Overall trends in the development of Ukraine’s M&A market

According to InVenture’s estimates, the total value of announced and completed M&A deals in Ukraine in 2025 amounted to $1.35bn, which is 10% higher than in 2024 ($1.2bn). The number of transactions also showed moderate growth — up to 123 deals in 2025 versus 114 deals in 2024, indicating a gradual recovery of investment activity despite wartime risks and constrained access to capital.

The calculations include corporate acquisitions, investment transactions in the technology sector, state asset privatization deals, as well as sales of pledged and distressed assets. At the same time, deals by Ukrainian companies outside the country were not included.

Low deal transparency remains one of the key structural issues of the market: approximately 15% of transactions cannot be valued due to the lack of public data. Some of these deals, in our assumption, may have exceeded tens of millions of US dollars. In addition, several dozen deals with ticket sizes above $1m did not enter the public domain — they were not covered by the media, were not subject to review by the Antimonopoly Committee of Ukraine, or were settled outside the banking system.

Given limited publicity and the low level of disclosure for a significant share of transactions, InVenture estimates that the actual size of Ukraine’s M&A market in 2025 was higher than officially recorded. Based on our expert assessment, the real market size may have reached approximately $1.7bn.

The key driving force of Ukraine’s M&A market in 2025 remained domestic investors. They accounted for 81 deals, or 65% of the total number, with an aggregate value of around $1.1bn, equivalent to over 80% of the market’s total value. This structure reflects the adaptation of Ukrainian capital to a wartime economy, local investors’ stronger awareness of risks and opportunities, as well as their willingness to work with distressed, restructured, and undervalued assets.

With the participation of foreign investors, 43 deals were concluded in 2025 (35% of the total number). However, in value terms their contribution remained limited — around $250m, which corresponds to only 19% of the total market value. This imbalance points to persistently high country risk, the caution of international capital, and a foreign investor focus primarily on selective, strategic, or special situations with an asymmetric risk-return profile.

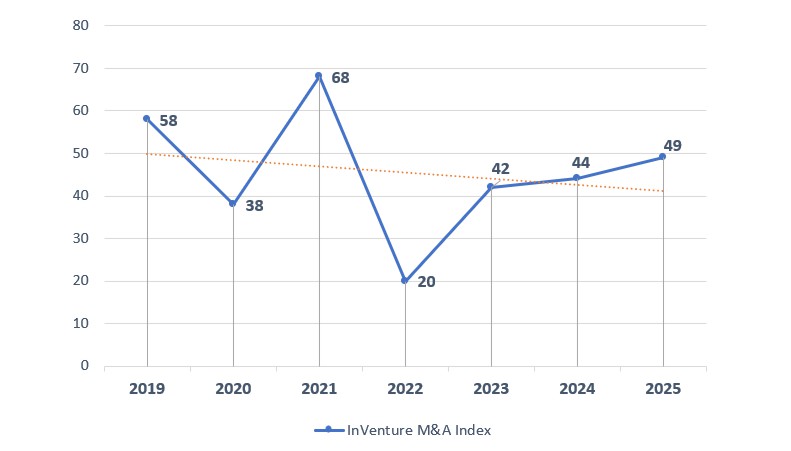

InVenture M&A Index

InVenture M&A Index (IMAI) is an integrated indicator that reflects the real state and quality of Ukraine’s M&A market, combining quantitative metrics (number and value of deals) with qualitative ones (market depth, participation of foreign capital, sector diversification, and actual investor activity).

- In 2019, the index stood at 58 points, reflecting a mature M&A market with a stable number of deals and moderate invested capital volumes.

- In 2020, it declined to 38 points under the impact of the COVID-19 pandemic, a global contraction of investment activity, and widespread deal postponements.

- 2021 became the record year in the observed period — 68 points. Growth was driven by the execution of deferred investment decisions, excess liquidity, and high investor activity.

- In 2022, the index fell to 20 points, as a direct result of the full-scale invasion, a sharp narrowing of the deal market, and the effective exit of foreign capital.

- From 2023, the M&A market has been gradually adapting to new realities: the index rose to 42 points, reached 44 in 2024, and increased to 49 points in 2025. The recovery has been supported by higher operational activity, domestic transactions, and increased interest in specific sectors — agribusiness, energy, logistics, defence, and distressed assets.

InVenture M&A Index Ukraine: 2019–2025

“The dynamics of the InVenture M&A Index show that Ukraine’s M&A market has passed through the shock phase and moved into adaptive recovery. However, current index levels still do not reach pre-war highs due to the limited number of large deals and the restrained presence of foreign investors. We see growing investment activity by local companies even during the war, but the deal structure has become more selective. The key driver in the coming years will be not the number of deals, but their quality and strategic rationale,” — notes Oleksii Oleinikov, Managing Partner at InVenture.

Key drivers of increased M&A activity in 2025

In 2025, Ukraine’s M&A market developed largely not because of economic growth, but due to structural shifts, asset redistribution, crisis factors, and further business adaptation to wartime conditions.

First, the preservation of FX and regulatory restrictions on capital outflows from Ukraine encouraged the corporate sector to allocate free liquidity to acquiring assets inside the country or investing in foreign assets via permitted outbound structures or other schemes. For many companies, M&A became a tool to reinvest profits and preserve capital value amid limited financial mobility.

