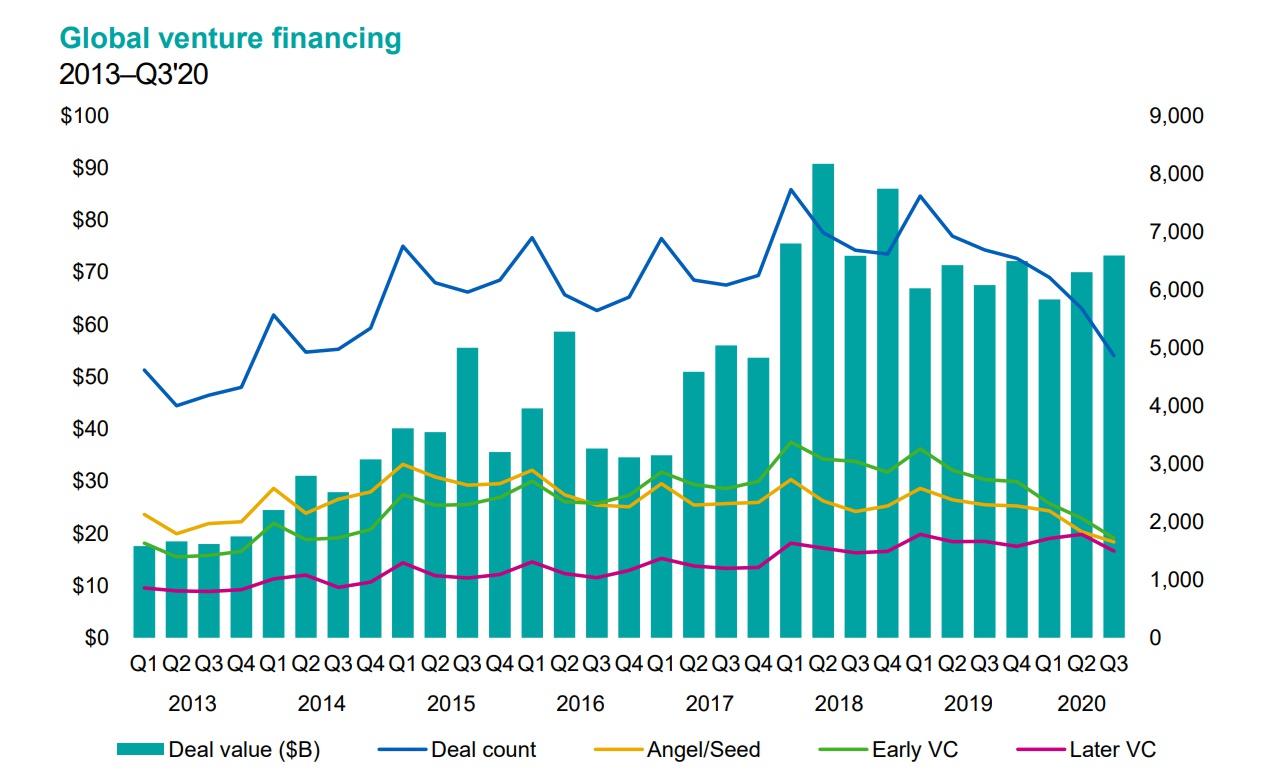

Global VC investment continued to be very strong in Q3’20, defying concerns of a potential drop-off in investment due to the challenges associated with getting deals completed during a pandemic.

While the number of VC deals dropped for a sixth straight quarter, the level of investment remained high, as VC investors continued to focus on late-stage companies. Three $1 billion+ mega-deals helped to propel the global investment total in Q3’20, including raises by WM Motor in China, SpaceX in the US, and Flipkart in India.

The US accounted for the largest amount of VC investment globally during Q3’20 at $37.8 billion raised, although both Asia and Europe also saw increases compared to the previous quarter. In the US, a diverse range of companies with digital business models attracted large funding rounds, including SpaceX ($1.9 billion) wealthtech Robinhood ($600m), online marketplace Offerup ($452m), egaming company Vindex ($300m), and online retail company Thrasio ($260m).

Global venture financing

After 2 relatively weak quarters of investment, VC investment in Asia bounced back, driven by a resurgence of activity in China. China accounted for seven of the region’s top deals during Q3’20, including the largest deal of the quarter, a $1.5 billion raise by Shanghai-based automotive company WM Motor. Other areas of Asia, especially India, also attracted significant deals, including India (Flipkart: $1.2 billion) and edtech provider BYJU ($500m), as well as Singapore based Grab ($200m), and Indonesia (Traveloka: $250m).

Following a record high in Q2’20, Europe continued to see robust VC investment this quarter. Fintech and healthtech were among the hottest areas of investment this quarter. Corporate investment was quite strong in Europe, particularly in the UK which set a new quarterly record high for CVC investment by a large margin.

During Q3’20, a number of technology companies held highly successful IPO exits. In September, US-based companies Snowflake and gaming platform Unity Software raised $3.36 billion and $1.3 billion respectively, while Israel-US DevOps platform JFrog raised $509 million. All three companies saw strong gains on their first day of trading, with Snowflake’s share price more than doubling. US-based unicorns Palantir Technologies and Asana, meanwhile, chose to go the direct listing route, the first companies to do so since Slack in December 2019. In Q3’20, several other unicorns also filed IPO documents indicating their intent to exit, including Airbnb and Wish in the US and Ant Financial on the Hong Kong Stock Exchange.

Ukrainian venture capital market reflects the events taking place in Europe and the world

Once again, the Ukrainian venture capital market reflects the events taking place in Europe and the world: the number and volume of transactions with venture capital in Ukraine in the 3rd quarter was significantly higher than in the previous one. 16 deals were reported, of which 10 deals worth $ 143 million, excluding the agreement to raise funds for Revolut. In the previous quarter, 12 deals were concluded, of which 10 deals for the amount of $ 36 million (the size of transactions is not known for all deals).

This emphasizes that Ukraine is an integral part of the global technology and innovation market. It is pleasant to note that local players remain active investors in Ukrainian startups. For example, during the 3rd quarter, Ukrainian investors ICU Ventures, Horizon Capital, Genesis Investments, Fedoriv Group, TA Ventures, SMRK, Quarter Partners, Pragmatech financed such Ukrainian projects as 3DLOOK, Augmented Pixels, WareTeka, Doc.ua, Liki.24 , Esper Bionics and Hurma Systems ", - said Ilya Segeda, leader of consulting services.

InVenture database "Venture Capital, Startups, M&A transactions in the IT sector of Ukraine for 2019-2020"

Trends to watch for globally

VC investment is expected to remain steady headed in Q4’20, although the US presidential election and the possibility of a hard Brexit on December 31, 2020 could cause some investor concern. While the IPO market is rebounding, it could see a pause in advance of the November presidential election like trends seen with in the past.

COVID-19 is expected to remain a key driver of both investor caution and investment heading into Q4’20. As some jurisdictions enter a second wave of COVID-19 cases, VC investors will likely continue to focus on solutions aimed at addressing the needs of businesses and consumers using digital approaches. Healthtech and fintech are expected to remain key areas of investment, in addition to B2B solutions and edtech.

The drop off in early-stage deals is expected to continue, which could drive an increase in early-stage companies running out of cash. This will likely drive some consolidation, particularly in the sectors most negatively affected by the pandemic. It could also drive increased strategic and distressed investment activity.

Download Venture Pulse Q3 2020 "Global analysis of venture funding"