Second, in 2025 the wave of business relocations from frontline regions continued and became systemic — primarily from Kharkiv, Zaporizhzhia, Sumy, Chernihiv, and partly Dnipropetrovsk regions. This created sustained demand for ready-made production, warehousing, and industrial assets in central and western regions of Ukraine, where businesses sought to minimize security and logistics risks.

Third, the deterioration of financial conditions for part of the business landscape became a key catalyst for M&A activity. Significant debt burdens, rising production costs, weaker domestic consumer demand, more complex employee reservation procedures, as well as higher tax and regulatory pressure increased the number of so-called stressed assets entering the market through forced sales or restructuring.

Another factor was the emigration of business owners abroad, which in 2025 was often combined with loss of operational control or reduced motivation to continue managing assets in Ukraine. This pushed owners toward faster exit solutions, including with significant discounts to pre-war valuations.

A significant driver remained the development of the defence-industrial sector, which generated additional demand for industrial real estate, production sites, warehouse facilities, and land plots to establish or scale manufacturing. In a number of cases, defence orders became the trigger for M&A transactions in industrial real estate and industrial asset segments.

In 2025, political and legal risks and pressure on certain business owners also persisted, leading to asset sales motivated by capital protection, changes of jurisdiction, or the reduction of personal risks.

Separately, the intensification of privatization processes should be highlighted, including new tenders for state asset sales offering investors opportunities to acquire large assets at attractive prices. State privatization in 2025 remained one of the few market segments with relatively high transparency and clear entry rules.

Largest M&A deals in Ukraine in 2025

In 2025, as in the year before, Ukraine’s M&A market recorded no mega-deals. The market remained segmented, dominated by mid-sized and large transactions — reflecting both wartime risks and investors’ limited readiness to assume large-scale country exposure.

The largest deal by value in 2025 was the acquisition by telecom group Kyivstar of online taxi service Uklon for $155m. The deal was indicative of strategic consolidation in the digital and consumer-tech segments and confirmed the interest of major Ukrainian corporates in scaling ecosystem business models.

The second-largest transaction was the exercise of an option to acquire 85% of Vinnytsia Oil-and-Fat Plant (ViOil) by US agribusiness corporation Bunge for $138m. This deal underscored sustained interest from international strategic investors in Ukraine’s agri-processing sector even amid the war.

Third place by value was taken by the acquisition by investment company City Capital Group of businessman Ofer Kerzner of the first phase of Leonardo Business Center and “Ukraina” Department Store Mall for $70m. It became one of the largest commercial real estate transactions during the full-scale war and a signal of a gradual return of interest to high-quality core assets in Kyiv.

Top 20 investment and M&A deals in Ukraine in 2025

| # | Deal date | Target / M&A deal | Seller | Buyer | Buyer HQ | Deal value ($m) | Confirmation | Stake / subject, % | Sector |

|---|---|---|---|---|---|---|---|---|---|

| 1 | February 2025 | Uklon | Serhii Smus, Vitalii Diatlenko, Dmytro and Viktoriia Dubrovskyi | PJSC “Kyivstar” | Ukraine | 155.0 | Confirmed | 97% | IT, technology & telecommunications |

| 2 | September 2025 | ViOil / Vinnytsia Oil and Fat Plant (LLC “Aktyv-OZhK” / Eltorne Limited) | Oleksii Ponomarchuk | Bunge | Switzerland | 138.0 | Confirmed | 85% | Food industry |

| 3 | June 2025 | “Leonardo” Business Center (23,155 m²) and “Ukraina” Department Store Mall (45,330 m²) | IBRC (Irish Bank Resolution Corporation) | City Capital Group (Ofer Kerzner) | Ukraine | 70.0 | Confirmed | 100% | Construction & real estate |

| 4 | December 2025 | Tabletki.ua service | Oleksandr Muravshchyk, Nataliia Muravshchyk, Yurii Savchyn, Volodymyr Osmachko, Yevhen Muravshchyk, Vadym Rohatynskyi | PJSC “Kyivstar” | Ukraine | 60.0 | Estimated | 100% | Retail trade |

| 5 | June 2025 | International Exhibition Centre (IEC), 73,230 m² | Oleksandr Tkach | Maksym Krippa | Ukraine | 60.0 | Estimated (AI) | 75% | Construction & real estate |

| 6 | May 2025 | Modern Expo | Bohdan Lukasyk | Petro Pylypiuk | Ukraine | 60.0 | Estimated (AI) | 45% | Machinery & equipment manufacturing |

| 7 | January 2025 | Shell filling stations — 51% (Alliance Holding LLC) | Shell Overseas Investments B.V. | PJSC “Ukrnafta” | Ukraine | 45.0 | Estimated (AI) | 100% | Retail trade |

| 8 | April 2025 | Idea Bank | Getin Holding | Alkemi Limited (Serhii Tihipko) | Ukraine | 36.5 | Confirmed | 100% | Financial services |

| 9 | February 2025 | SE “SK Omega-1 Logistics” | Dragon Capital (“Ueri Holding Limited”, Cyprus) | EVA (Rush LLC; Ruslan Shostak, Valerii Kiptik) | Ukraine | 36.0 | Estimated | — | Construction & real estate |

| 10 | November 2025 | Sky Park Shopping Center (30,000 m²) / Askor Company LLC | Dragon Capital (Tomas Fiala) | Inzhur REIT | Ukraine | 35.8 | Confirmed | 100% | Construction & real estate |

| 11 | November 2025 | ANP / Avias filling station network | Yurii Kiperman | UPG LLC | Ukraine | 30.0 | Estimated (AI) | 100% | Retail trade |

| 12 | June 2025 | Beiken Energy Ukraine LLC | Beiken Energy Group Co., Ltd (China) | Prato Golf Investments LTD (Ihor Mazepa) | Ukraine | 25.0 | Confirmed | 100% | Extractive industries |

| 13 | May 2025 | N’UNIT and Mostyska container terminal | Yehor Hrebennikov, Lemtrans (Rinat Akhmetov) | Medlog SA (MSC) | Switzerland | 25.0 | Estimated | 50% | Transport & warehousing |

| 14 | April 2025 | Hlukhiv-Agroinvest LLC (17,000 ha) | NCH Capital (Agroprosperis Group) | Krolevets Feed Mill LLC | Ukraine | 25.0 | Estimated | 100% | Agriculture |

| 15 | March 2025 | Building 6,869 m² (Kyiv, 46 Volodymyrska St.) | DGF (Deposit Guarantee Fund) | SE “National Investment Fund of Ukraine” | Ukraine | 22.0 | Confirmed | 100% | Construction & real estate |

| 16 | July 2025 | Kairos-Holding LLC (16,600 ha) | Bohdan Kuspys, Ivan Kotso | OKKO / Vi.An Holding Limited (Vitalii Antonov) | Ukraine | 20.0 | Estimated | 100% | Agriculture |

| 17 | June 2025 | Ukrbud construction company (114,000 m²) | SPFU (State Property Fund of Ukraine) | Techno-Online LLC (Yevhen and Vasyl Astion, Maryna Ayab) | Ukraine | 19.0 | Confirmed | 100% | Construction & real estate |

| 18 | April 2025 | Obolon golf club | KSG LLC (Serhii Kiroianets) | KSE | Ukraine | 18.0 | Confirmed | 100% | Construction & real estate |

| 19 | March 2025 | Private agricultural lease enterprise “Zoria” | Agropodservis (George Rohr, Maurice Tabasinik) | Agroton / Agroton Public Limited (Cyprus) | Ukraine | 17.0 | Estimated | 100% | Agriculture |

| 20 | September 2025 | Swarmer | Serhii Kupriienko, Alex Fin | Broadband Capital Investments, RG.AI, Radius Capital, Green Flag Ventures, D3 Ventures, Network VC | Foreign investors | 15.0 | Market-announced | 40% | IT, technology & telecommunications |

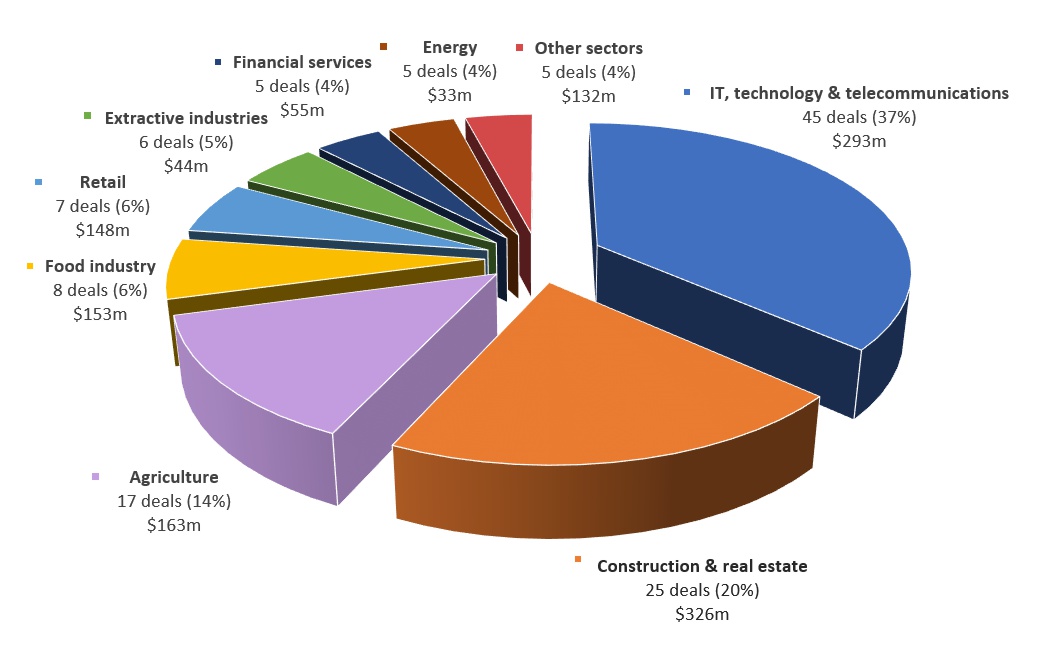

Sectoral trends in Ukraine’s M&A market

The sectoral structure of investment and M&A deals in 2025 demonstrates a dual focus typical for an economy operating under wartime conditions while gradually moving into a phase of adaptation and recovery:

-

by number of deals, the market was primarily driven by the technology sector (IT, digital, telecommunications);

-

by value of attracted capital, real assets dominated — primarily real estate, agriculture, and food processing.

This structure reflects a shift in investment behavior: from short-term liquidity preservation tactics to pragmatic medium- and long-term strategies focused on control over tangible assets, export chains, FX revenues, and post-war recovery potential.

Sectoral structure of investment and M&A deals in Ukraine in 2025

| № (by number / by value) | Sector | Number of deals | Deal value, $m |

|---|---|---|---|

| 1 (2) | IT, technology & telecommunications | 45 | 293 |

| 2 (1) | Construction & real estate | 25 | 326 |

| 3 (3) | Agriculture | 17 | 163 |

| 4 (4) | Food industry | 8 | 153 |

| 5 (5) | Retail trade | 7 | 148 |

| 6 (7) | Extractive industries | 6 | 44 |

| 7 (6) | Financial services | 5 | 55 |

| 8 (8) | Energy | 5 | 33 |

| — | Other sectors | 5 | 132 |

| Total | 123 | 1,347 |

IT, technology and telecommunications retained leadership by the number of deals — 45 transactions, accounting for more than one third of all deals completed during the year. The aggregate investment value in this sector was also substantial, totaling $293 million. The venture market traditionally attracts investors due to a combination of high scalability of business models, export orientation, a relatively low capital entry threshold, and strong human capital. Ukrainian technology companies continue to integrate into global value chains, working with international clients and funds even without a physical presence in the country. At the same time, the average deal size remained moderate, indicating the predominance of early- and mid-stage financing.

A distinct sectoral trend was the growth of investments in defence tech and Ukraine’s defence-industrial complex. The industry demonstrated its ability to attract international private capital, strategic industrial partners, and specialized venture funds, with a focus on drones, UAVs, battlefield software solutions, sensor systems, and dual-use technologies. In total, European and U.S. funds invested more than $100 million in defence startups, cementing the sector as a full-fledged component of the venture market. Alongside startup financing, joint ventures with leading Western players (including French and UK participation) were launched, as well as large-scale state and intergovernmental support programs — ranging from investor guarantees to the creation of specialized funds and miltech development programs. These instruments significantly reduced risks for private capital and accelerated the localization of production in Ukraine. As a result, in 2025 defence tech emerged as a structured, institutionally supported investment segment, where Ukraine is perceived not only as a high-risk market, but also as a source of unique technologies, R&D expertise, and battle-tested solutions.

Viktoriya Tigipko, Founder and Managing Partner at TA Ventures, President of ICLUB

For the Ukrainian venture market, 2025 was a year not of a leap, but of maturity. After several years of operating under full-scale war conditions, the ecosystem transitioned to a more conscious development model — with a focus on team quality, technological depth, and global scalability.

The highest investment activity in 2025 was observed in AI, defence tech, healthtech, deeptech, and B2B infrastructure solutions. At the same time, the market became significantly more selective: access to financing, regulatory complexity, and interaction with government and local partners remain key barriers — fully aligned with startups’ demand for capital, networks, and legal support.

For international investors, Ukraine in 2025 is increasingly perceived not as a ‘high-risk jurisdiction,’ but as a source of unique human capital, entrepreneurial resilience, and technological expertise. It is precisely the combination of this internal ecosystem motivation with the systematic work of venture funds and angel networks that creates the foundation for long-term growth of the Ukrainian venture market.

The construction and real estate sector topped the market by deal value in 2025, reaching $326 million across 25 transactions. This structure reflects growing investor interest in commercial, industrial, and logistics real estate, as well as in assets that may become the foundation for future reconstruction and economic growth. The sector is characterized by relatively large ticket sizes and longer investment horizons, which explains its leadership by value despite a smaller number of transactions. Investors increasingly view real estate as a capital preservation instrument, a risk hedge, and a source of stable cash flow. Notably, nine transactions totaling $68 million involved the sale of state-owned real estate assets, indicating sustained private-sector interest in privatization processes.

Ukraine’s agricultural sector traditionally ranks among the top three most investment-attractive industries and remains a key driver of the M&A market. In 2025, the sector recorded 17 deals totaling approximately $163 million, confirming its resilience even under wartime economic conditions.

Investment activity concentrated around control over land banks, agricultural production, storage and logistics infrastructure, and primary processing assets, which enable higher margins and reduced dependence on commodity price cycles.

Despite elevated military and regulatory risks, agriculture continues to be perceived by investors as a strategic, export-oriented sector capable of generating stable foreign-currency revenues, benefiting from predictable global demand, and serving as a foundation for long-term investment strategies.

A notable role in 2025 was played by consolidation deals, operational model optimization, and vertical integration, aimed at improving efficiency, reducing costs, and strengthening control over value chains.

Oleksii Oleinikov, Managing Partner at InVenture

“In 2025, a number of interrelated trends emerged in the agricultural sector that significantly influenced deal structures and investment sentiment. First, the market saw a noticeable number of offers for the sale of agricultural companies and land banks in frontline regions — primarily Chernihiv, Sumy, Kharkiv, and Dnipropetrovsk regions. For some owners, this became a forced decision due to security risks, infrastructure damage, and operational challenges.

At the same time, the trend of relocating agribusiness to central and western regions of Ukraine intensified, creating steady demand for agricultural assets in regions with more predictable business conditions. Interest remained particularly strong in assets located in favorable climate zones with fertile soils; however, the supply of high-quality assets was limited, fueling competition among investors and upward pressure on prices.

An additional factor was the rising cost of land lease rights, reflecting both a shortage of quality land plots and overall appreciation of agricultural assets in relatively safer regions.

Meanwhile, investment sentiment in 2025 remained volatile due to climate risks, global agricultural commodity price volatility, and logistical challenges caused by Russian strikes on port infrastructure. These factors made the agricultural market more selective: investors were willing to pay a premium for quality and safety, while taking a more cautious approach to risk assessment and long-term prospects.

A separate and important trend in 2025 was that a significant number of potential agricultural deals ultimately failed due to disagreements over settlement terms. Some asset owners insisted on payments abroad or the use of foreign jurisdictions for final settlements, creating additional regulatory, currency, and compliance risks for investors and complicating deal structures.

As a result, even where confirmed interest and agreed core economic parameters existed, many negotiations in 2025 did not reach closing. Key deterrents included valuation gaps, differing expectations regarding future risks, and misaligned strategic horizons between sellers and buyers. This further increased investor caution and reduced the number of completed transactions relative to declared demand for agricultural assets.

A telling example was the potential transaction between Kernel and IMC: despite the buyer receiving approval from the Antimonopoly Committee of Ukraine, the parties failed to agree on price and key strategic terms, leading to termination of negotiations. Similar scenarios occurred in a number of other transactions, including those advised by InVenture, where some deals were suspended at final valuation stages — further highlighting the gap between sellers’ expectations and the market’s real investment appetite in 2025.

The food industry ranked fourth in the sectoral investment structure, driven by one large systemic transaction that significantly impacted total investment volumes. Overall, eight deals totaling $153 million were completed in the sector. Investments were primarily directed toward capital-intensive production assets, export-oriented enterprises, and vertically integrated business models combining agricultural production with deep processing.

In the retail sector, seven deals totaling $148 million were completed in 2025. A relatively small number of transactions combined with comparatively large ticket sizes points to investor interest in large-scale national e-commerce projects as well as asset redistribution among fuel retail networks.

The financial sector recorded five deals totaling $55 million. Investment activity was concentrated mainly in the insurance segment, along with one banking transaction. Investors adopted a cautious approach, considering regulatory requirements and the overall condition of the financial system, while viewing select assets as opportunities for long-term entry.

In the extractive industries, at least six deals totaling $44 million were completed, reflecting restrained and selective investor interest. The primary focus was on local projects and the acquisition of special subsoil use permits. Large capital-intensive investments remained limited due to long implementation cycles, regulatory barriers, and heightened security-related risks.

The energy sector saw five deals totaling $33 million in 2025. Despite the sector’s strategic importance, investment activity was largely directed toward greenfield projects, particularly in decentralized generation and renewable energy. Amid growing electricity shortages in Ukraine, domestic companies significantly intensified investments aimed both at ensuring energy independence and developing commercial energy projects. Key drivers included systemic damage to energy infrastructure, rising costs of imported electricity, and the need to enhance business resilience to outages. The combination of private capital, bank financing, and support from international financial institutions is laying the groundwork for a structural transformation of the energy system — from centralized and vulnerable to more decentralized, diversified, and crisis-resilient. The most active investment areas in 2025 were renewable energy, gas generation, and energy storage systems, with a significant share of RES projects implemented with bank financing and international creditor support.

Deals by Ukraines Investors Abroad

Throughout 2025, Ukrainian companies continued to actively invest in foreign assets, using international expansion as a tool to reduce risks, gain access to new markets, and maintain growth momentum amid the war.

For large businesses, this was primarily a way to diversify operational and currency risks. For technology companies and venture investors, it offered opportunities to scale products globally and operate in a more stable regulatory environment. For Ukraine as a whole, outbound investments became a source of foreign currency inflows, international partnerships, and potential capital repatriation in the post-war period.

The largest Ukrainian outbound deal of 2025 was the acquisition by agribusiness holding MHP of 92% of the Spanish meat processing company Uvesa. The deal value amounted to €270 million (approximately $300 million), making it one of the largest international M&A transactions involving Ukrainian capital in recent years. The transaction significantly strengthened MHP’s presence in the EU market and reduced its dependence on Ukrainian production infrastructure.

In the industrial sector, a notable example of strategic expansion was Interpipe’s acquisition of the loss-making ArcelorMittal Tubular Products Roman S.A. plant in Romania, with annual revenue of approximately €73 million. The deal aligns with the strategy of bringing production closer to key European customers and end markets.

Similarly, Metinvest Group, owned by Rinat Akhmetov, acquired another loss-making Romanian pipe plant — ArcelorMittal Tubular Products Iasi S.A. (AMTP Iasi) — with annual revenue of around $70 million and an estimated valuation of less than €10 million.

In real estate, the Ukraine-linked investment fund Focus Estate Fund acquired three shopping malls in Poland: Sosnowiec Plaza, Ruda Śląska Plaza, and Rybnik Plaza.

Technology, Venture Capital and Outbound Expansion

Ukrainian IT companies and venture funds maintained their course toward international expansion in 2025 through targeted acquisitions of foreign players. Among the most notable transactions were:

-

The acquisition, valued at hundreds of millions of dollars, by Ukrainian unicorn Grammarly of the AI-powered email client Superhuman;

-

Sigma Software Group’s acquisition of U.S.-based consulting company A Society Group for $10 million, strengthening its position in the U.S. market;

-

Ciklum’s acquisition of Polish IT company GoSolve Group for $5 million;

-

TechMagic’s acquisition of Polish consulting firm Hitteps.

At the same time, Ukrainian venture funds, syndicates, and private investors deployed tens of millions of dollars into foreign startups. TA Ventures invested in a number of international projects, including Tarjama ($15 million), Flash Coffee ($3 million), HD ($7.8 million), Amwal Tech ($4 million), and Berry Street ($4 million), as well as Blossom Health, Kadeya, Proteinea, Aolani, Destinus, FinTech Farm, Liki24, Pleso Therapy, Wunderflats, Yepoda, Gropyus, and Impress.

Roosh Ventures participated in large funding rounds of Gable (around $20 million) and Prosper; SID Venture Partners invested in Go To-U; Flyer One Ventures invested in Heizma (€2.5 million); Toloka.vc invested in Alice Technologies, Portoro ($1.7 million), Forward Group ($1.2 million), and Bright Security ($1 million); Vesna Capital invested in Shook.ai; and Vchasno Group invested in fintech project Hippo.uz ($1 million).

A number of Ukrainian venture investors also recorded successful exits in 2025. Among them were Flyer One Ventures, which exited Greenscreens.ai in a transaction valuing the company at approximately $160 million; TA Ventures, which completed three exits (including Destinus); u.ventures and Digital Future (YouTeam); and InSoft.Partners, which exited Indeema and Forbytes.

Greenfield Projects and International Manufacturing Expansion

Beyond classic M&A and venture deals, Ukrainian companies actively launched greenfield projects and new production facilities abroad. Diligent Capital Partners led a $12 million investment round in Philippine neobank Tonik to scale its digital banking and lending model. Fintech Farm launched its fifth neobank, TezBank, in Uzbekistan. Nova Poshta increased investments in its European business to €10 million, while Odesa-based investor Vadim Rogovskiy acquired U.S. IT company Leadature through a newly established holding structure.

A separate trend was the relocation and scaling of manufacturing within the EU. Ukrainian-Polish retail equipment manufacturer Modern-Expo launched a new plant in Lublin, Kormotech began construction of its second factory in Lithuania with investments of €60 million, and entrepreneur Yevhen Cherniak invested $13 million in creating an international alcohol brand aimed at global markets.

In the defence sector, Ukrainian company Frontline Robotics announced the launch of Quantum Frontline, a joint drone production facility in Germany with Quantum Systems. The plant will serve as a new site for serial production of drones for the Ukrainian Defence Forces. Such projects indicate a shift by parts of Ukrainian business from a purely export model toward full integration into global value chains.

Ukrainian retailers and industrial groups also actively expanded their physical presence in Europe and Asia. Fozzy Group opened a store in Poland under a Carrefour franchise and is simultaneously being considered as a potential bidder for Carrefour Polska. Ajax Systems, a manufacturer of security systems, opened a new plant in Vietnam as part of its global manufacturing strategy.

Greenfield Investments and New Investment Projects in Ukraine

In addition to projects already under implementation in 2025, a significant number of Ukrainian and international investors announced large-scale greenfield projects during the year, designed for the medium- and long-term horizon. For some investors, these decisions were a forced response to changing business conditions in Ukraine; for others, they represented a strategic bet on post-war recovery and structural modernization of the economy.

The first systemic trend was the relocation of new production facilities to central and western regions of Ukraine. Most announced greenfield projects are concentrated in Lviv, Ternopil, Khmelnytskyi, Vinnytsia, Volyn, Zakarpattia, and Kyiv regions. Investors increasingly choose locations with better logistics to EU markets, access to labor, and lower security risks — effectively shaping a new geography of industrial development.

The second trend is reindustrialization and import substitution. A significant share of greenfield projects is focused on new production facilities in construction materials, glass, metallurgy, food processing, and agro-processing. Investors prioritize products with high domestic demand or guaranteed demand from the EU. At the same time, the share of deep-processing projects is growing — from agricultural raw materials to food ingredients, feed, bioproducts, and specialized materials — increasing value added and export potential.

The third key direction is the energy and infrastructure component of greenfield investments. Many new production projects integrate their own generation capacity, energy storage systems, or access to gas and renewable energy from the outset. This reflects structural changes in business models, where energy autonomy becomes a baseline condition for launching capital-intensive facilities. In parallel, logistics hubs, port and rail terminals, and Class A warehouses are developing, forming the foundation for the recovery of export infrastructure.

A separate trend is the growing role of international financial institutions and foreign strategic investors in greenfield projects. IFC, EBRD, Norfund, and export credit agencies are increasingly involved in financing new production facilities, acting as catalysts for private capital. For foreign companies, investments in 2026–2027 are often viewed as an early entry into Ukraine’s recovery market, allowing them to secure positions in key sectors before the full return of global capital.

Another notable trend is the sectoral diversification of greenfield investments. Alongside traditional industrial and agricultural projects, investments are emerging in the defence industry, machinery manufacturing, production of components for military equipment, as well as projects related to housing for internally displaced persons (IDPs) and the restoration of social infrastructure. Some of these projects have a hybrid nature, combining commercial logic with state or donor support.

Overall, the announced greenfield investments for 2026–2027 form a pipeline of deferred investment demand that can be realized subject to security stabilization and continued access to financing. For Ukraine’s economy, this signifies a gradual transition from a survival mode to a structural transformation phase, where new production capacity, logistics, and energy infrastructure lay the foundation for long-term post-war growth.

Financing of Ukraine’s Corporate Sector by International Financial Institutions

In 2025, international financial institutions (IFIs) continued to play a critically important role in supporting financing for Ukraine’s corporate sector, effectively substituting for part of market-based lending, which remained constrained due to wartime risks, a high cost of capital, and tighter regulatory requirements for banks. In practice, IFIs became a catalyst for the recovery of corporate lending, reduced systemic risks for the banking sector, and created conditions for implementing investment projects that otherwise would have been postponed or cancelled.

The key institutions shaping the architecture of this financing were the EBRD, the EIB, and the IFC, acting as direct lenders, guarantors, and providers of risk-sharing instruments.

The first and most visible trend was the large-scale use of guarantee instruments and risk-sharing mechanisms. Instead of providing direct loans to individual companies, IFIs increasingly issued guarantees to commercial banks, enabling a multiplier effect in business lending volumes. The EBRD implemented a number of guarantee programs for Raiffeisen Bank, Crédit Agricole, ProCredit Bank, UKRSIBBANK, OTP Bank, KredoBank, Ukreximbank, and other institutions, opening credit lines worth tens and hundreds of millions of euros. This approach reduced banks’ risks and stimulated a resumption of lending even in segments with elevated volatility.

The second systemic trend was the redirection of financial flows toward small and medium-sized enterprises (SMEs), which IFIs view as a key driver of economic resilience. Large-scale SME financing programs were launched through Ukrainian banks, including with participation from the EBRD, the EIB, and the IFC. The focus was not only on liquidity, but also on investment loans enabling companies to modernize production, adapt to new logistics routes, and improve operational efficiency.

The third important area was support for corporate investments in sustainability, energy efficiency, and energy autonomy. IFIs actively financed projects aimed at modernizing infrastructure and developing energy systems, district heating networks, logistics, and industrial facilities. Significant credit resources were directed both to real-sector companies — particularly in retail, pharmaceuticals, food production, and industrial manufacturing — and through state-owned and systemically important banks acting as financial intermediaries for businesses.

The fourth trend was the combination of IFI financing with export credit agency (ECA) instruments, especially in large industrial projects. Examples of long-term financing under ECA guarantees indicate growing confidence among international partners in Ukrainian corporate borrowers and a gradual revival of complex structured finance transactions even during wartime.

A distinct role was played by targeted loans and guarantees for systemically important companies, particularly in logistics, retail, industry, and agriculture. For IFIs, financing such companies was not merely support for an individual business, but an investment in supply chain continuity, employment, and the economy’s tax base. At the same time, the IFC and the EBRD increasingly applied credit risk coverage instruments for major banks, enabling the expansion of corporate loan portfolios without direct pressure on financial institutions’ balance sheets.

Investment Funds and Fundraising

In 2025, Ukraine’s funds and fundraising market moved from fragmented initiatives toward the formation of a full-fledged institutional investment ecosystem focused on economic recovery, technology development, and business resilience during the war. A defining feature of this stage was the active involvement of international financial institutions — EBRD, EIB, IFC, DFC, as well as governments of EU and North American countries — as anchor investors and guarantee partners.

One of the year’s defining trends was the creation of reconstruction and recovery funds combining private capital with resources from international institutions. The launch of the U.S.–Ukraine investment recovery fund, the Rebuild Ukraine Fund with Dragon Capital participation, and infrastructure funds supported by the EBRD and the EIB signal a shift from a grant-based logic of assistance toward market-based investment mechanisms. For investors, this implies a longer investment horizon, lower volatility, and the ability to participate in large infrastructure and development projects.

The second durable direction was the rapid development of venture and technology funds targeting both Ukrainian startups and global startups with Ukrainian roots. In 2025, several new venture funds were launched or announced with target sizes of €50–300 million, particularly in deep tech, defence tech, and enterprise software. Importantly, EBRD, EIB, and IFC increasingly appear in these funds’ capital as anchor limited partners (LPs), strengthening private investor confidence and accelerating fund closings.

A separate niche emerged for funds focused on defence and dual-use technologies, reflecting the direct impact of the war and Ukraine’s integration into the European security space. The launch of specialized defence funds with a focus on Ukrainian startups signals the institutionalization of investment in a segment that previously was financed mostly on a case-by-case basis or through grants.

The third important trend was the expansion of funds focused on SMEs and the real economy. Investment platforms involving international development banks, as well as private funds with Ukrainian roots, began actively raising capital to finance SMEs, agriculture, logistics, processing industries, and real estate. This segment is dominated by blended finance models — combining equity, quasi-equity, and debt instruments with partial risk coverage by IFIs.

At the same time, 2025 saw renewed activity in infrastructure investment funds and real estate funds, including REIT structures and specialized funds for residential, industrial, and logistics projects. Fund-backed deals in retail and warehouse real estate demonstrate that even under wartime conditions, investors are willing to enter assets with predictable cash flows and long-term value.

Overall, 2025 can be described as a turning point for Ukraine’s fund and investment landscape. The market is gradually shifting from individual transactions to systematic fundraising, and from sporadic investments to the launch of large-scale funds with clear strategies, geographic scope, and sector focus. International financial institutions played a central role in this process — not only by providing capital, but also by setting standards for fund structuring, risk management, and corporate governance.

Looking ahead to 2026–2027, these funds may become the main channel for transforming international support for Ukraine into long-term investments that directly influence economic recovery, infrastructure modernization, and the country’s integration into global capital markets.

Key 2025 Transactions Beyond M&A Statistics

Defence Tech: An Announced Deal Outside M&A Statistics

At the end of 2025, one of the largest investment deals in the history of Ukraine’s defence-tech sector was announced — a $760 million investment into Ukrainian company Fire Point through the acquisition of 30% of its equity by EDGE Group, a defence group controlled by sovereign structures of the United Arab Emirates.

The deal is strategic in nature and unprecedented in scale for Ukraine’s defence technology segment. However, it was not included in 2025 M&A statistics because by year-end it remained at the announcement and regulatory approval stage. On December 30, 2025, Ukraine’s Antimonopoly Committee officially received EDGE Group’s application to acquire a stake in LLC “Fire Point”, marking the start of the regulatory phase of the transaction.

Large Investments Without Equity Dilution (Non-Equity and Structured Finance)

Despite rising investment activity in 2025, several landmark transactions were not reflected in official M&A statistics because they did not involve a classic change of control or equity ownership. These include non-equity investments, debt financing, structured finance, and hybrid instruments, increasingly used in a wartime economy and under limited access to traditional capital.

-

Grammarly, one of the most valuable Ukrainian unicorn startups, raised $1 billion from General Catalyst’s Customer Value Fund in the format of revenue-based go-to-market financing, which provides the investor a share in future revenues without taking an equity stake.

-

British-Ukrainian fintech startup Carmoola raised $405 million through the issuance of private asset-backed securities — also not classified as an M&A or equity deal.

-

Ukrainian AI company Reface received $18 million from Singapore-based PvX Partners in the format of non-dilutive user acquisition funding, aimed at scaling its user base without diluting shareholders.

Debt Financing and Hybrid Corporate Deals in Ukraine

Among domestic transactions that significantly shaped the investment landscape but were not captured in M&A statistics:

-

Agribusiness holding Kernel signed a series of loan agreements with Oschadbank totaling $77 million, aimed at investment and operating needs.

-

Oschadbank exercised its right to enter into a financial leasing agreement for Ramada Encore Kyiv hotel and the “Europa” business center totaling UAH 797 million, with a first leasing payment of UAH 201 million.

-

MHP obtained operational control over the production facilities of major sausage producer “Miasovyta” through the acquisition of a legal entity and the lease of an integrated property complex — a structure that is not formally classic M&A, but has a similar economic effect.

Capital Markets and Public Transactions

In 2025, Nova Poshta carried out several corporate bond issuances at 18% per annum: series G, H, I totaling UAH 290 million, as well as series J, K, L — UAH 100 million each. The proceeds were directed toward the development of terminal infrastructure, IT solutions, container fleets, and vehicle assets.

Separately, it is worth noting the listing of Kyivstar on Nasdaq under the ticker KYIV via a SPAC deal with Cohen Circle Acquisition Corp. The transaction set a preliminary valuation for Kyivstar at approximately $2.21 billion at closing.

Taken together, these transactions demonstrate that the real scale of investment activity in Ukraine in 2025 was significantly higher than reflected in classic M&A statistics. The market is increasingly using alternative financing instruments that enable capital raising while minimizing regulatory, country, and wartime risks, and at the same time preserving strategic control over assets.

Conclusion and Outlook

In 2026, Ukraine’s investment and M&A market will largely depend on the security situation: any stabilization or de-escalation would increase investor confidence and unlock deferred investment demand, while renewed escalation would sustain a high country risk premium and restrain activity.

Access to capital remains a critical factor: global financial conditions are still tight, but Ukraine’s international partners continue large-scale support. In particular, the EU’s decision on a €90 billion loan facility for 2026–2027 is expected to ensure macro-stability, budget financing, and reserve replenishment. Domestic investors, who accounted for more than 80% of deal volume in 2025, will likely remain the main market driver due to better understanding of local risks and willingness to work with distressed assets. At the same time, accelerated privatization of state assets offers additional opportunities to acquire large assets at attractive prices under relatively transparent rules.

Foreign capital is expected to remain cautious: given persistent wartime risks, international investors focus mainly on selective strategic opportunities or deals with an asymmetric risk-return profile. At the same time, some foreign players view 2026 investments as an early entry into Ukraine’s future recovery, aiming to secure positions in key sectors before the full return of global capital.

Given the high cost of money and limited commercial lending, the implementation of many projects in 2026 will depend on support from international financial institutions and risk-sharing mechanisms. The EBRD, EIB, IFC, and other lenders and guarantors are expected to continue playing a key role by providing bank guarantees and other tools to restart business lending even amid elevated volatility.

This report is part of InVenture’s annual research series on the Ukraine's investment and mergers & acquisitions (M&A) market, which has been published continuously since 2020.

Investment & M&A Market in Ukraine 2024: Investments for Survival

Private Investment & M&A Market in Ukraine 2023: Forced Deals and Bold Investors

Investment & M&A Market in Ukraine 2022: Awaiting the End of the War

M&A Market in Ukraine in 2020: All Hope Lies with Domestic Investors